Consolidated Revenue: €664.2 m, up

3.0%

Consolidated EBITA: €161.1 m, up 8.6%

excluding non-recurring items

Operating Margin (excluding non-recurring

items): 24,9%, up 1.3 pp

Regulatory News:

M6 Metropole Television (Paris:MMT):

At its meeting held on 26 July 2022, the Supervisory Board

reviewed the 2022 half-year financial statements approved by the

Executive Board.

H1 (€ millions)

2022

2021

% change

2019

% change

Consolidated revenue1

664.2

645.0

+3.0%

714.6

-7.1%

Group advertising revenue

530.1

529.1

+0.2%

539.3

-1.7%

- of which TV advertising revenue

455.3

453.8

+0.3%

454.3

+0.2% - of which other advertising revenue

74.8

75.3

-0.6%

85.0

-12.0%

Group non-advertising revenue

134.1

115.9

+15.7%

175.3

-23.5%

Consolidated profit from recurring operations

(EBITA)2excluding non-recurring items

165.4

152.3

+8.6%

148.3

+11.6% Consolidated profit from recurring

operations (EBITA)2

161.1

165.0

-2.4%

148.3

+8.7% Operating income and expenses related to

business combinations

(5.9)

(3.3)

+82.2%

(6.5)

-8.4%

Capital gains on asset disposals

0.0

3.2

n.a

0.4

n.a

Operating profit (EBIT) from continuing

operations

155.2

164.9

-5.9%

142.2

+9.2% Net financial income/(expense)

(0.1)

(1.1)

n.a

(2.8)

n.a Share of profit/(loss) of equity-accounted entities

(20.5)

(17.4)

+18.2%

3.1

n.a Deferred and current tax

(40.1)

(27.1)

+48.1%

(53.8)

-25.4%

Net profit/(loss) from operations sold / held for sale

0.0

0.0

n.a

(0.3)

n.a

Net profit for the period

94.4

119.3

-20.9%

88.4

+6.8% Net profit for the period - Group share

92.5

119.2

-22.4%

88.4

+4.6%

M6 Group recorded consolidated revenue of €664.2 million

for the first half of 2022, an increase of 3.0% in relation to H1

2021 driven by non-advertising revenues (up 15.7%), which benefited

from the recovery of the cinema business and the consolidation of

Stéphane Plaza Immobilier from 1 January 2022. Multimedia

advertising revenues were stable, up 0.2%.

Consolidated profit from recurring operations (EBITA) stood

at €161.1 million, compared with €165.0 million in the first

half of 2021. It includes a residual audiovisual tax credit of €1.0

million (against €16.9 million in government support in H1 2021)

and costs of €5.3 million related to the M6/TF1 merger (against

€4.2 million in H1 2021). Restated for these non-recurring items,

EBITA stood at €165.4 million and thus recorded year-on-year growth

of 8.6%, reflecting in particular the Group’s agility in the

management of its entire cost base – despite the increase in

programming costs – and the contribution of Stéphane Plaza

Immobilier.

Operating margin stood at 24.9%, excluding non-recurring

items, and posted year-on-year growth of 1.3 pp.

Over the first half of 2022, the Group continued to invest in

streaming via the companies Bedrock and Salto.

The income tax expense stood at €40.1 million and reflects the

reduction in the rate of corporation tax from 28.41% to 25.83%. It

should be noted that a €16 million tax saving was recorded in the

first half of 2021 as a result of a favourable settlement in

respect of 2020.

Net profit was €94.4 million, compared with €119.3

million for the first half of 2021.

In accordance with IFRS 8, the contribution of the Group’s 4

operating segments to consolidated revenue and EBITA was as

follows:

Q1 Q2 H1 (€ millions)

2022

2021

%

2019

%

2022

2021

%

2019

%

2022

2021

%

2019

%

TV

256.3

232.2

+10.4%

238.6

+7.4%

270.0

278.4

-3.0%

250.9

+7.6%

526.3

510.6

+3.1%

489.5

+7.5% Radio

32.2

34.2

-5.9%

35.5

-9.1%

42.4

38.8

+9.2%

46.8

-9.5%

74.6

73.1

+2.1%

82.3

-9.3%

Production & Audiovisual Rights

15.3

9.6

+59.1%

19.7

-22.4%

11.4

10.2

+11.9%

20.4

-43.9%

26.7

19.8

+34.8%

40.1

-33.4%

Other diversification

18.5

20.3

-9.0%

51.9

-64.4%

17.6

20.7

-14.8%

50.7

-65.2%

36.1

41.0

-11.9%

102.5

-64.8%

Other revenue

0.2

0.2

n.a

0.1

n.a

0.2

0.3

n.a

0.1

n.a

0.5

0.5

n.a

0.2

n.a

Consolidated revenue

322.5

296.6

+8.7%

345.7

-6.7%

341.7

348.4

-1.9%

368.8

-7.4%

664.2

645.0

+3.0%

714.6

-7.1%

TV

129.0

137.2

-6.0%

113.5

+13.7% Radio

13.3

14.4

-7.7%

12.0

+11.3% Production & Audiovisual Rights

12.2

11.9

+2.5%

11.4

+7.0% Diversification

8.3

6.1

+35.6%

15.9

-48.1%

Unallocated EBITA

(1.6)

