Current Report Filing (8-k)

November 13 2019 - 6:03AM

Edgar (US Regulatory)

false0001037646

0001037646

2019-11-06

2019-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

Date of Report (Date of earliest event reported):

|

November 6, 2019

|

Mettler Toledo International Inc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

File No.

|

001-13595

|

|

13-3668641

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

1900 Polaris Parkway

|

|

|

|

|

Columbus

|

OH

|

|

|

|

|

and

Im Langacher, P.O. Box MT-100

CH Greifensee, Switzerland

|

|

43240

|

and 8606

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 1-614-438-4511 and +41-44-944-22-11

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

MTD

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On November 6, 2019, Mettler-Toledo International Inc. (the “Company”) entered into a Note Purchase Agreement with the accredited institutional investors named therein (the “Agreement”). Pursuant to the Agreement, the Company will issue and sell, in a private placement, €135 million aggregate principal amount of its 1.30% Series 2019-B Senior Notes due November 6, 2034 (the “Series 2019-B Notes”) on November 6, 2019 and $50 million aggregate principal amount of its 3.19% Series 2019-C Senior Notes due January 24, 2035 (the “Series 2019-C Notes”, and together with the Series 2019-B Notes, the “Notes”) on January 24, 2020.

The Series 2019-B Notes bear interest at a fixed rate of 1.30% and mature on November 6, 2034. Interest is payable semi-annually on May 6 and November 6 of each year, beginning on May 6, 2020. The Series 2019-C Notes bear interest at a fixed rate of 3.19% and mature on January 24, 2035. Interest is payable semi-annually on January 24 and July 24 of each year, beginning on July 24, 2020.

The Company may at any time prepay the Notes, in whole or in part, at a price equal to: 100% of the principal amount thereof; plus accrued and unpaid interest; plus, in some instances, a “make-whole” prepayment premium and a swap related currency loss. In the event of a change in control (as defined in the Agreement) of the Company, the Company may be required to offer to prepay the Notes at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest.

The Agreement contains customary affirmative and negative covenants for agreements of this type including, among others, limitations on the Company and its subsidiaries with respect to incurrence of liens and priority indebtedness, disposition of assets, mergers, and transactions with affiliates. The Agreement also requires the Company to maintain a consolidated interest coverage ratio of more than 3.5 to 1.0 and a consolidated leverage ratio of less than 3.5 to 1.0. The Agreement contains customary events of default with customary grace periods, as applicable.

The Notes are senior unsecured obligations of the Company. The Company may use the proceeds from the sale of Notes to refinance existing indebtedness and for other general corporate purposes.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, which is filed as Exhibit 4.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).*

* Submitted electronically with this Report in accordance with the provisions of Regulation S-T.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

METTLER-TOLEDO INTERNATIONAL INC.

|

|

|

|

|

|

Date: November 6, 2019

|

By:

|

/s/ Michelle M. Roe

|

|

|

|

|

|

|

|

Michelle M. Roe

|

|

|

|

General Counsel

|

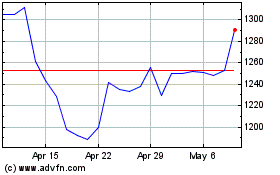

Mettler Toledo (NYSE:MTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

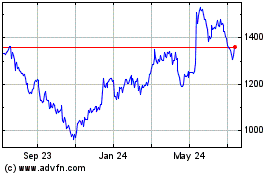

Mettler Toledo (NYSE:MTD)

Historical Stock Chart

From Apr 2023 to Apr 2024