UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2017

(Commission File No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

|

Main Results for the Fiscal Year 2017 (‘FY 2017’)

1

Consolidated net revenues of AR$50,347 million

2

, 100.5% higher than the AR$25,110 million for the same period of 2016 (‘FY 2016’), explained by increases of AR$4,973 million in power generation, AR$11,260 million in electricity distribution, AR$5,062 million in oil and gas, AR$4,722 million in petrochemicals and AR$344 million in holding and others segment, partially offset by higher eliminations as a result of intersegment sales for AR$1,124 million.

ð

Power Generation of 14,186 GWh

from 11 power plants

ð

Electricity sales of 21,503 GWh

to 3 million end-users

ð

Production of 69.7 thousand barrels per day of hydrocarbons:

284 million cf/d of gas and 22.2 kboe/d of oil and LPG

ð

Sales of 1.8 million m

3

of refined products and 458 thousand tons of petrochemical products

Adjusted consolidated EBITDA

3

of AR$17,953 million

, compared to AR$7,372 million for FY 2016, mainly due to increases of AR$2,990 million in power generation, AR$1,923 million in electricity distribution, AR$3,755 million in oil and gas, AR$1,036 million in refining and distribution, AR$90 million in petrochemicals and AR$795 million in holding and others segment, partially offset by lower intersegment eliminations for AR$8 million.

Consolidated gain of AR$5,670 million

, of which AR$4,606 million is attributable to the owners of the Company, higher than the AR$11 million of loss attributable to the owners in FY 2016, explained by

|

1

Under the International Financial Reporting Standards (‘IFRS’), the income statement must only consolidate the continuing operations, being the assets agreed for sale reported as discontinued operations. For more information, see section 1.6 of this Earnings Release.

2

Under the IFRS, Greenwind, OldelVal, Refinor, Transener and TGS are not consolidated in Pampa’s financial statements, its equity income being shown only as ‘Results for participation in associates/joint businesses’. For more information, see section 3 of this Earnings Release.

3

Consolidated adjusted EBITDA represents the consolidated results before net financial results, income tax and minimum notional income tax, depreciations and amortizations, non-recurring incomes and expenses and non-controlling interests, and includes other incomes not accrued and other adjustments from the IFRS implementation. For more information, see section 3 of this Earnings Release.

|

Pampa Energía

●

Q4 17 Earning Release

●

1

|

higher reported gains in power generation (AR$2,845 million), electricity distribution (AR$2,098 million) and oil and gas (AR$2,614 million), partially offset by losses in refining and distribution (AR$117 million), petrochemicals (AR$187 million), holding and others (AR$2,574 million) and intersegment eliminations (AR$62 million).

Main Results for the Fourth Quarter of 2017 (‘Q4 17’)

4

Consolidated net revenues of AR$13,977 million

, compared to AR$9,380 million recorded in the fourth quarter 2016 (‘Q4 16’), mainly explained by increases of AR$1,160 million in power generation, AR$2,801 million in electricity distribution, AR$299 million in oil and gas, AR$263 million in petrochemicals and AR$90 million in holding and others, partially offset by higher eliminations from intersegment sales for AR$16 million.

ð

Power generation of 2,693 GWh

from 11 power plants

ð

Electricity sales of 5,064 GWh

to 3 million of end-users

ð

Production of 67.4 kboe/d of hydrocarbons:

284 million cf/d of gas and 20 kboe/d of oil and LPG

ð

Sales of 443 thousand m

3

of refined products and 104 thousand tons of petrochemical products

Consolidated adjusted EBITDA of AR$5,180 million

, compared to AR$4,101 million in Q4 16, due to increases of AR$845 million in power generation, AR$51 million in oil and gas, AR$484 million in refining and distribution, AR$469 million in holding and others and AR$9 million in intersegment eliminations, partially offset by decreases of AR$671 million in electricity distribution and AR$108 million in petrochemicals.

Consolidated gain of AR$1,700 million

, of which AR$1,512 million is attributable to the owners of the Company, higher than the gain of AR$982 million attributable to the owners of the Company in the Q4 16, explained by reported higher earnings in our segments of power generation (AR$646 million), electricity distribution (AR$365 million) and oil and gas (AR$985 million), partially offset by losses in refining and distribution (AR$388 million), petrochemicals (AR$41 million), holding and others (AR$959 million) and intersegment eliminations (AR$78 million).

4

The financial information presented in this document for the quarters ended on December 31, 2017 and of 2016 are based on unaudited financial statements prepared according to the IFRS accounting standards in force in Argentina corresponding to the fiscal year 2017 and 2016, and the results corresponding to the nine-month period ended on September 30, 2017 and 2016, respectively.

|

Pampa Energía

●

Q4 17 Earning Release

●

2

|

Table of Contents

|

|

|

|

|

|

Main Results for the

20

17

|

1

|

|

Main Results for the Q

4

17

|

2

|

|

1.

|

Relevant Events

|

4

|

|

|

1.1

|

News from Power Generation Segment

|

4

|

|

|

1.2

|

News from Compañía de Transporte de Energía Eléctrica en Alta Tensión S.A. (“Transener”)

|

5

|

|

|

1.3

|

News from Empresa Distribuidora y Comercializadora Norte S.A. (“Edenor”)

|

5

|

|

|

1.4

|

News from the Oil and Gas Segment

|

6

|

|

|

1.5

|

News from Transportadora de Gas del Sur S.A. (“TGS”)

|

7

|

|

|

1.6

|

Strategic Divestments

|

7

|

|

|

1.7

|

Corporate Reorganization

|

8

|

|

|

1.8

|

Credit Rating Upgrade to Pampa and Subsidiaries’ Corporate Bonds

|

8

|

|

|

1.9

|

Repurchase of Own Shares for Compensation Plan

|

10

|

|

2.

|

Financial Highlights

|

12

|

|

|

2.1

|

Consolidated Balance Sheet

|

12

|

|

|

2.2

|

Consolidated Income Statement

|

13

|

|

|

2.3

|

Cash and Financial Borrowings

|

14

|

|

3.

|

Analysis of the Fourth Quarter 2017

|

15

|

|

|

3.1

|

Analysis of the Power Generation Segment

|

16

|

|

|

3.2

|

Analysis of the Electricity Distribution Segment

|

18

|

|

|

3.3

|

Analysis of the Oil and Gas Segment

|

20

|

|

|

3.4

|

Analysis of the Refining and Distribution Segment

|

2

4

|

|

|

3.5

|

Analysis of the Petrochemicals Segment

|

2

6

|

|

|

3.6

|

Analysis of the Holding and Others Segment

|

27

|

|

|

3.7

|

Analysis of the Fiscal Year, by Subsidiary

|

29

|

|

|

3.8

|

Analysis of the Quarter, by Subsidiary

|

30

|

|

4.

|

Information about the Conference Call

|

32

|

|

Pampa Energía

●

Q4 17 Earning Release

●

3

|

1.

Relevant Events

1.1

News from the Power Generation Segment

1.1.1

Commissioning of the New Thermal Power Plant Ingeniero White (‘CTIW’)

On December 22, 2017, the Wholesale Electricity Market Company (‘CAMMESA’) granted the commercial operation of CTIW, pursuant to the Wholesale Power Purchase Agreement (‘PPA’) executed between CAMMESA and Pampa as awardee under the Call for New Generation Capacity - Resolution No. 21/2016 of the Secretariat of Electric Energy (‘SEE’).

