~ Second Quarter Net Sales of $88.5 million

~

~ Second Quarter Loss Per Share of ($0.28),

or ($0.07) Excluding Restructuring Plan and Other Items ~

~ Ends Second Quarter with Cash of $170

million ~

~ Announces Licensing Partnership with

Calvin Klein ~

Movado Group, Inc. (NYSE: MOV) today announced second quarter

and six-month results for the period ended July 31, 2020.

Efraim Grinberg, Chairman and Chief Executive Officer, stated,

“We remain focused on ensuring the safety and health of our

employees, customers and the communities where we operate. In a

quarter that was significantly impacted globally by the COVID-19

pandemic, I am proud of our team’s ability to build on our

multi-year investments in our digital center of excellence and

adapt to support our ongoing mission to put consumers first,

allowing them to connect with our great brands, designs and

platforms wherever and whenever they choose to shop. These efforts

allowed us to capture strong online demand where our Movado brand

generated a 130% increase in our own and third party ecommerce

sales. In North America, we reopened our outlet stores in June and

were encouraged by the improved sequential performance in July,

despite reduced stores hours. We are also seeing encouraging demand

in our domestic department store channel. In China, we had a 16%

increase in sales for the quarter with trends continuing to

accelerate and we had positive top line growth in France and

Germany, despite our customers being closed for nearly half of the

quarter.”

Mr. Grinberg continued, “The aggressive actions we took at the

height of the pandemic have positioned us well to continue to

navigate the current environment. We have implemented initiatives

that are expected to generate $90 million in cost savings in this

fiscal year and have strengthened our financial health as evidenced

by our cash balance of $170 million after repaying $37 million on

our revolver at quarter end. As we look to the remainder of the

year, we continue to expect improving sales trends in the second

half relative to the first half with improved profitability and we

will continue to be disciplined and agile in managing the business

given the continued uncertainty. The actions we have taken,

combined with our strong liquidity, enable us to leverage our

powerful portfolio of brands which will be further strengthened by

the exciting new licensing partnership announced today to design

and develop Calvin Klein timepieces and jewelry. As a result, we

have confidence that we will emerge from this extraordinary period

a stronger company that is even better positioned to deliver

long-term shareholder value.”

Non-GAAP Items (See attached table for

GAAP and Non-GAAP measures)

Second quarter fiscal 2021 results of operations included the

following items:

- Operating expenses include a $0.7 million pre-tax charge, or

$0.5 million after tax, representing $0.02 per diluted share,

associated with the amortization of acquired intangible assets

related to the acquisition of Olivia Burton;

- $0.3 million pre-tax charge, or $0.2 million after tax,

representing $0.01 per diluted share, associated with the

amortization of acquired intangible assets and deferred

compensation related to the acquisition of MVMT;

- $7.4 million pre-tax charge, or $5.0 million after tax,

representing $0.22 per diluted share, related to corporate

initiatives primarily in response to the COVID-19 pandemic;

and

- Other non-operating income includes a $1.3 million pre-tax

gain, or $0.8 million after tax, representing $0.04 per diluted

share, associated with the sale of a non-operating asset in

Switzerland.

Second quarter Fiscal 2020 results of operations included the

following items:

- Operating expenses include a $0.7 million pre-tax charge, or

$0.6 million after tax, representing $0.02 per diluted share,

associated with the amortization of acquired intangible assets

related to Olivia Burton;

- $1.1 million pre-tax charge, or $0.9 million after tax,

representing $0.04 per diluted share, associated with the

amortization of acquired intangible assets and deferred

compensation related to the acquisition of MVMT;

- $0.3 million pre-tax gain, or $0.2 million after tax,

representing $0.01 per diluted share, associated with the change in

estimate of the remaining accrual for the fiscal 2018 cost saving

initiatives; and

- Other non-operating income includes a $13.6 million pre-tax

benefit, or $10.4 million after tax, representing $0.44 per diluted

share, associated with the remeasurement of the contingent

consideration liability associated with the MVMT acquisition.

