Companies' Financial Planning Comes Up Short in the Coronavirus Era

May 24 2020 - 9:29AM

Dow Jones News

By Mark Maurer and Nina Trentmann

To prepare for uncertainty, finance chiefs turn to scenario

planning. They develop models to help quantify the effects of

what-if situations involving cash flow, sales revenue and other

metrics.

However, the unprecedented nature of the coronavirus pandemic

has complicated the practice, upending annual budgets and

investment time lines, and rendering forward-looking guidance

futile.

CFOs in recent weeks have set aside pre-existing plans or are

treating them, at best, as a starting point. Some companies have

opted to draw on the fallout of the 2008 financial crisis as a de

facto worst-case scenario.

But unlike past crises, many executives find every element of

their business under strain.

"You've got these great plans and as of yesterday, they're

completely meaningless," said Brian Kalish, who consults on

financial planning and corporate treasury issues.

As the pandemic drags on, finance chiefs across sectors are

devoting more time and resources to examining a range of potential

scenarios. They are also stress-testing business-continuity plans

and trying to revise forecasts more frequently.

"We just don't know what we're facing," said Mark George, chief

financial officer of Norfolk, Va.-based railroad operator Norfolk

Southern Corp.

Norfolk Southern last year started relying on stress-test

scenarios to test its liquidity and gauge if it was positioned to

deal with another crisis such as the 2008 downturn, Mr. George

said. The company's finance team imagined scenarios using varying

multiples of revenue and then simulated the impact of that revenue

on cash flow. Those exercises are helping the company evaluate

possible outcomes, he said.

"Part of this is driven by, frankly, the PTSD we all have going

back to the 2008 financial crisis," he said.

Many CFOs, therefore, hesitate to stick to their predictions for

the coming quarters. Sixty-two percent of S&P 500 companies

have withdrawn or revised earnings guidance since April 1 because

of the pandemic, according to research and advisory firm Gartner

Inc.

Policy makers and company executives increasingly expect a

swoosh-shaped recovery, denoting a large drop in the economic

performance followed by a prolonged return. But economists continue

to consider a variety of possibilities, such as a short collapse

followed by a bounce back to pre-pandemic levels of activity, or a

slower version of gross domestic product recovery.

"The world is going to be different in three, six and 12

months," said Christopher Kastner, CFO of Newport News, Va.-based

shipbuilder Huntington Ingalls Industries Inc. "Thinking through

what's going to be next, I know that's hard to do and we're

challenged with it."

The unpredictability has made even worst-case scenarios

revolving around natural disasters seem suddenly manageable.

"A hurricane you can see the other side of, so it's easier to

plan when you're going to come back up the other side and how

you're going to execute," Mr. Kastner said.

As companies tighten their budgets, models and planning tools

aren't expected to undergo significant innovation. Businesses

likely will continue to use planning tools they already have

because it is very difficult to develop new tools in the midst of a

crisis, said Bryan Lapidus, director of the financial planning and

analysis practice for the Association for Financial

Professionals.

Group 1 Automotive Inc., is examining scenarios covering a

12-month period, said CFO John Rickel. Its parts and services

business division was particularly resilient during the 2008

financial crisis as people held on to their vehicles longer and

needed repairs and service, but is facing declines now, he

said.

The pandemic has pushed the Houston-based dealership chain to

test out worst-case scenarios that would be worse than anything

tested before the current crisis, Mr. Rickel said, such as a 30% to

40% decline in revenue for its parts and services division.

Group 1 is swiftly adjusting by focusing on the potential impact

on costs, cash and loan agreements. It has developed a strategic

plan to reduce capital spending and suspend its dividend, he

said.

"You want to be in a position where if those more dire forecasts

come through," said Mr. Rickel, "you're not putting the business at

risk."

Write to Mark Maurer at mark.maurer@wsj.com and Nina Trentmann

at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 24, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

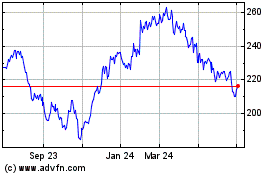

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

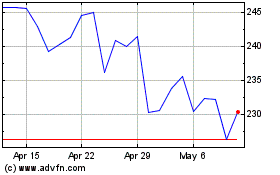

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Apr 2023 to Apr 2024