The project, which has identical features to the Thermal Power Plant Parque Pilar (‘CTPP’), consisted of building a new thermal power plant next to the Piedra Buena Power Plant (‘CPB’), located at Bahía Blanca, Province of Buenos Aires, made up of 6 cutting-edge high-efficiency Wärtsilä engines, with a total power capacity of 100 MW and able to fire either natural gas or fuel oil. The project demanded a US$90 million investment. It is worth to highlight that said commissioning was achieved before the commercial operation date stipulated in the PPA, as from the applicable supply obligations became effective.

1.1.2

Development of Two New Wind Farms

On January 30, 2018, Pampa announced the construction of two new wind farms in the Province of Buenos Aires, which will aggregate an installed capacity of 100 MW and will demand an estimated investment of US$140 million. These projects will be developed under the Term Market from Renewable Energy Sources regulation framework (‘MAT ER’), and by which CAMMESA granted the dispatch priority to Pampa Energía and De la Bahía wind farm projects, which production is targeted at large users’ market, by selling PPAs between private parties.

The priority allocation of 28 MW for De la Bahía and 50 MW for Pampa Energía wind farms will ensure their dispatch and therefore, will guarantee the provision to our clients who have chosen to comply their obligation of fulfilling electricity demand with renewable sources of energy coming from our wind farms.

The Pampa Energía wind farm will be placed nearby Corti wind farm, which is located at 20 kilometers (12 miles) from the City of Bahía Blanca and 100 MW will be commissioned in May of this year. Moreover, the De la Bahía wind farm will be built in the Coronel Rosales area, 25 kilometers (16 miles) from Bahía Blanca. It is worth highlighting the wind quality of both projects’ area, which fosters a load factor higher than 50%. In each farm it is scheduled the installation of 15 wind turbines.

The new capacity of 100 MW to be developed, in addition to the Corti wind farm which is currently under construction, add up as of today 200 MW of renewable sources’ power capacity developed by Pampa. Therefore, the total installed capacity that Pampa Energía will contribute to the Argentine power grid will be 4.4 GW, once all expansion projects are commissioned.

1.1.3

Repair of the Technical Problem at Thermal Power Plant Genelba (‘CTGEBA’)

In relation to the technical problem occurred in one of the two gas turbines at the combined-cycle in CTGEBA, the Company managed to repair the failure along with Siemens, the turbine’s manufacturer, installing a brand new unit. The new turbine commissioned at the beginning of January 2018, recovering to 100% the generation capacity of CTGEBA’s combined-cycle.

|

Pampa Energía

●

Q4 17 Earning Release

●

4

|

1.2

News from Transener

1.2.1

Semiannual Remuneration Update

The Integral Tariff Review’ (‘RTI’) of Transener and Transba S.A. (‘Transba’) stipulates a semiannual update mechanism in order to maintain the remuneration of Transener and Transba in real terms throughout the RTI’s five-year period. In that sense, the National Electricity Regulatory Agency (‘ENRE’) issued on December 15, 2017 the Resolutions No. 627/2017 and 628/2017, in which the remuneration schemes of Transener and Transba were adjusted by 11.35% and 10.96%, respectively, for the six-month period of December 2016 – June 2017, retroactively applicable over the remuneration scheme as of August 1, 2017.

Moreover, on February 19, 2018, the ENRE issued the Resolutions No. 37/18 and 38/18, adjusting the remuneration of Transener and Transba by 24.41% and 23.62%, respectively (both figures include 0.2% for the efficiency incentive X factor adjustment), corresponding to the period of December 2016 – December 2017, applicable over the remuneration scheme as of February 2017.

1.2.2

New Distribution Methodology for the High Voltage Transportation Cost

Under SEE Resolution No. 1085/17 issued on November 28, 2017 and effective as of December 1, 2017, a new distribution scheme for the transportation cost among users was established, based on the demand and/or contribution of electric energy by each user in the Wholesale Electricity Market (‘WEM’) (distribution companies, large users, power self-generators and generators), directly and/or indirectly connected with the High-Voltage Electric Energy System (‘DisTro’), deducting the operation and maintenance costs for equipment’s connection and voltage transformation, allocated to the power generation companies.

1.2.3

Amendment to the Technical Service Contract

On December 14, 2017, the Board of directors of Transener approved the amendment to the Technical Service Contract for the operation, maintenance and administration of the high voltage electric energy transportation system, originally executed on November 9, 1994. After several transactions through the years, the Technical Service Contract’s current parties are Transener, Transelec Argentina S.A. and Energía Argentina S.A. (‘ENARSA’), being the latter two the designated operators. In that sense, it was informed that the amendment consisted of reducing the fees paid by Transener to the operators for the contractual periods of 2017 and 2018.

It is worth clarifying that prior to the Board of directors’ approval, the Audit Committee of this company pronounced favorably in the matter, in the grounds that the transaction was in line with the normal and regular market conditions.

1.3

News from Edenor

1.3.1

Semiannual Remuneration Update, Increase in the Distribution Utility Fee (‘VAD’) and the Electricity Seasonal Price

On October 31, 2017 Edenor was informed through ENRE Note No. 128,399 that the Ministry of Energy and Mining (‘MEyM’) instructed the regulatory agency to defer until December 1, 2017 the application of the 18% tariff increase on VAD, which was previously scheduled in the RTI on November 1, 2017. The postponement shall be recognized in real terms, pursuant to the RTI update mechanism provided for by ENRE Resolution No. 63/2017.

Moreover, as regards the deferral in the implementation of the Own Distribution Costs (‘CPD’) variation monitoring mechanism, which according to the RTI keeps Edenor’s tariff in real terms and should

|

Pampa Energía

●

Q4 17 Earning Release

●

5

|

have been applicable since August 2017 and every six months, it was informed its implementation in real terms as from December 1, 2017, also using the above-mentioned update mechanism for its recognition in real terms. In August 2017, after verifying the validation of the trigger clause, Edenor requested the application of the CPD variation for the first semester (January-June, 2017), which amounted to 11.6%.

On November 17, 2017, the public hearings called by the MEyM took place, in which among other matters, addressed a new reference price for power capacity and electric energy to be charged in the WEM, corresponding to the summer seasonal period of December 2017 – April 2018, being effective as from December 2017 the reference price of power capacity for AR$3,157 per MW per month, and the stabilized price of the DisTro’s power transportation for AR$44/MWh and a main distribution system price depending on the distribution company (in the case of Edenor, it is AR$1.1/MWh). As regards the reference price of electric energy, the clients with consumption higher than 300 kW of power capacity are set to pay AR$1,325/MWh effective as from December 2017, and for the remaining distribution users the price is set at AR$835/MWh during December 2017 to January 2018 and AR$1,025/MWh during February to April 2018.

Moreover, another public hearing took place, in which it was informed the impact of the new seasonal price, the increase in VAD and the CPD recognition altogether on Edenor end-users’ bills. On November 30, 2017, the Resolution No. 603/17 was issued approving the new tariff scheme of Edenor effective as from December 1, 2017, in which considered the new values determined by the SEE for the Reference Seasonal Price of the electric energy, the pass-through of the stabilized transportation price to the end-users, the provided increase of 18% over VAD approved by the RTI, in addition to the semiannual remuneration adjustment as of August 2017 of 11.6% deferred to December 2017. These effects meant an increase in the end-users’ final tariff values between 48.5% and 66.3% on average, depending on the client’s category.

