Net Income of Approximately R$ 228

Million, up 178% Compared to 2Q17 or R$242

Million after Non-GAAP Adjustments to 2Q18, up

195% Compared to 2Q17

PagSeguro Digital Ltd., or (“PagSeguro” or “we”) (NYSE:PAGS),

today announced preliminary operational and financial results for

2Q18. PagSeguro expects to report Total Payment Volume (TPV) of

approximately R$16.9 billion, Net Income of approximately R$228

million and Non-GAAP Net Income of approximately R$242 million.

Operational and Financial Metrics (R$mn) 2Q18

(1) 1Q18 2Q17

Variation

2Q18 X 1Q18 (1)

Variation

2Q18 X 2Q17 (1)

TPV 16.9 14.4 8.1 17% 109% Net

Income 228 149 82 53% 178%

Non-GAAP Net Income

(2) (3) 242 213 82

14% 195%

[1] Numerical figures are preliminary and

approximate.

[2] The reconciliation of GAAP measures to Non-GAAP

measures are presented at the end of this announcement and it

includes (i) foreign exchange gain on IPO primary share proceeds,

(ii) foreign exchange gain on follow-on primary share proceeds,

(iii) share-based long-term incentive plan (LTIP), (iv) tax related

to remittance of IPO primary share proceeds (IOF tax), (v) tax

related to remittance of follow-on primary share proceeds (IOF

tax), and (vi) income tax on Non-GAAP measures.

[3] The presentation of Non-GAAP Net Income is aligned

with the Non-GAAP Net Income reported under the Form 6-K/A

furnished to the SEC on July 20, 2018, which replaced the previous

Form 6-K furnished to the SEC on May 30, 2018, and aligned the

presentation of non-GAAP financial measures with the presentation

included in PagSeguro’s Registration Statement on Form F-1

originally filed with the SEC on June 18, 2018. Therefore, Non-GAAP

Net Income for 2Q18 does not include the net adjustment of notes

receivable at present value of approximately R$8 million (or

Non-GAAP Net Income of approximately R$ 250 million).

“Our second quarter results show the strength of our unique

ecosystem. Being an independent fintech allows us to think

exclusively on our clients’ financial needs, delivering growth and

profitability while creating a higher stickiness with our clients

by offering a unique ecosystem through our digital account. Being

the first mover, with an unreplicable online distribution through

UOL and mobile first, brings a natural advantage to PagSeguro. We

believe that following this strategy we will deliver long-term

shareholder value through an increasingly attractive and growing

ecosystem,” said Ricardo Dutra, CEO of PagSeguro.

PagSeguro will provide full second quarter results and host a

conference call and earnings webcast on the following days and

time, respectively:

- Thursday, August 30, 2018, after market

close.

- Friday, August 31, 2018, at 10:00 AM

ET.

Event Details

Dial–in in the US and International: 1-800-492-3904 (Toll Free)

or +1 646 828-8246

Dial–in with connections in Brazil: +55 11 3193-1001 or + 55 11

2820-4001

Password: PagSeguro

Webcast: http://choruscall.com.br/pagseguro/2q18.htm

Forward Looking Statements

This press release includes “forward-looking statements” within

the meaning of the U.S. federal securities laws. Statements

contained herein that are not clearly historical in nature are

forward-looking, and the words “anticipate,” “believe,”

“continues,” “expect,” “estimate,” “intend,” “project” and similar

expressions and future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “can,” “may,” or similar

expressions are generally intended to identify forward-looking

statements. These forward-looking statements speak only as of the

date hereof and are based on PagSeguro’s current plans, estimates

of future events, expectations and trends that affect or may affect

our business, financial condition, results of operations, cash

flow, liquidity, prospects and the trading price of our Class A

common shares, and are subject to several known and unknown

uncertainties and risks, many of which are beyond PagSeguro’s

control. As a consequence, current plans, anticipated actions and

future financial position and results of operations may differ

significantly from those expressed in any forward-looking

statements in this press release. You are cautioned not to unduly

rely on such forward-looking statements when evaluating the

information presented and we do not intend to update any of these

forward-looking statements.

Reconciliation of Net Income to Non-GAAP Net Income

This press release includes certain non-GAAP measures. We

present non-GAAP measures when we believe that the additional

information is useful and meaningful to investors. These non-GAAP

measures are provided to enhance investors’ overall understanding

of our current financial performance and its prospects for the

future. Specifically, we believe the non-GAAP measures provide

useful information to both management and investors by excluding

certain expenses, gains and losses, as the case may be, that may

not be indicative of our core operating results and business

outlook.

These measures may be different from non-GAAP financial measures

used by other companies. The presentation of this non-GAAP

financial information, which is not prepared under any

comprehensive set of accounting rules or principles, is not

intended to be considered separately from, or as a substitute for,

our financial information prepared and presented in accordance with

International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board. Non-GAAP measures

have limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with IFRS. These measures should only be used to

evaluate our results of operations in conjunction with the

corresponding GAAP measures.

