UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 11-K

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2021

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-32190

| | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

SAVINGS PLAN FOR THE EMPLOYEES

OF NEWMARKET CORPORATION AND AFFILIATES

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

NEWMARKET CORPORATION

330 SOUTH FOURTH STREET

RICHMOND, VIRGINIA 23219-4350

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Index of Financial Statements and Supplemental Schedule

| | | | | |

| | Page |

| |

| |

| Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| Supplemental Schedule* | |

| |

| |

| | | | | |

| * | Other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are not included because they are not applicable. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Employee Savings Plan Committee, Plan Administrator, and Plan Participants of the

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Savings Plan for the Employees of NewMarket Corporation and Affiliates (the Plan) as of December 31, 2021 and 2020, the related statements of changes in net assets available for benefits for the years then ended, and the related notes to the financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Information

The supplemental information in the accompanying schedule of Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2021, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ PBMares, LLP

We have served as the Plan's auditor since 2017.

Fairfax, Virginia

June 2, 2022

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Statements of Net Assets Available for Benefits

December 31, 2021 and December 31, 2020

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Assets | | | | |

| Investments, at fair value (Note 3) | | $ | 476,450,147 | | | $ | 487,294,690 | |

| Receivables | | | | |

| | | | |

| | | | |

| Interest and dividends | | 874,325 | | | 827,480 | |

| Notes receivable from participants | | 2,803,895 | | | 2,938,196 | |

| Due from trustee | | 16,390 | | | 903,367 | |

| Total receivables | | 3,694,610 | | | 4,669,043 | |

| Cash (Note 3) | | 365 | | | 33,250 | |

| Total Assets | | 480,145,122 | | | 491,996,983 | |

| | | | |

| | | | |

| Total Liabilities | | 0 | | | 0 | |

| | | | |

| | | | |

| Net assets available for benefits | | $ | 480,145,122 | | | $ | 491,996,983 | |

The accompanying notes are an integral part of the financial statements.

2

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Statements of Changes in Net Assets Available for Benefits

Years Ended December 31, 2021 and December 31, 2020

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Additions to net assets attributed to | | | | |

| Net appreciation (depreciation) in fair value of investments | | $ | 12,197,539 | | | $ | 677,617 | |

| Investment income—interest and dividends | | 16,606,337 | | | 11,699,599 | |

| Net changes in investments | | 28,803,876 | | | 12,377,216 | |

| | | | |

| Interest income on notes receivable from participants | | 144,516 | | | 164,350 | |

| | | | |

| Contributions | | | | |

| Employees | | 13,533,849 | | | 13,066,142 | |

| Employer | | 5,311,958 | | | 5,159,721 | |

| Total contributions | | 18,845,807 | | | 18,225,863 | |

| | | | |

| Total additions | | 47,794,199 | | | 30,767,429 | |

| Deductions from net assets attributed to | | | | |

| Benefit payments | | (59,646,060) | | | (28,853,611) | |

| Total deductions | | (59,646,060) | | | (28,853,611) | |

| Net (decrease) increase | | (11,851,861) | | | 1,913,818 | |

| Net assets available for benefits | | | | |

| At beginning of year | | 491,996,983 | | | 490,083,165 | |

| At end of year | | $ | 480,145,122 | | | $ | 491,996,983 | |

The accompanying notes are an integral part of the financial statements.

3

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Notes to Financial Statements

December 31, 2021 and December 31, 2020

1. Description of Plan

General

The Savings Plan for the Employees of NewMarket Corporation and Affiliates (the Plan) is a defined contribution plan covering all eligible employees of NewMarket Corporation and certain subsidiaries (the Company or NewMarket). Employees become eligible to participate on their date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974. Information regarding Plan benefits, priority of distributions upon termination of the Plan, and vesting is provided in the Plan document, which is available at the main office of the Plan administrator at 330 South Fourth Street, Richmond, Virginia 23219.