Finally, through ENRE Resolution No. 33/18 issued on January 31, 2018, a new tariff scheme was released, effective as from February 1, 2018, which applies new seasonal electricity prices, the last stipulated VAD increase of 17.8%, the 22.5% CPD update cumulative since January 2017, corresponding to the six-month period of August 2017 – January 2018, and considers the collection of the tariff increase’s deferred amount due to the gradual implementation between February 2017 and January 2018 in 48 installments. The CPD of 22.5% considers a -2.51% efficiency incentive E factor, figure that currently Edenor is analyzing its calculation.

As stipulated in the RTI, from February 1, 2018 Edenor is invoicing the VAD under the full tariff calculated in the RTI, and by which every six months the remuneration update mechanism will be carried out.

1.3.2

Corporate Reorganization: Merger of Thermal Power Plant Loma de la Lata (‘CTLL’), Electricidad Argentina S.A. (‘EASA’) and IEASA S.A. (‘IEASA’)

Regarding the merger by absorption between CTLL, as absorbing company, and EASA and IEASA, as absorbed companies, on December 25, 2017 the MEyM issued the Resolution No. 2017-501-APN-MEM, in which the MEyM authorized the merger.

On January 18, 2018, the extraordinary shareholders’ meeting of CTLL, EASA and IEASA decided to approve the merger of CTLL, as absorbing company, and EASA and IEASA, as absorbed companies, pursuant to the terms of the Merger Agreement signed on March 29, 2017 and the Merger Prospectus published on May 8, 2017.

1.4

News from the Oil and Gas Segment

1.4.1

New Natural Gas Prices for Residential and Compress Natural Gas (‘CNG’)

Under MEyM Resolution No. 474/17, new natural gas prices at Transportation System Entry Point (‘PIST’) destined to supply the residential and CNG segments were determined, effective as from December 2017,

|

Pampa Ener

gía

● Q4 17 Earning Release ●

6

|

maintaining the saving incentive scheme, the tariff increase limits defined within the MEyM Resolution No. 129/16 and ensuring the social tariff category. In the case of residential users corresponding to full fare tariff, the PIST price is US$4.2/MBTU, while those end-users corresponding to differential tariff is US$1.7/MBTU. Finally, the CNG consumers are set to pay US$4.8/MBUT.

1.4.2

Execution of the Gas Distribution Companies Supply Agreement

In order to secure the supply of natural gas to distribution utility companies and continui

ng

the gradual path for subsidy reduction, on November 29, 2017, Pampa, together with other Argentina’s natural gas producers executed an agreement with the MEyM and ENARSA, in which they defined the framework and conditions to commit a minimum natural gas supply volume, effective as from January 1, 2018.

1.5

News from TGS

1.5.1

The RTI Process

On November 30, 2017, the Natural Gas Regulatory Entity (‘ENARGAS’) issued Resolution No. 120/17, granting TGS an average increase of 78% in the tariff scheme applicable to the utility service of natural gas transportation and the Access and Use Charge, effective as from December 1, 2017. This increase, which should be considered on account of the RTI, meant an increase for the end-users’ bill of 9.5%. Moreover, it is important to highlight that this included a 15% increase corresponding to the non-automatic cost variation adjustment stipulated in the RTI, corresponding to the period of January to October 2017, which follows the Wholesale Internal Price Index (‘IPIM’) published by INDEC.

Finally, in the public hearing that took place on February 20, 2018, TGS presented before ENARGAS the proposal for the tariff scheme effective as from April 1, 2018, with an increase of 42% (it includes a 6.62% of non-automatic update following the IPIM for the period of November 2017 – February 2018). As from this increase, TGS would be invoicing the full fare tariff calculated in the RTI, and every six months should conduct a non-automatic adjustment by IPIM.

To the date of this Earnings Release, the regulatory entity has not published any resolution containing the proposed tariff schemes.

1.5.2

Renewal of the Technical, Financial and Operational Service Contract

On December 14, 2017, the Board of TGS approved the renewal of the Technical, Financial and Operational Service Contract (which was originally dated in 1992), in which links TGS with Pampa Energía as Technical Operator.

P

ursuant to the Note ENRG GAL/GDyE/GT/D No. 11025 issued on November 8, 2017

, no findings were made by ENARGAS

.

In compliance with the section 72 of the Law No. 26,831, TGS’s audit committee requested the opinion of two independent professionals and issued an approval ruling, concluding that the terms of the aforementioned contract can be considered reasonable under the normal and regular market conditions.

1.6

Strategic Divestments

1.6.1

Sale of Refining and Marketing Segment’s Assets

Convinced that Pampa should continue with its key role in the energy industry, committing to reduce the Argentine energy matrix’s deficits and concentrating on the businesses in which we are accountable for the know-how and track record, the Company’s strategy is set to focus its investments and resources on the expansion of installed capacity for power generation, on the exploration and production of natural gas, and continue developing and strengthening of our utilities’ concessions. In that sense, on

|

Pampa Ener

gía

● Q4 17 Earning Release ●

7

|

December 7, 2017, Pampa executed with Trafigura Ventures B.V. and Trafigura Argentina S.A. (‘Trafigura’) an agreement to sell a set of assets related to the refining and marketing segment of the Company, subject to the compliance of certain precedent conditions. The targeted assets under the transaction are as follows:

i.

The Ricardo Eliçabe refinery, located in the City of Bahía Blanca, Province of Buenos Aires;

ii.

The lubricants plant, situated in the district of Avellaneda, Province of Buenos Aires;

iii.

The Caleta Paula reception and dispatch plant, located in the Province of Santa Cruz; and

iv.

The network of gas stations currently operated under Petrobras brand.

Due to its strategic and operative utility, the Dock Sud storage facility is excluded from the sale, as well as the Company’s 28.5% stake in Refinor.

The transaction price is US$90 million and includes the regular working capital of the business, subject to the customary at closing adjustments, plus an additional financed amount to be determined at transaction’s closing and calculated according to the provisions in the sale agreement.

1.6.2

Sale of Oil Assets

On January 16, 2018, Pampa executed with Vista Oil & Gas S.A.B. de C.V. (‘Vista Oil & Gas’) an agreement to sell its direct ownership of 58.88% at Petrolera Entre Lomas S.A. (‘Pelsa’), 3.85% at Entre Lomas, Bajada del Palo and Agua Amarga blocks, and 100% at Medanito S.E. and Jagüel de los Machos blocks.

The sale price is US$360 million, subject to standard adjustments for this type of transactions and the closing is subject to compliance of certain precedent conditions, including the approval of Vista’s shareholders meeting.

1.7

Convertible Corporate Bond Status

Given the sale transactions at the refining and marketing and crude oil exploration and production segments explained in section 1.6 of this Earnings Release, the resulting cash inflow allows the Company to comfortably face the defined strategic investments. Therefore, the Company considers that it is unnecessary to issue a bond convertible into common shares, which terms and conditions were approved by the Company’s Board of Directors on June 26, 2017.

