Moody's Downgrades Companies Reliant on PG&E Amid Spector of Bankruptcy

January 15 2019 - 6:26PM

Dow Jones News

By Maria Armental

Moody's Investors Service cut the debt of Topaz Solar Farms LLC

and Ruby Pipeline LLC to junk, citing the expected bankruptcy of

California's largest utility company.

PG&E Corp. intends to file for bankruptcy protection by the

end of the month, citing more than $30 billion in potential

liability costs related to its role in sparking deadly wildfires in

California.

Topaz Solar's revenue and cash flow comes from a long-term power

purchase and sales agreement with PG&E that expires in October

2039.

Similarly, PG&E's Pacific Gas & Electric is Ruby's

principal shipper, with take-or-pay arrangements that expire in

2026 and comprise about 35% of Ruby's contracted volumes and 25% of

total capacity, according to Moody's.

"While we believe that the natural gas contracted to PG&E is

needed by PG&E and will continue to flow, the very high

likelihood of a bankruptcy filing by PG&E and its parent,

PG&E Corp., reduces the quality of the cash flow from PG&E

and creates uncertainty about the potential for renegotiation of

the contract terms and the ability of Ruby to realize in full its

right to collateral against the PG&E contracts," Moody's

analyst Terry Marshall said.

Topaz Solar's senior secured debt due 2039 was cut to Caa2 from

Baa2, and Ruby's senior unsecured notes were cut to Ba2 from

Baa3.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 15, 2019 18:11 ET (23:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

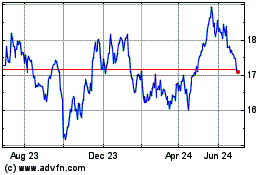

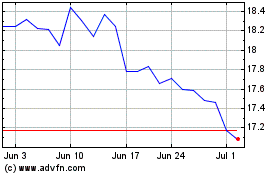

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024