- 67,600 customers as of June 30, 2019

- Net loss of $49.8 million for the three months ended June 30,

2019

- Adjusted EBITDA of $13.6 million for the three months ended

June 30, 2019

- Customer principal (net of amounts recorded in revenue) and

interest payments from solar loans ("P&I") of $5.2 million and

$2.7 million, respectively, for the three months ended June 30,

2019

Sunnova Energy International Inc. ("Sunnova") (NYSE: NOVA), one

of the leading U.S. residential solar and storage service

providers, today announced financial results for the second quarter

ended June 30, 2019.

"We are proud to report strong financial results in our first

earnings release as a public company," said President and CEO John

Berger. "We achieved several milestones since the end of the first

quarter, helping to advance our mission to power energy

independence. Highlights include the expansion of our geographical

footprint, the continued growth of our dealer base, the launch of

new solar plus storage product offerings and increases in battery

attachment rates.

"We signed two new dealer agreements in July that now brings

approximately 70% of our 2019 deal origination under multi-year

exclusivity agreements. We were also able to complete several

successful financial transactions, including a $167.6 million solar

loan securitization at favorable rates during the second quarter,

commitments of $75.0 million under a new tax equity facility we

closed last week, and our initial public offering on the New York

Stock Exchange in July.

"Looking forward, our business continues to build momentum

driven by the competitive benefits of our growing dealer network.

We are working closely with our dealers to originate and close new

business and expect to build on our strong record of positive

Adjusted EBITDA and P&I payments growth. Given our solid

progress to date coupled with a favorable macroeconomic

environment, we believe Sunnova is well-positioned and well-funded

to continue to drive strong growth and achieve our second-half and

longer term operational and financial targets."

Second Quarter 2019 Results

Our total number of customers was 67,600 as of June 30, 2019, an

increase of 13,900 compared to June 30, 2018.

Revenue increased to $34.6 million, or by $5.6 million, in the

three months ended June 30, 2019 compared to the three months ended

June 30, 2018, primarily as a result of an increased number of

systems in service. Revenue increased to $61.3 million, or by $12.6

million, in the six months ended June 30, 2019 compared to the six

months ended June 30, 2018, primarily as a result of an increased

number of systems in service.

Total operating expense, net increased to $37.3 million, or by

$10.8 million, in the three months ended June 30, 2019 compared to

the three months ended June 30, 2018 as a result of greater

associated depreciation expense and higher period-over-period

general and administrative expenses. Adjusted Operating Expense was

$21.0 million, an increase of $5.3 million over the same period

primarily because of an increase in the number of systems served as

well as certain expenses associated with our initial public

offering.

Total operating expense, net increased to $68.5 million, or by

$15.1 million, in the six months ended June 30, 2019 compared to

the six months ended June 30, 2018 as a result of greater

associated depreciation expense and higher period-over-period

general and administrative expenses. Adjusted Operating Expense was

$39.7 million, an increase of $8.7 million over the same period

primarily because of an increase in the number of systems served as

well as certain expenses associated with our initial public

offering.

We incurred a net loss of $49.8 million for the three months

ended June 30, 2019 compared to a net loss of $9.2 million for the

three months ended June 30, 2018. We incurred a net loss of $85.3

million for the six months ended June 30, 2019 compared to a net

loss of $22.7 million for the six months ended June 30, 2018. These

larger net losses were primarily driven by the factors described

above for the changes in total operating expense, net in addition

to higher realized and unrealized net losses on interest rate swaps

for the three and six months ended June 30, 2019 compared to the

three and six months ended June 30, 2018 of $23.6 million and $43.7

million, respectively, loss on extinguishment of debt and

unrealized loss on fair value option instruments of $11.2 million

and other interest expense of $2.2 million and $8.2 million,

respectively.