Bank of America, N.A. is the Plan's investment manager and trustee and Merrill Lynch, Pierce, Fenner & Smith, Inc. is the Plan's record-keeper.

Contributions

Participants in the Plan may make pre-tax contributions and Roth contributions from 1% to 50% of their base pay, as defined in the Plan document. Roth contributions to the Plan are made on an after-tax basis, and qualified distributions are not subject to income taxes. Participants may make after-tax contributions from 1% to 15% of their base pay. The total of pre-tax, after-tax, and Roth contributions may not exceed 50% of base pay.

In addition, federal law places a dollar limit on the amount of pre-tax contributions an individual can make to 401(k) plans during a calendar year. NewMarket may also impose an annual Plan contribution limitation that is lower than the maximum federal limitation. The maximum pre-tax federal limit was $19,500 for 2021 and 2020. Participants who have attained age 50 may make “catch-up” contributions in a dollar amount established by the Internal Revenue Service (IRS) ($6,500 for 2021 and 2020).

NewMarket contributes 50% of the first 10% of base pay that a participant contributes to the Plan. Contributions made by NewMarket are invested in the NewMarket Corporation Common Stock Fund. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans. Participant contributions are 100% vested at all times while contributions made by NewMarket are 40% vested after two years of service, 60% vested after three years of service, 80% vested after four years of service, and 100% vested after five years of service.

Base pay includes the straight-time portion of an employee’s regularly scheduled overtime, plus pay for any other overtime or extended work week pay, and any premium pay related to hours actually worked. Base pay does not include any type of bonus payment, reimbursement of moving expenses, reimbursement of educational expenses, or similar payments, or any other supplemental payments which an employee may receive in addition to base salary or wage regardless of the term used to designate such increment.

Investments

Participants currently in the Plan may invest their Plan account in any of the active 24 mutual funds, one commingled trust fund, and the NewMarket Corporation Common Stock Fund, or in any combination thereof. Investments also include two common stock funds in which new investments are prohibited. Participants may invest their own contributions to the Plan in these active investment funds in one percent increments and may transfer among the active funds at any time, subject to the restriction described below under "Employee Stock Ownership Plan Feature."

Administrative Expenses

Costs of administering the Plan are paid from investment-related compensation received by the record-keeper from the various mutual funds held in the Plan.

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Notes to Financial Statements

December 31, 2021 and December 31, 2020

Participant Accounts

Each participant’s account is adjusted for the participant’s contributions, the Company’s contributions, trading fees, and allocations of Plan earnings or losses. Allocations of Plan earnings or losses are based on account balances, as defined by the Plan. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Benefit Payments

Benefits are recorded when paid. Benefits are generally paid in cash. Participants may elect to have stock funds be distributed in cash or whole shares of common stock.

Notes Receivable from Participants

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance. Loan transactions are treated as transfers between the investment fund and the loan fund. Loans are made over a period not to exceed five years. The loans are collateralized by the balance in the participant’s account and bear a reasonable rate of interest determined by the Plan administrator based on a rate of return commensurate with the prevailing interest rate charged on similar commercial loans by persons in the business of lending money. Interest rates are determined as of the date of the loan. Notes receivable from participants are reported at their unpaid principal balances plus accrued but unpaid interest. Interest rates on participant loans were 4.25% to 6.50% at both December 31, 2021 and December 31, 2020. Principal and interest are generally paid through payroll deductions. Management has evaluated notes receivable from participants for collectability and has determined that no allowance is necessary.

Forfeitures

Participants who leave NewMarket before becoming fully vested in NewMarket contributions forfeit the value of their nonvested account. Forfeitures during a Plan year can serve to reduce required Company contributions and/or to cover Plan administrative expenses. Forfeitures that reduced the Company’s contributions were $89,555 for 2021 and $108,309 for 2020. The forfeiture balance at both December 31, 2021 and December 31, 2020 was immaterial.

