2019 Highlights

- Added over 18,000 customers in 2019, increasing total customer

count 30% year-over-year to 78,600;

- Exceeded midpoint of guidance for each 2019 financial

metric;

- Increased storage attachment rate on origination to 24% in the

fourth quarter of 2019; and

- Sustained 2019's accelerated growth into 2020.

Sunnova Energy International Inc. ("Sunnova") (NYSE: NOVA), one

of the leading U.S. residential solar and storage service

providers, today announced financial results for the fourth quarter

and full-year ended December 31, 2019.

"The past twelve months were an exciting period of disruption

for Sunnova as we became the industry leader in growth rate. In

2019, we increased our customer base 30 percent, saw escalating

growth in our contracted customer value, launched new product

offerings and entered new markets, saw a surge in storage

attachment rates, continued to build out our differentiated dealer

base, and met or exceeded our 2019 operational and financial

targets," said William J. (John) Berger, Chief Executive Officer of

Sunnova. "In addition, we closed on a number of important financial

transactions, including our IPO, new tax equity facilities, a new

credit facility for our leases and PPAs, a comprehensive amendment

to the credit facility for our loan products, and a safe harbor

credit facility to fund the purchase of inventory to qualify for a

30 percent federal investment tax credit. In addition, we opened

2020 with the closing of a $412.5 million asset-backed

securitization at some of the strongest terms the industry has

seen, which is a testament to our business model and focus on

customer service."

Berger added, "With higher than expected growth in late 2019,

which has continued into the new year, our outlook continues to

improve, supporting an increase in our 2020 guidance. We now

foresee our asset base growing at a higher rate than projected in

the third quarter of 2019 while we maintain our focus on maximizing

recurring cash flows from operations. In addition to overall

customer growth, we have also seen our Sunnova SunSafe™ solar +

storage sales and attachment rates increase at a faster pace than

expected as consumers seek out more resilient sources of energy to

combat severe weather events and unreliable electricity grids.

Solar + storage has become an integral component of our business

strategy and Sunnova SunSafe™ is now available in 16 markets. The

increased pace of solar + storage sales is contributing to our

growth and our customers' ability to power energy independence.

"We are proud of what we accomplished in 2019; these

accomplishments have given us additional momentum to continue to

produce strong growth, deliver superior energy service to our

customers, and achieve our 2020 operational and financial

targets."

Year-over-Year Results

Sunnova's total number of customers was 78,600 as of December

31, 2019, an increase of 18,300 compared to December 31, 2018.

Revenue increased to $131.6 million, or by $27.2 million, for

the year ended December 31, 2019 compared to the year ended

December 31, 2018. This increase in revenues is primarily the

result of an increase in the number of customers served.

Total operating expense, net increased to $153.8 million, or by

$35.7 million, in the year ended December 31, 2019 compared to the

year ended December 31, 2018. This increase is the result of an

increase in the number of customers served, greater depreciation

expense, and higher period-over-period general and administrative

expenses due to costs related to our initial public offering and

the hiring of personnel to support growth.

Adjusted Operating Expense increased to $83.3 million, or by

$20.0 million, in the year ended December 31, 2019 compared to the

year ended December 31, 2018. This increase is the result of an

increase in the number of customers served.

Sunnova incurred a net loss of $133.4 million for the year ended

December 31, 2019 compared to a net loss of $68.4 million for the

year ended December 31, 2018. This larger net loss was primarily

driven by the factors described above as well as higher net

interest expense, including higher realized and unrealized net

losses on interest rate swaps.

Adjusted EBITDA was $48.3 million for the year ended December

31, 2019 compared to $41.1 million for the year ended December 31,

2018. This increase was due to customer growth increasing at a

faster rate than expenses.

Customer principal (net of amounts recorded in revenue) and

interest payments received from solar loans increased to $20.0

million and $11.6 million, respectively, for the year ended

December 31, 2019, or by $13.2 million and $5.4 million,

respectively, compared to the year ended December 31, 2018 due to a

larger customer loan portfolio.

Net cash used in operating activities was $170.3 million in the

year ended December 31, 2019 compared to $11.6 million in the year

ended December 31, 2018. This increase was due primarily to higher

inventory and prepaid inventory purchases under our safe harbor

credit facility, additional higher inventory purchases to meet

growing demand, an increased use of working capital and an increase

in the amount of exclusivity and other bonus arrangement payments

made to certain dealers that are inclusive in our asset level

economics during the year ended December 31, 2019 compared to year

ended December 31, 2018.