Adjusted EBITDA was $13.6 million for the three months ended

June 30, 2019 compared to $13.2 million for the three months ended

June 30, 2018. Adjusted EBITDA was $21.7 million for the six months

ended June 30, 2019 compared to $17.8 million for the six months

ended June 30, 2018. This increase was due to the increase in

number of systems served, partially offset by an increase in

associated expenses.

Customer principal (net of amounts recorded in revenue) and

interest payments from solar loans increased to $5.2 million and

$2.7 million, respectively, for the three months ended June 30,

2019, or by $3.2 million and $1.3 million, respectively, compared

to the three months ended June 30, 2018 due to our larger customer

loan portfolio. Customer principal (net of amounts recorded in

revenue) and interest payments from solar loans increased to $8.7

million and $5.0 million, respectively, for the six months ended

June 30, 2019, or by $5.3 million and $2.5 million, respectively,

compared to the six months ended June 30, 2018 due to our larger

customer loan portfolio.

Net cash used in operating activities was $55.7 million in the

six months ended June 30, 2019 compared to $20.6 million in the six

months ended June 30, 2018. This increase in net cash used in

operating activities was due primarily to exclusivity payments of

$22.0 million to certain dealers during the six months ended June

30, 2019 and an increased use of working capital during the six

months ended June 30, 2019 compared to the same period of 2018.

Adjusted Operating Cash Flow was $(20.0) million in the six

months ended June 30, 2019 compared to $(12.2) million for the six

months ended June 30, 2018. This decrease in Adjusted Operating

Cash Flow was due primarily to higher operating and interest

payments offset by higher revenue and P&I.

Liquidity & Capital Resources

As of June 30, 2019, we had total cash of $99.5 million,

including restricted and unrestricted cash.

2019 Guidance

Management provided the following full year 2019 guidance:

- Customer growth rate in annual deployments of at least 30%

- Adjusted EBITDA between $47 million and $49 million

- Customer principal payments from solar loans, net of amounts

recorded in revenue, between $17 million and $18 million

- Customer interest payments from solar loans between $12 million

and $13 million

- Adjusted Operating Cash Flow between $(2) million and $1

million

Non-GAAP Financial Measures

We present our operating results in accordance with accounting

principles generally accepted in the U.S. ("GAAP"). We believe

certain financial measures, such as Adjusted EBITDA, Adjusted

Operating Expense and Adjusted Operating Cash Flow, which are

non-GAAP measures, provide users of our financial statements with

supplemental information that may be useful in evaluating our

business. We use Adjusted EBITDA and Adjusted Operating Expense as

performance measures, and believe investors and securities analysts

also use Adjusted EBITDA and Adjusted Operating Expense in

evaluating our performance. While Adjusted EBITDA effectively

captures the operating performance of our leases and PPAs, it only

reflects the service portion of the operating performance under our

loan agreements. Therefore, we separately show customer P&I

payments. Adjusted EBITDA is also used by our management for

internal planning purposes, including our consolidated operating

budget, and by our board of directors in setting performance-based

compensation targets. We use Adjusted Operating Cash Flow as a

liquidity measure and believe Adjusted Operating Cash Flow is a

supplemental financial measure useful to management, analysts,

investors, lenders and rating agencies as an indicator of our

ability to internally fund origination activities, service or incur

additional debt and service our contractual obligations. We believe

investors and analysts will use Adjusted Operating Cash Flow to

evaluate our liquidity and ability to service our contractual

obligations. However, Adjusted Operating Cash Flow has limitations

as an analytical tool because it does not account for all future

expenditures and financial obligations of the business or reflect

unforeseen circumstances that may impact our future cash flows, all

of which could have a material effect on our financial condition

and results of operations. We believe that such non-GAAP measures,

when read in conjunction with our operating results presented under

GAAP, can be used both to better assess our business from period to

period and to better assess our business against other companies in

our industry, without regard to financing methods, historical cost

basis or capital structure. Our calculation of these non-GAAP

financial measures may differ from similarly-titled non-GAAP

measures, if any, reported by other companies. In addition, other

companies may not publish these or similar measures. Such non-GAAP

measures should be considered as a supplement to, and not as a

substitute for, financial measures prepared in accordance with

GAAP. Sunnova is unable to reconcile projected Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to the

most comparable financial measures calculated in accordance with

GAAP because of fluctuations in interest rates and their impact on

our unrealized and realized interest rate hedge gains or losses.