Second Quarter Fiscal 2021 (See

attached table for GAAP and Non-GAAP measures)

- Net sales decreased 43.9% to $88.5 million compared to $157.8

million in the second quarter of fiscal 2020 primarily due to the

impact of the COVID-19 pandemic. Net sales on a constant dollar

basis also decreased 43.9%.

- Gross profit was $45.4 million, or 51.2% of sales, compared to

$85.3 million, or 54.1% of sales, in the second quarter last year.

The decrease in gross margin percentage was primarily the result of

unfavorable changes in channel and product mix, decreased leverage

on fixed costs due to decreased sales, and U.S. special tariff

headwinds.

- Operating expenses were $54.3 million compared to $76.6 million

in the prior year period. For the second quarter of fiscal 2021,

adjusted operating expenses were $45.9 million, which excludes the

operating expense charges mentioned above in the Non-GAAP Items

section. For the second quarter of fiscal 2020, adjusted operating

expenses were $75.1 million, which excludes the operating expense

charges mentioned above in the Non-GAAP Items section. The decrease

in adjusted operating expenses was primarily due to the Company’s

initiative to minimize all non-essential operating expenses such as

certain marketing, selling and payroll related expenses.

- Operating loss was $8.9 million compared to operating income of

$8.8 million in the second quarter of fiscal 2020. Adjusted

operating loss for the second quarter of fiscal 2021 was $0.6

million, which excludes the fiscal 2021 charges listed above in the

Non-GAAP Items section, compared to adjusted operating income for

the second quarter of fiscal 2020 of $10.3 million, which excludes

the fiscal 2020 charges listed above in the Non-GAAP Items

section.

- The Company recorded a tax benefit of $1.6 million compared to

a tax provision of $4.7 million in the second quarter of fiscal

2020. The Company recorded an adjusted tax provision in the second

quarter of fiscal 2021 of $0.6 million compared to an adjusted tax

provision of $1.8 million for the second quarter of fiscal

2020.

- Net loss was $6.6 million, or $0.28 per diluted share, compared

to net income of $17.5 million, or $0.75 per diluted share, in the

second quarter of fiscal 2020 . Adjusted net loss for the fiscal

2021 period was $1.7 million, or $0.07 per diluted share, which

excludes the second quarter fiscal 2021 net charges listed above in

the Non-GAAP Items section after the associated tax effects. This

compares to adjusted net income in the second quarter of fiscal

2020 of $8.3 million, or $0.36 per diluted share, which excludes

the second quarter fiscal 2020 net charges listed above in the

Non-GAAP Items section after the associated tax effects.

First Half Fiscal 2021 (See attached

table for GAAP and Non-GAAP measures)

- Net sales were $158.2 million compared to $304.4 million in the

first six months of fiscal 2020, a decrease of 48.0% primarily due

to the COVID-19 pandemic. Net sales on a constant dollar basis

decreased 47.8%.

- Gross profit was $77.2 million, or 48.8% of sales, compared to

$164.2 million, or 54.0% of sales in the same period last year.

Adjusted gross profit for the first six months of fiscal 2021,

which excludes $3.5 million in corporate initiative charges related

to the impact to the business of the COVID-19 pandemic, was $80.8

million, or 51.0% of net sales. Adjusted gross profit for the first

six months of fiscal 2020, which excludes $0.1 million in

adjustments associated with the amortization of acquisition

accounting adjustments related to the MVMT acquisition, was $164.4

million, or 54.0% of net sales. The decrease in adjusted gross

margin percentage was primarily the result of decreased leverage on

fixed costs due to decreased sales, unfavorable changes in channel

and product mix, unfavorable foreign currency exchange rates and

U.S. special tariff headwinds.