Employee Stock Ownership Plan Feature

A portion of the Plan’s assets are designated as an employee stock ownership plan (ESOP), comprised of the NewMarket Corporation Common Stock Fund. Dividends declared on NewMarket Corporation common stock held in the ESOP are fully vested without regard to whether any other portion of the ESOP or any participant’s account is vested. In addition, with respect to dividends, participants are permitted to make an election to receive those dividends or to have those dividends reinvested in the ESOP. A participant may request the liquidation and transfer of all or a portion of his or her investment in the ESOP to an alternate investment fund at any time. Further, a participant may request that his or her ESOP benefits be distributed in the form of NewMarket Corporation common stock. In addition to a participant’s after-tax, pre-tax, rollover, and Roth accounts, loans are available from the portion of a participant’s account attributable to dividends with a record date on or after December 1, 2009, declared on shares of NewMarket Corporation common stock held in the ESOP.

A participant who transfers all or part of their investment in the NewMarket Corporation Common Stock Fund into another investment fund cannot liquidate and transfer amounts held in such other investment fund into the NewMarket Corporation Common Stock Fund until 90 days after the date of the most recent liquidation and transfer out of the NewMarket Corporation Common Stock Fund. This restriction does not apply to the investment of future after-tax, pre-tax, and rollover contributions made by the participant, or future matching and discretionary contributions made by the Company.

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Notes to Financial Statements

December 31, 2021 and December 31, 2020

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements of the Plan have been prepared in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation and Income Recognition

All investments of the Plan are reported at fair value in the financial statements. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants at the measurement date. Security transactions are recorded as of the trade date. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation or depreciation in fair value of investments includes the Plan's gains and losses on investments purchased and sold as well as held during the year.

Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Plan’s management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan provides for various mutual fund and commingled trust fund investment options in stocks, bonds, and fixed income securities, as well as investments directly in common stock. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

3. Fair Value Measurements

The following is a description of valuation methodologies used for fair value measurement of cash and investments:

| | | | | | | | |

| Cash | | Cash is valued at cost, which approximates fair value. |

| | |

| Mutual funds | | Mutual funds are valued at the daily closing price reported on the NASDAQ. |

| | |

| Common stocks | | Common stocks are valued at the closing price reported on the New York Stock Exchange. |

| |

| Commingled trust fund | | The commingled trust fund is valued daily at the net asset value of shares or units held by the Plan based on the quoted market value of the underlying assets held by the fund. There are no redemption or frequency restrictions as of December 31, 2021 or December 31, 2020. |

The valuation methodologies described above may generate a fair value calculation that may not be indicative of net realizable value or future fair values. While the Plan’s management believes the valuation methodologies used are appropriate, the use of different methodologies or assumptions in calculating fair value could result in different amounts.

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Notes to Financial Statements

December 31, 2021 and December 31, 2020

The following tables provide information by level on the Plan's assets which are measured at fair value on a recurring basis. Assets that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified by level in the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | December 31, 2021 |

| | | | | Fair Value Measurements Using |

| | | Fair Value | Level 1 | | Level 2 | | Level 3 |

| Cash | | $ | 365 | | | $ | 365 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

| Mutual funds | | $ | 282,574,199 | | | $ | 282,574,199 | | | $ | 0 | | | $ | 0 | |

| Common stocks | | 155,786,442 | | | 155,786,442 | | | 0 | | | 0 | |

| Total investments in the fair value hierarchy | | 438,360,641 | | | $ | 438,360,641 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

| Commingled trust fund-fixed income measured at net asset value | | 38,089,506 | | | | | | | |

| | | | | | | | |

| Total investments, at fair value | | $ | 476,450,147 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | December 31, 2020 |

| | | | | Fair Value Measurements Using |

| | | Fair Value | Level 1 | | Level 2 | | Level 3 |

| Cash | | $ | 33,250 | | | $ | 33,250 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Mutual funds | | $ | 259,859,937 | | | $ | 259,859,937 | | | $ | 0 | | | $ | 0 | |

