Owlet Announces $30 Million Private Placement Financing

February 17 2023 - 4:05PM

Business Wire

Owlet, Inc. (NYSE: OWLT) (“Owlet” or the “Company”) today

announced it has consummated a sale of its newly issued Series A

convertible preferred stock (“Series A preferred stock”) and

warrants to purchase its Class A common stock (“common stock”) in a

private placement with certain institutional and other accredited

investors for gross proceeds to Owlet of $30 million, before

deducting offering expenses. The transaction closed on February 17,

2023 and involved participation from new and existing

investors.

Pursuant to the terms of the definitive agreements and the

closing of the private placement, Owlet has issued shares of Series

A preferred stock that are convertible into approximately 61.2

million shares of common stock. Each purchaser will also receive a

warrant to purchase 180% of the number of shares of common stock

into which their Series A preferred stock is convertible. The

warrants will have a per share exercise price of $0.333 and will be

exercisable by the holder at any time on or after the issuance date

for a period of five years.

Additional details regarding the private placement will be

included in a Form 8-K to be filed by Owlet with the Securities and

Exchange Commission (“SEC”).

Owlet intends to utilize the net proceeds for general corporate

purposes and to fund its strategic initiatives.

The securities sold in the private placement have not been

registered under the Securities Act of 1933, as amended (the

“Securities Act”), or securities laws of any state or other

jurisdiction, and may not be resold absent registration under, or

exemption from registration under, the Securities Act. Owlet has

agreed to file a registration statement with the SEC registering

the resale of the shares of common stock underlying the Series A

preferred stock and warrants.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

jurisdiction.

Cowen acted as placement agent for the private placement.

Cautionary Note Regarding Forward-Looking

Statements This press release contains certain statements

that are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 (the “Reform

Act”), including the use of proceeds from the private placement.

Generally, forward-looking statements include the words “estimate,”

“may,” “believes,” “plans,” “expects,” “anticipates,” “intends,”

“goal,” “potential,” “upcoming,” “outlook,” “guidance,” the

negation thereof, or similar expressions, although not all

forward-looking statements contain these identifying words.

Forward-looking statements are based on the Company’s expectations

at the time such statements are made, speak only as of the dates

they are made and are susceptible to a number of risks,

uncertainties and other factors. For all such forward-looking

statements, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Reform Act. The

Company’s actual results, performance or achievements may differ

materially from any future results, performance or achievements

expressed or implied by our forward-looking statements. Many

important factors could affect the Company’s future results and

cause those results to differ materially from those expressed in or

implied by the Company’s forward-looking statements. Such factors

include, but are not limited to, risks and uncertainties related to

financial results, including risks related to the private placement

reported herein, reflect information available to the Company only

as of the date of this press release, as well as those set forth in

the Company’s other releases, public statements and/or filings with

the U.S. Securities and Exchange Commission, including those

identified in the “Risk Factors” sections of the Company’s Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q. All future

written and oral forward-looking statements attributable to the

Company or any person acting on the Company’s behalf are expressly

qualified in their entirety by the cautionary statements contained

or referred to above. Moreover, Owlet operates in an evolving

environment. In addition to the factors described above, new risk

factors and uncertainties may emerge from time to time, and factors

that the Company currently deems immaterial may become material,

and it is impossible for the Company to predict such events or how

they may affect us. Except as required by federal securities laws,

the Company assumes no obligation to update any forward-looking

statements after the date of this release as a result of new

information, future events or otherwise, although we may do so from

time to time. The Company does not endorse any projections

regarding future performance, results or events that may be made by

third parties.

About Owlet, Inc. Owlet was founded

by a team of parents in 2012. Owlet’s mission is to empower parents

with the right information at the right time, to give them more

peace of mind and help them find more joy in the journey of

parenting. Owlet’s digital parenting platform aims to give parents

real-time data and insights to help parents feel more calm and

confident. Owlet believes that every parent deserves peace of mind

and the opportunity to feel their well-rested best. To learn more,

visit www.owletcare.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230217005352/en/

Media & Investors Mike

Cavanaugh Westwicke/ICR +1.617.877.9641

mike.cavanaugh@westwicke.com

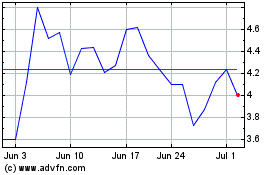

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

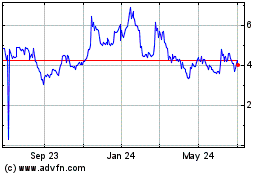

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024