1.8

Credit Rating Upgrade to Pampa and Subsidiaries’ Corporate Bonds

At the beginning of December 2017, credit rating agency Moody’s upgraded the ratings of Edenor, TGS and Pampa’s corporate bonds as a result of the global rating upgrade to Argentina’s sovereign debt from ‘B3’ to ‘B2’. The upgrade also recognizes the favorable operating conditions as well as the recent positive development of the infrastructure related companies in the country, of which it is highlighted the increase of electricity price and regulated tariffs in general. Moreover, the rating action takes into account the positive structural changes in the Argentine regulatory framework, that will improve the financial strength of utility companies.

In the case of Edenor, global rating was upgraded from ‘B3’ to ‘B1’, whereas local rating was upgraded from ‘Baa2.ar’ with a positive outlook to ‘Aa3.ar’ with a stable outlook. In TGS, global rating was upgraded from ‘B3’ to ‘B1’, whereas local rating was upgraded from ‘Baa1.ar’ with a positive outlook to ‘Aa2.ar’ with a stable outlook. Finally, in the case of Pampa, global rating was upgrade from ‘B3’ to ‘B2’.

|

Pampa Ener

gía

● Q4 17 Earning Release ●

8

|

1.9

Corporate Reorganization

1.9.1

The New Corporate Reorganization Process

In relation to the new merger process announced on September 22, 2017, on December 21, 2017 the Boards of all participating companies approved the merger by absorption, all subject to the corresponding assembly and regulatory resolutions. Said merger will be effective as of October 1, 2017, subject to the corresponding registration of the merger and dissolution without liquidation of the companies absorbed before the Public Registry. Moreover, the participating companies’ Boards decided to approve, among other items and subject to the corresponding corporate and regulatory approvals, the following merger exchange ratios:

i.

Regarding the 50.46% share capital of Petrolera Pampa that is not directly or indirectly owned by Pampa, set 2.2699 Pampa's ordinary book-entry shares, with a par value of AR$1 and entitled to one vote per share (the ‘Shares of Pampa’), for each ordinary book-entry share of Petrolera Pampa, with par value of AR$1 and entitled to one vote per share, which will imply the issuance of 136.7 million Shares of Pampa;

ii.

Regarding the 9.58% share capital of CTG that is not directly or indirectly owned by Pampa, set 0.6079 Shares of Pampa for each ordinary book-entry share of CTG, with a par value AR$1 and one vote per share, which will imply the issuance of 5.6 million Shares of Pampa;

iii.

Regarding the 8.40% share capital of Inversora Diamante S.A. that is not directly or indirectly owned by Pampa, set 0.1832 Shares of Pampa for each ordinary book-entry share of Inversora Diamante S.A., with a par value of AR$$1 and one vote per share, which will imply the issuance of 0.7 million Shares of Pampa;

iv.

Regarding the 9.73% of the share capital of Inversora Nihuiles S.A. that is not directly or indirectly owned by Pampa, set 0.2644 Shares of Pampa for each non-endorsable ordinary share of Inversora Nihuiles S.A., with a par value of AR$1 and entitled to one vote per share, which will imply the issuance of 1.3 million Shares of Pampa; and

In relation to the other companies involved, exchange ratio is not needed to be determined since they are 100% directly or indirectly controlled by Pampa.

Therefore, once all the corresponding regulatory and corporate approvals are obtained, the merger transactions are duly registered before the Argentine Corporate Public Registry and the ending of the corporate reorganization process that began with the collapse of former Petrobras Argentina S.A. (‘Petrobras Argentina’) in November 2016, the share capital will be composed by 2,082.7 million Shares of Pampa, representing a 7.4% dilution.

1.9.2

Status of Merger with Petrobras Argentina

On February 28, 2018, Pampa informed the market the current status of the proceedings before the Argentine Securities Commission (the ‘CNV’) regarding the merger between the Company and Petrobras Argentina, Petrobras Energía Internacional S.A. and Albares Renovables Argentina S.A. (the ‘Merger’), as required by the CNV the day before due to a public information request submitted by a shareholder of Petrobras Argentina before the CNV.

On July 27, 2016, Pampa indirectly acquired 67.1933% of the capital stock and votes of Petrobras Argentina. As a result of the purchase, in accordance with the Capital Markets Law No. 26,831, articles 87 and following and CNV regulations, Section II, Chapter II, Title III (T.O. 2013) regarding mandatory tender offers on account of change of control and acquisition of significant indirect interest, the Company was obliged to launch a cash tender offer to the minority shareholdings of Petrobras Argentina (the ‘MTO’). Simultaneously with the MTO, Pampa launched an offer to voluntarily exchange shares of Petrobras Argentina for shares of Pampa (the ‘Exchange’ and, together with the MTO, the ‘Offers’). In order to carry out the Offers and in accordance with the stipulated in the regulations, Pampa submitted the request for approval of the Offers before the CNV, which processed within file No. 1889/16

‘Pampa Energía regarding

|

Pampa Ener

gía

● Q4 17 Earning Release ●

9

|

MTO and Exchange of Petrobras Argentina’

, obtaining consent by the Board of the CNV on September 23 and 28, 2016.

On October 6, 2016, Pampa launched the Offers, which closed on November 15, 2016. Only 9.6% of Petrobras Argentina’s capital stock did not to participate the Offers. Moreover, from the total minority shareholders of Petrobras Argentina that voluntarily participated in the local Offers, 85% decided to sell their holdings in cash according to the MTO and only 15% decided to exchange their shares of Petrobras Argentina for Shares of Pampa in the terms of the Exchange. We clarify that neither at the date of the Offers’ closing nor subsequently, there was any judicial or administrative restriction in place.

After the closing of the Offers and totally independent of this process, the Board of Directors of the Company decided to approve the Merger at its meetings held on December 7 and 23, 2016, setting the effective date of Merger as of November 1, 2016 (date as of Pampa and Petrobras operate as one entity), all subject to the corresponding shareholders’ assembly resolutions and the respective approvals from the regulatory authorities. On January 13, 2017, the CNV proceeded to consent the filing and let the course of action to carry out the public offering of the shares of Pampa that shall be issued because of the Merger, a necessary step for the Company to continue with the Merger process through the publication of the Merger Prospectus.

Subsequently, on February 16, 2017, the shareholders’ assemblies of the companies involved approved the Merger. It is worth highlighting that the decision was approved by the favorable vote of 99.99% of Pampa’s capital stock and votes and 92.98% of the capital stock and votes of Petrobras Argentina.

After making the corresponding legal disclosures and once the period for the opposition of creditors ended without the existence of any manifestation against the Merger, on April 19, 2017 the Final Merger Agreement was executed, following the Argentine Business Organizations Law. After different findings were made regarding the merger and dissolution filings, Pampa Energía fully complied with all the findings and comments received from the CNV, being pending only the CNV’s prior administrative consent, a formality that allows the filing to be registered before the Argentine Public Registry.

To this regard, the CNV informed us that the Argentine Federal Criminal and Correctional Court No. 11, Secretary No. 22, resolved:

‘[…] In this regard, let the officiating know that the CNV MUST NOT take any measure and/or definitive resolution regarding the merits of the case without prior authorization from this Court, in relation to the filing that is being processed in the CNV regarding the corporate reorganization of Pampa Energía S.A.’.

It is worth mentioning that the criminal investigation refers to the voluntary participation of the shareholder ANSES (the Argentine National Pension Fund) in the MTO and not in the Merger, procedure that took place after, completely independent and in which the ANSES did not participate given that, at that moment, it was no longer a shareholder of Petrobras Argentina.

