PG&E Makes Final Push to Stay in Charge of Chapter 11

August 13 2019 - 8:15PM

Dow Jones News

By Peg Brickley and Soma Biswas

Faced with losing control of a multibillion-dollar bankruptcy

process, PG&E Corp. promised to swiftly file a chapter 11 exit

plan with financial backing in a bid to keep the company's fate in

its own hands.

Two contingents of creditors are anxious to propose their own

strategy to lift PG&E out of bankruptcy, and they need a judge

to clear the way. The utility owner has opposed the request, and

asked to hold on to the exclusive right to file a chapter 11 plan.

Bondholders and other investors said PG&E's pledge of a fast

chapter 11 exit plan, which came after the company had spent six

months under bankruptcy protection, only proves that competition is

needed to push the embattled company toward a chapter 11 exit.

Judge Dennis Montali is expected to rule Wednesday in the U.S.

Bankruptcy Court in San Francisco on creditors' requests to present

their own restructuring strategies for PG&E, which filed for

chapter 11 in January.

The company filed papers on Monday, saying it has ample access

to financing to cover the damages from years of wildfires linked to

its equipment, and enough to end its costly bankruptcy. PG&E

promised to file a chapter 11 exit plan by Sept. 9.

At a court hearing on Tuesday, PG&E lawyer Stephen Karotkin

said financing offers continued to roll in as investors line up to

support the company.

By Tuesday morning, 33 different Wall Street institutions were

offering more than $13 billion in financing commitments to help

PG&E pay down the damage caused by its equipment, Mr. Karotkin

said.

Under fire from bondholders, PG&E outlined terms of a plan

with certain shareholders that values the company's stock at a

minimum price of $17.80 per share. A competing plan from

bondholders including Elliott Management Corp. and Pacific

Investment Management Co. values the shares at $6 at most,

according to a lawyer for shareholders.

Shareholder lawyer Bruce Bennett slammed the bondholders' plan,

saying they would pocket $1.5 billion in unnecessary interest

payments, hundreds of millions of dollars in fees and control over

PG&E at the expense of its current owners.

Insurance companies that have paid fire damage claims and

hedge-fund manager Baupost Group LLC, which bought insurance

claims, also have floated a chapter 11 plan, saying it will push

progress in the case.

At one point at Tuesday's hearing, PG&E's lawyer described

the company as an "honest broker" of the interests of its

creditors, provoking laughter in the courtroom.

If Judge Montali opens the door to competing chapter 11 plans,

PG&E can still propose its own version of a restructuring, and

can hope to draw support from those entitled to vote. The crucial

votes will come from people with claims for death, injury or damage

because of the fires that swept through California in 2017 and

2018.

Bondholders have offered to raise up to $18.4 billion for

wildfire damage under their plan, which would hand them majority

control of the company. PG&E has refused to talk to the

bondholders, according to their lawyer, Abid Qureshi.

PG&E's lawyer said the company has sound business reasons

for ignoring the bondholders. "They are not here as altruistic

players. They are here to acquire the company at a discount, at a

substantial discount," Mr. Karotkin said.

Victims of the 2017 and 2018 wildfires linked to PG&E

equipment said none of the three plans will pass muster and will be

voted down for providing insufficient cash for fire claims.

"There are a lot of hedge funds and private-equity funds that

would like to own this company," said Cecily Dumas, a lawyer for

the official committee that speaks for fire victims. "We are far

apart from everybody."

The three proposals are based on estimates of what the fire

damages will be and will likely change in the coming months as

bankruptcy proceedings produce a final figure PG&E will have to

pay.

Estimates run from $18 billion under the bondholder plan, to $30

billion in PG&E's reports to the Securities and Exchange

Commission, to more than $50 billion, according to the computations

of fire victims.

On Wednesday, PG&E is scheduled to oppose fire victims

clamoring for jury trials to test how much the utility is to blame

and set a price on damages.

PG&E is under the gun to get a chapter 11 plan confirmed by

January to leave enough time for its regulators to review the terms

before a June 30, 2020, deadline set by California lawmakers. If

PG&E misses the deadline, it can't participate in a wildfire

fund signed into law by California Gov. Gavin Newsom.

Write to Peg Brickley at peg.brickley@wsj.com and Soma Biswas at

soma.biswas@wsj.com

(END) Dow Jones Newswires

August 13, 2019 20:00 ET (00:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

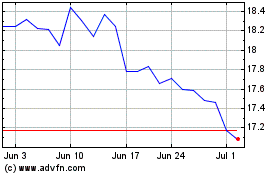

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

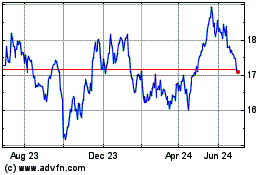

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024