Additional Proxy Soliciting Materials (definitive) (defa14a)

October 27 2021 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to Section 240.14a-12

|

Oracle

Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oracle Corporation

|

|

2300 Oracle Way Austin, Texas 78741

|

|

Phone: (737) 867-1000

|

|

|

October 27, 2021

To: Glass Lewis Subscribers

RE: Report Feedback Statement

We appreciate the opportunity to respond directly to the Glass Lewis proxy paper for Oracle’s (the “Company’s”) proxy

statement for its 2021 Annual Meeting of Stockholders (the “Proxy Statement”).

|

1.

|

Election of Directors: Recommendation to Withhold Votes for the Members of our Compensation Committee,

George H. Conrades, Charles W. Moorman IV, Leon E. Panetta and Naomi O. Seligman (page 16).

|

|

|

•

|

|

We strongly disagree with Glass Lewis’ recommendation to withhold votes for the election of

Mr. Conrades, Mr. Moorman, Secretary Panetta and Ms. Seligman, each of whom are members of the Company’s Compensation Committee. We believe Glass Lewis’ recommendation does not consider the valuable experience and expertise

offered by each of these directors and minimizes the significant efforts of the Compensation Committee to respond to stockholder feedback and enact changes to the Company’s compensation programs.

|

|

|

•

|

|

The current structure of the Company’s compensation program reflects significant input from stockholders.

In a chart on page 4 of the Proxy Statement, we provide a detailed discussion of how the Compensation Committee carefully weighed and considered stockholder feedback and describe the Company’s response:

|

|

|

•

|

|

The Compensation Committee did not grant any new equity awards to Mr. Ellison or Ms. Catz in fiscal

2021 and does not intend to grant new awards to these named executive officers (“NEOs”) during the performance period of the performance stock options (“PSOs”).

|

|

|

•

|

|

The Compensation Committee extended the PSO performance period by three additional years to encourage a

longer-term focus on the performance of the Company.

|

|

|

•

|

|

We believe that the goals associated with the PSOs are tailored to focus our executives on the long-term

strategic and operational goals of the Company. In fact, the vesting of one tranche of PSOs (representing one-seventh of the PSOs) is indicative of significant performance improvements that align with

long-term stockholder value. In order for that tranche of PSOs to vest, we achieved an $80 stock price goal, which is a significant benefit to stockholders. The Company’s stock price has closed above $80 every day since July 2, 2021. We

believe that the remaining PSO performance goals are rigorous and not easily attainable during the performance period. If the goals are attained, it will mean that we have achieved significant milestones in our long-term strategic and operational

plan that we believe will be beneficial to our stockholders.

|

1

|

2.

|

Election of Directors: Recommendation to Withhold Votes for Safra Catz (page 17).

|

|

|

•

|

|

We strongly disagree with Glass Lewis’ recommendation to withhold votes for the election of

Ms. Catz. Ms. Catz brings unique expertise regarding the Company’s strategic vision, management and operations to the Board from her experience with the Company as CEO. It is unclear what Glass Lewis hopes to achieve by recommending

that stockholders vote against Ms. Catz. The role of the CEO on a public company’s board is well established and Ms. Catz is an integral member of the Board. It would be highly unusual to have a sitting CEO excluded from a public

company’s board.

|

|

|

•

|

|

As a technical matter, we note that Ms. Catz is not the Company’s CFO and we object to her treatment

as one under Glass Lewis’ policies (including with the heading “CFO on Board”). Glass Lewis fails to appreciate and understand this aspect of the Company’s leadership structure and seeks to penalize Ms. Catz for performing

the roles of both CEO and principal financial officer.

|

|

|

•

|

|

Like most other public companies, our Board is directly responsible for overseeing Ms. Catz in all of her

functions, including hiring, termination, annual review, goals and compensation. Her relationship with the Board is not complicated by her responsibility for the oversight and accuracy of our financial results in addition to her many

responsibilities as CEO.

|

|

|

•

|

|

Ms. Catz is aware of her duties and potential conflicts. The Board and the Company have robust compliance

mechanisms in place to ensure that any conflicts involving Ms. Catz are recognized and managed appropriately, as they do for all directors.

|

|

|

•

|

|

Glass Lewis claims that this year is the first that Ms. Catz was identified as principal financial

officer of the Company in its proxy statement. However, we note that Ms. Catz’ service as principal financial officer of the Company was disclosed in the Company’s 2020 proxy statement. The fact that Ms. Catz has been acting as

the Company’s joint principal executive officer and principal financial officer for many years has also been widely known to stockholders and is apparent in our SEC filings.

|

|

3.

|

Election of Directors: Recommendation to Withhold Votes for Vishal Sikka (page 17).

|

|

|

•

|

|

We strongly disagree with Glass Lewis’ recommendation to withhold votes for the election of

Dr. Sikka. Dr. Sikka brings extensive leadership experience and expertise in the fields of artificial intelligence, information management, distributed systems and related areas, each of which are highly sought-after areas of expertise.