Even in the hypothetical scenario that the allegedly questioned issue in the criminal investigation had not ever occurred, and the ANSES had maintained its shares and had participated in the shareholders’ meeting of Petrobras Argentina on February 16, 2017 and voted against the Merger, even in this hypothetical scenario, the decision would had been validly approved anyway, with 81.13% of the capital stock and the votes of Petrobras Argentina.

For all the facts mentioned before, we understand that the said criminal investigation regarding the sale of the shares of Petrobras Argentina owned by the ANSES in the MTO has no connection with the Merger and had no influence whatsoever over it. The delay in the registration of the Merger directly affects approximately 6,250 minority shareholders of Petrobras Argentina in the local market, in addition to the holders overseas, that are waiting for the share swap to take place once the Merger is duly registered. The Company will continue to take the necessary measures to promote and obtain the registration of the Merger.

1.10

Repurchase of Own Shares for Compensation Plan

In relation to the compensation plan in shares benefitting the Company’s key personnel, on March 8, 2018 the Board of the Company approved the following terms and conditions:

|

Pampa Ener

gía

● Q4 17 Earning Release ●

10

|

i.

Maximum amount:

up to AR$150 million from the Voluntary Reserve of Pampa;

ii.

Maximum quantity and price:

3.5 million ordinary shares or 140 thousand ADSs (0.19% of current Pampa’s capital stock or 0.17% of Pampa’s post-merger capital stock

5

) and up to a cap price of AR$60 per ordinary share or US$70 per ADS; and

iii.

Market transactions limits:

according to the rules, the daily quantity of shares to be repurchased shall be up to 25% of the share’s average daily trading volume for the 90 prior trading days, calculated from the stock markets that the Company is listed.

5

For further information, please refer to section 1.7.1 of this Earnings Release.

|

Pampa Ener

gía

● Q4 17 Earning Release ●

11

|

2.

Financial Highlights

2.1

Consolidated Balance Sheet (AR$ Million)

|

|

|

|

|

|

As of 12.31.17

|

As of 12.31.16

|

|

ASSETS

|

|

|

|

Participation in joint businesses

|

4,930

|

3,699

|

|

Participation in associates

|

824

|

787

|

|

Property, plant and equipment

|

41,214

|

41,001

|

|

Intangible assets

|

1,586

|

2,103

|

|

Other assets

|

2

|

13

|

|

Financial assets with a results changing fair value

|

150

|

742

|

|

Investments at amortized cost

|

-

|

62

|

|

Deferred tax assets

|

1,306

|

1,232

|

|

Trade receivable and other credits

|

5,042

|

4,469

|

|

Total non-current assets

|

55,054

|

54,108

|

|

|

|

|

|

Other Assets

|

-

|

1

|

|

Inventories

|

2,326

|

3,360

|

|

Financial assets with a results changing fair value

|

14,613

|

4,188

|

|

Investments at amortized cost

|

25

|

23

|

|

Financial derivatives

|

4

|

13

|

|

Trade receivable and other credits

|

19,145

|

14,144

|

|

Cash and cash equivalents

|

799

|

1,421

|

|

Total current assets

|

36,912

|

23,150

|

|

|

|

|

|

Assets classified as held for sale

|

12,501

|

19

|

|

|

|

|

|

Total assets

|

104,467

|

77,277

|

|

|

|

|

|

|

As of 12.31.17

|

As of 12.31.16

|

|

EQUITY

|

|

|

|

Share capital

|

2,080

|

1,938

|

|

Share premium

|

5,818

|

4,828

|

|

Repurchased shares

|

3

|

-

|

|

Cost of repurchased shares

|

(72)

|

-

|

|

Statutory reserve

|

300

|

232

|

|

Voluntary reserve

|

5,146

|

3,862

|

|

Other reserves

|

140

|

135

|

|

Retained earnings

|

3,243

|

(11)

|

|

Other comprehensive result

|

252

|

70

|

|

Equity attributable to

owners of the parent

|

16,910

|

11,054

|

|

|

|

|

|

Non-controlling interests

|

3,202

|

3,020

|

|

|

|

|

|

Total equity

|

20,112

|

14,074

|

|

|

|

|

|

LIABILITIES

|

|

|

|

Accounts payable and other liabilities

|

6,404

|

5,336

|

|

Borrowings

|

37,126

|

15,286

|

|

Deferred revenues

|

195

|

200

|

|

Salaries and social security payable

|

120

|

94

|

|

Defined benefit plan obligations

|

992

|

921

|

|

Deferred tax liabilities

|

1,526

|

3,796

|

|

Income tax and minimum expected profit tax liability

|

863

|

934

|

|

Tax payable

|

366

|

306

|

|

Provisions

|

4,435

|

6,267

|

|

Total non-current liabilities

|

52,027

|

33,140

|

|

|

|

|

|

Accounts payable and other liabilities

|

18,052

|

12,867

|

|

Borrowings

|

5,840

|

10,686

|

|

Deferred income

|

3

|

1

|

|

Salaries and social security payable

|

2,154

|

1,745

|

|

Defined benefit plan obligations

|

121

|

112

|

|

Income tax and minimum expected profit tax liability

|

943

|

1,454

|

|

Tax payable

|

1,965

|

2,392

|

|

Financial derivatives

|

82

|

-

|

|

Provisions

|

798

|

806

|

|

Total current liabilities

|

29,958

|

30,063

|

|

|

|

|

|

Liabilities associated to assets classified as held for sale

|

2,370

|

-

|

|

|

|

|

|

Total liabilities

|

84,355

|

63,203

|

|

|

|

|

|

Total liabilities and equity

|

104,467

|

77,277

|

|

Pampa Ener

gía

● Q4 17 Earning Release ●

12

|

2.2

Consolidated Income Statement (AR$ Million)

|

|

|

Fiscal Year

|

|

4

th

Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

2016

|

|

2017

|

|

2016

|

|

Sales revenue

|

|

50,347

|

|

25,110

|

|

13,977

|

|

9,380

|

|

Cost of sales

|

|

(34,427)

|

|

(20,153)

|

|

(9,618)

|

|

(6,702)

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

15,920

|

|

4,957

|

|

4,359

|

|

2,678

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

(2,904)

|

|

(2,132)

|

|

(841)

|

|

(762)

|

|

Administrative expenses

|

|

(4,905)

|

|

(3,628)

|

|

(1,444)

|

|

(1,268)

|

|

Exploration expenses

|

|

(44)

|

|

(94)

|

|

(7)

|

|

(21)

|

|

Other operating income

|

|

3,388

|

|

4,164

|

|

787

|

|

1,824

|

|

Other operating expenses

|

|

(2,951)

|

|

(1,876)

|

|

(684)

|

|

(1,062)

|

|

Reversal of property, plant and equipment impairment

|

|

461

|

|

-

|

|

461

|

|

-

|

|

Reversal of intangible assets impairment

|

|

82

|

|

-

|

|

82

|

|

-

|

|

Results for participation in joint businesses

|

|

1,064

|

|

105

|

|

244

|

|

299

|

|

Results for participation in associates

|

|

44

|

|

7

|

|

(1)

|

|

5

|

|

Results from sale of equity share in companies

|

|

-

|

|

480

|

|

-

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

10,155

|

|

1,983

|

|

2,956

|

|

1,693

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

1,432

|

|

849

|

|

418

|

|

366

|

|

Financial costs

|

|

(5,112)

|

|

(4,277)

|

|

(1,433)

|

|

(1,243)

|

|

Other financial results

|

|

(2,266)

|

|

(80)

|

|

(1,079)

|

|

(253)

|

|

Financial results, net

|

|

(5,946)

|

|

(3,508)

|

|

(2,094)

|

|

(1,130)

|

|

|

|

|

|

|

|

|

|

|

|

Profit before tax

|

|

4,209

|

|

(1,525)

|

|

862

|

|

563

|

|

|

|

|

|

|

|

|

|

|

|

Income tax and minimum expected profit tax

|

|

1,367

|

|

1,201

|

|

1,295

|

|

750

|

|

|

|

|

|

|

|

|

|

|

|

Net income for continuing operations

|

|

5,576

|

|

(324)

|

|

2,157

|

|

1,313

|

|

|

|

|

|

|

|

|

|

|

|

Net income from discontinued operations

|

|

94

|

|

72

|

|

(457)

|

|

(21)