- Operating expenses were $268.3 million as compared to $150.5

million in the first six months of last fiscal year. For the first

six months of fiscal 2021, adjusted operating expenses were $99.0

million, which excludes $155.9 million in adjustments related to

the impairment of goodwill and certain intangible assets, $11.1

million in corporate initiative charges related to the impact to

the business from the COVID-19 pandemic, $1.4 million of expenses

associated with the amortization of acquired intangible assets

related to Olivia Burton and $1.0 million in adjustments associated

with the amortization of acquired intangible assets and deferred

compensation related to the MVMT acquisition. For the first six

months of fiscal 2020, adjusted operating expenses were $146.9

million, which excludes $1.4 million of expenses associated with

the amortization of acquired intangible assets related to Olivia

Burton and $2.5 million in adjustments associated with the

amortization of acquired intangible assets, accounting adjustments

and deferred compensation related to the MVMT acquisition,

partially offset by $0.3 million in adjustments associated with the

change in estimate of the remaining accrual for the fiscal 2018

cost saving initiatives. The decrease in adjusted operating

expenses was primarily due to the Company’s initiative to minimize

all non-essential operating expenses such as certain marketing,

selling and payroll related expenses.

- Operating loss was $191.1 million compared to operating income

of $13.8 million in the first six months of fiscal 2020. Adjusted

operating loss for the first six months of fiscal 2021 was $18.2

million, which excludes the fiscal 2021 charges listed in the

immediately preceding bullet, compared to adjusted operating income

of $17.4 million in the first six months of fiscal 2020 which

excludes the fiscal 2020 net charges listed in the immediately

preceding bullet.

- The Company recorded a tax benefit in the first six months of

fiscal 2021 of $33.9 million as compared to a tax provision of $5.6

million in the first six months of last year. Based upon adjusted

pre-tax income, the adjusted tax benefit was $4.3 million in the

first half of fiscal 2021 compared to an adjusted tax provision of

$3.1 million in the first half of fiscal 2020.

- Net loss was $156.6 million, or $6.75 per diluted share,

compared to net income of $21.4 million, or $0.92 per diluted

share, in the first six months of fiscal 2020. Adjusted net loss

for the first half of fiscal 2021 was $14.7 million, or $0.63 per

diluted shares, which excludes $131.1 million, net of $24.9 million

of tax, in adjustments related to the impairment of goodwill and

certain intangible assets, $10.0 million, net of $4.6 million of

tax, in corporate initiative charges related to the impact to the

business from the COVID-19 pandemic, $1.1 million, net of $0.3

million of tax, of expenses associated with the amortization of

acquired intangible assets related to Olivia Burton and $0.6

million, net of $0.4 million of tax, in adjustments associated with

the amortization of acquired intangible assets and deferred

compensation related to the MVMT acquisition, and $0.8 million, net

of $0.5 million of tax, associated with a gain on the sale of a

non-operating asset in Switzerland. This compares to adjusted net

income for the first half of fiscal 2020 of $13.9 million, or $0.60

per diluted share, which excludes $1.1 million, net of $0.3 million

of tax, of expenses associated with the amortization of acquired

intangible assets related to Olivia Burton; $2.0 million, net of

$0.6 million of tax, of expenses related to the amortization of

acquired intangible assets, accounting adjustments and deferred

compensation related to MVMT; $10.4 million, net of $3.3 million of

tax, of gains associated with the remeasurement of the contingent

consideration liability associated with the MVMT acquisition; and

$0.2 million, net of $0.1 million of tax, of gains associated with

the change in estimate of the remaining accrual for the fiscal 2018

cost saving initiatives.

Fiscal 2021 Outlook

Given the dynamic nature of the COVID-19 crisis and lack of

visibility, the potential financial impact to the business cannot

be reasonably estimated. The Company is not providing fiscal 2021

guidance.

Conference Call

The Company’s management will host a conference call and audio

webcast to discuss its results today, August 27, 2020 at 9:00 a.m.

Eastern Time. The conference call may be accessed by dialing (877)

407-0784. Additionally, a live webcast of the call can be accessed

at www.movadogroup.com. The webcast will be archived on the

Company’s website approximately one hour after the conclusion of

the call. Additionally, a telephonic re-play of the call will be

available at 12:00 p.m. ET on August 27, 2020 until 11:59 p.m. ET

on September 10, 2020 and can be accessed by dialing (844) 512-2921

and entering replay pin number 13708469.

Movado Group, Inc. designs, sources, and distributes MOVADO®,

MVMT®, OLIVIA BURTON®, EBEL®, CONCORD®, COACH®, TOMMY HILFIGER®,

HUGO BOSS®, LACOSTE®, SCUDERIA FERRARI®, REBECCA MINKOFF® and URI

MINKOFF® watches worldwide, and operates Movado company stores in

the United States and Canada.

