Investors Back PG&E on Bankruptcy Control -- WSJ

May 22 2019 - 3:02AM

Dow Jones News

By Peg Brickley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 22, 2019).

Shareholders that own more than 27% of PG&E Corp.'s stock

and billions of dollars worth of its debt clashed with victims of

the wildfires that sent California's largest utility into

bankruptcy.

The issue is whether PG&E deserves to stay in charge of its

multibillion-dollar chapter 11 case without worrying about rival

restructuring proposals. Shareholders, including a trio that shook

up the company's top management and board recently, said PG&E

deserves more time to figure out how to pay damage claims from

years of blazes linked to the utility's equipment.

But lawyers for wildfire claimants, in a filing last week in the

U.S. Bankruptcy Court in San Francisco, called for limits on

PG&E's ability to determine its future, given a history of

safety lapses. California Gov. Gavin Newsom last week sided with

the fire victims in a filing that criticized PG&E's leadership

and recent changes to its board, and that said the company valued

financial performance over safety.

A bankruptcy judge is set to decide at a hearing Wednesday in

San Francisco whether to give PG&E exclusive control until Nov.

29, as the company has asked, or for a shorter period, as Mr.

Newsom wants.

The dispute sheds light on the developing power dynamics of

PG&E's bankruptcy case, set to play out over a period of years

in the halls of government as well as in the bankruptcy court.

Big shareholders that are part of the group defending PG&E

also own, in the aggregate, more than $2 billion in PG&E debt

-- mostly bonds, but some loans, including pieces of $5.5 billion

in bankruptcy financing.

Only five of the 22 investment funds that signed up to support

the company as shareholders own stock exclusively. All the rest own

debt instruments, and some have much more money tied up in debt

holdings than in PG&E's stock.

In court papers Friday, the group said none of the investors

that spoke up as shareholders are legally bound to look out for

anyone's interests but their own, including the interests of other

shareholders.

Abrams Capital Management LP, Knighthead Capital Management LLC

and Redwood Capital Management LLC -- three funds that worked with

PG&E to shake up its board and management -- each owns either

bonds or insurance claims stemming from wildfire damage.

They are sharing bankruptcy law firm Jones Day and financial

adviser PJT Partners with veteran distressed-debt investors like

Centerbridge Partners LP and York Capital Management. Centerbridge

and York each has more than twice as much money riding on

PG&E's debt than in the company's stock.

It is common for big investment firms to buy debt of varied

ranking within a company's capital structure in a major chapter 11

case. What isn't common is for big investment firms to risk

hundreds of millions of dollars on stock, since shareholders almost

always lose everything in bankruptcy.

PG&E's shares have traded at healthy levels during the

bankruptcy, despite the massive damage claims and turmoil in the

C-suite. That has shifted the power structure in PG&E's

bankruptcy. While creditors typically vie with shareholders, in

PG&E's case they are aligned in this legal battle against the

people who lost homes, businesses and loved ones in wildfires

linked to the company's equipment.

In court papers, the official fire victims committee said it has

doubts that PG&E is a solvent company, as its debts appear to

outweigh its assets. If that is the case, the company's shares

would be reduced in value, or even wiped out.

An investor that owns both debt and stock in PG&E's

bankruptcy has more clout than is typical, said Jonathan Lipson,

professor at Temple University's Beasley School of Law.

Theoretically, creditors' interests are at odds with the

interests of shareholders, he said. But debt investors that also

can claim credentials as significant shareholders have amplified

their power in PG&E's case.

"What may be more important to these sorts of sophisticated

stakeholders than economic positions that might appear to conflict

are the control rights," Mr. Lipson said.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

May 22, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

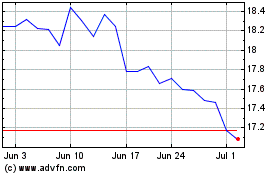

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

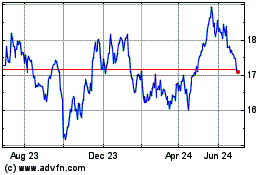

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024