UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Owlet, Inc.

(Name of Issuer)

Class A Common Stock, par value $0.0001 per share

(Title of Class of Securities)

69120X 107

(CUSIP

Number)

Kurt Workman

C/O Owlet, Inc.

3300

North Ashton Boulevard, Suite 300

Lehi, Utah 84043

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 17, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition which is subject of this Schedule 13D, and is filing this statement because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No.: 69120X 107

|

|

|

|

|

|

|

| 1. |

|

Name of Reporting Person:

Kurt Workman |

| 2. |

|

Check the Appropriate Box

if a Member of Group (See Instructions): (a) ☐ (b) ☐

|

| 3. |

|

SEC Use Only:

|

| 4. |

|

Source of Funds:

PF |

| 5. |

|

Check if Disclosure of

Legal Proceedings is Required Pursuant to Items 2(d) or 2(e):

☐ |

| 6. |

|

Citizenship or Place of

Organization:

USA |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With: |

|

7. |

|

Sole Voting Power:

5,003,438 |

| |

8. |

|

Shared Voting Power:

2,074,200 |

| |

9. |

|

Sole Dispositive Power:

5,003,438 |

| |

10. |

|

Shared Dispositive Power:

2,074,200 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

7,473,415 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares: ☐ |

| 13. |

|

Percent of

Class Represented By Amount In Row (11): 6.3% |

| 14. |

|

Type of Reporting

Person: IN |

| Item 1. |

Security and Issuer |

The class of equity security to which this statement on Schedule 13D relates is the Class A Common Stock, par value $0.0001 per share (the “Common

Stock”) of Owlet, Inc., a Delaware corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 3300 North Ashton Boulevard, Suite 300, Lehi, Utah 84043. Information given in response to each item shall

be deemed incorporated by reference in all other items, as applicable.

| Item 2. |

Identity and Background |

| |

(a) |

This Schedule 13D is filed by Kurt Workman (the “Reporting Person”). The Reporting Person is

currently a member of the board of directors of the Issuer (the “Board”). |

| |

(b) |

The business address of the Reporting Person is Owlet, Inc., 3300 North Ashton Boulevard, Suite 300, Lehi, Utah

84043. |

| |

(c) |

The Reporting Person is President, Chief Executive Officer, Co-Founder

and Director of the Issuer. |

| |

(d) |

During the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding

traffic violations or similar misdemeanors). |

| |

(e) |

During the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activity subject to, federal or state securities

laws or finding any violations with respect to such laws. |

| |

(f) |

The Reporting Person is a citizen of the United States. |

| Item 3. |

Source and Amount of Funds or Other Consideration |

On July 15, 2021, pursuant to that certain Business Combination Agreement, dated as of February 15, 2021, by and among the Issuer, Project Olympus

Merger Sub, Inc. (“Merger Sub”) and Owlet Baby Care Inc. (“Owlet Baby Care”), Merger Sub merged with and into Owlet Baby Care with Owlet Baby Care surviving as a wholly owned subsidiary of the Issuer (the “Merger”).

Upon consummation of the Merger (the “Effective Time”), (i) each issued and outstanding share of preferred stock of Owlet Baby Care (“Old Owlet Preferred Stock”) was automatically canceled and converted into a share of common

stock of Owlet Baby Care (“Old Owlet Common Stock”) and (ii) each issued and outstanding share of the Old Owlet Common Stock was automatically canceled and converted into approximately 2.053 shares of Common Stock.

Immediately prior to the Effective Time, the Reporting Person held 1,010,231 shares of Old Owlet Common Stock and, as of the Effective Time, the pre-merger shares converted into 2,074,202 shares of Common Stock.

On February 17, 2023, the Issuer entered into

Investment Agreements (collectively, the “Investment Agreement”) with certain investors listed on Schedule 1 thereto (the “Investors”), pursuant to which the Issuer issued and sold to the Investors (i) an aggregate of 30,000

shares of the Issuer’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”) and (ii) warrants to purchase an aggregate of 110,204,066 shares of the Issuer’s Common Stock (the

“Warrants” and each, a “Warrant”), for an aggregate purchase price of $30.0 million. Pursuant to the Investment Agreement, the Reporting Person purchased 500 shares of Series A Preferred Stock that are convertible into

1,020,408 shares of the Issuer’s Common Stock and 1,836,734 shares of Common Stock that are issuable upon the exercise of the Warrant for an aggregate purchase price of $500,000. The Investment Agreement is filed herewith as Exhibit A, and any

description thereof is qualified in its entirety by reference thereto.

