By Stella Yifan Xie and Julie Wernau

In recent months, Chinese officials have had to contend with a

bruising U.S. trade war, a slowing economy and crippling outbreaks

of African swine fever.

Add to those threats to order and prosperity a financial bubble

in high-end sneakers.

"Trading sneakers is not so different from trading stocks," said

Wang Zhichen, a 32-year-old client manager at a Shanghai

mobile-payments firm, who checks prices on Nice and Poizon, two

widely used Chinese sneaker-trading platforms, as soon as he wakes

up. He then adjusts the prices of shoes he intends to sell to a

clientele of 700-plus potential buyers via Chinese all-purpose app

WeChat. "You need to watch the opening and closing prices."

Chinese sneaker mania has gone into hyperdrive, taking the U.S.

subculture and its obsession with the first Air Jordans to a new

level. Speculators are flooding trading platforms and treating

sneakers much like financial derivatives, including buying and

selling shoe fractions.

It's all getting a bit much for the People's Bank of China,

whose Shanghai branch recently warned financial agencies in the

city of sneaker-frenzy risk, including "mass disturbances,"

according to state media reports and a document seen by The Wall

Street Journal.

Chinese investors are on a perpetual search for the next big

thing and tend to pile into anything hot, such as bitcoin or

garlic, which saw fortyfold price rises in some parts of the

country in 2009.

Such feeding frenzies rarely end well. The past month exposed

another one -- certificates purportedly exchangeable for crabs, a

popular food during China's weeklong October holiday. An avalanche

of what were essentially crab futures ended up leaving many buyers

with neither crabs nor money.

Sneaker trading platforms were set up partly to help buyers

verify shoes' condition and weed out fakes, much like similar

platforms in the U.S.

In China, however, speculators exploited a 30-minute time lag in

which both buyers and sellers can opt out of a trade without

penalty, using multiple accounts to cancel trades and make new bids

in a rapid-fire sequence that creates an illusion of hot demand,

sometimes tripling the price of a shoe in half an hour.

Some use a "warehouse" option to buy and sell shoes without ever

taking delivery of the actual item. Others trade on fractions of

shoes, represented by a token, through cryptocurrency exchanges

such as 55.com.

Trading platforms are plugging some of the loopholes by forcing

buyers of already-inspected sneakers to take delivery of them

before they can sell them again. It isn't clear that is helping

much.

On trading platform Nice, a pair of Travis Scott Nike Air Force

1s is set to go on sale on Nov. 4 for around $170. Two buyers have

already bought rights, similar to a call option, to buy the shoes

for $1,553 and $2,667, respectively, and more than 2,000 users have

said they are generally interested. More than 800 buyers are

offering between $295 and $700 for a pair of Air Jordans set for

release on Nov. 5 at $183.

Nice and Poizon didn't respond to requests for comment. Nike

declined to comment.

A government crackdown would be bad news for Yang Lei, 25. The

telecom-company employee started trading shoes with a pair of "Bugs

Bunny" Air Jordans he sold for a more than $100 profit on Nice.

With 24 pairs now in his portfolio, he isn't worried his

investment will depreciate. "Everyone just thinks he won't be the

last to pick up the hot potato." He figures if he sold all his

shoes now, his profit would be around $3,500.

On that principle -- that a rising price will keep rising --

even nonsneaker items are getting swept up in rallies. On Nice in

September, a 70 cent IKEA keychain saw its value soar to more than

$140, and a paratrooper toy given away free in a store-chain

promotion sold for as much as $282.

The frenzy is creating distance between true sneakerheads and

sneaker speculators.

One of Liu Yuan's most beloved pairs, Nike's SB Dunk High Pro

Dog Walkers, feature a colorful mix of faux dog fur. He thinks they

represent Afghans, Golden Retrievers, German shepherds and

Dalmatians. On the soles are a collage of dog photos. When the

shoes arrived, the dark brown shoelaces came folded like dog feces

in a plastic bag.

Mr. Liu, 23, who works in branding at a Shanghai sports firm,

bought the pair in July for around $212 on the Nice platform. They

now trade for $310, a near 50% premium.

That is not enough for Mr. Liu to sell. "When I wear these

sneakers to work, my colleagues always say I look hip," he

said.

Guan Tian, 25, runs a high-end sneaker store in Beijing's

upscale Sanlitun neighborhood with friends and displays his

personal collections there. Surrounded by shrink-wrapped Nike

sneakers behind plexiglass, he said the sneaker bubble has driven

up prices for the true aficionados. A few years ago, fans could

line up outside stores for new releases, while now they are

selected mostly by online lotteries.

That has also made it harder for traders to secure fresh supply

at release prices. To increase his chances in a lottery on Nike's

official website, Mr. Wang hired a company that uses registration

bots.

On a recent Saturday, he and a few fellow traders staked out two

Nike stores in Shanghai for 18 hours, with just a break for lunch.

They circled buyers who had just paid around $180 for a pair of

dark gray Air Jordan 6s, a limited edition designed by rapper

Travis Scott, offering them more than $1,000.

For those taking the offer, Mr. Wang demanded to see the store

receipt to guard against buying a fake pair. "Unlike stocks, there

are no regulators in this market," he said,

--Raffaele Huang contributed to this article.

Write to Stella Yifan Xie at stella.xie@wsj.com and Julie Wernau

at Julie.Wernau@wsj.com

(END) Dow Jones Newswires

October 27, 2019 13:08 ET (17:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

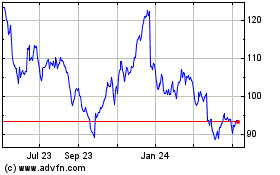

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

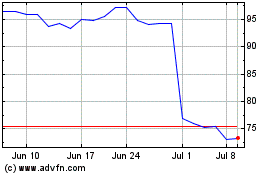

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024