Adjusted Operating Cash Flow was relatively unchanged at $8.3

million in the year ended December 31, 2019 compared to $8.4

million for the year ended December 31, 2018.

Fourth Quarter 2019 Results

Revenue increased to $33.6 million, or by $8.4 million, in the

three months ended December 31, 2019 compared to the three months

ended December 31, 2018. Total operating expense, net increased to

$42.8 million, or by $5.1 million, in the three months ended

December 31, 2019 compared to the three months ended December 31,

2018. Adjusted Operating Expense increased to $22.9 million, or by

$5.6 million, in the three months ended December 31, 2019 compared

to the three months ended December 31, 2018. These increases are

the result of an increase in the number of customers served.

Sunnova incurred a net loss of $13.8 million for the three

months ended December 31, 2019 compared to a net loss of $39.1

million for the three months ended December 31, 2018. This smaller

net loss was driven by an unrealized gain on interest rate swaps in

the three months ended December 31, 2019 versus an unrealized loss

on swaps in the three months ended December 31, 2018.

Adjusted EBITDA was $10.8 million for the three months ended

December 31, 2019 compared to $8.0 million for the three months

ended December 31, 2018. This increase was due to customer growth

increasing at a faster rate than expenses.

Customer principal (net of amounts recorded in revenue) and

interest payments received from solar loans increased to $7.1

million and $3.4 million, respectively, for the three months ended

December 31, 2019, or by $5.3 million and $1.4 million,

respectively, compared to the three months ended December 31, 2018

due to a larger customer loan portfolio.

Net cash used in operating activities was $95.7 million in the

three months ended December 31, 2019 compared to $13.7 million of

net cash provided by operating activities in the three months ended

December 31, 2018. This change was primarily due to higher

inventory and prepaid inventory purchases necessary to meet growing

demand and safe harbor requirements.

Adjusted Operating Cash Flow was $26.7 million in the three

months ended December 31, 2019 compared to $22.0 million for the

three months ended December 31, 2018. This increase in Adjusted

Operating Cash Flow was primarily due to the increase in the number

of customers served.

Liquidity & Capital Resources

As of December 31, 2019, Sunnova had total cash of $150.3

million, including restricted and unrestricted cash.

2020 Guidance

Management announces updates to 2020 full-year guidance as

follows:

- Increase guidance on customer additions from 23,000 - 27,500 to

28,000 - 30,000;

- Increase guidance on Adjusted EBITDA from $55 million - $60

million to $58 million - $62 million;

- Increase guidance on customer principal payments received from

solar loans, net of amounts recorded in revenue from $30 million -

$35 million to $32 million - $36 million;

