Navios Maritime Holdings Inc. Announces Sale of Ship Management for $20.0 Million and a Five-Year Services Agreement

August 30 2019 - 4:15PM

Navios Maritime Holdings Inc. (the “Company") (NYSE: NM), today

announced that it sold its ship management division and certain

general partnership interests (the “Transaction”) to N

Shipmanagement Acquisition Corp. and related entities

(“NSAC”), affiliated with Company’s Chairman and Chief

Executive Officer, Angeliki Frangou. The Company received

aggregate consideration of $20.0 million (including assumption of

liabilities) and new five-year service agreements under which NSAC

will provide technical and commercial management services at fixed

rates (as described below) and administrative services, reimbursed

at allocable cost.

As a result of the Transaction –

- The Company is a holding company owning dry bulk vessels and

various investments in entities owning maritime and infrastructure

assets.

- NSAC owns all entities providing ship management services and

employs all associated people.

- The Company will pay a fixed rate of $3,700 per day per vessel,

which will cover all technical and commercial management services

and operating costs, other than dry-docking and special surveys.

This rate will be fixed for a two-year period and will increase

thereafter by 3% annually.

- NSAC will provide all administrative services to the Company

and will be reimbursed at allocable cost.

- NSAC will own the general partner interests in Navios Maritime

Containers L.P. (NASDAQ: NMCI) and Navios Maritime Partners

L.P. (NYSE: NMM).

The Company simultaneously entered into a

secured loan agreement with NSAC whereby the Company agreed to

repay NSAC $125.0 million (subject to post-closing adjustment) over

a five-year period. In general, the amount owed

reflects the excess of the (1) liabilities of the ship management

business (including liabilities for advances previously made by

affiliates to the Company for ongoing operating costs, including

technical management services, supplies, dry-docking and related

expenses) other than liabilities the assumption of which forms part

of the consideration for the Transaction over (2) the short term

assets of the ship management business. Of the amount owed,

$47.0 million will be repayable during the first 12 months in equal

quarterly installments, with the remaining principal amount

repayable in equal quarterly installments over the following 48

months. In certain cases, amortization can be deferred. The

loan agreement provides for interest at 5% annually, and 7%

annually for deferred principal amounts.

Closing

The closing of the Transaction occurred

simultaneously with the execution of the definitive transaction

agreements.

Special Committee

The Company’s Board of Directors formed a

Special Committee of independent and disinterested directors to

consider the Transaction. The Special Committee, with the

assistance of its independent financial and legal advisors,

exclusively negotiated the terms of the transaction agreements and

approved the transaction on behalf of the Board of Directors.

Advisors

Pareto Securities AS acted as financial advisor

and Debevoise & Plimpton LLP acted as legal counsel to the

Special Committee. S. Goldman Advisors LLC acted as financial

advisor and Fried, Frank, Harris, Shriver & Jacobson LLP acted

as legal counsel to NSAC.

About Navios Maritime Holdings

Inc.

Navios Maritime Holdings Inc. (NYSE:NM) is a

global, vertically integrated seaborne shipping and logistics

company focused on the transport and transshipment of drybulk

commodities including iron ore, coal and grain. For more

information about Navios Holdings please visit the Company’s

website: www.navios.com.

Forward Looking Statements - Safe

Harbor

This press release contains and will contain

forward-looking statements (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended) concerning future

events Words such as “may,” “expects,” “intends,” “plans,”

“believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify

forward-looking statements. Such statements include comments

regarding expected revenue and time charters. These forward-looking

statements are based on the information available to, and the

expectations and assumptions deemed reasonable by Navios Holdings

at the time these statements were made. Although Navios Holdings

believes that the expectations reflected in such forward-looking

statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. These statements

involve known and unknown risks and are based upon a number of

assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Holdings. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to uncertainty relating to

global trade, including prices of seaborne commodities and

continuing issues related to seaborne volume and ton miles, our

continued ability to enter into long-term time charters, our

ability to maximize the use of our vessels, expected demand in the

dry cargo shipping sector in general and the demand for our vessels

in particular, fluctuations in charter rates for dry cargo vessels,

the aging of our fleet and resultant increases in operations costs,

the loss of any customer or charter or vessel, the financial

condition of our customers, changes in the availability and costs

of financing, increases in costs and expenses, including but not

limited to: crew wages, insurance, provisions, port expenses, lube

oil, bunkers, repairs, maintenance, and general and administrative

expenses, the expected cost of, and our ability to comply with,

governmental regulations and maritime self-regulatory organization

standards, as well as standard regulations imposed by our

charterers applicable to our business, general domestic and

international political conditions, competitive factors in the

market in which Navios Holdings operates, the value of our publicly

traded subsidiaries, risks associated with operations outside the

United States, Vale’s obligations under the Vale port contract, and

other factors listed from time to time in Navios Holdings' filings

with the Securities and Exchange Commission, including its Forms

20-F and Forms 6-K. Navios Holdings expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Navios Holdings' expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based. Navios Holdings makes no prediction

or statement about the performance of its common stock.

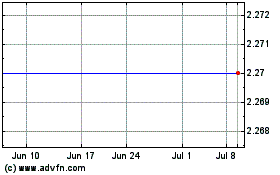

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

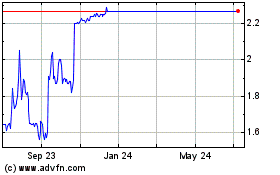

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024