First Quarter 2020 Sales Increase by

Approximately 11%, Driven by Strength of Bowflex and Schwinn

Brands

Retail Segment Delivers Strong Sales Growth

and Direct Segment Breaks Negative Streak

Company Raises First Quarter 2020

Guidance

Nautilus, Inc. (NYSE: NLS) today reported preliminary first

quarter 2020 sales results and offered a brief business update

given the unprecedented environment related to the coronavirus

disease 2019 (“COVID-19”).

First Quarter 2020 Preliminary Net Sales Results

Preliminary net sales for the first quarter of 2020 were

approximately $94 million, up 11% versus the same quarter in 2019,

the first time quarterly sales have grown year-over-year since Q3,

2018. This increase was driven by the power of the Bowflex and

Schwinn brands, recent strategic and operational changes,

disciplined execution, and a near-term trend toward home

fitness.

Segment Sales

Direct Segment

- Preliminary Q1, 2020 net sales were approximately $47 million,

up 1% compared to Q1 2019. This is the first quarter of

year-over-year sales growth for the Direct segment since Q4, 2017.

Top-selling direct-to-consumer items like the Bowflex® SelectTech®

dumbbells and kettlebells and the Bowflex® C6 and Schwinn® IC4

bikes more than offset lower Max Trainer® sales. Both the Bowflex

C6 and Schwinn IC4 connected-fitness bikes have been popular with

consumers since they were first introduced in October 2019.

Retail Segment

- Preliminary Q1, 2020 net sales were approximately $46 million,

up 24% compared to Q1 2019. Strong sales of Bowflex and Schwinn

home fitness products more than offset weaker performance in the

Octane Fitness commercial line. Like the Direct segment, the Retail

segment was boosted by strong demand for Bowflex SelectTech 552

adjustable weights and Schwinn IC4 connected-fitness bikes.

Although numerous retailers have temporarily closed store locations

due to COVID-19, Bowflex and Schwinn experienced strong

year-over-year sales increases through retail partners’ ecommerce

and curbside pick-up platforms.

In addition to meeting strong customer demand, Nautilus is

focused on the health and welfare of its employees. Before

government orders were in place in the jurisdictions where Nautilus

conducts business, the Company implemented its work from home

policies for most employees world-wide, while continuing to provide

leading customer care for Direct and Retail customers. The

Company’s distribution centers remain open for both receiving and

shipping with strict guidelines on social distancing and worker

health and safety protocols.

Manufacturing and Supply Chain

A significant volume of Nautilus products is manufactured in

China and most workers in the factories the Company utilizes have

returned to work. Further, ground transportation to the ports, and

shipping capabilities from China are improving daily. Management is

working closely with partners across its entire supply chain to

improve production and delivery timelines and has expedited

deliveries to the U.S. and Europe to meet increased customer

demand.

Management Comments

Jim Barr, Chief Executive Officer of Nautilus Inc., noted, “The

power of our trusted brands, quality products, and strong execution

in sales, marketing, and supply chain fueled significant growth and

strong results in Q1. COVID-19 has created a heightened need for

home-fitness products and our company was able to meet customer

demand well, through both the Direct and Retail segments. We

reversed five quarters of year-over-year sales declines and

delivered sales growth of 11% in Q1, 2020 as customers gravitated

to key products like the Bowflex SelectTech dumbbells, Bowflex C6

bike, and the Schwinn IC4 bike. Demand for many of our home-fitness

products continues to outpace supply and we are pulling all levers

to accelerate the manufacturing and delivery of key products. Our

better than expected EBITDA is the result, in part, of the

strategic and operational improvements we’ve made recently,

combined with a dedicated and engaged employee base focused on

consistent execution.

While these short-term results have exceeded expectations, it is

prudent to realize the coming quarters may present added challenges

for all businesses as we better understand the longer-term impacts

of COVID-19. Short-term, it may remain a significant challenge to

fully match the unplanned surge in demand with supply. Looking to

the long term, like many companies, we will be evaluating the

potential impact and duration of the pandemic on the overall

macro-economic environment.”