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

5,670

|

|

(252)

|

|

1,700

|

|

1,292

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

Owners of the Company

|

|

4,606

|

|

(11)

|

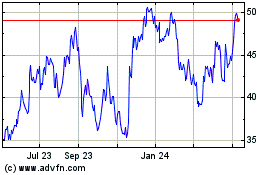

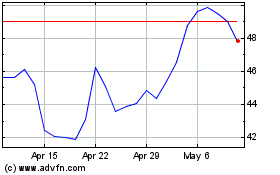

|

1,512

|

|

982

|

|

Continuing operations

|

|

4,623

|

|

(93)

|

|

2,061

|

|

958

|

|

Discontinued operations

|

|

(17)

|

|

82

|

|

(549)

|

|

24

|

|

Non-controlling interests

|

|

1,064

|

|

(241)

|

|

188

|

|

310

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share for the period attributable to the owners of the Company

|

|

2.3369

|

|

(0.0063)

|

|

0.7801

|

|

0.5286

|

|

Basic and diluted income per share of continued operations

|

|

2.3455

|

|

(0.0478)

|

|

1.0633

|

|

0.5157

|

|

Basic and diluted income per share of discontinued operations

|

|

(0.0086)

|

|

0.0415

|

|

(0.2832)

|

|

0.0129

|

|

Pampa Ener

gía

● Q4 17 Earning Release ●

13

|

2.3

Cash and Financial Borrowings (AR$ Million)

|

Cash

(1)

|

Consolidated Financial Statements

|

Ownership Adjusted

|

|

(as of December 31, 2017)

|

|

Power generation

|

478

|

305

|

|

Electricity distribution

|

2,992

|

1,542

|

|

Refining & distribution

|

-

|

-

|

|

Petrochemicals

|

-

|

-

|

|

Holding and others

|

11,915

|

11,915

|

|

Oil and gas

|

52

|

52

|

|

Total

|

15,437

|

13,814

|

|

|

|

|

|

|

|

Bank and Financial Debt

|

Consolidated Financial Statements

|

Ownership Adjusted

|

|

(as of December 31, 2017)

|

|

Power generation

(2)

|

-

|

-

|

|

Electricity distribution

|

4,263

|

2,197

|

|

Refining & distribution

|

-

|

-

|

|

Petrochemicals

|

-

|

-

|

|

Holding and others

|

35,305

|

35,305

|

|

Oil and gas

|

-

|

-

|

|

Total

|

39,568

|

37,502

|

Note: (1) It includes cash and short-term investments. (2) It does not include regulatory liability held against CAMMESA for AR$3,398 million.

2.3.1

Summary of Listed Debt Securities (AR$ Million)

|

Company

|

Security

|

Maturity

|

Amount Issued

|

Amount Outstanding

|

Coupon

|

|

In US$

|

|

|

|

|

|

|

Transener

1

|

ON Series 2

|

2021

|

101

|

99

|

9.75%

|

|

Edenor

|

ON par at fixed rate

|

2022

|

300

|

176

|

9.75%

|

|

TGS

1

|

ON par at fixed rate

|

2020

|

192

|

192

|

9.625%

|

|

Pampa Energía

|

ON Series 4 US$-Link

2,3

|

2020

|

34

|

34

|

6.25%

|

|

ON Series T at discount & fixed rate

|

2023

|

500

|

500

|

7.375%

|

|

ON Series I at discount & fixed rate

|

2027

|

750

|

750

|

7.5%

|

|

|

|

|

|

|

|

|

In AR$

|

|

|

|

|

|

|

Pampa Energía

|

ON Series A

3

|

2018

|

282

|

282

|

Badlar Privada

|

|

ON Series E

3

|

2020

|

575

|

575

|

Badlar Privada

|

Note: (1) Affiliates are not consolidated in Pampa’s financial statements, according to the IFRS standards. (2) Bond Note dollar-link, with initial FX rate of AR$8.4917 /US$. (3) Debt securities issued by CTLL, a power generation subsidiary merged by absorption to Pampa Energía, subject to regulatory and corporate approvals.

|

Pampa Ener

gía

● Q4 17 Earning Release ●

14

|

3.

Analysis of the Fourth Quarter 2017

Consolidated net revenues of AR$13,977 million

, compared to AR$9,380 million recorded in the fourth quarter 2016 (‘Q4 16’), mainly explained by increases of AR$1,160 million in power generation, AR$2,801 million in electricity distribution, AR$299 million in oil and gas, AR$263 million in petrochemicals and AR$90 million in holding and others, partially offset by higher eliminations from intersegment sales for AR$16 million.

ð

Power generation of 2,693 GWh

from 11 power plants

ð

Electricity sales of 5,064 GWh

to 3 million of end-users

ð

Production of 67.4 kboe/d of hydrocarbons:

284 million cf/d of gas and 20 kboe/d of oil and LPG

ð

Sales of 443 thousand m

3

of refined products and 104 thousand tons of petrochemical products

Consolidated adjusted EBITDA of AR$5,180 million

, compared to AR$4,101 million in Q4 16, due to increases of AR$845 million in power generation, AR$51 million in oil and gas, AR$484 million in refining and distribution, AR$469 million in holding and others and AR$9 million in intersegment eliminations, partially offset by decreases of AR$671 million in electricity distribution and AR$108 million in petrochemicals.

Consolidated gain of AR$1,700 million

, of which AR$1,512 million is attributable to the owners of the Company, higher than the gain of AR$982 million attributable to the owners of the Company in the Q4 16, explained by reported higher earnings in our segments of power generation (AR$646 million), electricity distribution (AR$365 million) and oil and gas (AR$985 million), partially offset by losses in refining and distribution (AR$388 million), petrochemicals (AR$41 million), holding and others (AR$959 million) and intersegment eliminations (AR$78 million).

