Current Report Filing (8-k)

July 26 2019 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 24, 2019

NL Industries, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

New Jersey

|

|

1-640

|

|

13-5267260

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

5430 LBJ Freeway, Suite 1700, Dallas, Texas 75240-2620

(Address of Principal Executive Offices, and Zip Code)

Registrant’s Telephone Number, Including Area Code

(972) 233-1700

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

◻

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

◻

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

◻

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

◻

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

NL

|

New York Stock Exchange

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On July 24, 2019, the court in

County of Santa Clara v. Atlantic Richfield Company, et al

. (Superior Court of the State of California, County of Santa Clara, Case No.

1-00-CV-788657) signed an order and judgment approving a global settlement agreement entered into among all of the plaintiffs and the three co-defendants (the Sherwin Williams Company, ConAgra Grocery Products and the registrant), and dismissing the

case with prejudice. The global settlement agreement provides that an aggregate $305 million will be paid collectively by the three co-defendants in full satisfaction of all claims resulting in a dismissal of the case with prejudice and the

resolution of (i) all pending and future claims by the plaintiffs in the case, and (ii) all potential claims for contribution or indemnity between the registrant and its co-defendants in respect to the case.

Under the terms of the global settlement agreement, each defendant must pay an aggregate $101.7 million to the plaintiffs as follows: $25 million within sixty days of the court’s approval of the settlement and dismissal

of the case, and the remaining $76.7 million in six annual installments beginning on the first anniversary of the initial payment ($12 million dollars for the first five installments and $16.7 million for the sixth installment). The registrant’s

sixth installment will be made with funds already on deposit at the court that are committed to the settlement, including all accrued interest at the date of payment, with any remaining balance to be paid by the registrant (and any amounts on deposit

in excess of the final payment would be returned to the registrant).

The case was brought in 2000 by a number of California government entities against defendants and others asserting various claims, including public nuisance, property damage, personal injury, strict liability,

negligence, trespass, fraud and other claims relating to lead paint. The registrant expressly denies any and all liability in the agreement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NL Industries, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

/s/ Clarence B. Brown, III

|

|

Date: July 26, 2019

|

Clarence B. Brown, III, Vice President and Secretary

|

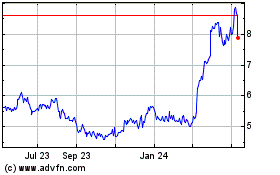

NL Industries (NYSE:NL)

Historical Stock Chart

From Mar 2024 to Apr 2024

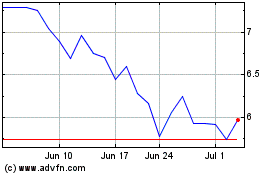

NL Industries (NYSE:NL)

Historical Stock Chart

From Apr 2023 to Apr 2024