In this release, the Company presents certain financial measures

that are not calculated according to generally accepted accounting

principles in the United States (“GAAP”). Specifically, the Company

is presenting adjusted gross profit, adjusted gross margin,

adjusted operating expenses and adjusted operating income, which

are gross profit, gross margin, operating expenses and operating

income, respectively, under GAAP, adjusted to eliminate the

amortization of acquisition accounting adjustments related to the

Olivia Burton and MVMT acquisitions, corporate initiatives and the

impairment of goodwill and certain intangible assets. The Company

is also presenting adjusted tax provision, which is the tax

provision under GAAP, adjusted to eliminate the impact of charges

for the Olivia Burton and MVMT acquisitions, corporate initiatives,

the impairment of goodwill and certain intangible assets and the

gain on sale of a non-operating asset. The Company believes these

adjusted measures are useful because they give investors

information about the Company’s financial performance without the

effect of certain items that the Company believes are not

characteristic of its usual operations. The Company is also

presenting adjusted net income, adjusted earnings per share and

adjusted effective tax rate, which are net income, earnings per

share and effective tax rate, respectively, under GAAP, adjusted to

eliminate the after-tax impact of amortization of acquisition

accounting adjustments related to the Olivia Burton and MVMT

acquisitions, corporate initiatives, the impairment of goodwill and

certain intangibles and the gain on sale of a non-operating asset.

The Company believes that adjusted net income, adjusted earnings

per share and adjusted effective tax rate are useful measures of

performance because they give investors information about the

Company’s financial performance without the effect of certain items

that the Company believes are not characteristic of its usual

operations. Additionally, the Company is presenting constant

currency information to provide a framework to assess how its

business performed excluding the effects of foreign currency

exchange rate fluctuations in the current period. Comparisons of

financial results on a constant dollar basis are calculated by

translating each foreign currency at the same US dollar exchange

rate as in effect for the prior-year period for both periods being

compared. The Company believes this information is useful to

investors to facilitate comparisons of operating results. These

non-GAAP financial measures are designed to complement the GAAP

financial information presented in this release. The non-GAAP

financial measures presented should not be considered in isolation

from or as a substitute for the comparable GAAP financial measures,

and the methods of their calculation may differ substantially from

similarly titled measures used by other companies.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The Company has tried, whenever possible, to identify

these forward-looking statements using words such as “expects,”

“anticipates,” “believes,” “targets,” “goals,” “projects,”

“intends,” “plans,” “seeks,” “estimates,” “may,” “will,” “should”

and variations of such words and similar expressions. Similarly,

statements in this press release that describe the Company's

business strategy, outlook, objectives, plans, intentions or goals

are also forward-looking statements. Accordingly, such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company's

actual results, performance or achievements and levels of future

dividends to differ materially from those expressed in, or implied

by, these statements. These risks and uncertainties may include,

but are not limited to general economic and business conditions

which may impact disposable income of consumers in the United

States and the other significant markets (including Europe) where

the Company’s products are sold, uncertainty regarding such

economic and business conditions, trends in consumer debt levels

and bad debt write-offs, general uncertainty related to possible

terrorist attacks, natural disasters, pandemics, including the

effect of the COVID-19 pandemic and other diseases on travel and

traffic in our retail stores and the stores of our wholesale

customers, supply disruptions and delivery delays from our Chinese

and other suppliers as a result of the COVID-19 pandemic, adverse

impact on the Company’s wholesale customers and customer traffic in

the Company’s stores as a result of increased uncertainty and

economic disruption caused by the COVID-19 pandemic, the stability

of the European Union (including the impact of the United Kingdom’s

process to exit from the European Union), the stability of the

United Kingdom after its exit from the European Union, and defaults

on or downgrades of sovereign debt and the impact of any of those

events on consumer spending, changes in consumer preferences and

popularity of particular designs, new product development and

introduction, decrease in mall traffic and increase in e-commerce,

the ability of the Company to successfully implement its business

strategies, competitive products and pricing, the impact of “smart”

