PAR Technology Corporation (NYSE:PAR) today announced its

results for its third quarter ended September 30, 2018.

Summary of Fiscal 2018 Third Quarter and Year-to-Date

Financial Results

- Revenues were reported at $46.4 million

for the third quarter of 2018, compared to $48.9 million for the

same period in 2017, a 5.3% decrease.

- GAAP net loss for the third quarter of

2018 was $16.7 million, or $1.04 loss per diluted share, compared

to the GAAP net loss of $1.5 million, or $0.10 loss per diluted

share reported for the same period in 2017. GAAP net loss was

impacted by a one-time $14.9 million valuation allowance recorded

to reduce the carrying value of deferred tax assets recorded to

income tax expense for the quarter.1

- Non-GAAP net loss for the third quarter

of 2018 was $1.0 million, or $0.06 loss per diluted share, compared

to non-GAAP net loss of $0.9 million, or $0.06 loss per diluted

share, for the same period in 2017.

- Revenues were reported at $154.6

million for the first nine months of 2018, compared to $177.1

million for the same period in 2017, a 12.7% decrease.

- GAAP net loss for the first nine months

of 2018 was $18.0 million, or $1.12 loss per diluted share,

compared to the GAAP net income of $1.9 million, or $0.12 earnings

per diluted share reported for the same period in 2017. GAAP net

loss was impacted by a one-time $14.9 million valuation allowance

recorded to reduce the carrying value of deferred tax assets

recorded to income tax expense for the first nine months.1

- Non-GAAP net loss for the first nine

months of 2018 was $1.1 million, or $0.07 loss per diluted share,

compared to non-GAAP net income of $4.0 million, or $0.25 earnings

per diluted share, for the same period in 2017.

A reconciliation and description of non-GAAP financial measures

to corresponding GAAP financial measures are included in the tables

at the end of this press release.

“Our results for the quarter reflect the continued transition of

the Company, with declining revenues from our legacy products

offset by growth from our new offerings, including a 60% increase

in year-over-year subscription revenues. In addition, Brink, our

industry leading cloud POS solution, continues to gain traction in

the restaurant marketplace, evidenced by the 886 new restaurant

bookings in the quarter, an increase of more than 150% from last

year’s third quarter,” commented PAR President & CEO, Dr.

Donald H. Foley. “In the recently ended quarter we also reported a

17% increase in year-over-year contract revenues in our Government

segment. We continue to focus on making important investments in

the Company that will support and enhance our future growth.”

1 See the following GAAP to Non-GAAP Reconciliations for further

detail on the valuation allowance.

Conference Call.

There will be a conference call at 4:30 p.m. (Eastern) on

November 7, 2018, during which the Company’s management will

discuss the financial results for the third quarter ended September

30, 2018. To participate in the call, please call 844-419-5412,

approximately 10 minutes in advance. No passcode is required to

participate in the live call or to listen to the replay version.

Individual & Institutional Investors will have the opportunity

to listen to the conference call/event over the internet by

visiting the Company’s website at www.partech.com/about-us/investors. Alternatively,

listeners may access an archived version of the presentation call

after 7:30 p.m. on November 7, 2018 through November 14, 2018 by

dialing 855-859-2056 and using conference ID 3593778.

About PAR Technology Corporation.

PAR Technology Corporation's stock is traded on the New York

Stock Exchange under the symbol “PAR”. PAR’s Restaurant/Retail

segment has been a leading provider of restaurant and retail

technology for more than 35 years. PAR offers management technology

solutions for the full spectrum of restaurant operations, from

large chain and independent table service restaurants to

international quick service chains. PAR products can be found in

retailers, cinemas, cruise lines, stadiums, and food service

companies. PAR’s Government segment is a leader in providing

computer-based system design, engineering and technical services to

the Department of Defense and various federal agencies. For more

information visit http://www.partech.com/about-us/investors or

connect with us on Facebook and Twitter.

Forward-Looking Statements.

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements

appear throughout this press release, including express or implied

forward-looking statements relating to our expectations regarding

anticipated financial performance, customer and product

opportunities, and assumptions as to future events. Forward-looking

statements are subject to a variety of risks and uncertainties,

many of which are beyond the Company’s control that could cause

actual results to differ materially from those contemplated in

these statements. Risks and uncertainties that could cause the

Company's actual results to differ materially include: delays in

new product development and/or product introduction; changes in

customer base and product, and service demands, including changes

in product or service demands by the two customers from whom a

significant portion of our revenue is derived; risks associated

with the internal investigation into conduct at our China and

Singapore offices, including sanctions and fines that may be

imposed by the U.S. Department of Justice, the Securities and

Exchange Commission (“SEC”), and other governmental authorities;

our ability to execute our business plan and continue to fund

current operations will require us to obtain waivers or

modifications to our credit agreement and/or secure alternative or

additional sources of capital, which may be unavailable on

acceptable terms, or at all; significant changes in U.S. and

international trade policies that restrict imports or increase

tariffs on goods imported to the United States from China; and the

other risk factors discussed in our most recent Annual Report

on Form 10-K and other filings with the SEC. The Company undertakes

no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as may be required under applicable securities

law.