Sunnova provides a range for the forecasts of Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to

allow for the variability in the timing of cash receipts and

disbursements, customer utilization of our assets, and the impact

on the related reconciling items, many of which interplay with each

other. Therefore, the reconciliation of projected Adjusted EBITDA,

Adjusted Operating Expense and Adjusted Operating Cash Flow to

projected net income (loss), total operating expense, or net cash

provided by (used in) operating activities, as the case may be, is

not available without unreasonable effort.

Second Quarter 2019 Financial and Operational Results

Conference Call Information

Sunnova is hosting a conference call for analysts and investors

to discuss its second quarter 2019 results at 5:00 p.m. Eastern

Time, on August 19, 2019. The conference call can be accessed live

over the phone by dialing 1-866-211-4135, or for international

callers, 1-647-689-6729. A replay will be available two hours after

the call and can be accessed by dialing 1-800-585-8367, or for

international callers, 1-416-621-4642. The passcode for the live

call and the replay is 6879989. The replay will be available until

August 26, 2019.

Interested investors and other parties may also listen to a

simultaneous webcast of the conference call by logging onto the

Investor Relations section of Sunnova’s website at

www.sunnova.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Sunnova’s future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as "may," "will," "should," "expects,"

"plans," "anticipates," "going to," "could," "intends," "target,"

"projects," "contemplates," "believes," "estimates," "predicts,"

"potential" or "continue" or the negative of these words or other

similar terms or expressions that concern Sunnova’s expectations,

strategy, priorities, plans or intentions. Forward-looking

statements in this release include, but are not limited to,

statements regarding the benefits of our growing dealer network,

that we are well-funded to drive strong growth and achieve

second-half and longer term operational targets and

future: customer growth rate, adjusted EBITDA, customer P&I

payments from solar loans and adjusted operating cash flows.

Sunnova’s expectations and beliefs regarding these matters may not

materialize, and actual results in future periods are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected, including risks regarding our

ability to forecast our business due to our limited operating

history, our competition, fluctuations in the solar and

home-building markets, our ability to attract and retain dealers

and customers and our dealer and strategic partner relationships.

The forward-looking statements contained in this release are also

subject to other risks and uncertainties, including those more

fully described in Sunnova’s filings with the Securities and

Exchange Commission, including Sunnova’s prospectus filed pursuant

to Rule 424(b) under the Securities Act of 1933, as amended, on

July 26, 2019. The forward-looking statements in this release are

based on information available to Sunnova as of the date hereof,

and Sunnova disclaims any obligation to update any forward-looking

statements, except as required by law.

About Sunnova

Sunnova is a leading residential solar and energy storage

service provider, serving customers in more than 20 U.S. states and

territories. Our goal is to be the leading provider of clean,

affordable and reliable energy for consumers, and we operate with a

simple mission: to power energy independence.

SUNNOVA ENERGY CORPORATION

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands, except share amounts and share par values)

As of June 30, 2019

As of December 31,

2018

Assets

Current assets:

Cash

$

58,776

$

52,706

Accounts receivable—trade, net

11,150

6,312

Accounts receivable—other

4,531

3,721

Other current assets

34,546

26,794

Total current assets

109,003

89,533

Property and equipment, net

1,499,891

1,328,457

Customer notes receivable, net

223,645

172,031

Other assets

120,125

75,064

Total assets (1)

$

1,952,664

$

1,665,085

Liabilities, Redeemable

Noncontrolling Interests and Stockholders' Equity

Current liabilities:

Accounts payable

$

45,134

$

20,075

Accrued expenses

18,861

18,650

Current portion of long-term debt

58,403

26,965

Current portion of long-term

debt—affiliates

17,505

16,500

Other current liabilities

18,701

13,214

Total current liabilities

158,604

95,404

Long-term debt, net

1,081,360

872,249

Long-term debt, net—affiliates

71,524

44,181

Other long-term liabilities

92,044

66,453

Total liabilities (1)

1,403,532

1,078,287

Redeemable noncontrolling interests

107,547

85,680

Stockholders' equity:

Series A convertible preferred stock,

44,929,110 and 44,942,594 shares issued as of June 30, 2019 and

December 31, 2018, respectively, at $0.01 par value

449

449

Series C convertible preferred stock,

13,006,780 shares issued as of June 30, 2019 and December 31, 2018

at $0.01 par value

130

130

Series A common stock, 8,612,728 shares

issued as of June 30, 2019 and December 31, 2018 at $0.01 par

value

86

86

Series B common stock, 23,870 and 21,727

shares issued as of June 30, 2019 and December 31, 2018,

respectively, at $0.01 par value

—

—

Additional paid-in capital—convertible

preferred stock

701,635

701,326

Additional paid-in capital—common

stock

86,437

85,439

Accumulated deficit

(347,152

)

(286,312

)

Total stockholders' equity

441,585

501,118

Total liabilities, redeemable

noncontrolling interests and stockholders' equity

$

1,952,664

$

1,665,085

(1) The consolidated assets as of June 30, 2019 and December 31,

2018 include $543,451 and $411,325, respectively, of assets of

variable interest entities ("VIEs") that can only be used to settle

obligations of the VIEs. These assets include cash of $5,433 and

$3,674 as of June 30, 2019 and December 31, 2018, respectively;

accounts receivable—trade, net of $1,352 and $884 as of June 30,

2019 and December 31, 2018, respectively; accounts receivable—other

of $0 and $109 as of June 30, 2019 and December 31, 2018,

respectively; other current assets of $192 and $4,821 as of June

30, 2019 and December 31, 2018, respectively; property and

equipment, net of $531,354 and $398,693 as of June 30, 2019 and

December 31, 2018, respectively; and other assets of $5,120 and

$3,144 as of June 30, 2019 and December 31, 2018, respectively. The

consolidated liabilities as of June 30, 2019 and December 31, 2018

include $7,605 and $9,260, respectively, of liabilities of VIEs

whose creditors have no recourse to Sunnova Energy Corporation.

These liabilities include accounts payable of $1,082 and $4,278 as

of June 30, 2019 and December 31, 2018, respectively; accrued

expenses of $49 and $14 as of June 30, 2019 and December 31, 2018,

respectively; other current liabilities of $206 and $296 as of June

30, 2019 and December 31, 2018, respectively; and other long-term

liabilities of $6,268 and $4,672 as of June 30, 2019 and December

31, 2018, respectively.

SUNNOVA ENERGY CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Revenue

$

34,612

$

28,963

$

61,327

$

48,747

Operating expense:

Cost of revenue—depreciation

10,225

8,274

19,878

16,119

Cost of revenue—other

1,076

448

1,728

860

Operations and maintenance

2,289

2,251

4,543

4,591

General and administrative

23,794

15,578

42,475

31,933

Other operating income

(62

)

(23

)

(80

)

(39

)

Total operating expense, net

37,322

26,528

68,544

53,464

Operating income (loss)

(2,710

)

2,435

(7,217

)

(4,717

)

Interest expense, net

37,310

10,724

68,971

15,707

Interest expense, net—affiliates

1,575

2,354

3,397

4,847

Interest income

(2,967

)

(1,418

)

(5,461

)

(2,610

)

Loss on extinguishment of long-term debt,

net—affiliates

10,645

—

10,645

—

Other (income) expense

534

(1

)