- Increase guidance on customer interest payments received from

solar loans from $15 million - $20 million to $17 million - $21

million; and

- Increase guidance on Adjusted Operating Cash Flow from $5

million - $15 million to $10 million - $20 million

Non-GAAP Financial Measures

We present our operating results in accordance with accounting

principles generally accepted in the U.S. ("GAAP"). We believe

certain financial measures, such as Adjusted EBITDA, Adjusted

Operating Expense and Adjusted Operating Cash Flow, which are

non-GAAP measures, provide users of our financial statements with

supplemental information that may be useful in evaluating our

business. We use Adjusted EBITDA and Adjusted Operating Expense as

performance measures, and believe investors and securities analysts

also use Adjusted EBITDA and Adjusted Operating Expense in

evaluating our performance. While Adjusted EBITDA effectively

captures the operating performance of our leases and PPAs, it only

reflects the service portion of the operating performance under our

loan agreements. Therefore, we separately show customer P&I

payments. Adjusted EBITDA is also used by our management for

internal planning purposes, including our consolidated operating

budget, and by our board of directors in setting performance-based

compensation targets. We use Adjusted Operating Cash Flow as a

liquidity measure and believe Adjusted Operating Cash Flow is a

supplemental financial measure useful to management, analysts,

investors, lenders and rating agencies as an indicator of our

ability to internally fund origination activities, service or incur

additional debt and service our contractual obligations. We believe

investors and analysts will use Adjusted Operating Cash Flow to

evaluate our liquidity and ability to service our contractual

obligations. However, Adjusted Operating Cash Flow has limitations

as an analytical tool because it does not account for all future

expenditures and financial obligations of the business or reflect

unforeseen circumstances that may impact our future cash flows, all

of which could have a material effect on our financial condition

and results of operations. We believe that such non-GAAP measures,

when read in conjunction with our operating results presented under

GAAP, can be used both to better assess our business from period to

period and to better assess our business against other companies in

our industry, without regard to financing methods, historical cost

basis or capital structure. Our calculation of these non-GAAP

financial measures may differ from similarly-titled non-GAAP

measures, if any, reported by other companies. In addition, other

companies may not publish these or similar measures. Such non-GAAP

measures should be considered as a supplement to, and not as a

substitute for, financial measures prepared in accordance with

GAAP. Sunnova is unable to reconcile projected Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to the

most comparable financial measures calculated in accordance with

GAAP because of fluctuations in interest rates and their impact on

our unrealized and realized interest rate hedge gains or losses.

Sunnova provides a range for the forecasts of Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to

allow for the variability in the timing of cash receipts and

disbursements, customer utilization of our assets, and the impact

on the related reconciling items, many of which interplay with each

other. Therefore, the reconciliation of projected Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to

projected net income (loss), total operating expense, or net cash

provided by (used in) operating activities, as the case may be, is

not available without unreasonable effort.

Fourth Quarter and Full-Year 2019 Financial and Operational

Results Conference Call Information

Sunnova is hosting a conference call for analysts and investors

to discuss its fourth quarter and full-year 2019 results at 8:30

a.m. Eastern Time, on February 25, 2020. The conference call can be

accessed live over the phone by dialing 1-866-211-4135, or for

international callers, 1-647-689-6729. A replay will be available

two hours after the call and can be accessed by dialing

1-800-585-8367, or for international callers, 1-416-621-4642. The

conference ID for the live call and the replay is 1496478. The

replay will be available until March 3, 2020.

Interested investors and other parties may also listen to a

simultaneous webcast of the conference call by logging onto the

Investor Relations section of Sunnova’s website at

www.sunnova.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Sunnova’s future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as "may," "will," "should," "expects,"

"plans," "anticipates," "going to," "could," "intends," "target,"

"projects," "contemplates," "believes," "estimates," "predicts,"

"potential" or "continue" or the negative of these words or other

similar terms or expressions that concern Sunnova’s expectations,

strategy, priorities, plans or intentions. Forward-looking

statements in this release include, but are not limited to,

statements regarding our improved outlook, expectations about net

contracted customer value asset base growth rate, the momentum to

continue to drive strong growth and maximize recurring cash flows,

deliver superior energy service to our customers, add more net

contracted value and achieve our 2020 operational and financial

targets, and references to future rate of customer additions,

Adjusted EBITDA, customer P&I payments from solar loans and

adjusted operating cash flows. Sunnova’s expectations and beliefs

regarding these matters may not materialize, and actual results in

future periods are subject to risks and uncertainties that could

cause actual results to differ materially from those projected,

including risks regarding our ability to forecast our business due

to our limited operating history, our competition, fluctuations in

the solar and home-building markets, our ability to attract and

retain dealers and customers and our dealer and strategic partner

relationships. The forward-looking statements contained in this

release are also subject to other risks and uncertainties,

including those more fully described in Sunnova’s filings with the

Securities and Exchange Commission, including Sunnova’s annual

report on Form 10-K for the year ended December 31, 2019. The

forward-looking statements in this release are based on information

available to Sunnova as of the date hereof, and Sunnova disclaims

any obligation to update any forward-looking statements, except as

required by law.

About Sunnova

Sunnova Energy International Inc. (NYSE: NOVA) is a leading

residential solar and energy storage service provider with

customers across the U.S. and its territories. Sunnova’s goal is to

be the source of clean, affordable and reliable energy with a

simple mission: to power energy independence so that homeowners

have the freedom to live life uninterruptedTM.