| Common stocks | | 180,969,671 | | | 180,969,671 | | | 0 | | | 0 | |

| Total investments in the fair value hierarchy | | 440,829,608 | | | $ | 440,829,608 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

| Commingled trust fund-fixed income measured at net asset value | | 46,465,082 | | | | | | | |

| | | | | | | | | |

| Total investments, at fair value | | $ | 487,294,690 | | | | | | | |

4. Tax Status

The IRS advised the Plan administrator by letter dated January 19, 2017, that the Plan and related trust, as then designed, are qualified under Section 401 of the Internal Revenue Code (the Code) and are therefore exempt from federal income taxes. The Plan has been amended since receiving the determination letter; however, the Plan administrator believes the Plan is currently designed and being operated in compliance with the applicable requirements of the Code.

The Plan's management has evaluated the effects of accounting guidance related to uncertain income tax positions and concluded that the Plan had no significant financial statement exposure to uncertain income tax positions at December 31, 2021 or December 31, 2020. The Plan is not currently under audit by any tax jurisdiction.

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Notes to Financial Statements

December 31, 2021 and December 31, 2020

5. Plan Termination

Although it has not expressed any intent to do so, NewMarket has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of the Employee Retirement Income Security Act of 1974. In the event of Plan termination, participants will become 100% vested in their account balances and the assets of the Plan shall be allocated to participants in proportion to their account balances as of the effective date of termination.

6. Related Party and Party-In-Interest Transactions

Plan assets available for benefits include cash funds, which are managed by Bank of America, N.A., the trustee of the Plan, and therefore, qualify as party-in-interest transactions. Investments in the NewMarket Corporation Common Stock Fund represent investments in shares of common stock of NewMarket Corporation, the Plan Sponsor. The table below shows the activity in the NewMarket Corporation Common Stock Fund during 2021 and 2020.

| | | | | | | | | | | | | | |

| | Shares | | Amount |

| Balance—January 1, 2020 | | 409,518 | | | $ | 199,238,955 | |

| Purchases | | 35,206 | | | 14,302,080 | |

| Distributions and sales | | (33,068) | | | (13,864,849) | |

| Depreciation | | 0 | | | (35,717,819) | |

| Balance—December 31, 2020 | | 411,656 | | | 163,958,367 | |

| Purchases | | 29,381 | | | 10,973,781 | |

| Distributions and sales | | (46,345) | | | (16,691,328) | |

| Depreciation | | 0 | | | (22,972,074) | |

| Balance—December 31, 2021 | | 394,692 | | | $ | 135,268,746 | |

The Plan also issues loans to participants, which are secured by the vested balances in the participant's accounts. These transactions qualify as party-in-interest transactions.

7. Other Matters

Effective January 1, 2020, the Plan was amended to comply with the SECURE Act regarding post-death distributions.

8. Subsequent Events

The Plan's management has evaluated subsequent events through the date the financial statements were issued.

Savings Plan for the Employees of NewMarket Corporation and Affiliates

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2021

EIN: 20-0812170 PN: 002

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) Identity of issuer, borrower,

lessor, or similar party | | (c) Description | | (d) Cost ** | | (e) Current value |

| * | | NewMarket Corporation Common Stock Fund: | | | | | | |

| | Matching contributions | | Common stock; no par value (221,967 shares) | | $ | 33,909,506 | | | $ | 76,072,527 | |

| | Employee deferrals | | Common stock; no par value (172,725 shares) | | | | 59,196,219 | |

| | Tredegar Corporation Common Stock Fund | | Common stock; no par value (31,147 shares) | | | | 368,152 | |

| | Albemarle Corporation Common Stock Fund | | Common stock; $.01 par value (86,194 shares) | | | | 20,149,544 | |

| | Invesco Stable Value Retirement Fund | | Commingled trust (38,089,506 units) | | | | 38,089,506 | |

| | MFS International Diversification Fund | | Mutual fund (273,092 units) | | | | 6,846,422 | |

