PAR Technology Corporation (NYSE: PAR) today announced its

results of operations for its first quarter ended March 31,

2019.

Summary of Fiscal 2019 First Quarter Financial

Results

- Revenues were reported at $44.7 million

in the first quarter of 2019, compared to $55.7 million in the same

period in 2018, a 19.7% decrease.

- GAAP net loss in the first quarter of

2019 was $2.7 million, or $0.17 loss per diluted share, a decrease

from the GAAP net income of $0.1 million, or $0.00 earnings per

diluted share reported in the same period in 2018.

- Non-GAAP net loss in the first quarter

of 2019 was $1.8 million, or $0.11 loss per diluted share, compared

to non-GAAP net income of $0.6 million, or $0.04 earnings per

diluted share, in the same period in 2018.

A reconciliation and description of non-GAAP financial measures

to their comparable GAAP financial measures are included in the

tables at the end of this press release.

"In the first quarter we continued the ongoing transition of our

business. I am pleased with our progress in the quarter. I am also

particularly proud of our employees' continued efforts to focus on

growing our business by serving our customers, delivering excellent

products and adding new Brink bookings and recurring revenue

streams on a consistent basis," said Savneet Singh, CEO &

President PAR Technology Corporation. "We continue to invest in

product development and focus our business development efforts on

identifying new opportunities for our cloud solutions. Our strategy

remains to rapidly accelerate our recurring revenue growth through

providing a comprehensive portfolio of products and services to our

restaurant customer base. We are also seeking out opportunities to

increase monthly fees and subscription prices through strategic

partnerships."

Highlights of the First Quarter 2019:

-- Brink ARR* at end of Q1 '19 now totals $15.8 million - an

increase of $5.5 million from end of Q1 '18

-- Active Brink sites at end of Q1 '19 - now total 8,000

restaurants

-- Brink bookings in Q1 '19 719 restaurants

-- Brink bookings in Q1 '19 ASP** = $200 per month

*ARR - Run rate of annual recurring revenues - SaaS and support

revenues**ASP - Average selling price SaaS and support revenues

Mr. Singh added, "During the past three months, PAR has

undergone a significant transition. Our Company has new leadership,

we've released new versions of our products, reduced costs and

improved our cash position. We are now poised to actually take

advantage of the large and fast growing market in front of us. We

have made the tough choices in the Company; those are now behind

us, so we can focus our energies on building a great business. Our

passionate focus on return on capital has led us to discovering new

revenue streams and sharpened our awareness on customer

satisfaction."

Conference Call.

There will be a conference call at 4:30 p.m. (Eastern) on May 6,

2019, during which the Company’s management will discuss the

financial results for the first quarter ended March 31, 2019. To

participate in the call, please call 844-419-5412,

approximately 10 minutes in advance. No passcode is required to

participate in the live call or to listen to the replay version.

Individual & Institutional Investors will have the opportunity

to listen to the conference call/event over the internet by

visiting the Company’s website at www.partech.com. Alternatively, listeners may

access an archived version of the presentation call after 7:30 p.m.

on May 6, 2019 through May 13, 2019 by dialing 855-859-2056 and

using conference ID 1338389.

About PAR Technology Corporation.

PAR Technology Corporation's stock is traded on the New York

Stock Exchange under the symbol “PAR”. PAR’s Restaurant / Retail

segment has been a leading provider of restaurant and retail

technology for more than 35 years. PAR offers management technology

solutions for the full spectrum of restaurant operations, from

large chain and independent table service restaurants to

international quick service chains. Products from PAR also can be

found in retailers, cinemas, cruise lines, stadiums, and food

service companies. PAR’s Government segment is a leader in

providing computer-based system design, engineering and technical

services to the Department of Defense and various federal agencies.

For more information visit http://www.partech.com or connect with

us on Facebook and Twitter .

Forward-Looking Statements.

