Owlet, the Connected Nursery Ecosystem, Provides Full Year 2020 Financial Results and Corporate Update

April 05 2021 - 4:05PM

Business Wire

Strong Year-Over-Year Revenue Growth Driven by

the Continued Adoption of Owlet Technology

Recent Highlights

- Full year 2020 revenues of $75.4 million, a 51% increase from

2019.

- 2020 gross margin was 47.6%, compared with 46.0% the previous

year.

- Operating loss in 2020 declined 59% year-over-year to $(7.0)

million.

- Announcements of former Livongo CEO Zane Burke joining the

Board of Directors, and of Jim Fidacaro joining as Healthcare

General Manager, bolstering the Company’s digital health and

telehealth initiatives.

- In 2020, the Company made investments in new products and

services to help drive future growth in its connected

ecosystem.

- In February, Owlet entered into a business combination

agreement with Sandbridge Acquisition Corporation.

Owlet Baby Care Inc. (“Owlet” or the “Company”), the connected

nursery ecosystem that delivers data-driven technology to modern

parenting, recently disclosed 2020 financial results and provides a

recap of recent corporate activity.

“Over 1.5 million parents have trusted Owlet to be their partner

since we first started selling the Owlet Smart Sock in 2015. 2020

was a pivotal year all around for Owlet, including the release of

the next generation Smart Sock, with great results both financially

and with customer satisfaction,” said Kurt Workman, Owlet’s

Co-Founder and Chief Executive Officer. “The release of our new

online platform Dream Lab and continued growth of the Owlet Cam in

2020 were tremendous accomplishments and additional catalysts for

the momentum we are bringing into 2021.”

“Owlet is well positioned to capture the trend of healthcare

moving to the edge, a move that was accelerated by the COVID-19

pandemic during the past year. The Company’s products provide

parents with accurate, real-time data about their babies in the

comfort of their own home,” said Lior Susan, Founding Partner of

Eclipse Ventures and Owlet’s Chairman. “Enthusiastically embraced

by users, Owlet’s products are fast becoming indispensable

components of the modern, connected nursery, and offer parents a

peace of mind not previously available to the average consumer. The

company’s strong revenue growth in 2020 demonstrates a convergence

of Owlet’s high-quality product and robust market demand. We are

committed to continuing to enhance our products as part of our

ongoing goal to provide parents with a better understanding of

their baby’s needs.”

About Owlet

Owlet was founded by a team of parents in 2012. Owlet’s mission

is to empower parents with the right information at the right time,

to give them more peace of mind and help them find more joy in the

journey of parenting. Owlet’s digital parenting platform aims to

give parents real-time data and insights to help parents feel more

calm and confident. Owlet believes that every parent deserves peace

of mind and the opportunity to feel their well-rested best. Owlet

also believes that every child deserves to live a long, happy, and

healthy life, and is working to develop products to help facilitate

that belief.

Additional Information and Where to Find It

In February, Owlet entered into a definitive merger agreement in

February with Sandbridge Acquisition Corporation (NYSE: SBG)

(“Sandbridge”), a special purpose acquisition company.

Sandbridge has filed with the SEC a Registration Statement on

Form S-4, which includes a proxy statement/prospectus, that will be

both the proxy statement to be distributed to holders of

Sandbridge’s Class A common stock in connection with its

solicitation of proxies for the vote by Sandbridge’s stockholders

with respect to the business combination and other matters as may

be described in the registration statement, as well as the

prospectus relating to the offer and sale of certain securities to

be issued in the business combination. After the registration

statement is declared effective, Sandbridge will mail a definitive

proxy statement/prospectus and other relevant documents to its

stockholders. This press release does not contain all the

information that should be considered concerning the proposed

business combination and is not intended to form the basis of any

investment decision or any other decision in respect of the

proposed business combination. Sandbridge’s stockholders and other

interested persons are advised to read, when available, the

preliminary proxy statement/prospectus included in the registration

statement and the amendments thereto and the definitive proxy

statement/prospectus and other documents filed in connection with

the proposed business combination, as these materials will contain

important information about the Company, Sandbridge and the

proposed business combination. When available, the definitive proxy

statement/prospectus and other relevant materials for the proposed

business combination will be mailed to stockholders of Sandbridge

as of a record date to be established for voting on the proposed

business combination. Stockholders of Sandbridge will also be able

to obtain copies of the preliminary proxy statement, the definitive

proxy statement and other documents filed with the SEC, without

charge, once available, at the SEC’s website at www.sec.gov, or by

directing a written request to: Sandbridge Acquisition Corp., 1999

Avenue of the Stars, Suite 2088, Los Angeles, California 90067.

Participants in the Solicitation

Sandbridge and its directors and executive officers may be

deemed participants in the solicitation of proxies from

Sandbridge’s stockholders with respect to the proposed business

combination. The names of those directors and executive officers

and a description of their interests in Sandbridge are contained in

the proxy statement/prospectus for the proposed business

combination.

Owlet and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of Sandbridge in connection with the proposed business

combination. A list of the names of such directors and executive

officers and information regarding their interests in the proposed

business combination are included in the proxy statement/prospectus

for the proposed business combination.

Forward-Looking Statements

Certain statements, estimates, targets, and projections in this

press release may be considered forward-looking statements.

Forward-looking statements generally relate to future events. For

example, statements regarding the expected future operating and

financial performance and market opportunities of Owlet are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may”, “should”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential” or “continue”, or the negatives of these

terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward-looking

statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Sandbridge and its

management, and Owlet and its management, as the case may be, are

inherently uncertain. Factors that may cause actual results to

differ materially from current expectations include, but are not

limited to: the regulatory pathway for Owlet products and responses

from regulators, including the U.S. Food and Drug Administration

and similar regulators outside of the United States; changes in

applicable laws or regulations; the evolution of the markets in

which Owlet competes; the ability of Owlet to implement its

strategic initiatives and continue to innovate its existing

products; the ability of Owlet to defend its intellectual property

and satisfy regulatory requirements; the impact of the COVID 19

pandemic on Owlet’s business; the limited operating history of

Owlet; and other risks and uncertainties set forth in the sections

titled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Sandbridge’s registration statement

on Form S-4 and other documents to be filed with the SEC by

Sandbridge.

Nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Neither Sandbridge

nor Owlet undertakes any duty to update these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210405005399/en/

Media Relations Cammy Duong Westwicke, an ICR company

cammy.duong@westwicke.com (203) 682-8380 Jane Putnam

jputnam@owletcare.com Investor Relations Mike Cavanaugh

Westwicke, an ICR company mike.cavanaugh@westwicke.com (617)

877-9641

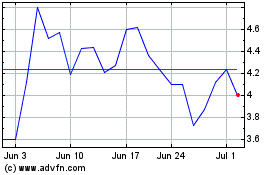

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

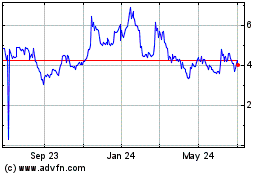

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024