Steel Mogul Lakshmi Mittal Turns Over CEO Role To Son

February 11 2021 - 9:33AM

Dow Jones News

By Alistair MacDonald

Lakshmi Mittal built what was until last year the world's

largest steelmaker, ArcelorMittal. On Thursday, he tapped his son

to take over amid rising domination of the industry by China and

growing investor pressure to produce steel more cleanly.

ArcelorMittal said Aditya Mittal, 44 years old and currently the

company's chief financial officer, will replace his father as CEO.

The elder Mr. Mittal will stay on as executive chairman.

Aditya Mittal's promotion represents a generational change of

the guard long in the making at ArcelorMittal, the Luxembourg-based

steelmaking giant that is almost 40% owned by his family. He told

reporters Thursday that the shift "is much more evolutionary than

revolutionary." Lakshmi Mittal said the two had been effectively

running the company together.

Aditya Mittal was already helping lead the company's effort to

shift production to less carbon-intensive steel and, following the

rest of the industry, to manufacturing sites in the developing

world.

Raised in India, Lakshmi Mittal laid the foundations of his

company with a single steel plant in Indonesia in 1976. He set off

on years of acquisitions, mainly in Eastern Europe and the

developing world. Mittal Steel became the world's largest

steelmaker by production after buying Arcelor, a European

conglomerate, in 2006.

The company held that title until last year, when steel analysts

said it was overtaken by China Baowu Steel Group Corp. This

reflects a long-term shift in steel production away from the

developed world. China alone was responsible for 56.5% of global

steel production last year, with the European Union, one of

ArcelorMittal's largest markets, producing only 7.4% of output, and

the U.S. responsible for less than 4%.

The younger Mr. Mittal inherits a company that has reduced the

heavy debt load built up over some 45 years of deal making by his

father. The company said Thursday that it has net debt of $6.4

billion, the lowest level since the Arcelor acquisition. The

company has also shed some of his earlier acquisitions, including

the sale last year of ArcelorMittal's U.S. steel business.

The Covid-19 pandemic has hit demand, outside of China, in an

industry that was already suffering from low margins amid massive

oversupply. The industry also faces growing pressure from

governments and investors to shake off its century-old reputation

as a smoke-belching industry.

"The biggest challenge of the day is how we lead the

decarbonization of the steel industry," Aditya Mittal told

reporters. He has promised a shift away from using coal to fuel the

steelmaking process towards cleaner fuels like hydrogen. Mr. Mittal

said on Thursday that the company is piloting a hydrogen plant in

Germany and capturing waste gases at a plant in Belgium.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

February 11, 2021 09:18 ET (14:18 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

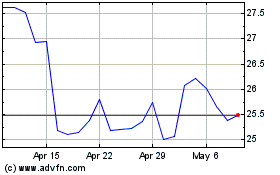

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

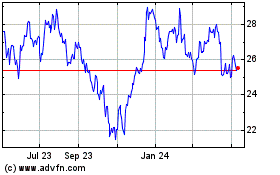

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024