About Non-GAAP Financial Measures

The Company reports its financial results in accordance with

GAAP. However, non-GAAP adjusted financial measures, as set forth

in the reconciliation tables below, are provided because management

uses these non-GAAP financial measures in evaluating the results of

the Company's continuing operations and believes this information

provides investors supplemental insight into underlying business

trends and operating results. These non-GAAP financial measures are

not based on any comprehensive set of accounting rules or

principles and should not be considered a substitute for, or

superior to, financial measures calculated in accordance with GAAP.

In addition, these non-GAAP financial measures should be read in

conjunction with the Company’s financial statements prepared in

accordance with GAAP.

The Company's results of operations are impacted by certain

non-recurring charges, including equity based compensation,

acquisition related expenditures, expense relating to the internal

investigation into conduct in China and Singapore and the SEC

subpoena, and other non-recurring charges that may not be

indicative of the Company’s financial performance. Management

believes that adjusting its operating expenses, operating income

(loss), net earnings (loss) and diluted earnings (loss) per share

to remove non-recurring charges provides a useful perspective with

respect to our operating results and provides supplemental

information to both management and investors by removing items that

are difficult to predict and are often unanticipated. While the

Company believes the adjustments provide a useful comparison, the

reconciliations of non-GAAP financial measures to corresponding

GAAP measures should be carefully evaluated.

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED BALANCE SHEETS(in thousands,

except share and per share amounts)(Unaudited)

Assets

September 30,2018

December 31,2017

Current assets: Cash and cash equivalents $ 5,817 $ 6,600 Accounts

receivable-net 27,150 30,077 Inventories-net 24,345 21,746 Assets

held for sale 901 939 Other current assets 4,486 4,209

Total current assets 62,699 63,571 Property, plant and

equipment – net 11,933 9,816 Deferred income taxes — 13,809

Goodwill 11,051 11,051 Intangible assets – net 12,567 12,070 Other

assets 4,546 4,307

Total Assets $ 102,796

$ 114,624

Liabilities and Shareholders’ Equity

Current liabilities: Current portion of long-term debt $ 204 $ 195

Borrowings of line of credit 6,965 950 Accounts payable 12,879

14,332 Accrued salaries and benefits 6,022 6,275 Accrued expenses

3,782 3,926 Customer deposits and deferred service revenue 10,235

10,241 Other current liabilities 2,600 — Total

current liabilities 42,687 35,919 Long-term debt 31 185 Deferred

revenue 4,641 2,668 Other long-term liabilities 3,392 6,866

Total liabilities 50,751 45,638 Commitments

and contingencies Shareholders’ Equity: Preferred stock, $.02 par

value, 1,000,000 shares authorized — —

Common stock, $.02 par value, 29,000,000

shares authorized; 17,869,430 and17,677,161 shares issued,

16,161,321 and 15,969,052 outstanding at September 30, 2018

andDecember 31, 2017, respectively

357 354 Capital in excess of par value 49,849 48,349 Retained

earnings 11,590 29,549 Accumulated other comprehensive loss (3,915

) (3,430 ) Treasury stock, at cost, 1,708,109 shares (5,836 )

(5,836 ) Total shareholders’ equity 52,045 68,986

Total Liabilities and Shareholders’ Equity $ 102,796

$ 114,624

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED STATEMENTS OF OPERATIONS(in

thousands, except per share amounts)(Unaudited)

Three Months EndedSeptember 30,

Nine Months EndedSeptember 30,

2018 2017 2018 2017 Net revenues:

Product $ 15,451 $ 20,706 $ 62,658 $ 90,594 Service 13,475 13,317

40,615 42,694 Contract 17,436 14,915 51,321

43,776 46,362 48,938 154,594 177,064 Costs of sales: Product

12,065 15,861 46,844 67,822 Service 10,248 10,241 30,000 31,113

Contract 15,511 13,608 46,005 39,264

37,824 39,710 122,849 138,199 Gross

margin 8,538 9,228 31,745 38,865 Operating expenses: Selling,

general and administrative 7,967 9,054 25,587 27,581 Research and

development 2,992 2,529 9,082 8,161 Amortization of identifiable

intangible assets 241 241 724 724

11,200 11,824 35,393 36,466 Operating

(loss) income from continuing operations (2,662 ) (2,596 ) (3,648 )