The Warrants are exercisable for a number of shares of Common Stock equal to 180%

of the number of shares of Common Stock into which such investor’s Series A Preferred Stock is initially convertible. The Warrants have a five-year term and an exercise price that is equal to $0.333 per share. The Warrants also provide for an

exercise on a cash or cashless net exercise basis at any time after the closing and will be automatically exercised on a cashless basis if not exercised prior to the expiration of the five-year term. Upon a fundamental change or other liquidation

event, the Warrants will automatically net exercise if not exercised before the consummation of such event. The Form of Warrant is filed herewith as Exhibit B, and any description thereof is qualified in its entirety by reference thereto.

| Item 4. |

Purpose of Transaction |

The Reporting Person acquired the securities of the Issuer for investment purposes. The Reporting Person may purchase additional securities or dispose of

securities in varying amounts and at varying times depending upon the Reporting Person’s continuing assessments of pertinent factors, including the availability of shares of Common Stock or other securities for purchase at particular price

levels, the business prospects of the Issuer, other business investment opportunities, economic conditions, stock market conditions, money market conditions, the attitudes and actions of the Board and management of the Issuer, the availability and

nature of opportunities to dispose of shares of the Issuer and other plans and requirements of the particular entities. The Reporting Person may discuss items of mutual interest with the Issuer, which could include items in subparagraphs

(a) through (j) of Item 4 of Schedule 13D.

Depending upon assessments of the above factors, the Reporting Person may change its present

intentions as stated above and may assess whether to make suggestions to the Board regarding financing, and whether to acquire additional securities of the Issuer, including shares of Common Stock (by means of open market purchases, privately

negotiated purchases, or otherwise) or to dispose of some or all of the securities of the Issuer, including shares of Common Stock, under its control. The Reporting Person may seek to acquire other securities of the Issuer, including other equity,

debt, notes or other financial instruments related to the Issuer or the Common Stock (which may include rights or securities exercisable or convertible into securities of the Issuer), and/or sell or otherwise dispose of some or all of such Issuer

securities or financial instruments (which may include distributing some or all of such securities to such Reporting Person’s respective partners or beneficiaries, as applicable) from time to time, in each case, in open market or private

transactions, block sales or otherwise. Any transaction that the Reporting Person may pursue may be made at any time and from time to time without prior notice and will depend on a variety of factors, including, without limitation, the price and

availability of the Issuer’s securities or other financial instruments, the Reporting Person’s trading and investment strategies, subsequent developments affecting the Issuer, the Issuer’s business and the Issuer’s prospects,

other investment and business opportunities available to such Reporting Person, general industry and economic conditions, the securities markets in general, tax considerations and other factors deemed relevant by the Reporting Person.

The Reporting Person intends to review its investment in the Issuer on an ongoing basis and, in the course of its review, may take actions with respect to its

investment or the Issuer, including communicating from time to time with the Board, other members of management, other securityholders of the Issuer, or other third parties, advisors, such as legal, financial, regulatory, or other advisors, to

assist in the review and evaluation of strategic alternatives. Such discussions and other actions may relate to various alternative courses of action, including, without limitation, those related to an extraordinary corporate transaction (including,

but not limited to a merger, reorganization or liquidation) involving the Issuer or any of its subsidiaries; a sale or transfer of a material portion of the assets of the Issuer or any of its subsidiaries or the acquisition of material assets; the

formation of joint ventures or other strategic alliances with the Issuer or any of its subsidiaries; changes in the present business, operations, strategy, future plans or prospects of the Issuer, financial or governance matters; changes to the

Board or management of the Issuer; changes to the capitalization, ownership structure, dividend policy, business or corporate structure or governance documents of the Issuer; de-listing or de-registration of the Issuer’s securities; or any action similar to the foregoing. Such discussions and actions may be exploratory in nature, and not rise to the level of a plan or proposal.

The Reporting Person is currently a member of the Board and the Chief Executive Officer and President of the Issuer. In such capacity, the Reporting Person

may have influence over the corporate activities of the Issuer and may engage in communications with the Issuer’s other directors, other members of management and stockholders and third parties regarding the corporate governance, business,

operations, strategy or future plans (including proposed corporate transactions of a significant nature) of the Issuer, including any plans or proposals which may relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule

13D.