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements

appear throughout this press release, including express or implied

forward-looking statements relating to our expectations regarding

anticipated financial performance, customer and product

opportunities, and assumptions as to future events. Forward-looking

statements are subject to a variety of risks and uncertainties,

many of which are beyond the Company’s control, that could cause

actual results to differ materially from those contemplated in

these statements. Factors that could cause actual results to differ

materially, include: delays in new product development and/or

product introduction; changes in customer base, or in product and

service demands from our customers, particularly as to the two

restaurant chain customers and the U.S. Department of Defense, each

of which represent a significant portion of our revenue; risks

associated with the internal investigation into conduct at our

China and Singapore offices, including sanctions and fines that may

be imposed by governmental authorities; and the other factors

discussed in our most recent Annual Report on Form 10-K and

other filings with the Securities and Exchange Commission (SEC).

The Company undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as may be required under

applicable securities law.

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED BALANCE SHEETS(in thousands,

except share and per share amounts)(Unaudited)

Assets March 31, 2019 December 31, 2018 Current

assets: Cash and cash equivalents $ 4,142 $ 3,485 Accounts

receivable-net 29,311 26,219 Inventories-net 22,639 22,737 Other

current assets 5,099 3,251 Total current assets

61,191 55,692 Property, plant and equipment – net 13,169 12,575

Goodwill 11,051 11,051 Intangible assets – net 11,176 10,859

Operating leases right-of-use assets 3,697 — Other assets 4,764

4,504

Total Assets $ 105,048 $ 94,681

Liabilities and Shareholders’ Equity Current

liabilities: Borrowings of line of credit $ 16,139 $ 7,819 Accounts

payable 14,794 12,644 Accrued salaries and benefits 5,145 5,940

Accrued expenses 2,223 2,113 Customer deposits and deferred service

revenue 11,540 9,851 Operating lease liabilities - current portion

1,540 — Other current liabilities — 2,550 Total

current liabilities 51,381 40,917 Deferred revenue 4,807 4,407

Operating lease liabilities - net of current portion 2,177 — Other

long-term liabilities 3,198 3,411 Total liabilities

61,563 48,735 Commitments and contingencies

Shareholders’ Equity: Preferred stock, $.02 par value, 1,000,000

shares authorized — —

Common stock, $.02 par value, 29,000,000

shares authorized; 17,956,318 and17,879,761 shares issued,

16,248,209 and 16,171,652 outstanding at March 31,2019 and December

31, 2018, respectively

357 357 Capital in excess of par value 50,529 50,251 Retained

earnings 2,698 5,427 Accumulated other comprehensive loss (4,263 )

(4,253 ) Treasury stock, at cost, 1,708,109 shares (5,836 ) (5,836

) Total shareholders’ equity 43,485 45,946

Total

Liabilities and Shareholders’ Equity $ 105,048 $ 94,681

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED STATEMENTS OF OPERATIONS(in

thousands, except per share amounts)(Unaudited)

Three Months EndedMarch 31,

2019 2018 Net revenues: Product $ 15,517 $ 26,324

Service 14,043 13,196 Contract 15,122 16,141 44,682

55,661 Costs of sales: Product 11,241 19,440 Service

10,027 9,547 Contract 13,650 14,827 34,918

43,814 Gross margin 9,764 11,847 Operating

expenses: Selling, general and administrative 8,564 8,600 Research

and development 3,060 2,868 Amortization of identifiable intangible

assets 241 241 11,865 11,709 Operating

(loss) income (2,101 ) 138 Other (expense) income, net (430 ) 49

Interest expense, net (146 ) (41 ) (Loss) income before provision

for income taxes (2,677 ) 146 Provision for income taxes (52 ) (78

) Net (loss) income $ (2,729 ) $ 68 Basic Earnings per

Share: Net (loss) income $ (0.17 ) $ — Diluted Earnings per

Share: Net (loss) income $ (0.17 ) $ — Weighted

average shares outstanding Basic 16,044 15,948

Diluted 16,044 16,286

PAR TECHNOLOGY

CORPORATIONRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

RESULTS(in thousands, except per share and per share

data)(Unaudited)

For the three months ended March

31,2019

For the three months ended March

31,2018

Reportedbasis(GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Reportedbasis(GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Net revenues $ 44,682 $ — $ 44,682 $