2,399 Other income (expense), net 455 (70 ) 120 (264 ) Interest

expense, net (142 ) (39 ) (261 ) (84 ) (Loss) income from

continuing operations before (provision for) benefit from income

taxes (2,349 ) (2,705 ) (3,789 ) 2,051 (Provision for) / benefit

from income taxes (14,355 ) 1,188 (14,170 ) (327 ) (Loss)

income from continuing operations (16,704 ) (1,517 ) (17,959 )

1,724 Discontinued operations Income from discontinued operations

(net of tax) — — — 183 Net (loss)

income $ (16,704 ) $ (1,517 ) $ (17,959 ) $ 1,907 Basic

(Loss) Earnings per Share: (Loss) income from continuing operations

(1.04 ) (0.10 ) (1.12 ) 0.11 Income from discontinued operations —

— — 0.01 Net (loss) income $ (1.04 ) $

(0.10 ) $ (1.12 ) $ 0.12 Diluted (Loss) Earnings per Share:

(Loss) income from continuing operations (1.04 ) (0.10 ) (1.12 )

0.11 Income from discontinued operations — — —

0.01 Net (loss) income per share $ (1.04 ) $ (0.10 ) $ (1.12

) $ 0.12 Weighted average shares outstanding Basic 16,071

15,976 16,033 15,949 Diluted 16,071

15,976 16,033 16,260

PAR TECHNOLOGY

CORPORATIONRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

RESULTS(in thousands, except per share data)(Unaudited)

For the three months ended September

30,2018

For the three months ended September

30,2017

Reportedbasis(GAAP)

Adjustments

Comparablebasis(Non-GAAP)

Reportedbasis(GAAP)

Adjustments

Comparablebasis(Non-GAAP)

Net revenues $ 46,362 $ — $ 46,362 $ 48,938 $ —

$ 48,938 Costs of sales 37,824 — 37,824

39,710 — 39,710 Gross margin 8,538 —

8,538 9,228 — 9,228 Operating Expenses: Selling, general and

administrative 7,967 785 7,182 9,054 768 8,286 Research and

development 2,992 — 2,992 2,529 — 2,529 Acquisition amortization

241 241 — 241 241

— Total operating expenses 11,200 1,026 10,174 11,824

1,009 10,815 Operating (loss) income from continuing operations

(2,662 ) 1,026 (1,636 ) (2,596 ) 1,009 (1,587 ) Other income

(expense), net 455 — 455 (70 ) — (70 ) Interest expense, net (142 )

— (142 ) (39 ) — (39 )

(Loss) income from continuing operations before (provision for) /

benefit from income taxes (2,349 ) 1,026 (1,323 ) (2,705 ) 1,009

(1,696 ) (Provision for) / benefit from income taxes (14,355 )

14,648 293 1,188 (373 )

815 Net loss (16,704 ) (1,030 ) (1,517

) (881 ) Loss per diluted share $ (1.04 ) $ (0.06 ) $

(0.10 ) $ (0.06 )

During the third quarter of 2018, the Company recorded $305,000

of selling, general and administrative expenses related to the

Company’s internal investigation into conduct at its China and

Singapore offices and the SEC subpoena. Additionally, $323,000 of

equity based compensation charges were recorded during the third

quarter of 2018. There were $157,000 of severance expenses

recorded in the third quarter. The Company recognized amortization

of acquired intangible assets of $241,000 related to the Company’s

2014 acquisition of Brink Software, Inc. ("Brink") and recorded a

one-time $14,894,000 valuation allowance to reduce the carrying

value of its deferred tax assets. FASB ASC 740-10-30-21 indicates

that the main negative factor in determining whether to establish a

valuation allowance is the incurrence of cumulative losses in the

most recent three years. Such objective evidence (or factor) limits

the ability to consider other subjective factors, such as

projections for future growth. The Company has incurred losses for

two of the past three years and is in a loss position for the nine

months ended September 30, 2018. A significant factor of the losses

has been the Company’s strategic investment in operating expenses

to fund the growth of the Brink business line. The increase in

investments has outpaced operating performance of the Company’s

other lines of business. The Company plans to continue to fund the

Brink business line growth in the foreseeable future. Based on its

evaluation of its deferred tax assets at September 30, 2018, the

Company established a full valuation allowance for the

carrying value of its deferred tax assets. The valuation allowance

can be reversed if objective negative evidence in the form of

cumulative losses is no longer present and additional weight is

given to subjective evidence, such as our projections of future

growth. The valuation allowance was offset by $0.3 million or 24%

representing the tax impact of non-GAAP adjustments.

