Current Report Filing (8-k)

September 29 2020 - 9:01AM

Edgar (US Regulatory)

false0000812011001-09614

0000812011

2020-09-24

2020-09-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 24, 2020

Vail Resorts, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

Delaware

|

|

51-0291762

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

390 Interlocken Crescent

|

|

|

|

Broomfield,

|

Colorado

|

|

80021

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

(303)

|

404-1800

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting materials pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

MTN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 24, 2020, Vail Resorts, Inc. (the “Company”) and Ryan Siurek, Senior Vice President, Controller and Chief Accounting Officer, agreed that his employment will end on October 9, 2020, and Mr. Siurek resigned from his position as Chief Accounting Officer of the Company effective September 29, 2020.

Also effective September 29, 2020, the Company appointed Nathan Gronberg to serve as Vice President, Controller and Chief Accounting Officer. Mr. Gronberg will report to the Company’s Executive Vice President and Chief Financial Officer.

Mr. Gronberg, who is 42 years old, has served as Vice President and Assistant Controller of the Company since January 2019. Prior to joining the Company, Mr. Gronberg held various roles at Ferrellgas Partners, L.P. from January 2016 to January 2019, most recently as the Vice President of Accounting and Corporate Controller. From March 2012 until December 2015, Mr. Gronberg served as Manager, Technical Accounting & Policy at Sprint Corporation. Mr. Gronberg started his career with PricewaterhouseCoopers LLP, where he worked as a member of their audit and assurance practice for over seven years. Mr. Gronberg holds a bachelor of science - accounting and business administration from the University of Kansas.

In connection with Mr. Gronberg’s appointment, Mr. Gronberg will be entitled to receive compensation and participate in benefits plans generally available to the Company’s other executives, including equity compensation and annual cash incentive plans. These plans are described in the Company’s definitive proxy statement for its annual meeting of stockholders filed with the Securities and Exchange Commission. Mr. Gronberg will also receive an equity award under the Company’s equity compensation plan consisting of restricted share units of approximately $54,723 and share appreciation rights of approximately $187,582, which are each expected to vest in three equal installments beginning on the first anniversary of the grant date.

There is no arrangement or understanding pursuant to which Mr. Gronberg was selected to serve as an officer of the Company and there are no related party transactions between the Company and Mr. Gronberg that would require disclosure under Item 404(a) of Regulation S-K. In addition, there are no family relationships between Mr. Gronberg and any director or executive officer of the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Vail Resorts, Inc.

|

|

Date: September 29, 2020

|

By:

|

/s/ Michael Z. Barkin

|

|

|

|

Michael Z. Barkin

|

|

|

|

Executive Vice President and Chief Financial Officer

|

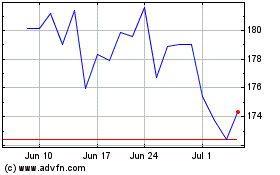

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

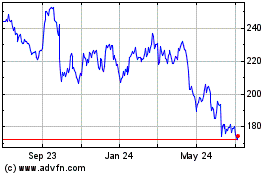

Vail Resorts (NYSE:MTN)

Historical Stock Chart

From Apr 2023 to Apr 2024