|

Consolidated Adjusted EBITDA Calculation, in AR$ million

|

|

2017

|

|

2016

|

|

Q4 17

|

|

Q4 16

|

|

Consolidated operating income

|

|

10,155

|

|

1,983

|

|

2,956

|

|

1,693

|

|

Consolidated depreciations and amortizations

|

|

3,421

|

|

2,201

|

|

852

|

|

764

|

|

Consolidated EBITDA under IFRS standards

|

|

13,576

|

|

4,184

|

|

3,808

|

|

2,457

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments from generation segment

|

|

(126)

|

|

(32)

|

|

46

|

|

(22)

|

|

Deletion of profit from tax amnesty

|

|

(174)

|

|

-

|

|

0

|

|

-

|

|

Others (deletions of results from share in associates, one-off recoveries)

|

|

48

|

|

(32)

|

|

46

|

|

(22)

|

|

Adjustments from distribution segment

|

|

(769)

|

|

1,094

|

|

(515)

|

|

91

|

|

Adjustments from retroactive penalties

|

|

(333)

|

|

960

|

|

-

|

|

48

|

|

Reversal of impairments

|

|

(543)

|

|

-

|

|

(543)

|

|

-

|

|

Late payment interests

|

|

107

|

|

134

|

|

28

|

|

43

|

|

Adjustments from oil and gas segment

|

|

2,850

|

|

2,170

|

|

845

|

|

1,839

|

|

Deletions of results from share in associates

|

|

(44)

|

|

(11)

|

|

(16)

|

|

(7)

|

|

EBITDA from discont'd operations (PELSA, Medanito and Jagüel de los Machos blocks)

|

2,764

|

|

1,151

|

|

829

|

|

501

|

|

OldelVal's EBITDA adjusted by ownership

|

|

103

|

|

28

|

|

32

|

|

16

|

|

Reporting adjustments from the acquisition of former Petrobras Argentina

|

|

-

|

|

643

|

|

-

|

|

1,001

|

|

Other adjustments (retirement of wells, extraordinary contribution contigency)

|

|

27

|

|

358

|

|

-

|

|

327

|

|

Adjustments from refining and distribution segment

|

|

951

|

|

(83)

|

|

422

|

|

(77)

|

|

Deletions of results from share in associates

|

|

-

|

|

1

|

|

17

|

|

2

|

|

EBITDA from discont'd operations (Refinery, gas stations and Caleta Paula terminal)

|

871

|

|

(102)

|

|

360

|

|

(84)

|

|

Refinor's EBITDA adjusted by ownership

|

|

80

|

|

18

|

|

45

|

|

5

|

|

Adjustments from petrochemicals segment

|

|

383

|

|

166

|

|

121

|

|

166

|

|

Contingencies from former Petrobras Argentina

|

|

383

|

|

166

|

|

121

|

|

166

|

|

Adjustments from holding and others segment

|

|

1,088

|

|

(127)

|

|

454

|

|

(353)

|

|

Deletions of results from share in joint ventures/associates

|

|

(1,114)

|

|

(102)

|

|

(290)

|

|

(299)

|

|

TGS's EBITDA adjusted by ownership

|

|

1,294

|

|

293

|

|

403

|

|

243

|

|

Transener's EBITDA adjusted by ownership

|

|

997

|

|

90

|

|

327

|

|

37

|

|

Results from the sale of participation in subsidiaries

|

|

-

|

|

(480)

|

|

-

|

|

-

|

|

Reporting adjustments from the acquisition of former Petrobras Argentina and others

|

(89)

|

|

72

|

|

14

|

|

(334)

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated adjusted EBITDA

|

|

17,953

|

|

7,372

|

|

5,180

|

|

4,101

|

|

Pampa Ener

gía

● Q4 17 Earning Release ●

15

|

3.1

Analysis of the Power Generation Segment

|

Power Generation Segment, Consolidated

(AR$ million)

|

Fiscal Year

|

4

th

Quarter

|

|

2017

|

2016

|

∆ %

|

2017

|

2016

|

∆ %

|

|

Sales revenue

|

9,597

|

4,624

|

+108%

|

2,822

|

1,662

|

+70%

|

|

Cost of sales

|

(5,358)

|

(2,726)

|

+97%

|

(1,626)

|

(1,125)

|

+45%

|

|

|

|

|

|

|

|

|

|

Gross profit

|

4,239

|

1,898

|

+123%

|

1,196

|

537

|

+123%

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

(94)

|

(65)

|

+45%

|

(31)

|

(28)

|

+11%

|

|

Administrative expenses

|

(357)

|

(392)

|

-9%

|

(90)

|

(69)

|

+30%

|

|

Other operating income

|

420

|

55

|

NA

|

46

|

25

|

+84%

|

|

Other operating expenses

|

(149)

|

(104)

|

+43%

|

7

|

(38)

|

NA

|

|

Results for participation in joint businesses

|

(50)

|

-

|

NA

|

(46)

|

-

|

NA

|

|

|

|

|

|

|

|

|

|

Operating income

|

4,009

|

1,392

|

+188%

|

1,082

|

427

|

+153%

|

|

|

|

|

|

|

|

|

|

Finance income

|

881

|

600

|

+47%

|

269

|

246

|

+9%

|

|

Finance costs

|

(932)

|

(750)

|

+24%

|

(209)

|

(201)

|

+4%

|

|

Other financial results

|

55

|

228

|

-76%

|

1

|

53

|

-98%

|

|

|

|

|

|

|

|

|

|

Profit before tax

|

4,013

|

1,470

|

+173%

|

1,143

|

525

|

+118%

|

|

|

|

|

|

|

|

|

|

Income tax and minimum expected profit tax

|

85

|

(317)

|

NA

|

28

|

(62)

|

NA

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

4,098

|

1,153

|

+255%

|

1,171

|

463

|

+153%

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

Owners of the Company

|

3,890

|

1,045

|

+272%

|

1,085

|

439

|

+147%

|

|

Non-controlling interests

|

208

|

108

|

+93%

|

86

|

24

|

+258%

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

4,728

|

1,738

|

+172%

|

1,419

|

574

|

+147%

|

|

|

|

|

|

|

|

|

|

Increases in property, plant, equipment and intangible assets

|

6,277

|

2,486

|

+152%

|

1,549

|

1,073

|

+44%

|

|

Depreciation and amortization

|

845

|

378

|

+124%

|

291

|

169

|

+72%

|

In Q4 17,

the

gross margin at power generation was AR$1,196 million, 123% higher than the same period of 2016, mainly due to the update in the legacy energy remuneration scheme by the application of SEE Resolution No. 19E/2017. Pursuant to this resolution, as from February 2017 the remuneration is US$-nominated for power capacity and dispatched energy, gradually increased from a minimum remuneration discriminated by technology and scale, followed by an increase to a base remuneration with availability commitment (‘DIGO’) in May 2017, and reaching to the full and final remuneration scheme as from November 2017. It is worth mentioning that during the entire Q4 17 the legacy capacity was billed under the new remuneration scheme (base remuneration in October and full remuneration in November and December, being the thermal units monthly subject to DIGO and real availability). In Q4 16 the remuneration scheme for the legacy capacity was AR$-nominated and under a lower pricing scheme, pursuant to SEE Resolution No. 22/2016.

Furthermore, the increase in gross margin is explained by the devaluation in the nominal exchange rate with impact on our new capacity contracts (Energy Plus and SE Resolution No. 220/2007) and our legacy energy remuneration, as well as the new contracts at CTLL for the gas turbines #04 and #5, CTPP and CTIW

6

coming into force.

In operating terms, Pampa’s power generation during Q4 17 decreased by 22% compared to Q4 16, mainly due to the technical problem occurred by the end of September 2017 in one of the two gas turbines at the combined-cycle in CTGEBA, which was repaired and commissioned at the beginning of January 2018 (-642 GWh)

7

. Moreover, the lower generation during Q4 17 is also due to programmed maintenance service in CTLL's steam turbine of the combined-cycle (-219 GWh) and a lower dispatch at CPB (-183 GWh). These decreases were partially offset by higher generation at HPPL, as 2016 was

6

For further information, please refer to section 1.1.1 of this Earnings Release.

