Current Report Filing (8-k)

December 03 2018 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 3, 2018 (November

28

, 2018

)

MURPHY OIL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-8590

|

|

71-0361522

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

300 Peach Street

|

|

|

P.O. Box 7000, El Dorado, Arkansas

|

71730-7000

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

Registrant’s telephone number, including area code

870-862-6411

|

|

|

|

Not applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement

On November

28

, 2018,

Murphy Oil Corporation (the “Company”) entered into a $1.

6

billion revolving credit facility (the “New Revolving Credit Facility”). The New Revolving Credit Facility will be a senior unsecured guaranteed facility and will expire in November 2023

.

Borrowings under the New Revolving Credit Facility bear interest at rates, based, at the Company’s option, on the “Alternate Base Rate” of interest in effect plus the “ABR Spread” or the “Adjusted LIBO

R

Rate,” which is a periodic fixed rate based on LIBOR with a term equivalent to the interest period for such borrowing, plus the “Eurodollar Spread.” The “Alternate Base Rate” of interest is the highest of (i) the Wall Street Journal prime rate, (ii) the New York Federal Reserve Bank Rate plus 0.50%, and (iii) one-month LIBOR plus 1.00%. The “Eurodollar Spread” ranges from 1.075% to 2.10% per annum based upon the Corporation’s senior unsecured long-term debt securities credit ratings (the “Credit Ratings”). A facility fee accrues and is payable quarterly in arrears at a rate ranging from 0.175% to 0.40% per annum (based upon the Company’s Credit Ratings) on the aggregate commitments under the New Revolving Credit Facility

.

On the date the Company achieves certain Credit Ratings (the “Investment Grade Ratings Date”), the guarantees will be released and certain covenants will be modified as set forth in the New Revolving Credit Facility. In addition, prior to the Investment Grade Ratings Date, the Company will be required to comply with a maximum consolidated debt ratio of 4.00x, and a minimum ratio of Adjusted EBITDAX to interest expense of 2.50x. From and after the Investment Grade Ratings Date, the Company will be required to comply with a maximum ratio of consolidated debt to consolidated total capitalization of 60%.

The foregoing description of the New Revolving Credit Facility does not purport to be complete and is qualified in its entirety by reference to the full text of the New Revolving Credit Facility, which

will be

filed as Exhibit 10.1 to

the Annual

Report on Form

10

-K.

In the ordinary course of their respective businesses, the lenders under the New Revolving Credit Facility and their affiliates have engaged, and may in the future engage, in commercial banking and/or investment banking transactions with the Company and its affiliates.

Item 1.02 Termination of a Material Definitive Agreement

Effective November

28

, 2018, the Company terminated the Credit Agreement dated as of August 10, 2016 among the Company, the other parties thereto and JPMorgan Chase, N.A.

Item 2

.01

Completion of Acquisition or Disposition of Assets

On November 30, 2018, Murphy Exploration & Production Company

–

USA (

“

Murphy

”

), a subsidiary of Murphy Oil Corporation, and Petrobras America Inc. (

“

PAI

”

), a subsidiary of Petróleo Brasileiro S.A., formed a joint venture pursuant to the terms of the Contribution Agreement (the “Contribution Agreement”), dated as of October 10, 2018, among Murphy, PAI and MP Gulf of Mexico, LLC

(“MPGOM”)

, the joint venture company previously 100% owned by Murphy. The transaction has an effective date of October 1, 2018.

Pursuant to the Contribution Agreement, Murphy contributed its interests in the Dalmatian, Clipper, Front Runner, Habanero, Kodiak, Tahoe and Thunder

H

awk fields and its interest in the Medusa Spar LLC to MP

GOM

, and PAI contributed its interests in the Cascade, Chinook, Lucius, St. Malo, Cottonwood, South Marsh Island, Northwestern, Main Pass, Ship Shoal and South Hadrian fields and its interests in exploration blocks in the U.S. Gulf of Mexico to MP

GOM

. Murphy also paid cash consideration of $900 million, subject to normal closing adjustments, to PAI on behalf of MP

GOM

. Additionally, PAI can earn an additional contingent consideration up to $150 million if certain price and production thresholds are exceeded beginning in 2019 through 2025. Also, Murphy will carry $50 million of PAI costs in the St. Malo field if certain enhanced oil recovery projects are undertaken. As a result of the transaction, PAI received a 20% membership interest in MP

GOM

, and Murphy’s membership interest in MP

GOM

was reduced to 80%. Murphy controls the operations of MP

GOM

, subject to certain PAI approval rights. In addition, Murphy is the contract operator of MP

GOM

’s assets. Murphy funded the transaction through a combination of cash-on-hand and its senior credit facility.

A full text of a news release announcing the closing of this transaction is attached as Exhibit 99.1 and in

corporated herein by reference.

Item 2.02 Results of Operations and Financial Condition

The following information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition.”

On December 3, 2018, Murphy Oil Corporation announced updated full year capital expenditure information related to field development activities in the Eagle Ford Shale and updated fourth quarter and full year production guidance information related to the joint venture between Murphy and PAI and other operational events.

A full text of a news release announcing the details of the updated guidance is attached as Exhibit 99.1 and incorporated herein by reference.

Item 2.03 Creation of

a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of the Business Acquired

The financial statements required by this Item will be included in an amendment to this Current Report on Form 8-K as soon as practicable, but not later than 71 calendar days after the date that the initial report on Form 8-K must be filed.

(b) Pro Forma Financial Information

The pro forma financial information required by this Item will be included in an amendment to this Current Report on Form 8-K as soon as practicable, but not later than 71 calendar days after the date that the initial report on Form 8-K must be filed.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MURPHY OIL CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Christopher D. Hulse

|

|

|

|

Christopher D. Hulse

|

|

|

|

Vice President and Controller

|

|

|

|

|

|

|

|

|

|

Date:

December 3

, 2018

|

|

|

Exhibit Index

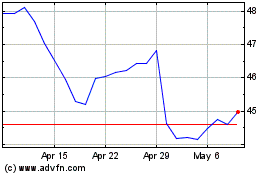

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

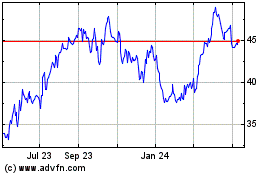

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Apr 2023 to Apr 2024