Dr. Sikka is the only director to hold a PhD in computer science and focused his studies on artificial intelligence – areas that are critical to the Company’s business strategy. Dr. Sikka also serves as a director of another

multinational company, providing the Board with an important perspective in its evaluation of the Company’s practices and processes. Furthermore, Dr. Sikka is one of the newest members of the Board and contributes to the Board’s

desire to maintain a mix of longer-tenured directors and newer directors.

|

|

|

•

|

|

Our Nomination & Governance Committee actively seeks women and minority candidates for the pool from

which director candidates are chosen. We have also heard feedback from our stockholders and stakeholders that board diversity is important to

|

2

|

|

them. We therefore do not understand why Glass Lewis has singled out a diverse and relatively new board member simply because they prefer fewer

non-independent directors (an issue affecting the full Board and not just Dr. Sikka). This is particularly perplexing in light of the public investor efforts to assemble diverse boards, the legislation in

a number of states that requires diverse directors or disclosure of board diversity as well as recent changes to diversity requirements for one of the U.S. stock exchanges.

|

|

|

•

|

|

Upon the recommendation of our Independence Committee, our Board determined that nine of our fourteen current

directors, or approximately 64%, are independent. We believe imposing an arbitrary two-thirds cutoff for board independence would deprive our Board and our stockholders of Dr. Sikka’s valuable

experience and expertise without conferring any corresponding benefit. The logical extension of Glass Lewis’ objection would be either to add another independent director to the Board, or to remove one of the

non-independent directors, neither of which the Board believes is in stockholders’ interests at this time. The Board believes it currently has the appropriate number of directors and right mix of skills

on the Board.

|

|

|

•

|

|

Although historical transactions resulted in Dr. Sikka not being independent under NYSE’s

bright-line rules, we do not expect this to have any meaningful impact on Dr. Sikka’s ability to render independent judgment as a member of the Board.

|

|

4.

|

Say on Pay: Recommendation Against Advisory Approval of Executive Compensation (page 23).

|

|

|

•

|

|

We strongly disagree with Glass Lewis’ recommendation against advisory approval of our executive

compensation. In fact, we believe the fact that Glass Lewis provided the Company with an “A” grade in its pay-for-performance model, which indicates that the

Company has adequately aligned pay with performance, does not align with this recommendation. Specifically, with respect to CEO compensation, the Glass Lewis report notes that “overall the Company paid less than its peers, but performed better

than its peers”.

|

|

|

•

|

|

As mentioned above, in fiscal 2021, the Compensation Committee engaged with stockholders to understand and

address feedback. With respect to the PSOs, we and our Compensation Committee believe the goals associated with the PSOs are drivers of the Company’s business and that they are tailored to focus our executives on the Company’s most

important long-term strategic and operational goals. The matching of operational performance goals with market capitalization goals ensures that stockholders will benefit from the achievement of the goals in the future. We note that if and when the

remaining PSOs vest, stockholders will have achieved significant long-term value. According to our internal projections, the remaining, unachieved performance goals are rigorous and are not easily attainable during the extended performance period.

|

3

|

|

•

|

|

Although Glass Lewis claims that we did not sufficiently disclose the performance period of the Company’s

recently granted performance-based long-term incentive awards, on page 4 and in other sections of the Proxy Statement we clearly state that we have extended the PSO performance period from May 31, 2022 through to May 31, 2025, which will

encourage a longer-term focus on the Company’s performance.

|

|

|

•

|

|

As mentioned above, one tranche of the PSOs (representing one-seventh

of the PSOs) vested on June 30, 2021. The first market capitalization goal has also been certified as achieved. However, because the remaining PSO tranches require matching of operational performance goals with market capitalization goals, no

additional vesting will occur until additional operational performance goals are also achieved. If the PSO goals are attained, it will be to the benefit of the Company’s stockholders.

|

|

|

•

|

|

During fiscal 2021, Ms. Catz and Mr. Ellison received no increase to their base salaries and no new

equity awards. Moreover, no additional equity awards have been granted to Mr. Ellison or Ms. Catz since the PSOs were granted in July 2017. The Compensation Committee does not expect to grant any equity awards to Mr. Ellison and

Ms. Catz during the eight-year performance period of the PSOs.

|

|

|

•

|

|

For fiscal 2021, the total compensation mix for our other NEOs is heavily weighted toward equity-based awards,

thus aligning their compensation with the interests of our stockholders. Approximately 81.4% of the aggregate fiscal 2021 total compensation for Mr. Screven and Ms. Daley was equity-based. Although Mr. Screven and Ms. Daley did

not receive performance-based equity awards, we do think that it is meaningful that such a large portion of their compensation is equity-based and thus aligned with our stockholders’ interests and is subject to vesting. In addition, the roles

of these other NEOs are focused on compliance matters, which leads us to believe that it is appropriate for their compensation to be weighted more toward fixed and time-based vesting compensation.

