Molecular Partners Shares Rise 37% Premarket After Trial Meets Primary Endpoint

January 10 2022 - 7:06AM

Dow Jones News

By Chris Wack

Molecular Partners AG shares rose 37% to $22.60 in premarket

trading after the company and Novartis said that Part A of their

clinical trial comparing single intravenous doses of ensovibep, a

DARPin antiviral therapeutic candidate, versus placebo to treat

Covid-19, met the primary endpoint of viral load reduction over

eight days.

The company said the two secondary endpoints in the study also

showed clinically meaningful benefit over placebo: composite

endpoint of hospitalization and/or Emergency Room visits or death,

and time to sustained clinical recovery.

Novartis said it will exercise its option to in-license

ensovibep from Molecular Partners and, following exercise of the

option, will seek expedited access globally, first via the Food and

Drug Administration's EUA process.

The clinical trial, which is being conducted by Novartis, with

Molecular Partners as sponsor, is a placebo controlled study in

ambulatory adult patients with Covid-19. Part A enrolled 407

patients to identify a dose of ensovibep with optimal safety and

efficacy and recruited patients in the U.S., South Africa, India,

the Netherlands, and Hungary to explore three doses: 75mg, 225mg

and 600mg.

Results from the study showed that the primary endpoint was met

with a statistically significant reduction in viral load over eight

days, compared to placebo, for all three dosing arms. The secondary

endpoint of hospitalization and/or ER visits related to Covid-19,

showed an overall 78% reduction in risk of events across ensovibep

arms compared to placebo. No deaths occurred in any of the patients

treated with ensovibep. All doses were well-tolerated and no

unexpected safety issues were identified for any of the doses.

Novartis told Molecular Partners of its intent to option its

exclusive license to global rights of ensovibep, which will lead to

a milestone payment. Molecular Partners will also be eligible to

receive 22% royalty on sales. Molecular Partners has agreed to

forgo royalties in lower income countries and is aligned with

Novartis' plans to ensure affordability based on countries' needs

and capabilities.

Novartis will become responsible for development, manufacturing,

distribution and commercialization activities of ensovibep.

Novartis has initiated scale-up activities in its large-scale

biologics production facilities.

Molecular Partners estimates its cash runway to extend into

2025, excluding any potential royalty income as well as excluding

potential further cash flows.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

January 10, 2022 06:51 ET (11:51 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

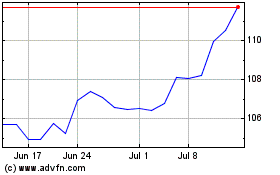

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

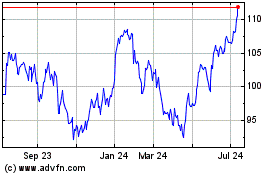

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024