Current Report Filing (8-k)

January 22 2020 - 5:02PM

Edgar (US Regulatory)

0001163739

false

0001163739

2020-01-16

2020-01-17

0001163739

us-gaap:CommonStockMember

2020-01-16

2020-01-17

0001163739

us-gaap:SeriesAPreferredStockMember

2020-01-16

2020-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 17, 2020

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in

its charter)

|

Bermuda

|

|

001-32657

|

|

98-0363970

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda

|

|

N/A

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(441) 292-1510

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which

registered

|

|

Common shares

|

|

NBR

|

|

NYSE

|

|

Preferred

shares – Series A

|

|

NBR.PRA

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material

Definitive Agreement.

On

January 21, 2020, Nabors Industries Ltd. (“Nabors”) announced that pursuant to its previously announced consent solicitations,

on January 17, 2020, its indirect wholly-owned subsidiary, Nabors Industries, Inc. (“NII”) had received the requisite

consents (the “Requisite Consents”) from the holders of a majority of the outstanding principal amount of NII’s

5.50% senior notes due 2023 (the “Notes”) to approve amendments to the indenture dated December 9, 2016 (the “Indenture”)

among NII, as issuer, Nabors, as guarantor, Wilmington Trust Company, as trustee (the “Trustee”), and Citibank, N.A.

(“Citi”), as securities administrator, pursuant to which the Notes were issued.

In

connection with the receipt of the Requisite Consents, on January 22, 2020, NII entered into the First Supplemental Indenture to

the Indenture (the “Supplemental Indenture”), among NII, Nabors, the Trustee and Citi. The Supplemental Indenture amends

the Indenture to, among other things, eliminate substantially all of the restrictive covenants and certain events of default and

reduce the minimum notice period required for redemptions of the Notes from twenty (20) days, as currently required by the Indenture,

to three (3) business days. The amendments to the Indenture implemented by the Supplemental Indenture will not become operative

until NII accepts and purchases the Notes satisfying the Requisite Consents. A copy of the Supplemental Indenture is included in

this Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 21, 2020, Nabors issued a press release

announcing NII’s early tender results, the upsizing of its previously announced tender offers, the increase of a previously

announced tender cap, an additional tender cap and NII’s receipt of the Requisite Consents requested pursuant to its previously

announced consent solicitations. A copy of the press release is included in this Form 8-K as Exhibit 99.1 and is incorporated herein

by reference.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

First Supplemental Indenture to the Indenture, dated January 22, 2020, among Nabors Industries, Inc., as issuer, Nabors Industries Ltd., as guarantor, Wilmington Trust, National Associate, as trustee, and Citibank, N.A., as securities administrator.

|

|

|

|

|

|

99.1

|

|

Press Release regarding early settlement dated January 21, 2020.

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NABORS INDUSTRIES LTD.

|

|

|

|

Date: January 22, 2020

|

By:

|

/s/

Mark D. Andrews

|

|

|

|

Name:

|

Mark D. Andrews

|

|

|

|

Title:

|

Corporate Secretary

|

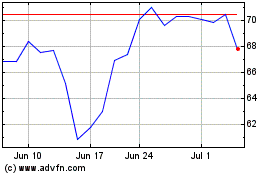

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

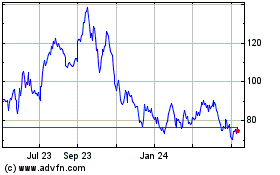

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024