SUNNOVA ENERGY INTERNATIONAL

INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

amounts and share par values)

As of December 31,

2019

2018

Assets

Current assets:

Cash

$

83,485

$

52,706

Accounts receivable—trade, net

10,672

6,312

Accounts receivable—other

6,147

3,721

Other current assets

174,016

26,794

Total current assets

274,320

89,533

Property and equipment, net

1,745,060

1,328,457

Customer notes receivable, net

297,975

172,031

Other assets

169,712

75,064

Total assets (1)

$

2,487,067

$

1,665,085

Liabilities, Redeemable

Noncontrolling Interests and Stockholders' Equity

Current liabilities:

Accounts payable

$

36,190

$

20,075

Accrued expenses

39,544

18,650

Current portion of long-term debt

97,464

26,965

Current portion of long-term

debt—affiliates

—

16,500

Other current liabilities

21,804

13,214

Total current liabilities

195,002

95,404

Long-term debt, net

1,346,419

872,249

Long-term debt, net—affiliates

—

44,181

Other long-term liabilities

127,406

66,453

Total liabilities (1)

1,668,827

1,078,287

Redeemable noncontrolling interests

172,305

85,680

Stockholders' equity:

Series A convertible preferred stock, 0

and 44,942,594 shares issued as of December 31, 2019 and 2018,

respectively, at $0.01 par value

—

449

Series C convertible preferred stock, 0

and 13,006,780 shares issued as of December 31, 2019 and 2018,

respectively, at $0.01 par value

—

130

Series A common stock, 0 and 8,612,728

shares issued as of December 31, 2019 and 2018, respectively, at

$0.01 par value

—

86

Series B common stock, 0 and 21,727 shares

issued as of December 31, 2019 and 2018, respectively, at $0.01 par

value

—

—

Common stock, 83,980,885 and 0 shares

issued as of December 31, 2019 and 2018, respectively, at $0.0001

par value

8

—

Additional paid-in capital—convertible

preferred stock

—

701,326

Additional paid-in capital—common

stock

1,007,751

85,439

Accumulated deficit

(361,824

)

(286,312

)

Total stockholders' equity

645,935

501,118

Total liabilities, redeemable

noncontrolling interests and stockholders' equity

$

2,487,067

$

1,665,085

(1) The consolidated assets as of December

31, 2019 and 2018 include $790,211 and $411,325, respectively, of

assets of variable interest entities ("VIEs") that can only be used

to settle obligations of the VIEs. These assets include cash of

$7,347 and $3,674 as of December 31, 2019 and 2018, respectively;

accounts receivable—trade, net of $1,460 and $884 as of December

31, 2019 and 2018, respectively; accounts receivable—other of $4

and $109 as of December 31, 2019 and 2018, respectively; other

current assets of $47,606 and $4,821 as of December 31, 2019 and

2018, respectively; property and equipment, net of $726,415 and

$398,693 as of December 31, 2019 and 2018, respectively; and other

assets of $7,379 and $3,144 as of December 31, 2019 and 2018,

respectively. The consolidated liabilities as of December 31, 2019

and 2018 include $13,440 and $9,260, respectively, of liabilities

of VIEs whose creditors have no recourse to Sunnova Energy

International Inc. These liabilities include accounts payable of

$1,926 and $4,278 as of December 31, 2019 and 2018, respectively;

accrued expenses of $35 and $14 as of December 31, 2019 and 2018,

respectively; other current liabilities of $612 and $296 as of

December 31, 2019 and 2018, respectively; and other long-term

liabilities of $10,867 and $4,672 as of December 31, 2019 and 2018,

respectively.

SUNNOVA ENERGY INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share

and per share amounts)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Revenue

$

33,614

$

25,206

$

131,556

$

104,382

Operating expense:

Cost of revenue—depreciation

12,716

9,242

43,536

34,710

Cost of revenue—other

963

533

3,877

2,007

Operations and maintenance

2,120

9,540

8,588

14,035

General and administrative

27,002

18,327

97,986

67,430

Other operating income

(32

)

(19

)

(161

)

(70

)

Total operating expense, net

42,769

37,623

153,826

118,112

Operating loss

(9,155

)

(12,417

)

(22,270

)

(13,730

)

Interest expense, net

8,169

26,459

108,024

51,582

Interest expense, net—affiliates

—

2,303

4,098

9,548

Interest income

(3,615

)

(2,077

)

(12,483

)

(6,450

)

Loss on extinguishment of long-term debt,

net—affiliates

—

—

10,645

—

Other (income) expense

53

—

880

(1

)

Loss before income tax

(13,762

)

(39,102

)

(133,434

)