Reconciliation of Net Income to Non-GAAP Net

Income: 1Q18 2Q18 (1) Net income

149 228 Foreign exchange gain on IPO

primary share proceeds

[2] (90 ) - Foreign exchange gain on

Follow on proceeds

[3] - (27 ) Share-based long-term

incentive plan (LTIP)

[4] 211 62 New shares issued (new

hires/ additions to LTIP/ others) - 31

Recurrent quarterly provision

- 31 Tax related to remittance of IPO primary share proceeds (IOF

tax)

[5] 13 - Tax related to remittance of Follow on

proceeds (IOF tax)

[6] - 1 Income tax on non-GAAP

adjustments

[7] (70 ) (21 ) Total non-GAAP net income

adjustments 64 15

Non-GAAP Net Income

213 242 Share-based long-term

incentive plan (LTIP) 1Q18 2Q18 (1)

Stock-based compensation expenses (non-cash) 131 40 Related

Employer Payroll Taxes 80 22

[1] Numerical figures are preliminary and

approximate

[2] Foreign exchange gain on IPO primary share

proceeds: financial income in the amount of R$90 million

related to the impact of exchange rate variation on the conversion

from U.S. dollars into Brazilian reais of the proceeds from our

sale of new shares in the IPO. We exclude this foreign exchange

variation from our non-GAAP measures primarily because it is an

unusual income.

[3] Foreign exchange gain on Follow on proceeds:

financial income in the approximate amount of R$27 million

related to the impact of exchange rate variation on the conversion

from U.S. dollars into Brazilian reais of the proceeds from our

sale of new shares in the follow-on offer completed on June 22,

2018. We exclude this foreign exchange variation from our non-GAAP

measures primarily because it is an unusual income.

[4] Share-based long-term incentive plan (LTIP):

Stock-based compensation expenses and related employer payroll

taxes. This amount consists of expenses for equity awards under our

long-term incentive plan (LTIP). We exclude stock-based

compensation expenses from our non-GAAP measures primarily because

they are non-cash expenses. The related employer payroll taxes

depend on our stock price and the timing and size of exercises and

vesting of equity awards, over which management has limited to no

control, and as such management does not believe these expenses

correlate to the operation of our business. In the 2Q18 the total

approximate amount of R$31 million is mainly related to new

shares issued for new employees and employee additions to the

long-term incentive plan. The total approximate amount of R$31

million is related to the recurrent quarterly provision.

[5] Tax related to remittance of IPO primary share

proceeds (IOF tax): R$13 million related to the impact

of Brazilian IOF tax (currency remittance tax) payable when we

remitted the proceeds from our sale of new shares in the IPO from

the Cayman Islands to Brazil. We exclude this IOF tax on the

remittance of IPO primary share proceeds from our non-GAAP measures

primarily because it is an unusual expense.

[6] Tax related to remittance of follow-on proceeds (IOF

tax): approximately R$1 million related to the impact of

Brazilian IOF tax (currency remittance tax) payable when we

remitted the proceeds from our sale of new shares in the follow-on

offer completed on June 22, 2018, from the Cayman Islands to

Brazil. We exclude this IOF tax on the remittance of follow-on

proceeds from our non-GAAP measures primarily because it is an

unusual expense.

[7] Income tax and on Non-GAAP adjustments: consists of

income tax effect related to the Non-GAAP adjustments mentioned

above, excluding the foreign exchange gain on IPO primary share

proceeds of R$90 million and the foreign exchange gain on

follow on proceeds of approximately R$27 million, which are

not taxable, and the tax benefits related to other Non-GAAP

adjustments.

About PagSeguro:

PagSeguro is a disruptive provider of financial technology

solutions focused primarily on micro-merchants, small companies and

medium-sized companies in Brazil. PagSeguro's business model covers

all of the following five pillars:

- Multiple digital payment

solutions;

- In-person payments via point of sale

(POS) devices that PagSeguro sells to merchants;

- Free digital accounts;

- Issuer of prepaid cards to clients for

spending or withdrawing account balances; and

- Operating as an acquirer.

PagSeguro is an UOL Group Company that provides an easy, safe

and hassle-free way of accepting payments, where its clients can

transact and manage their cash, without the need to open a bank

account. PagSeguro’s end-to-end digital ecosystem enables its

customers to accept a wide range of online and in-person payment

methods, including credit cards, debit cards, meal voucher cards,

boletos, bank transfers, bank debits and cash deposits.

PagSeguro's mission is to disrupt and democratize financial

services in Brazil, a concentrated, underpenetrated and high

interest rate market, by providing an end-to-end digital ecosystem

that is safe, affordable, simple and mobile-first for both

merchants and consumers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180731005440/en/

PagSeguro Digital Ltd.André Cazotto, +55 (11)

3914-9403ir@pagseguro.com

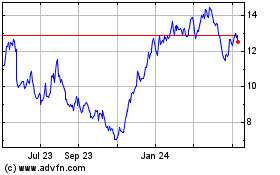

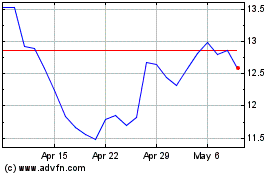

PagSeguro Digital (NYSE:PAGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

PagSeguro Digital (NYSE:PAGS)

Historical Stock Chart

From Apr 2023 to Apr 2024