Current Report Filing (8-k)

June 14 2021 - 7:00AM

Edgar (US Regulatory)

0001772695false00017726952021-06-142021-06-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________

FORM 8-K

_______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 14, 2021 (June 11, 2021)

_______________________________________________________________________________

Sunnova Energy International Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-38995

|

30-1192746

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

20 East Greenway Plaza, Suite 540

Houston, Texas 77046

(Address, including zip code, of principal executive offices)

(281) 892-1588

(Registrant's telephone number, including area code)

_______________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.0001 par value per share

|

NOVA

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On June 11, 2021, a wholly owned, indirect subsidiary of Sunnova Energy International Inc., a Delaware corporation (the “Company”), entered into a Note Purchase Agreement (the “Note Purchase Agreement”) with certain other subsidiaries of the Company (collectively, the “Sunnova NPA Parties”) and Credit Suisse Securities (USA) LLC (“Credit Suisse”), as the initial purchaser, relating to the sale of $319,000,000 aggregate principal amount of 2.58% Solar Asset Backed Notes, Series 2021-1 (the “Notes”). The Company intends to use the proceeds from the sale of the Notes for (i) the payment of expenses related to the offering of the Notes, (ii) the repayment of one or more currently existing financing arrangements of the Company’s subsidiaries, including a voluntary prepayment of all outstanding 4.94% Series 2017-1 Class A solar asset-backed notes, 6.00% Series 2017-1 Class B solar asset-backed notes and 8.00% Series 2017-1 Class C solar asset-backed notes with a maturity date of September 2049 pursuant to the Indenture dated as of April 19, 2017, as amended and supplemented to date, among Helios Issuer, LLC, as issuer, and Wells Fargo Bank, National Association, as trustee and (iii) for general corporate purposes.

The Note Purchase Agreement contains customary representations, warranties and affirmative and negative covenants by each of the Sunnova NPA Parties and Credit Suisse together with customary closing conditions. Under the terms of the Note Purchase Agreement, each of the Sunnova NPA Parties and Credit Suisse have agreed to indemnify such other party or parties against certain liabilities.

The Notes were offered within the United States only to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”) and to persons outside of the United States in compliance with Regulation S under the Securities Act. The Notes have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements under the Securities Act and other applicable securities laws.

The foregoing description of the Note Purchase Agreement is qualified in its entirety by reference to the full text of the Note Purchase Agreement, a copy of which the Company plans to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2021.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information relating to the Note Purchase Agreement set forth in Item 1.01 above is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

SUNNOVA ENERGY INTERNATIONAL INC.

|

|

|

|

|

|

Date: June 14, 2021

|

By:

|

/s/ Walter A. Baker

|

|

|

|

Walter A. Baker

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

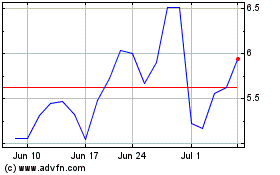

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024