534

(1

)

Loss before income tax

(49,807

)

(9,224

)

(85,303

)

(22,660

)

Income tax

—

—

—

—

Net loss

(49,807

)

(9,224

)

(85,303

)

(22,660

)

Net income attributable to redeemable

noncontrolling interests

931

3,350

3,949

4,124

Net loss attributable to stockholders

(50,738

)

(12,574

)

(89,252

)

(26,784

)

Dividends earned on Series A convertible

preferred stock

(9,760

)

(9,198

)

(19,271

)

(17,328

)

Dividends earned on Series C convertible

preferred stock

(2,762

)

(1,497

)

(5,454

)

(1,546

)

Deemed dividends on convertible preferred

stock exchange

—

—

—

(19,332

)

Net loss attributable to common

stockholders—basic and diluted

$

(63,260

)

$

(23,269

)

$

(113,977

)

$

(64,990

)

Net loss per share attributable to common

stockholders—basic and diluted

$

(7.32

)

$

(2.69

)

$

(13.20

)

$

(7.53

)

Weighted average common shares

outstanding—basic and diluted

8,636,598

8,634,455

8,636,065

8,634,455

SUNNOVA ENERGY CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Six Months Ended June

30,

2019

2018

CASH FLOWS FROM OPERATING

ACTIVITIES

Net loss

$

(85,303

)

$

(22,660

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation

22,639

18,350

Impairment and loss on disposals, net

851

1,155

Amortization of intangible assets

7

67

Amortization of customer acquisition

costs

14

—

Amortization of deferred financing

costs

7,770

4,363

Amortization of debt discount

1,292

501

Non-cash effect of equity-based

compensation plans

994

1,408

Non-cash payment-in-kind interest on

loan—affiliates

2,201

2,700

Unrealized (gain) loss on derivatives

17,449

(13,658

)

Loss on fair value option securities

534

—

Loss on extinguishment of long-term debt,

net—affiliates

10,645

—

Other non-cash items

3,449

2,558

Changes in components of operating assets

and liabilities:

Accounts receivable

(6,597

)

(4,482

)

Dealer advances

—

(237

)

Other current assets

(9,357

)

(6,605

)

Other assets

(26,063

)

(3,600

)

Accounts payable

2,279

(579

)

Accrued expenses

(1,995

)

(62

)

Other current liabilities

5,362

1,827

Long-term debt—paid-in-kind—affiliates

—

(1,144

)

Other long-term liabilities

(1,865

)

(463

)

Net cash used in operating activities

(55,694

)

(20,561

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchases of property and equipment

(164,796

)

(124,067

)

Payments for investments and customer

notes receivable

(62,360

)

(50,509

)

Proceeds from customer notes

receivable

9,336

3,768

State utility rebates

227

450

Other, net

183

(1,485

)

Net cash used in investing activities

(217,410

)

(171,843

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from long-term debt

526,045

82,907

Payments of long-term debt

(287,363

)

(14,421

)

Proceeds of long-term debt from

affiliates

15,000

15,000

Payments of long-term debt to

affiliates

—

(20,000

)

Payments on notes payable

(248

)

—

Payments of deferred financing costs

(7,268

)

(750

)

Payments of debt discounts

(1,084

)

(70

)

Payments of IPO costs

(484

)

—

Proceeds from issuance of convertible

preferred stock, net

(2,509

)

97,146

Contributions from redeemable

noncontrolling interests

50,237

34,865

Distributions to redeemable noncontrolling

interests

(5,143

)

(789

)

Payments of costs related to redeemable

noncontrolling interests

(1,622

)

(879

)

Other, net

(7

)

(1

)

Net cash provided by financing

activities

285,554

193,008

Net increase in cash and restricted

cash

12,450

604

Cash and restricted cash at beginning of

period

87,046

81,778

Cash and restricted cash at end of

period

99,496

82,382

Restricted cash included in other current

assets

(482

)