watches and other wearable tech products on the traditional watch

market, seasonality, availability of alternative sources of supply

in the case of the loss of any significant supplier or any

supplier’s inability to fulfill the Company’s orders, the loss of

or curtailed sales to significant customers, the Company’s

dependence on key employees and officers, the ability to

successfully integrate the operations of acquired businesses

without disruption to other business activities, the possible

impairment of acquired intangible assets including goodwill if the

carrying value of any reporting unit were to exceed its fair value,

volatility in reported earnings resulting from changes in the

estimated fair value of contingent acquisition consideration, the

continuation of the company’s major warehouse and distribution

centers, the continuation of licensing arrangements with third

parties, losses possible from pending or future litigation, the

ability to secure and protect trademarks, patents and other

intellectual property rights, the ability to lease new stores on

suitable terms in desired markets and to complete construction on a

timely basis, the ability of the Company to successfully manage its

expenses on a continuing basis, information systems failure or

breaches of network security, the continued availability to the

Company of financing and credit on favorable terms, business

disruptions, and general risks associated with doing business

outside the United States including, without limitation, import

duties, tariffs (including retaliatory tariffs), quotas, political

and economic stability, changes to existing laws or regulations,

and success of hedging strategies with respect to currency exchange

rate fluctuations, and the other factors discussed in the Company’s

Annual Report on Form 10-K and other filings with the Securities

and Exchange Commission. These statements reflect the Company's

current beliefs and are based upon information currently available

to it. Be advised that developments subsequent to this press

release are likely to cause these statements to become outdated

with the passage of time. The Company assumes no duty to update its

forward looking statements and this release shall not be construed

to indicate the assumption by the Company of any duty to update its

outlook in the future.

(Tables to

follow)

MOVADO GROUP, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data)

(Unaudited)

Three Months Ended

Six Months Ended

July 31,

July 31,

2020

2019

2020

2019

Net sales

$

88,538

$

157,816

$

158,204

$

304,365

Cost of sales

43,182

72,477

80,955

140,153

Gross profit

45,356

85,339

77,249

164,212

Operating expenses

54,272

76,563

112,409

150,462

Impairment of goodwill and intangible assets

-

-

155,919

-

Total operating expenses

54,272

76,563

268,328

150,462

Operating (loss)/income

(8,916

)

8,776

(191,079

)

13,750

Non-operating (expense)/income: Gain on sale of a

non-operating asset

1,317

-

1,317

-

Change in contingent consideration

-

13,627

-

13,627

Interest expense

(590

)

(225

)

(861

)

(449

)

Interest income

8

24

23

45

(Loss)/Income before income taxes

(8,181

)

22,202

(190,600

)

26,973

(Benefit)/Provision for income taxes

(1,559

)

4,741

(33,889

)

5,588

Net (loss)/income

(6,622

)

17,461

(156,711

)

21,385

Less: Net loss attributable to noncontrolling interests

(7

)

(44

)

(103

)

(45

)

Net (loss)/income attributable to Movado Group, Inc.

$

(6,615

)

$

17,505

$

(156,608

)

$

21,430

Diluted Income Per Share Information Net

(loss)/income attributable to Movado Group, Inc.

$

(0.28

)

$

0.75

$

(6.75

)

$

0.92

Weighted diluted average shares outstanding

23,240

23,292

23,191

23,370

MOVADO GROUP, INC. GAAP AND NON-GAAP

MEASURES (In thousands, except for percentage data)

(Unaudited)

As Reported

Three Months Ended

July 31,

% Change

2020

2019

Total net sales, as reported

$

88,538

$

157,816

-43.9

%

Total net sales, constant dollar basis

$

88,461

$

157,816

-43.9

%

As Reported

Six Months Ended

July 31,

% Change

2020

2019

Total net sales, as reported

$

158,204

$

304,365

-48.0

%

Total net sales, constant dollar basis

$

158,813

$

304,365

-47.8

%

MOVADO GROUP, INC. GAAP AND NON-GAAP MEASURES

(In thousands, except per share data) (Unaudited)

Net Sales

Gross Profit

Operating

(Loss)/Income

Pre-tax (Loss)/Income

(Benefit)/Provision for Income

Taxes

Net (Loss)/Income Attributable

to Movado Group, Inc.