(68,409

)

Income tax

—

—

—

—

Net loss

(13,762

)

(39,102

)

(133,434

)

(68,409

)

Net income attributable to redeemable

noncontrolling interests

3,747

1,726

10,917

5,837

Net loss attributable to stockholders

(17,509

)

(40,828

)

(144,351

)

(74,246

)

Dividends earned on Series A convertible

preferred stock

—

(9,581

)

(19,271

)

(36,346

)

Dividends earned on Series C convertible

preferred stock

—

(2,608

)

(5,454

)

(5,948

)

Deemed dividends on convertible preferred

stock exchange

—

—

—

(19,332

)

Net loss attributable to common

stockholders—basic and diluted

$

(17,509

)

$

(53,017

)

$

(169,076

)

$

(135,872

)

Net loss per share attributable to common

stockholders—basic and diluted

$

(0.21

)

$

(6.14

)

$

(4.14

)

$

(15.74

)

Weighted average common shares

outstanding—basic and diluted

83,980,885

8,634,455

40,797,976

8,634,477

SUNNOVA ENERGY INTERNATIONAL

INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Year Ended December

31,

2019

2018

CASH FLOWS FROM OPERATING

ACTIVITIES

Net loss

$

(133,434

)

$

(68,409

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation

49,340

39,290

Impairment and loss on disposals, net

1,772

7,565

Amortization of deferred financing

costs

9,822

9,074

Amortization of debt discount

3,018

1,083

Non-cash effect of equity-based

compensation plans

9,235

2,984

Non-cash payment-in-kind interest on

loan—affiliates

2,716

5,524

Unrealized loss on derivatives

19,237

6,100

Unrealized loss on fair value option

instruments

150

—

Loss on extinguishment of long-term debt,

net—affiliates

10,645

—

Other non-cash items

8,442

4,818

Changes in components of operating assets

and liabilities:

Accounts receivable

(9,349

)

(4,983

)

Dealer advances

—

(237

)

Other current assets

(131,741

)

(11,331

)

Other assets

(40,118

)

(8,529

)

Accounts payable

5,292

(996

)

Accrued expenses

15,099

4,234

Other current liabilities

8,452

4,938

Long-term debt—paid-in-kind—affiliates

(719

)

(3,184

)

Other long-term liabilities

1,879

489

Net cash used in operating activities

(170,262

)

(11,570

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchases of property and equipment

(430,822

)

(252,618

)

Payments for investments and customer

notes receivable

(159,303

)

(108,354

)

Proceeds from customer notes

receivable

21,604

7,715

State utility rebates and tax credits

668

853

Other, net

(463

)

3,555

Net cash used in investing activities

(568,316

)

(348,849

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from long-term debt

883,360

445,586

Payments of long-term debt

(342,540

)

(292,091

)

Proceeds of long-term debt from

affiliates

15,000

15,000

Payments of long-term debt to

affiliates

(56,236

)

(40,000

)

Payments on notes payable

(4,672

)

—

Payments of deferred financing costs

(12,110

)

(8,598

)

Payments of debt discounts

(1,084

)

(2,465

)

Proceeds from issuance of common stock,

net

164,452

—

Proceeds from equity component of debt

instrument, net

13,984

—

Proceeds from issuance of convertible

preferred stock, net

(2,510

)

172,771

Contributions from redeemable

noncontrolling interests

157,149

79,017

Distributions to redeemable noncontrolling

interests

(7,559

)

(2,017

)

Payments of costs related to redeemable

noncontrolling interests

(5,395

)

(1,510

)

Other, net

(16

)

(6

)

Net cash provided by financing

activities

801,823

365,687

Net increase in cash and restricted

cash

63,245

5,268

Cash and restricted cash at beginning of

period

87,046

81,778

Cash and restricted cash at end of

period

150,291

87,046

Restricted cash included in other current

assets

(10,474

)

(5,190

)

Restricted cash included in other

assets

(56,332

)

(29,150

)

Cash at end of period

$

83,485

$

52,706

Key Financial and Operational

Metrics

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(in thousands)

Reconciliation of Net Loss to Adjusted

EBITDA:

Net loss

$

(13,762

)

$

(39,102

)

$

(133,434

)

$

(68,409

)