(2,979

)

Restricted cash included in other

assets

(40,238

)

(25,680

)

Cash at end of period

$

58,776

$

53,723

Key Financial and Operational

Metrics

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

(in thousands)

Reconciliation of Net Loss to Adjusted

EBITDA:

Net loss

$

(49,807

)

$

(9,224

)

$

(85,303

)

$

(22,660

)

Interest expense, net

37,310

10,724

68,971

15,707

Interest expense, net—affiliates

1,575

2,354

3,397

4,847

Interest income

(2,967

)

(1,418

)

(5,461

)

(2,610

)

Depreciation expense

11,627

9,386

22,639

18,350

Amortization expense

7

34

12

67

EBITDA

(2,255

)

11,856

4,255

13,701

Non-cash compensation expense (1)

1,884

824

2,271

1,550

ARO accretion expense

327

402

640

613

Financing deal costs

849

(182

)

968

1,341

Disaster losses and related charges,

net

—

296

—

612

IPO costs

1,307

1

2,046

1

Loss on extinguishment of long-term debt,

net—affiliates

10,645

—

10,645

—

Unrealized loss on fair value option

instruments

534

—

534

—

Legal settlements

293

—

293

—

Adjusted EBITDA

$

13,584

$

13,197

$

21,652

$

17,818

(1) Amount includes non-cash effect of equity-based compensation

plans of $0.7 million for the three months ended June 30, 2019 and

2018 and $1.0 million and $1.4 million for the six months ended

June 30, 2019 and 2018, respectively, and partial forgiveness of a

loan to an executive officer used to purchase our capital stock of

$1.2 million and $0.1 million for the three months ended June 30,

2019 and 2018, respectively, and $1.3 million and $0.1 million for

the six months ended June 30, 2019 and 2018, respectively.

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

(in thousands)

Interest income from customer notes

receivable

$

2,692

$

1,355

$

5,020

$

2,488

Principal proceeds from customer notes

receivable, net of related Easy Own revenue

$

5,224

$

2,031

$

8,653

$

3,380

Six Months Ended June

30,

2019

2018

(in thousands)

Reconciliation of Net Cash Used in

Operating Activities to Adjusted Operating Cash Flow:

Net cash used in operating activities

$

(55,694

)

$

(20,561

)

Principal proceeds from customer notes

receivable

9,336

3,768

Distributions to redeemable noncontrolling

interests

(5,143

)

(789

)

Payments to dealers for exclusivity and

other bonus arrangements

22,000

—

Inventory purchases

9,517

5,360

Adjusted Operating Cash Flow

$

(19,984

)

$

(12,222

)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

(in thousands, except per

customer data)

Reconciliation of Total Operating

Expense, Net to Adjusted Operating Expense:

Total operating expense, net

$

37,322

$

26,528

$

68,544

$

53,464

Depreciation expense

(11,627

)

(9,386

)

(22,639

)

(18,350

)

Amortization expense

(7

)

(34

)

(12

)

(67

)

Non-cash compensation expense

(1,884

)

(824

)

(2,271

)

(1,550

)

ARO accretion expense

(327

)

(402

)

(640

)

(613

)

Financing deal costs

(849

)

182

(968

)

(1,341

)

Disaster losses and related charges,

net

—

(296

)

—

(612

)

IPO costs

(1,307

)

(1

)

(2,046

)

(1

)

Legal settlements

(293

)

—

(293

)

—

Adjusted Operating Expense

$

21,028

$

15,767

$

39,675

$

30,930

Adjusted Operating Expense per weighted

average customer

$

320

$

304

$

621

$

621

As of June 30, 2019

As of December 31,

2018

Number of customers

67,600

60,300

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Weighted average number of customers

(excluding loan agreements)

58,100

48,100

56,700

46,500

Weighted average number of customers with

loan agreements

7,700

3,700

7,200

3,300

Weighted average number of customers

65,800

51,800

63,900

49,800

As of June 30, 2019

As of December 31,

2018

(in millions, except per

customer data)