Except as described in this Schedule 13D, the Reporting Person does not have any present plans or proposals that relate to or would result in any of

the actions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D, although, subject to the agreements described herein, the Reporting Person, at any time and from time to time, may review, reconsider and change their

position and/or change its purpose and/or develop such plans and may seek to influence management of the Issuer or the Board with respect to the business and affairs of the Issuer and may from time to time consider pursuing or proposing such matters

with advisors, the Issuer or other persons.

| Item 5. |

Interest in Securities of the Issuer |

| |

(a) |

The Reporting Person beneficially owns 7,473,415 shares of the Common Stock, or approximately 6.3% of the

outstanding Common Stock, comprised of (i) 2,146,296 shares of Common Stock held directly by the Reporting Person, (ii) 2,074,200 shares of Common Stock held directly by the Reporting Person’s spouse, (iii) 195,649 shares of Common Stock of

exercisable options, (iv) 200,128 shares of Common Stock issuable upon the vesting of restricted stock units, which will vest within 60 days of February 17, 2023, (v) 1,020,408 shares of Common Stock that would be issued upon the conversion of

Series A Convertible Preferred Stock purchased by the Reporting Person pursuant to the Investment Agreement described herein, and (vi) 1,836,734 shares of Common Stock that would be issued upon the exercise of the Warrant purchased by the Reporting

Person pursuant to the Investment Agreement described herein. The Reporting Person disclaims beneficial ownership of the shares of Common Stock owned by the Reporting Person’s spouse, and the inclusion of such shares herein shall not constitute

an admission that the Reporting Person is a beneficial owner of such shares. |

| |

The |

percentage ownership is based on 114,852,448 shares of the Issuer’s Common Stock outstanding as of

November 10, 2022, as reported in the Issuer’s Form 10-Q filed with the SEC on November 14, 2022. |

| |

(b) |

The Reporting Person, has the sole power to vote and dispose, or direct the voting or disposition, of 5,003,438

shares of the Common Stock and may be deemed to share voting and dispositive power with respect to 2,074,200 shares of Common Stock held directly by the Reporting Person’s spouse. |

| |

(c) |

Except as described herein, the Reporting Person has not effected any transactions in the Issuer’s Common

Stock within the past 60 days. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

On February 17, 2023, the Issuer entered into an Investment Agreement with the Reporting Person, pursuant to which the

Reporting Person purchased (i) 500 shares of Series A Preferred Stock that are convertible into 1,020,408 shares of the Issuer’s Common Stock and (ii) a warrant (the “Warrant”) to purchase 1,836,734 shares of Common Stock for an

aggregate purchase price of $500,000. The Investment Agreement is filed herewith as Exhibit A, and any description thereof is qualified in its entirety by reference thereto.

The Warrant has a five-year term and an exercise price that is equal to $0.333 per share. The Warrant also provides for an exercise on a cash or cashless net

exercise basis at any time after the closing and will be automatically exercised on a cashless basis if not exercised prior to the expiration of the five-year term. Upon a fundamental change or other liquidation event, the Warrant will automatically

net exercise if not exercised before the consummation of such event. The Form of Warrant is filed herewith as Exhibit B, and any description thereof is qualified in its entirety by reference thereto.

Item 7. Material to be Filed as Exhibits

Exhibit A - Investment Agreement, dated February 17, 2023, by and among Owlet, Inc. and the investors listed on Schedule I thereto (Excluded Investors)

(incorporated by reference to Exhibit 10.2 of the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 21, 2023).

Exhibit B - Form of Warrant to Purchase Common Stock (incorporated by reference to Exhibit 4.1 of the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 21, 2023).

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

| Dated: February 27, 2023 |

|

|

|

|

|

OWLET, INC. |

|

|

|

|

|

|

|

|

|

|

/s/ Kurt Workman |

|

|

|

|

|

|

Name: Kurt Workman Title: Chief

Executive Officer |

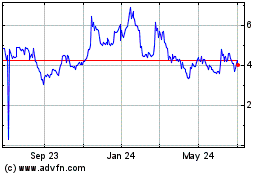

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

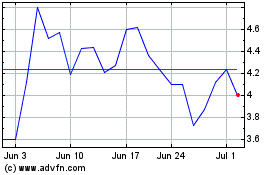

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024