Amended Current Report Filing (8-k/a)

October 16 2020 - 4:37PM

Edgar (US Regulatory)

0000726728false00007267282020-10-022020-10-020000726728us-gaap:CommonClassAMember2020-10-022020-10-020000726728o:NotesDue2030Member2020-10-022020-10-02

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K/A

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: October 2, 2020

(Date of Earliest Event Reported)

REALTY INCOME CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

1-13374

|

|

33-0580106

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange On Which Registered

|

|

Common Stock, $0.01 Par Value

|

O

|

New York Stock Exchange

|

|

1.625% Notes due 2030

|

O30

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

EXPLANATORY NOTE

On October 5, 2020, Realty Income Corporation (the "Company") filed a Form 8-K to report certain events under Items 2.02, 7.01 and 9.01 (the “Original Report”). This Form 8-K/A is being filed to correct the contractual rent collections for the quarter ended June 30, 2020, the month ended July 31, 2020, and the month ended August 31, 2020 contained in the press release furnished as Exhibit 99.1 thereto (the "Original Press Release"), by furnishing such corrected information under Items 2.02 and 7.01 of this Form 8-K/A in the table below. Changes in the contractual rent collections from those contained in the Original Press Release are indicated by the marked changes below. Contractual rent collections for the month ended September 30, 2020 are unchanged by this update. In addition, due to an inadvertent error, the submission header coding in the Original Report incorrectly referred to Item 2.01 and not to Item 2.02. This Form 8-K/A corrects the submission header coding to refer to Item 2.02. Except as set forth herein, the remainder of the Original Form 8-K is unchanged.

Item 2.02 Results of Operations and Financial Condition

Item 7.01 Regulation FD Disclosure

On October 2, 2020, the Company provided a business update regarding its contractual rent collections through such date with respect to the periods set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

|

|

For the

|

|

For the

|

|

For the

|

|

|

Quarter Ended

|

|

Month Ended

|

|

Month Ended

|

|

Month Ended

|

|

|

June 30, 2020

|

|

July 31, 2020

|

|

August 31, 2020

|

|

September 30, 2020

|

|

Through October 1, 2020:

|

|

|

|

|

|

|

|

|

Contractual rent collected(1) across total portfolio

|

88.3% / 85.9%

|

|

92.5% / 91.6%

|

|

93.6% / 93.3%

|

|

93.8%

|

|

Contractual rent collected(1) from top 20 tenants(2)

|

82.9%

|

|

90.9% / 89.8%

|

|

91.7%

|

|

91.9%

|

|

Contractual rent collected(1) from investment grade tenants(3)

|

99.4%

|

|

100.0%

|

|

99.9% / 100.0%

|

|

100.0%

|

(1) Collection rates are calculated as the aggregate cash rent collected divided by the contractual cash rent charged for the applicable period. Cash rent collected is defined as amounts received including amounts in transit, where the tenant has confirmed payment is in process. Rent collection percentages are calculated based on contractual base rents (excluding percentage rents and tenant reimbursements). Charged amounts have not been adjusted for any COVID-19 related rent relief granted and include contractual base rents from any tenants in bankruptcy.

(2) We define top 20 tenants as our 20 largest tenants based on percentage of total portfolio annualized contractual rental revenue as of the last day of such period.

(3) We define investment grade tenants as tenants with a credit rating, and tenants that are subsidiaries or affiliates of companies with a credit rating, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch).

The foregoing information, including the information contained in the revised press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Dated: October 16, 2020

|

REALTY INCOME CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ MICHAEL R. PFEIFFER

|

|

|

|

Michael R. Pfeiffer

|

|

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

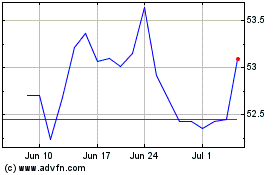

Realty Income (NYSE:O)

Historical Stock Chart

From Mar 2024 to Apr 2024

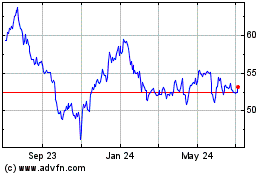

Realty Income (NYSE:O)

Historical Stock Chart

From Apr 2023 to Apr 2024