Estimated gross contracted customer

value

$

1,652

$

1,476

Estimated gross contracted customer value

per customer

$

24,441

$

24,478

Key Terms for Our Key Metrics and Non-GAAP Financial

Measures

Estimated Gross Contracted Customer Value. Estimated

gross contracted customer value as of a specific measurement date

represents the sum of the present value of the remaining estimated

future net cash flows we expect to receive from existing customers

during the initial contract term of our solar leases and power

purchase agreements ("PPAs"), which are typically 25 years in

length, plus the present value of future net cash flows we expect

to receive from the sale of related solar renewable energy

certificates ("SRECs"), either under existing contracts or in

future sales, plus the carrying value of outstanding customer loans

on our balance sheet. From these aggregate estimated initial cash

flows, we subtract the present value of estimated net cash

distributions to redeemable noncontrolling interests and estimated

operating, maintenance and administrative expenses associated with

the solar service agreements. These estimated future cash flows

reflect the projected monthly customer payments over the life of

our solar service agreements and depend on various factors

including but not limited to solar service agreement type,

contracted rates, expected sun hours and the projected production

capacity of the solar equipment installed. For the purpose of

calculating this metric, we discount all future cash flows at

6%.

Number of Customers. We define number of customers to

include each customer that is party to an in-service solar service

agreement. For our leases, PPAs and loan agreements, in-service

means the related solar energy system and, if applicable, energy

storage system, must have met all the requirements to begin

operation and be interconnected to the electrical grid. For our

Sunnova Protect services, in-service means the customer’s system

must have met the requirements to have the service activated. We do

not include in our number of customers any customer under a lease,

PPA or loan agreement for whom we have terminated the contract and

removed the solar energy system. We also do not include in our

number of customers any customer of our Sunnova Protect services

that has been in default under his or her solar service agreement

in excess of six months. We track the total number of customers as

an indicator of our historical growth and our rate of growth from

period to period.

Weighted Average Number of Customers. We calculate the

weighted average number of customers based on the number of months

a given customer is in-service during a given measurement period.

The weighted average customer count reflects the number of

customers at the beginning of a period, plus the total number of

new customers added in the period adjusted by a factor that

accounts for the partial period nature of those new customers. For

purposes of this calculation, we assume all new customers added

during a month were added in the middle of that month. We track the

weighted average customer count in order to accurately reflect the

contribution of the appropriate number of customers to key

financial metrics over the measurement period.

Definitions of Non-GAAP Measures

Adjusted EBITDA. We define Adjusted EBITDA as net income

(loss) plus net interest expense, depreciation and amortization

expense, income tax expense, financing deal costs, disaster losses

and related charges, net, legal settlements and excluding the

effect of certain non-recurring items we do not consider to be

indicative of our ongoing operating performance such as, but not

limited to, costs of the IPO and other non-cash items such as asset

retirement obligation ("ARO") accretion expense and non-cash

compensation expense.

Adjusted Operating Cash Flow. We define Adjusted

Operating Cash Flow as net cash used in operating activities plus

principal proceeds from customer notes receivable and distributions

to redeemable noncontrolling interests less payments to dealers for

exclusivity and other bonus arrangements and inventory

purchases.

Adjusted Operating Expense. We define Adjusted Operating

Expense as total operating expense, net, less depreciation and

amortization expense, non-cash compensation expense, ARO accretion

expense, financing deal costs, disaster losses and related charges,

net, IPO costs and legal settlements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190819005520/en/

Media and Investor Contact: Kelsey Smith IR@sunnova.com

877-770-5211

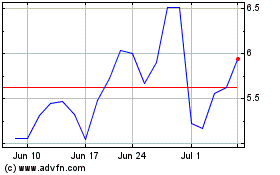

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunnova Energy (NYSE:NOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024