|

|

5.

|

Support for Stockholder Proposal Regarding Racial Equity Audit (page 29).

|

|

|

•

|

|

We are deeply committed to the advancement of racial diversity, equity and inclusion. Our current initiatives,

commitment of corporate resources, top-down oversight and our culture are key elements of our commitment in these areas, which has been externally acknowledged through awards and other recognitions. We believe

such outcomes are reflective of the success of our policies and our focus on diversity and inclusion, which is demonstrated throughout our organization, starting at the highest level:

|

|

|

•

|

|

Our CEO is a woman and 36% of our Board members are women or come from a diverse background (four of our

fourteen Board members are women);

|

|

|

•

|

|

Our Board’s Corporate Governance Guidelines affirm that our Nomination & Governance Committee,

acting on behalf of the Board, is committed to actively seeking women and minority candidates for the pool from which director candidates are selected;

|

|

|

•

|

|

Our Board has oversight responsibility and has received management presentations on diversity and inclusion

matters at the Company; and

|

4

|

|

•

|

|

Principles of freedom from discrimination in all aspects of the employment relationship and our commitment to

them are firmly set in our Code of Ethics and Business Conduct for employees as well as in our Codes of Ethics and Business Conduct for our suppliers and partners.

|

|

|

•

|

|

Glass Lewis is quick to ascribe what it views as sector-specific issues to the Company, without any indicia or

support that the issues raised generally (including through a report from over seven years ago) are reflected in the Company or any of its practices. In fact, the Company-specific “controversies” cited include two lawsuits that have been

decided in the Company’s favor. Further, Glass Lewis repeats allegations from a partisan and agenda-based news organization as facts. The Company has publicly rebutted the unfounded allegations, innuendo and insinuations contained in the

articles and noted that the Company information cited was outdated. We take exception to the inclusion of this sensationalized information that is only tangentially related to the stockholder proposal as evidence for Glass Lewis’ support.

|

|

|

•

|

|

Consistent with our commitment to transparency, we regularly publish information regarding the progress of our

diversity and inclusion efforts, both within and outside of the Company. The Board believes that an externally requested audit and related report are unnecessary in light of the Company’s significant efforts on this area.

|

|

|

•

|

|

We have an Equal Employment Opportunity policy, a Human Rights Statement and a Code of Ethics and Business

Conduct, each of which were put in place in part to ensure that our corporate culture embraces respect for racial diversity and cultivates an inclusive workforce and work environment.

|

|

|

•

|

|

We also publish a Corporate Citizenship Report that describes our corporate citizenship values and ethics and

efforts in the areas of education, giving, volunteering and sustainability.

|

|

|

•

|

|

Additionally, we maintain a website devoted to “Diversity and Inclusion” that discusses methods

through which we promote diversity and inclusion within and outside of our workplace and provides detailed reporting on the demographic make-up of our workforce.

|

|

6.

|

Support for Stockholder Proposal Regarding Independent Chair (page 34).

|

|

|

•

|

|

We believe that our stockholders benefit from the Board’s flexibility to determine our leadership

structure over a “one-size-fits-all” approach to Board leadership. The Board has carefully considered its leadership

structure and believes that this flexibility serves the best interests of the Company and our stockholders and permits the Board to take into account the Company’s needs and circumstances at any given time.

|

|

|

•

|

|

We also believe that the annual rotation of lead independent directors and the separation of Chairman and CEO

roles currently serve to provide the level of independent leadership and oversight requested by the stockholder proposal and maintains flexibility for the Board to evaluate its structure in the future.

|

|

|

•

|

|

The Board believes that the separation of the offices of the Chairman and CEO allows our CEO to focus on the

Company’s business strategy, operations and corporate vision. We believe it is valuable for Mr. Ellison to serve as Chairman because his familiarity with and knowledge of our technologies and product offerings are unmatched.

|

5

|

|

•

|

|

The Board evaluated the annual rotation of the lead independent director among committee chairs and determined

that the directors filling this role take it very seriously and believe the position is strengthened by the particular insights and diversity of viewpoints the committee chairs bring to the position.

|

|

|

•

|

|

During our extensive stockholder engagement efforts, we received feedback that was supportive of

Mr. Ellison’s role as Chairman due, in part, to his long-standing history with the Company and his perspectives. Our stockholders noted that they prefer a majority independent board that is not overly deferential to Mr. Ellison, which

we believe is reflected in our current structure and Board makeup.

|

We invite our stockholders to review our 2021 Proxy

Statement, and we would be pleased to discuss any questions they may have.

|

|

|

Best regards,

|

|

|

|

/s/ Brian S. Higgins

|

|

Brian S. Higgins

|

|

Senior Vice President, Associate General Counsel and Secretary

|

6

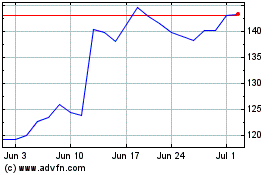

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024