Annaly Capital Management, Inc. Announces Share Repurchase Program of $1.5 Billion

June 03 2019 - 8:00AM

Business Wire

Annaly Capital Management, Inc. (NYSE:NLY) (“Annaly” or the

“Company”) today announced that its Board of Directors has

authorized the repurchase of up to $1.5 billion of its outstanding

shares of common stock through December 31, 2020.

Purchases made pursuant to the program will be made in either

the open market or in privately negotiated transactions from time

to time as permitted by securities laws and other legal

requirements. The timing, manner, price and amount of any

repurchases will be determined by the Company in its discretion and

will be subject to economic and market conditions, stock price,

applicable legal requirements and other factors. The authorization

does not obligate the Company to acquire any particular amount of

common stock and the program may be suspended or discontinued at

the Company’s discretion without prior notice.

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financings; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential credit business; our ability to

grow our middle market lending business; credit risks related to

our investments in credit risk transfer securities, residential

mortgage-backed securities and related residential mortgage credit

assets, commercial real estate assets and corporate debt; risks

related to investments in mortgage servicing rights; our ability to

consummate any contemplated investment opportunities; changes in

government regulations or policy affecting our business; our

ability to maintain our qualification as a REIT for U.S. federal

income tax purposes; and our ability to maintain our exemption from

registration under the Investment Company Act of 1940, as amended.

For a discussion of the risks and uncertainties which could cause

actual results to differ from those contained in the

forward-looking statements, see "Risk Factors" in our most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on

Form 10-Q. We do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190603005089/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

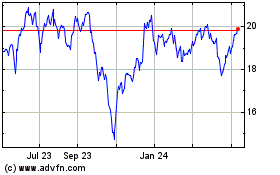

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

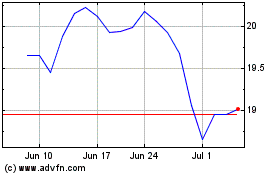

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024