Mr. Barr continued, “Our management team is very proud of our

employees and how they faced this current adversity. We rapidly and

profoundly changed our historical working model, well ahead of

government mandates, and have created new solutions to ensure we

are meeting our customers’ enhanced needs. Our supply chain and

front-line customer care teams have been handling holiday-level

volumes with very little time to prepare. I want to thank our

employees and partners for their amazing efforts and for coming

together as a team for our customers. We believe this challenge has

brought out the best in our company, further demonstrating our

resolve, resilience, and agility, qualities that make us stronger,

and will serve us well in our efforts to return to long-term

profitable growth.”

Raising First Quarter 2020 Guidance

The Company now expects EBITDA from continuing operations to be

in the range of $0.0 million to positive $1.5 million. This

information is preliminary and based upon information available as

of the date of this release. While preliminary Q1 results have

exceeded expectations, it is prudent to realize the coming quarters

may present added challenges for Nautilus and other businesses as

the longer-term impacts of COVID-19 are highly uncertain and cannot

be predicted with confidence.

The Company does not plan to release preliminary financial

information on an ongoing basis.

Liquidity

As of March 31, 2020, the Company had cash and cash equivalents

of $26.5 million and debt of $28.0 million, compared to cash and

cash equivalents of $11.1 million and debt of $14.1 million as of

December 31, 2019. The Company had $19.3 million available for

borrowing on its line of credit as of March 31, 2020.

The amounts and financial results described in this press

release reflect the Company’s estimates based solely upon

information available to it as of the date of this press release,

which are not a comprehensive statement of its financial results or

position as of March 31, 2020, and have not been reviewed or

compiled by the Company’s independent registered public accounting

firm. The actual amounts that the Company reports will be subject

to its financial closing procedures and any final adjustments that

may be made prior to the time its financial results for the period

ended March 31, 2020 are finalized.

First Quarter Earnings Results Conference Call

Nautilus will host a conference call at 4:30 p.m. ET (1:30 p.m.

PT) on Tuesday, May 5, 2020 to discuss the Company’s operating

results for the first quarter ended March 31, 2020. The call will

be broadcast live via the Internet hosted at

http://www.nautilusinc.com/events and will be archived online

within one hour after completion of the call. In addition,

listeners may call (877) 425-9470 in North America and

international listeners may call (201) 389-0878. Participants from

the Company will include Jim Barr, Chief Executive Officer, Aina

Konold, Chief Financial Officer, and Bill McMahon, Special

Assistant to the CEO.

A telephonic playback will be available from 7:30 p.m. ET, May

5, 2020 through 11:59 p.m. ET, May 19, 2020. Participants can dial

(844) 512-2921 in North America and international participants can

dial (412) 317-6671 to hear the playback. The passcode for the

playback is 13701186.

Non-GAAP Presentation

In addition to disclosing its financial results determined in

accordance with GAAP, Nautilus has presented in this release

certain non-GAAP financial measures, which exclude the impact of

certain items (as further described below) and provide supplemental

information regarding operating performance. Nautilus presents

non-GAAP financial measures as a complement to results provided in

accordance with GAAP, and the non-GAAP financial measures should

not be regarded as a substitute for GAAP. By disclosing these

non-GAAP financial measures, management intends to provide

investors with a supplemental comparison of operating results and

trends for the periods presented. Management believes these

measures are also useful to investors as such measures allow

investors to evaluate performance using the same metrics that

management uses to evaluate past performance and prospects for

future performance. Nautilus strongly encourages you to review all

its financial statements and publicly filed reports in their

entirety and to not rely on any single financial measure.

We have not reconciled guidance for non-GAAP financial measures

to our most directly comparable GAAP measures because certain items

that impact these measures are uncertain, out of our control and/or

cannot be reasonably predicted or estimated at this time, such as

net/income tax or benefit from continuing operations. Accordingly,

a reconciliation of the non-GAAP financial measure guidance to the

corresponding GAAP measures is not available without unreasonable

effort.

