Oracle Gets Boost From Licensing Software -- WSJ

June 20 2019 - 3:02AM

Dow Jones News

By Asa Fitch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 20, 2019).

Oracle Corp. reported stronger-than-expected sales and beat

profit targets for its latest quarter as the business-software

giant's fast-growing new businesses offset declining old ones.

Oracle, a more than 40-year-old pioneer in business database

management, has struggled to keep up with competitors as its

customers put more of their data online and do more of their

business using cloud computing instead of their own machines.

Microsoft Corp., Amazon.com Inc. and Salesforce.com Inc. are all

seeing rapid growth in sales of cloud services and software.

Earlier this month, Salesforce said revenue rose by 24% in its

latest quarter.

Oracle said on Wednesday that fiscal-fourth-quarter revenue

increased about 1% from the year earlier to $11.14 billion,

surpassing the $10.93 billion that analysts polled by FactSet

predicted.

That growth, which followed two consecutive quarters of

declines, sprang from product offerings like a database that

performs updates and plugs security holes automatically, Co-Chief

Executive Safra Catz told analysts.

"Our overall customer base is growing, and that growth is

starting to accelerate," she said.

Oracle's business of licensing software grew by 12%

year-over-year to $2.52 billion in the quarter. Cloud services and

license support, the company's largest unit, was up 0.5% to $6.79

billion. Hardware revenue fell 11% to $1.12 billion.

Rebecca Wettemann, the vice president of research at

Boston-based analysis firm Nucleus Research, said the company was

having success in selling business and financial-management tools

like NetSuite, which Oracle bought in 2016. However, she added that

the bright spots were offset by a cloud-computing business that

lagged behind some competitors and older software that may be

difficult to sustain going forward.

"Some of our businesses are not, if you will, hot, but the good

news is the hot businesses are now bigger than the not-so-hot

businesses, and that's determining our future," Oracle founder and

chief technology officer Larry Ellison said.

Ms. Catz said the company was expecting revenue for the current

quarter to be flat to up by 2%. She said she expected revenue for

the company's current fiscal year, which began this month, to

exceed the 3% increase for the previous year.

The company's adjusted profit margin of 47% in the quarter that

ended May 31 was the highest level it has recorded in five years,

Ms. Catz said.

The positive trend for revenue, however, did nothing to dispel

the notion that Oracle is still behind in its quest to become a

major cloud-computing competitor, said Brad Reback, an analyst at

Stifel Nicolaus & Co.

"Most of the [earnings] beat came from the license business, and

I would stress the legacy license business, with the cloud business

being just in line" with expectations, he said.

Shares of Oracle closed at $52.68 on Wednesday and were down

slightly after hours.

Profit rose to $3.74 billion, or $1.07 cents a share, for the

quarter, up from $3.28 billion, or 79 cents a share last year.

After adjustments, Oracle reported a profit of $1.16 a share, 9

cents better than Wall Street targets.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

June 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

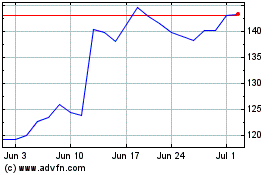

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024