Interest expense, net

8,169

26,459

108,024

51,582

Interest expense, net—affiliates

—

2,303

4,098

9,548

Interest income

(3,615

)

(2,077

)

(12,483

)

(6,450

)

Depreciation expense

14,353

10,290

49,340

39,290

Amortization expense

9

33

29

133

EBITDA

5,154

(2,094

)

15,574

25,694

Non-cash compensation expense (1)

2,261

944

10,512

3,410

ARO accretion expense

454

292

1,443

1,183

Financing deal costs

133

564

1,161

1,902

Natural disaster losses and related

charges, net

—

7,787

54

8,217

IPO costs

—

482

3,804

563

Loss on unenforceable contracts

2,381

—

2,381

—

Loss on extinguishment of long-term debt,

net—affiliates

—

—

10,645

—

Unrealized loss on fair value option

instruments

53

—

150

—

Realized loss on fair value option

instruments

—

—

730

—

Amortization of payments to dealers for

exclusivity and other bonus arrangements

328

—

583

—

Legal settlements

—

—

1,260

150

Adjusted EBITDA

$

10,764

$

7,975

$

48,297

$

41,119

(1)

Amount includes non-cash effect of

equity-based compensation plans of $2.3 million and $0.8 million

for the three months ended December 31, 2019 and 2018,

respectively, and $9.2 million and $3.0 million for the years ended

December 31, 2019 and 2018, respectively, and partial forgiveness

of a loan to an executive officer used to purchase our capital

stock of $0.1 million for the three months ended December 31, 2018

and $1.3 million and $0.4 million for the years ended December 31,

2019 and 2018, respectively.

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(in thousands)

Interest income from customer notes

receivable

$

3,432

$

1,987

$

11,588

$

6,147

Principal proceeds from customer notes

receivable, net of related revenue

$

7,058

$

1,714

$

20,044

$

6,812

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(in thousands)

Reconciliation of Net Cash Provided by

(Used in) Operating Activities to Adjusted Operating Cash

Flow:

Net cash provided by (used in) operating

activities

$

(95,724

)

$

13,672

$

(170,262

)

$

(11,570

)

Principal proceeds from customer notes

receivable

7,532

1,982

21,604

7,715

Distributions to redeemable noncontrolling

interests

(1,270

)

(695

)

(7,559

)

(2,017

)

Payments to dealers for exclusivity and

other bonus arrangements

—

—

31,733

—

Inventory and prepaid inventory

purchases

115,250

7,001

127,818

14,288

Payments of non-capitalized costs related

to IPO

884

—

4,944

—

Adjusted Operating Cash Flow

$

26,672

$

21,960

$

8,278

$

8,416

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(in thousands, except per

customer data)

Reconciliation of Total Operating

Expense, Net to Adjusted Operating Expense:

Total operating expense, net

$

42,769

$

37,623

$

153,826

$

118,112

Depreciation expense

(14,353

)

(10,290

)

(49,340

)

(39,290

)

Amortization expense

(9

)

(33

)

(29

)

(133

)

Non-cash compensation expense

(2,261

)

(944

)

(10,512

)

(3,410

)

ARO accretion expense

(454

)

(292

)

(1,443

)

(1,183

)

Financing deal costs

(133

)

(564

)

(1,161

)

(1,902

)

Natural disaster losses and related

charges, net

—

(7,787

)

(54

)

(8,217

)

IPO costs

—

(482

)

(3,804

)

(563

)

Loss on unenforceable contracts

(2,381

)

—

(2,381

)

—

Amortization of payments to dealers for

exclusivity and other bonus arrangements

(328

)

—

(583

)

—

Legal settlements

—

—

(1,260

)

(150

)

Adjusted Operating Expense

$

22,850

$

17,231

$

83,259

$

63,264

Adjusted Operating Expense per weighted

average customer

$

301

$

293

$

1,215

$

1,185

As of December 31,

2019

2018

Number of customers

78,600

60,300

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Weighted average number of customers

(excluding loan agreements)

65,600

53,200

60,100

49,200

Weighted average number of customers with

loan agreements

10,300

5,600

8,400

4,200

Weighted average number of customers

75,900

58,800

68,500

53,400

As of December 31,

2019

2018

(in millions, except per

customer data)