EBITDA from Continuing Operations

Nautilus defines EBITDA from continuing operations as its income

from continuing operations, adjusted to exclude interest expense

(income), income tax expense (benefit) of continuing operations,

and depreciation and amortization expense. Nautilus uses EBITDA

from continuing operations in evaluating its operating results and

for financial and operational decision-making purposes such as

budgeting and establishing operational goals. Nautilus believes

that EBITDA from continuing operations helps identify underlying

trends in its business that could otherwise be masked by the effect

of the items that are excluded from EBITDA from continuing

operations and enhances the overall understanding of the Company’s

past performance and future prospects. Management believes that

EBITDA is frequently used by investors, securities analysts and

other interested parties in their evaluation of companies, many of

which present EBITDA when reporting their results. Other companies

may calculate EBITDA differently, and it may not be comparable.

About Nautilus, Inc.

Headquartered in Vancouver, Washington, Nautilus, Inc. (NYSE:

NLS) is a global technology driven fitness solutions company that

believes everyone deserves a fit and healthy life. With a brand

portfolio including Bowflex®, Nautilus®, Octane Fitness® and

Schwinn®, Nautilus, Inc. develops innovative products to support

healthy living through direct and retail channels as well as in

commercial channels. Nautilus, Inc. uses the investor relations

page of its website (www.nautilusinc.com/investors) to make

information available to its investors and the market.

Forward-Looking Statements

This press release includes forward-looking statements

(statements which are not historical facts) within the meaning of

the Private Securities Litigation Reform Act of 1995, including:

estimated, projected or forecasted financial and operating results

for the first quarter of 2020, the expected impact of the COVID-19

pandemic on our operations and results; anticipated demand for the

Company's new and existing products; and statements regarding the

Company's prospects, resources or capabilities; planned

investments, strategic initiatives and the anticipated or targeted

results of such initiatives. Factors that could cause Nautilus,

Inc.’s actual results to differ materially from these

forward-looking statements include: weaker than expected demand for

new or existing products; our ability to timely acquire inventory

that meets our quality control standards from sole source foreign

manufacturers at acceptable costs; an inability to pass along or

otherwise mitigate the impact of raw material price increases and

other cost pressures, including unfavorable currency exchange

rates; experiencing delays and/or greater than anticipated costs in

connection with launch of new products, entry into new markets, or

strategic initiatives; our ability to hire and retain key

management personnel; changes in consumer fitness trends; changes

in the media consumption habits of our target consumers or the

effectiveness of our media advertising; a decline in consumer

spending due to unfavorable economic conditions; and softness in

the retail marketplace. Additional assumptions, risks and

uncertainties are described in detail in our registration

statements, reports and other filings with the Securities and

Exchange Commission, including the “Risk Factors” set forth in our

Annual Report on Form 10-K, as supplemented by our quarterly

reports on Form 10-Q. Such filings are available on our website or

at www.sec.gov. You are cautioned that such statements are not

guarantees of future performance and that our actual results may

differ materially from those set forth in the forward-looking

statements. We undertake no obligation to publicly update or revise

forward-looking statements to reflect subsequent developments,

events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200408005709/en/

Investor Relations: John Mills ICR, LLC 646-277-1254

john.mills@ICRinc.com

Media: John Fread Nautilus, Inc. 360-859-5815

jfread@nautilus.com

Carey Kerns The Hoffman Agency 503-754-7975

ckerns@hoffman.com

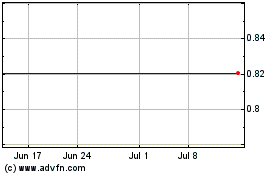

Nautilus (NYSE:NLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

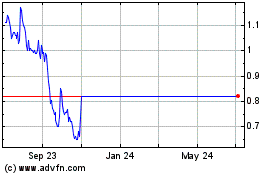

Nautilus (NYSE:NLS)

Historical Stock Chart

From Apr 2023 to Apr 2024