| | PIMCO Total Return Fund | | Mutual fund (1,454,831 units) | | | | 14,941,115 | |

| | Janus Henderson Mid Cap Fund | | Mutual fund (231,573 units) | | | | 3,818,641 | |

| | Vanguard US Growth Fund | | Mutual fund (74,182 units) | | | | 12,496,741 | |

| | Vanguard Total Bond Market Fund | | Mutual fund (1,047,873 units) | | | | 11,725,698 | |

| | Vanguard Mid Cap Index Adm | | Mutual fund (13,517 units) | | | | 4,264,003 | |

| | Vanguard Small Cap Index Adm | | Mutual fund (26,111 units) | | | | 2,829,643 | |

| | American Century Small Cap Fund | | Mutual fund (531,025 units) | | | | 5,899,682 | |

| | ClearBridge Small Cap Growth Fund | | Mutual fund (102,479 units) | | | | 5,352,475 | |

| | iShares MSCI EAFE Intl Idx Fund | | Mutual fund (543,678 units) | | | | 8,622,732 | |

| | iShares S&P 500 Index Fund | | Mutual fund (138,160 units) | | | | 77,437,219 | |

| | Invesco Growth & Income Fund | | Mutual fund (299,410 units) | | | | 7,329,567 | |

| | Franklin Small-Mid Cap Growth Fund | | Mutual fund (327,078 units) | | | | 17,485,595 | |

| | BlackRock Balanced Capital Fund | | Mutual fund (282,850 units) | | | | 7,594,518 | |

| | BlackRock LifePath Indx 2025 | | Mutual fund (801,702 units) | | | | 13,316,264 | |

| | BlackRock LifePath Indx 2030 | | Mutual fund (910,076 units) | | | | 16,071,943 | |

| | BlackRock LifePath Indx 2035 | | Mutual fund (817,936 units) | | | | 15,499,895 | |

| | BlackRock LifePath Indx 2040 | | Mutual fund (653,076 units) | | | | 13,054,991 | |

| | BlackRock LifePath Indx 2045 | | Mutual fund (499,925 units) | | | | 10,523,429 | |

| | BlackRock LifePath Indx 2050 | | Mutual fund (398,225 units) | | | | 8,637,490 | |

| | BlackRock LifePath Indx 2055 | | Mutual fund (242,959 units) | | | | 5,405,848 | |

| | BlackRock LifePath Indx 2060 | | Mutual fund (57,282 units) | | | | 1,135,325 | |

| | BlackRock LifePath Indx 2065 | | Mutual fund (15,685 units) | | | | 218,180 | |

| | BlackRock LifePath Indx RET | | Mutual fund (816,426 units) | | | | 12,066,783 | |

| | | | | | | | 476,450,147 | |

| * | | Participant loans | | Notes receivable from participants bearing interest at 4.25% to 6.50% annually, maturity dates of 1/15/2022-01/07/2027 | | 0 | | 2,803,895 | |

| | | | | | | | $ | 479,254,042 | |

| | | | | |

| * | Denotes a party-in-interest to the Plan |

| ** | Cost information is not required for employee deferrals invested in the NewMarket Corporation Common Stock Fund or other investments directed by the participants. |

See report of independent registered public accounting firm.

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | SAVINGS PLAN FOR THE EMPLOYEES

OF NEWMARKET CORPORATION AND

AFFILIATES |

| | | |

| Date: June 2, 2022 | | | | By: | /s/ Brian D. Paliotti |

| | | | Brian D. Paliotti |

| | | | Vice President, Chief Financial Officer,

Member of the Employee Savings Plan Committee |

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit Number | | Description |

| |

| 23 | | |

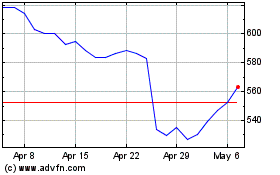

NewMarket (NYSE:NEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

NewMarket (NYSE:NEU)

Historical Stock Chart

From Apr 2023 to Apr 2024