55,661

$ — $ 55,661 Costs of sales 34,918 143

34,775 43,814 —

43,814 Gross margin 9,764 143 9,907 11,847 — 11,847

Operating Expenses:

Selling, general and administrative

8,564 755 7,809 8,600 478 8,122 Research and development 3,060 108

2,952 2,868 — 2,868 Acquisition amortization 241 241

— 241 241 —

Total operating expenses 11,865 1,104 10,761 11,709 719

10,990 Operating (loss) income (2,101 ) 1,247 (854 ) 138 719 857

Other (expense) income, net (430 ) — (430 ) 49 — 49 Interest

expense, net (146 ) — (146 ) (41

) — (41 )

(Loss) income before provisionfor income

taxes

(2,677 ) 1,247 (1,430 ) 146 719 865 Provision for income taxes (52

) (299 ) (351 ) (78 ) (173 )

(251 ) Net (loss) income (2,729 ) (1,781 ) 68

614 (Loss) income per diluted share (0.17 )

(0.11 ) 0.00 0.04

About Non-GAAP Financial Measures

The Company reports its financial results in accordance with

GAAP. However, non-GAAP adjusted financial measures, as set forth

in the reconciliation table above, are provided because management

uses these non-GAAP financial measures in evaluating the results of

the Company's continuing operations and believes this information

provides investors supplemental insight into underlying business

trends and operating results. These non-GAAP financial measures are

not based on any comprehensive set of accounting rules or

principles and should not be considered a substitute for, or

superior to, financial measures calculated in accordance with GAAP.

In addition, these non-GAAP financial measures should be read in

conjunction with the Company’s financial statements prepared in

accordance with GAAP.

The Company's results of operations are impacted by certain

non-recurring charges, including equity based compensation,

acquisition related expenditures, expense relating to the internal

investigation into conduct in China and Singapore and the SEC

document subpoena, and other non-recurring charges that may not be

indicative of the Company’s financial performance. Management

believes that adjusting its operating expenses, operating loss, net

loss and diluted loss per share to remove non-recurring charges

provides a useful perspective with respect to our operating results

and provides supplemental information to both management and

investors by removing items that are difficult to predict and are

often unanticipated. While the Company believes the adjustments

provide a useful comparison, the reconciliations of non-GAAP

financial measures to corresponding GAAP measures should be

carefully evaluated.

During the first quarter of 2019, the Company recorded $568,000

of severance expenses, of which $143,000 are included in costs of

sales, $317,000 are included in selling, general and administrative

expenses and $108,000 are included in research and development

expenses. The Company recorded $190,000 of expenses related to the

Company’s internal investigation into conduct at its China and

Singapore offices and the SEC document subpoena. Additionally,

$248,000 of equity based compensation charges were recorded during

the first quarter of 2019. The Company recognized amortization

of acquired intangible assets of $241,000 related to the Company’s

2014 acquisition of Brink Software, Inc. (the "Brink

Acquisition"). The provision for income tax line above is

netted down by a 24%, or $299,000 tax impact from non-GAAP

adjustments.

During the first quarter of 2018, the Company recorded $297,000

of expenses related to the Company’s internal investigation and the

SEC document subpoena. Additionally, $181,000 of equity based

compensation charges were recorded during the first quarter of

2018. The Company recognized amortization of acquired intangible

assets of $241,000 related to the Company’s 2014 Brink Acquisition.

The provision for income tax line above is netted down by a 24% or

$173,000 tax impact from non-GAAP adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190506005720/en/

Christopher R. Byrnes (315) 738-0600 ext.

6226cbyrnes@partech.com, www.partech.com

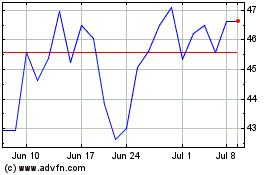

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

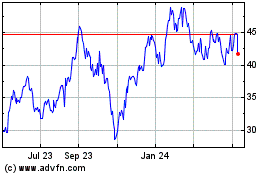

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024