During the third quarter of 2017, the Company recorded charges

within selling, general and administrative of $705,000 related to

the Company’s internal investigation into conduct at its China and

Singapore offices and the SEC subpoena. In addition, $63,000 of

equity based compensation charges were recorded during the third

quarter of 2017. The Company recognized amortization of acquired

intangible assets of $241,000 related to the Company’s acquisition

of Brink. The benefit from income tax was decreased by 37%, or

$373,000, to reflect the tax impact from non-GAAP adjustments.

PAR TECHNOLOGY

CORPORATIONRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

RESULTS(in thousands, except per share data)(Unaudited)

For the nine months ended September

30,2018

For the nine months ended September

30,2017

Reportedbasis(GAAP)

Adjustments

Comparablebasis(Non-GAAP)

Reportedbasis(GAAP)

Adjustments

Comparablebasis(Non-GAAP)

Net revenues $ 154,594 $ — $ 154,594 $ 177,064 $ —

$ 177,064 Costs of sales 122,849 — 122,849

138,199 — 138,199 Gross margin 31,745 —

31,745 38,865 — 38,865 Operating Expenses: Selling, general and

administrative 25,587 1,904 23,683 27,581 2,594 24,987 Research and

development 9,082 — 9,082 8,161 — 8,161 Acquisition amortization

724 724 — 724 724

— Total operating expenses 35,393 2,628 32,765 36,466

3,318 33,148 Operating (loss) income from continuing operations

(3,648 ) 2,628 (1,020 ) 2,399 3,318 5,717 Other income (expense),

net 120 — 120 (264 ) — (264 ) Interest expense, net (261 ) —

(261 ) (84 ) — (84 ) (Loss)

income from continuing operations before (provision for) / benefit

from income taxes (3,789 ) 2,628 (1,161 ) 2,051 3,318 5,369

(Provision for) / benefit from income taxes (14,170 ) 14,264

94 (327 ) (1,228 ) (1,555 )

(Loss) income from continuing operations (17,959 ) 16,892

(1,067 ) 1,724 2,090

3,814 Income from discontinued operations, (net of tax) —

— — 183 — 183

Net (loss) income (17,959 ) (1,067 ) 1,907

3,997 (Loss) income per diluted share from continuing

operations (1.12 ) (0.07 ) 0.11 0.24

Income per diluted share from discontinued operations 0.00 0.00

0.01 0.01 (Loss) income per diluted

share $ (1.12 ) $ (0.07 ) $ 0.12 $ 0.25

During the nine months ended September 30, 2018, the Company

recorded $916,000 of selling, general and administrative expenses

related to the Company’s internal investigation into conduct at its

China and Singapore offices and the SEC subpoena. Additionally,

$754,000 of equity based compensation charges were recorded during

the first nine months of 2018. There were $234,000 of

severance expenses recorded in the first nine months of 2018. The

Company recognized amortization of acquired intangible assets of

$724,000 related to the Company’s 2014 acquisition of

Brink and recorded a one-time $14,894,000 valuation allowance

to reduce the carrying value of its deferred tax assets pursuant to

FASB ASC 740-10-30-21. The valuation allowance was offset by $0.6

million or 24% representing the tax impact of non-GAAP

adjustments.

During the nine months ended September 30, 2017, the Company

recorded charges within selling, general and administrative of

$2,272,000 related to the Company’s internal investigation into

conduct at its China and Singapore offices and the SEC subpoena,

and $21,000 of legacy charges related to the Company’s former chief

financial officer’s unauthorized transfers of Company funds. In

addition, $301,000 of equity based compensation charges were

recorded during the nine months ended September 30, 2017. The

Company recognized amortization of acquired intangible assets of

$724,000 related to the Company’s acquisition of Brink. The benefit

from income tax was increased by 37%, or $1,228,000, to reflect the

tax impact from non-GAAP adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181107005879/en/

For PAR Technology CorporationChristopher R. Byrnes,

315-738-0600 ext. 6226cbyrnes@partech.comwww.partech.com

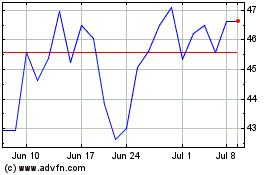

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

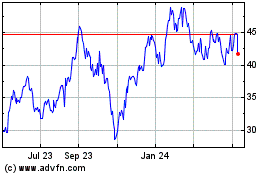

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024