Current Report Filing (8-k)

March 27 2020 - 4:22PM

Edgar (US Regulatory)

false0001373715

0001373715

2020-03-24

2020-03-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (date of earliest event reported): March 24, 2020

___________

SERVICENOW, INC.

(Exact name of registrant as specified in its charter)

___________

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35580

|

|

20-2056195

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

2225 Lawson Lane

Santa Clara, California 95054

(Address of principal executive offices and Zip Code)

(408) 501-8550

(Registrant’s telephone number, including area code)

|

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.001 per share

|

|

NOW

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)

As previously disclosed in the Current Report on Form 8-K of ServiceNow, Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) on October 23, 2019 (the “October 2019 8-K”), William R. McDermott’s employment agreement with the Company dated October 22, 2019 (the “Employment Agreement”) provides, among other things, that, in the event that Mr. McDermott’s prior employer does not make one or more of the required payments under that employer’s long term incentive plan despite Mr. McDermott’s best efforts to secure such payments, the Company will pay to Mr. McDermott cash amounts equal to the difference between the amount required to be paid to him and the amount actually received by Mr. McDermott from his prior employer, such payments not to exceed $21,115,498 in the aggregate (the “LTIP Make-Whole Payments”). Mr. McDermott’s prior employer was also obligated to make certain non-competition payments to Mr. McDermott (the “Non-competition Payments”).

As a result of Mr. McDermott’s employment by the Company and his receipt of compensation from the Company, Mr. McDermott’s prior employer has disputed its obligation to make this payment to Mr. McDermott and has refused to pay the full amount of the Non-competition Payments to Mr. McDermott despite Mr. McDermott’s best efforts to secure such payments. In the interest of avoiding the distraction of Mr. McDermott trying to resolve this situation with his prior employer, so that he can continue to devote his time and attention to aggressively pursue the Company’s growth strategy, the Company agreed to amend the Employment Agreement (the “Amendment”) to provide that it would make a payment to Mr. McDermott of $3.9 million (the “Non-competition Make-Whole Payment”). This represents the amount which restores the benefit which Mr. McDermott was entitled to receive from his prior employer.

The Amendment does not increase the Company’s total obligation for make-whole payments to Mr. McDermott. The Amendment provides the total of the Non-competition Make-Whole Payment and any and all LTIP Make-Whole Payments will not exceed $21,115,498 in the aggregate. For avoidance of doubt, in the event that there is a shortfall on the LTIP Make-Whole Payments from Mr. McDermott’s prior employer and the Company is required to make Make-Whole Payments, the total of such payments, together with the Non-Competition Make-Whole Payment shall not exceed $21,115,498.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

(d)

|

Exhibits.

|

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

SERVICENOW, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Russell S. Elmer

|

|

|

|

|

|

Russell S. Elmer

General Counsel and Secretary

|

|

|

|

|

|

|

|

|

Date: March 27, 2020

|

|

|

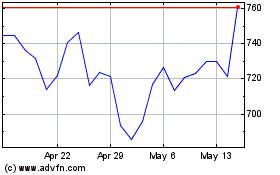

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

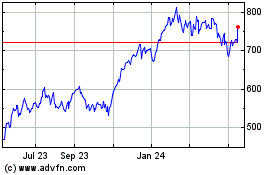

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Apr 2023 to Apr 2024