Diluted EPS

Three Months Ended July 31, 2020 As Reported (GAAP)

$

88,538

$

45,356

$

(8,916

)

$

(8,181

)

$

(1,559

)

$

(6,615

)

$

(0.28

)

Olivia Burton Costs (1)

-

-

671

671

139

532

$

0.02

MVMT Costs (2)

-

-

284

284

108

176

$

0.01

Gain On Sale of a Non-Operating Asset (3)

-

-

-

(1,317

)

(474

)

(843

)

$

(0.04

)

Corporate Initiatives (4)

-

-

7,368

7,368

2,353

5,015

$

0.22

Adjusted Results (Non-GAAP)

$

88,538

$

45,356

$

(593

)

$

(1,175

)

$

567

$

(1,735

)

$

(0.07

)

Three Months Ended July 31, 2019 As

Reported (GAAP)

$

157,816

$

85,339

$

8,776

$

22,202

$

4,741

$

17,505

$

0.75

Olivia Burton Costs (1)

-

-

690

690

131

559

0.02

MVMT Costs (2)

-

-

1,125

1,125

270

855

0.04

Change In Contingent Consideration (5)

-

-

-

(13,627

)

(3,270

)

(10,357

)

(0.44

)

Cost Savings Initiatives (6)

-

-

(320

)

(320

)

(77

)

(243

)

(0.01

)

Adjusted Results (Non-GAAP)

$

157,816

$

85,339

$

10,271

$

10,070

$

1,795

$

8,319

$

0.36

Net Sales Gross Profit

Operating(Loss)/Income Pre-tax(Loss)/Income

(Benefit)/Provisionfor Income Taxes

Net(Loss)/IncomeAttributable toMovado Group,Inc. Diluted

EPS Six Months Ended July 31, 2020 As Reported

(GAAP)

$

158,204

$

77,249

$

(191,079

)

$

(190,600

)

$

(33,889

)

$

(156,608

)

$

(6.75

)

Olivia Burton Costs (1)

-

-

1,356

1,356

258

1,098

$

0.05

MVMT Costs (2)

-

-

981

981

373

608

$

0.03

Goodwill and Intangible Asset Impairment (7)

-

-

155,919

155,919

24,867

131,052

$

5.65

Gain On Sale of a Non-Operating Asset (3)

-

-

-

(1,317

)

(474

)

(843

)

$

(0.04

)

Corporate Initiatives (4)

-

3,508

14,608

14,608

4,592

10,016

$

0.43

Adjusted Results (Non-GAAP)

$

158,204

$

80,757

$

(18,215

)

$

(19,053

)

$

(4,273

)

$

(14,677

)

$

(0.63

)

Six Months Ended July 31, 2019 As Reported

(GAAP)

$

304,365

$

164,212

$

13,750

$

26,973

$

5,588

$

21,430

$

0.92

Olivia Burton Costs (1)

-

-

1,402

1,402

266

1,136

0.05

MVMT Costs (2)

-

140

2,598

2,598

624

1,974

0.08

Change In Contingent Consideration (5)

-

-

-

(13,627

)

(3,270

)

(10,357

)

(0.44

)

Cost Savings Initiatives (6)

-

-

(320

)

(320

)

(77

)

(243

)

(0.01

)

Adjusted Results (Non-GAAP)

$

304,365

$

164,352

$

17,430

$

17,026

$

3,131

$

13,940

$

0.60

(1)

Related to the amortization of acquired intangible assets for

Olivia Burton.

(2)

Related to the amortization of acquired intangible assets,

accounting adjustments and deferred compensation of MVMT, where

applicable.

(3)

Related to a gain on sale of a non-operating asset in Switzerland.

(4)

Related to provision established associated with corporate

initiatives, including restructuring plan.

(5)

Remeasurement of contingent consideration liability.

(6)

Change in estimate in Fiscal 2020 for severance and occupancy

expenses.

(7)

Related to the impairment of goodwill for MVMT, Olivia Burton and

City Time and impairment of certain of MVMT's intangible assets.