7

For further information, please refer to section 1.1.3 of this Earnings Release.

|

Pampa Ener

gía

● Q4 17 Earning Release ●

16

|

hydraulically dry year (+198 GWh) and generation

from our

new power plants CTPP and CTIW

,

that started operations

at

the end of August and December 2017, respectively (+101 GWh).

|

Summary of

Electricity Generation Assets

|

Hydroelectric

|

Thermal

|

Total

|

|

HINISA

|

HIDISA

|

HPPL

1

|

CTLL

2

|

CTG

3

|

CTP

|

CPB

|

CTPP

4

|

CTIW

5

|

CTGEBA

1

|

Eco-

Energía

1

|

|

Installed Capacity (MW)

|

265

|

388

|

285

|

750

|

361

|

30

|

620

|

100

|

100

|

843

|

14

|

3,756

|

|

New Capacity (MW)

|

-

|

-

|

-

|

349

|

100

|

30

|

-

|

100

|

100

|

169

|

14

|

862

|

|

Market Share

|

0.7%

|

1.1%

|

0.8%

|

2.1%

|

1.0%

|

0.1%

|

1.7%

|

0.3%

|

0.3%

|

2.3%

|

0.04%

|

10.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Generation 2017 (GWh)

|

751

|

480

|

760

|

3,864

|

1,772

|

156

|

1,453

|

142

|

23

|

4,685

|

100

|

14,186

|

|

Market Share

|

0.6%

|

0.4%

|

0.6%

|

2.8%

|

1.3%

|

0.1%

|

1.1%

|

0.1%

|

0.0%

|

3.4%

|

0.1%

|

10.4%

|

|

Sales 2017 (GWh)

|

751

|

480

|

760

|

3,864

|

2,337

|

156

|

1,453

|

142

|

23

|

5,412

|

103

|

15,481

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Generation 2016 (GWh)

|

706

|

564

|

176

|

3,644

|

1,577

|

155

|

2,054

|

-

|

-

|

2,211

|

43

|

11,131

|

|

Variation 2017 vs. 2016

|

+6%

|

-15%

|

+332%

|

+6%

|

+12%

|

+1%

|

-29%

|

na

|

na

|

+112%

|

+132%

|

+27%

|

|

Sales 2016 (GWh)

|

706

|

564

|

176

|

3,644

|

2,076

|

155

|

2,056

|

-

|

-

|

2,499

|

44

|

11,921

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Price 2017 (US$ / MWh)

|

24

|

33

|

22

|

38

|

36

|

52

|

32

|

98

|

42

|

39

|

69

|

36

|

|

Average Price 2016 (US$ / MWh)

|

17

|

17

|

24

|

27

|

30

|

52

|

14

|

na

|

na

|

34

|

60

|

26

|

|

Average Gross Margin 2017 (US$ / MWh)

|

11

|

16

|

12

|

34

|

15

|

na

|

12

|

82

|

33

|

15

|

21

|

20

|

|

Average Gross Margin 2017 (US$ / MWh)

|

8

|

4

|

14

|

23

|

14

|

na

|

1

|

na

|

na

|

11

|

18

|

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Generation Q4 17 (GWh)

|

275

|

148

|

317

|

617

|

362

|

33

|

151

|

79

|

23

|

661

|

28

|

2,693

|

|

Market Share

|

0.8%

|

0.4%

|

0.9%

|

1.8%

|

1.1%

|

0.1%

|

0.4%

|

0.2%

|

0.1%

|

2.0%

|

0.1%

|

8.0%

|

|

Sales Q4 17 (GWh)

|

275

|

148

|

317

|

617

|

490

|

33

|

151

|

79

|

23

|

834

|

28

|

2,994

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Generation Q4 16 (GWh)

|

244

|

176

|

119

|

837

|

386

|

43

|

333

|

-

|

-

|

1,304

|

27

|

3,469

|

|

Variation Q4 17 vs. Q4 16

|

+12%

|

-16%

|

+167%

|

-26%

|

-6%

|

-25%

|

-55%

|

na

|

na

|

-49%

|

+2%

|

-22%

|

|

Sales Q4 16 (GWh)

|

244

|

176

|

119

|

837

|

505

|

43

|

333

|

-

|

-

|

1,478

|

27

|

3,763

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Avg. Price Q4 17 (US$/MWh)

|

20

|

32

|

17

|

62

|

56

|

60

|

80

|

123

|

40

|

63

|

68

|

53

|

|

Avg. Price Q4 16 (US$/MWh)

|

14

|

15

|

22

|

30

|

31

|

47

|

17

|

na

|

na

|

34

|

54

|

29

|

|

Avg. Gross Margin Q4 17 (US$/MWh)

|

9

|

16

|

10

|

56

|

17

|

na

|

30

|

104

|

31

|

22

|

26

|

28

|

|

Avg. Gross Margin Q4 16 (US$/MWh)

|

6

|

4

|

na

|

23

|

11

|

na

|

(10)

|

na

|

na

|

na

|

na

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Gross margin before amortization and depreciation. FX rate of AR$/US$: FY 2017 – 16.57; FY 2016 – 14.78; Q4 17 – 17.55; Q4 16 – 15.45. (1) The figures from HPPL, CTGEBA and EcoEnergía accounts from the closing of the acquisition in August 2016. (2) The installed capacity of CTLL includes 210 MW from GT04 and GT05. (3) CTG’s average gross margin considers results for CTP. (4) CTPP commissioned as from August 29, 2017. (5) CTIW commissioned as from December 22, 2017.

Net operating costs increased by 37% compared to Q4 16, mainly due to higher labor costs, higher energy purchase costs to cover contracts, AR$ depreciation in the nominal exchange rate, higher costs due to the new operated machines at CTLL’s GT04 and GT05, CTPP and CTIW, and higher depreciations due to these new units and programmed maintenance services.

The gains on net financial results decreased by AR$37 million in comparison to Q4 16, registering a AR$61 million profit in Q4 17, mainly due to lower gains from the holding of financial instruments, lower gains from net exchange difference and higher interest losses on loan agreements with CAMMESA. These effects were partially offset by lower interests due to decrease of financial liabilities stock and higher gains from the recognition of net interest to the credits held against CAMMESA by the former Petrobras Argentina’s generation assets.

Adjusted EBITDA increased by 147% over Q4 16 to AR$1,419 million, mainly due to a better remuneration for legacy energy, Peso devaluation, the new PPAs performing at CTLL, CTPP and CTIW, and the recognition of a higher price for assignments of gas, partially offset by higher labor, energy purchase costs and operational costs. Moreover, adjusted EBITDA in the Q4 16 does not include minor non-recurring amounts such as recovery of insurance and expenses, that amounted to AR$22 million at CTG

.

The following table shows a summary of the committed expansion projects, in which Pampa Energía and De La Bahía wind farm projects are added for a total of 100 MW:

|

Pampa Ener

gía

● Q4 17 Earning Release ●

17

|

|

Project

|

MW

|

Equipment Provider

|

Marketing

|

Awarded Price

|

Estimated Capex in

US$ million

1

|

Date of

Commissioning

|

|

Capacity

US$/MW-month

|

Variable

US$/MWh

|

Total

US$/MWh

|

|

Thermal

|

|

|

|

|

|