Job cuts are part of push to focus on delivering growth to

parent Alphabet

By Aaron Tilley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 24, 2020).

Google's decision to cut jobs at its cloud-computing division is

the latest move in a yearlong effort by Thomas Kurian to shake up

the unit and put greater focus on delivering growth to parent

Alphabet Inc.

Mr. Kurian, after joining from Oracle Corp. in November 2018,

imposed hard project deadlines, riling some workers used to looser

execution targets, according to former Google employees, some of

whom left because of the move. The job cuts that Google disclosed

last week to The Wall Street Journal were part of a restructuring

aimed at improving how the company works with cloud customers, it

said.

Among the objectives Google has set since Mr. Kurian joined are

to become one of the top two cloud-computing providers and exceed

$25 billion in sales within a few years, according to former

employees. Google has room to grow -- its market share in the cloud

is just 4%, according to Gartner Inc. It trails Amazon.com Inc.,

Microsoft Corp. and China's Alibaba Group Holding Ltd.

Google wouldn't comment on specific internal targets, and Mr.

Kurian said league tables aren't his priority. "I don't wake up

counting if we're first, second or third biggest," he said. "If we

deliver the right product innovation, we'll grow with [customers]

and see results."

To spur growth, Mr. Kurian has focused on six industries,

including financial services and health care, to chase customers.

He is also building out regional sales teams.

Mr. Kurian is also exploring ways for Google Cloud to pursue

business in China, according to former employees. The size of

China's market makes it an attractive target for cloud providers,

but political tensions with the U.S. present obstacles.

China is a market where Google has a difficult history. In 2010,

Google pulled its search engine out of the country over the

censoring of search results. When plans to resume work in China

surfaced in 2018, they drew internal backlash, causing the company

to abandon the effort.

"Until we see further progress in ongoing discussions between

the U.S. government and Chinese government, we're waiting," Mr.

Kurian said. "We haven't made that decision yet."

Cloud computing has become one of the hottest markets for tech

companies as corporations shift more of their IT budgets to renting

data storage and number-crunching capacity rather than buying their

own hardware. Gartner estimates companies will spend more than $260

billion on cloud services this year, up more than a third from

2018.

Within Google, the cloud business has been growing in

importance. The cloud generated 5.5% of Alphabet sales last year,

or $8.9 billion, up from $4.1 billion, or 3.7% of total sales, two

years earlier. Alphabet only began separately reporting cloud sales

in the last quarter, further highlighting the growth push.

Mr. Kurian's changes have led to tensions within Google's cloud

ranks, where engineers had largely worked unencumbered by

deadlines, according to current and former employees. Engineers

were often more focused on projects they deemed interesting, former

employers said, rather than what customers were wanting. That meant

such features as databases and identity management -- which didn't

excite employees but were prized by corporate buyers -- were

neglected, former employers said.

Under Mr. Kurian, said a former Google Cloud engineer, "we have

to build stuff we can sell. People weren't used to having

that."

Mr. Kurian also upset some sales people when he shifted their

compensation plans by lowering their base pay but offering more in

bonuses for the deals they secured, former employees said. Google

declined to comment.

Over the past year, the changes at Google Cloud have been

noticeable to partners and customers, said Christian Rast, global

head of technology at KPMG International, which teamed up with

Google Cloud in mid-2018 before Mr. Kurian joined. Mr. Rast said

Google Cloud has a better understanding of how to work with big

legacy enterprises than it did in the past.

Google has a history of offering consumer products in the cloud,

providing services such as email, documents and spreadsheets as

well as selling storage and computing services to outside

customers. But it began to pursue enterprise contracts with big

business more formally in 2015. At the time, Google's cloud

business was led by Diane Greene, a veteran of the

enterprise-software world and co-founder of software provider

VMware Inc., now majority-owned by Dell Technologies Inc.

Early progress was slowed when Ms. Greene was unable to get

backing for some acquisitions to help expand in the cloud, people

close to Ms. Greene said. Ms. Greene couldn't enlist Chief

Executive Officer Sundar Pichai to meet with GitHub executives to

close a deal. Google lost out to Microsoft, which agreed in 2018 to

buy the coding-collaboration site for $7.5 billion in stock, with

Microsoft CEO Satya Nadella's support.

Ms. Greene left Google in January 2019, replaced by Mr. Kurian.

Since joining from Oracle, where he spent two decades in areas

including product development, Mr. Kurian has said his priority is

making the cloud business more responsive to corporate customers,

which are the biggest cloud spenders.

Under Mr. Kurian, Google bought the data-analytics firm Looker

for $2.6 billion. This past week the company announced it was

buying, for an undisclosed amount, Cornerstone Technology, an

IT-services company that helps companies shift their work to the

cloud.

Late last year Google set up a "customer success" team to help

customers achieve their objectives on the company's cloud service,

said John Jester, Google Cloud vice president for customer

experience, who leads the effort. "We weren't focused on the

enterprise at the level we needed to be," said Mr. Jester, who

joined from Microsoft.

Google has picked up some marquee customers. Riot Games Inc.,

maker of the popular online videogame League of Legends and owned

by the Chinese tech giant Tencent Holdings Ltd., is moving its data

analytics from Amazon to Google Cloud because of the sophisticated

tools Google Cloud offered, people familiar with the move said.

Google's cloud effort under Mr. Kurian has also encountered

challenges. Google teamed up with the second-largest health system

in the U.S. to collect detailed information on 50 million American

patients, sparking a federal inquiry and criticism from patients

and lawmakers.

Despite the layoffs in other parts of its business, Google Cloud

continues to bolster its sales ranks. At the end of 2019, Google

Cloud had 1,500 sales people, and by the end of this year, the

group plans to double to 3,000 sales people, according to a person

familiar with company's plans.

--Robert McMillan contributed to this article.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

February 24, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

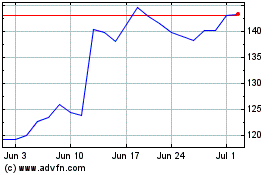

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024