MOVADO GROUP, INC. CONSOLIDATED BALANCE SHEETS (In

thousands) (Unaudited)

July 31,

January 31,

July 31,

2020

2020

2019

ASSETS Cash and

cash equivalents

$

170,195

$

185,872

$

134,890

Trade receivables, net

60,128

78,388

93,699

Inventories

173,374

171,406

200,953

Other current assets

29,856

28,888

32,113

Total current assets

433,553

464,554

461,655

Property, plant and equipment, net

25,888

29,238

28,248

Operating lease right-of-use assets

82,169

89,523

91,119

Deferred and non-current income taxes

59,747

25,403

24,621

Goodwill

-

136,366

131,936

Other intangibles, net

18,071

42,359

43,995

Other non-current assets

60,261

59,865

59,057

Total assets

$

679,689

$

847,308

$

840,631

LIABILITIES AND EQUITY

Accounts payable

$

29,929

$

35,488

$

50,281

Accrued liabilities

45,509

44,210

43,874

Accrued payroll and benefits

12,431

6,302

7,333

Current operating lease liabilities

14,766

15,083

14,609

Income taxes payable

6,774

8,217

10,800

Total current liabilities

109,409

109,300

126,897

Loans payable to bank, non current

48,341

51,910

50,300

Deferred and non-current income taxes payable

20,743

25,419

26,593

Non-current operating lease liabilities

75,376

81,877

82,972

Other non-current liabilities

48,124

48,393

50,025

Redeemable noncontrolling interest

3,037

3,165

3,540

Shareholders' equity

373,671

526,537

500,304

Noncontrolling interest

988

707

-

Total equity

374,659

527,244

500,304

Total liabilities, redeemable noncontrolling interest and

equity

$

679,689

$

847,308

$

840,631

MOVADO GROUP, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited)

Six Months Ended

July 31,

2020

2019

Cash flows from operating activities: Net

(loss)/income

$

(156,608

)

$

21,430

Impairment of goodwill and intangible assets

155,919

-

Non-cash corporate initiatives

6,608

-

Change in contingent consideration

-

(13,627

)

Depreciation and amortization

7,200

7,937

Other non-cash adjustments

(33,833

)

2,289

Changes in working capital

9,630

(50,401

)

Changes in non-current assets and liabilities

(292

)

(222

)

Net cash used in operating activities

(11,376

)

(32,594

)

Cash flows from investing activities:

Capital expenditures

(1,891

)

(6,948

)

Proceeds from sale of a non-operating asset

1,317

-

Tradenames and other intangibles

(51

)

(99

)

Net cash used in investing activities

(625

)

(7,047

)

Cash flows from financing activities:

Repayments of bank borrowings

(36,772

)

-

Proceeds from bank borrowings

30,879

-

Dividends paid

-

(9,196

)

Stock repurchase

-

(4,199

)

Stock awards and options exercised and other changes

(474

)

(1,234

)

Debt issuance costs

(300

)

-

Net cash used in financing activities

(6,667

)

(14,629

)

Effect of exchange rate changes on cash, cash

equivalents, and restricted cash

3,022

(751

)

Net change in cash, cash equivalents, and restricted cash

(15,646

)

(55,021

)

Cash, cash equivalents, and restricted cash at beginning of period

186,438

190,459

Cash, cash equivalents, and restricted cash at end

of period

$

170,792

$

135,438

Reconciliation of cash, cash equivalents, and

restricted cash: Cash and cash equivalents

$

170,195

$

134,890

Restricted cash included in other non-current assets

597

548

Cash, cash equivalents, and restricted cash

$

170,792

$

135,438

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200827005233/en/

ICR, Inc. Rachel Schacter/Allison Malkin 203-682-8200

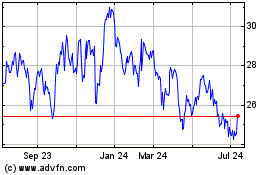

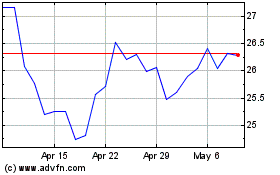

Movado (NYSE:MOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Movado (NYSE:MOV)

Historical Stock Chart

From Apr 2023 to Apr 2024