Estimated gross contracted customer

value

$

1,879

$

1,476

Estimated gross contracted customer value

per customer

$

23,906

$

24,478

Key Terms for Our Key Metrics and Non-GAAP Financial

Measures

Estimated Gross Contracted Customer Value. Estimated

gross contracted customer value as of a specific measurement date

represents the sum of the present value of the remaining estimated

future net cash flows we expect to receive from existing customers

during the initial contract term of our leases and power purchase

agreements ("PPAs"), which are typically 25 years in length, plus

the present value of future net cash flows we expect to receive

from the sale of related solar renewable energy certificates

("SRECs"), either under existing contracts or in future sales, plus

the carrying value of outstanding customer loans on our balance

sheet. From these aggregate estimated initial cash flows, we

subtract the present value of estimated net cash distributions to

redeemable noncontrolling interests and estimated operating,

maintenance and administrative expenses associated with the solar

service agreements. These estimated future cash flows reflect the

projected monthly customer payments over the life of our solar

service agreements and depend on various factors including but not

limited to solar service agreement type, contracted rates, expected

sun hours and the projected production capacity of the solar

equipment installed. For the purpose of calculating this metric, we

discount all future cash flows at 6%.

Number of Customers. We define number of customers to

include each customer that is party to an in-service solar service

agreement. For our leases, PPAs and loan agreements, in-service

means the related solar energy system and, if applicable, energy

storage system, must have met all the requirements to begin

operation and be interconnected to the electrical grid. For our

Sunnova Protect services, in-service means the customer’s system

must have met the requirements to have the service activated. We do

not include in our number of customers any customer under a lease,

PPA or loan agreement for whom we have terminated the contract and

removed the solar energy system. We also do not include in our

number of customers any customer of our Sunnova Protect services

that has been in default under his or her solar service agreement

in excess of six months. We track the total number of customers as

an indicator of our historical growth and our rate of growth from

period to period.

Weighted Average Number of Customers. We calculate the

weighted average number of customers based on the number of months

a given customer is in-service during a given measurement period.

The weighted average customer count reflects the number of

customers at the beginning of a period, plus the total number of

new customers added in the period adjusted by a factor that

accounts for the partial period nature of those new customers. For

purposes of this calculation, we assume all new customers added

during a month were added in the middle of that month. We track the

weighted average customer count in order to accurately reflect the

contribution of the appropriate number of customers to key

financial metrics over the measurement period.

Definitions of Non-GAAP Measures

Adjusted EBITDA. We define Adjusted EBITDA as net income

(loss) plus net interest expense, depreciation and amortization

expense, income tax expense, financing deal costs, natural disaster

losses and related charges, net, amortization of payments to

dealers for exclusivity and other bonus arrangements, legal

settlements and excluding the effect of certain non-recurring items

we do not consider to be indicative of our ongoing operating

performance such as, but not limited to, costs of our IPO, losses

on unenforceable contracts, losses on extinguishment of long-term

debt, realized and unrealized gains and losses on fair value option

instruments and other non-cash items such as non-cash compensation

expense and asset retirement obligation ("ARO") accretion

expense.

Adjusted Operating Cash Flow. We define Adjusted

Operating Cash Flow as net cash used in operating activities plus

principal proceeds from customer notes receivable and distributions

to redeemable noncontrolling interests less payments to dealers for

exclusivity and other bonus arrangements, inventory and prepaid

inventory purchases and payments of non-capitalized costs related

to our IPO.

Adjusted Operating Expense. We define Adjusted Operating

Expense as total operating expense less depreciation and

amortization expense, financing deal costs, natural disaster losses

and related charges, net, amortization of payments to dealers for

exclusivity and other bonus arrangements, legal settlements and

excluding the effect of certain non-recurring items we do not

consider to be indicative of our ongoing operating performance such

as, but not limited to, costs of our IPO, losses on unenforceable

contracts, and other non-cash items such as non-cash compensation

expense and ARO accretion expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200224005934/en/

Rodney McMahan - Investors Kelsey Hultberg - Media

IR@sunnova.com 877-770-5211

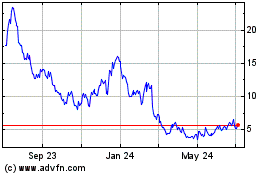

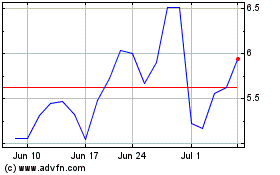

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024