(4.5)

n.a

(4.5)

n.a

Consolidated profit from recurring operations

(EBITA)

67.2

64.3

+4.5%

64.2

+4.7%

94.0

100.8

-6.7%

84.1

+11.7

161.1

165.0

-2.4%

148.3

+8.7% Operating margin

20.8%

21.7%

18.6%

27.5%

28.9%

22.8%

24.3%

25.6%

20.7%

TELEVISION

Over the first six months of 2022, Average Television Viewing

Time stood at 3 hours 22 minutes3 for viewers aged 4 and over, a

year-on-year decline of 24 minutes or 11%. This rapid shift in

linear audiences towards non-linear alternatives highlights the

need to accelerate the strengthening of the range of high-quality

French content, both in linear and streaming.

Within an environment full of current events (Winter Olympics,

war in Ukraine, French presidential election) benefiting public

broadcasters and news channels, and facing a challenging base

effect due to the broadcast of Euro 2020 in June 2021, M6 Group’s

four free-to-air channels achieved an average audience share of

13.9% across the entire viewing public in the first half of 2022

(down 0.8 pp), and of 22.4% amongst women under 50 responsible for

purchasing (down 0.7 pp)3.

Within this context, the Group’s channels have strengthened

their appeal in the strategic primetime slot (9.10pm-11.00pm),

achieving their best ever half-year on the commercial

target, with a 27.2% cumulative audience share, a year-on-year

increase of 0.7 pp.

After a buoyant start to the year, the Group’s TV advertising

revenue was impacted by an unfavourable base effect over the second

quarter. It had received a significant boost in the second quarter

of 2021 with the broadcast on the Group’s channels of eight Euro

2020 matches and with the strong recovery of both the advertising

market and consumer spending from April 2021 onwards following the

last lockdown. Against a backdrop of inflation in the cost of raw

materials and supply chain issues, the trend was also marked by the

decline in advertising investments in the Food & Beverage and

Automotive sectors, partly offset by the gradual recovery of other

sectors (Tourism & Eating Out, Health & Beauty). Over the

entire first half, advertising revenues from the TV division

grew slightly, up 0.3% year-on-year, driven by 6play’s strong

advertising offer.

TV programming costs totalled €240.5 million compared

with €237.1 million over the first half of 2021 and €241.9 million

over the first half of 2019 (which did not include costs related to

the Youth TV division, acquired in H2 2019). The necessary upturn

in the Group’s investments in linear and non-linear content has

been contained, with programming costs remaining below their

pre-pandemic levels.

In this way, the TV activity contributed €129.0 million to

consolidated EBITA, against €137.2 million over the first half

of 2021, which benefited from an audiovisual tax credit of €13.4

million (€1.0 million in H1 2022) and included €4.2 million (€5.3

million in H2 2022) in expenses related to the planned merger of M6

and TF1 Groups. Excluding non-recurring items and at constant

consolidation scope, margin from recurring operations for the

Group’s core business increased once more and stood at 25.3%,

against 24.8% in H1 2021.

RADIO

Over the first half of 2022, the RTL radio division – the

leading privately-owned radio group – posted growth, recording an

audience share of 18.2% with listeners aged 13 and over5 (up 0.1

percentage points year-on-year).

- RTL, France’s top commercial radio

station, achieved an audience share of 12.7%, a year-on-year

increase of 0.4 pp. The station is also well positioned in

non-linear listening, with 32 million podcast plays per month6

equating to an 18% market share. Les Grosses Têtes has established

itself as the France’s top podcast, with 18.2 million plays. -

RTL2 achieved record levels, a 3.1% audience share, up 0.1

pp year-on-year.

- FUN Radio achieved an audience share

of 2.4%, down 0.5 pp year-on-year.

Over the first six months of the year, Radio revenue stood at

€74.6 million, a slight increase of 2.1% compared with H1 2021.

Advertising activity recovered in the second quarter, following a

decline early on in the year.

EBITA totalled €13.3 million, against €14.4 million over

the first half of 2021 which included €3.4 million in exceptional

government support. The operating margin of the Radio Division was

17.9%, compared with 15.1% in H1 2021 (excluding government

support). This improvement reflects the optimisation of its costs

and the synergies developed with the Group’s other media.

PRODUCTION & AUDIOVISUAL RIGHTS

Revenue from the Production & Audiovisual Rights activity

totalled €26.7 million, a year-on-year increase of 34.8%,

thanks to the improvement in the cinema business, which was due to

cinemas being opened throughout 2022, compared with their closure

from 1 January to 18 May in 2021, and to the release of four films

distributed by SND, totalling 2.5 million admissions7, including

1.3 million for the animated film Vaillante and 0.5 million for the

film Maigret.

Divisional EBITA was €12.2 million, compared with €11.9

million for the first half of 2021.

DIVERSIFICATION

Diversification revenue was €36.1 million, compared with

€41.0 million for the first half of 2021. The first half of 2022

was marked by the consolidation of Stéphane Plaza Immobilier (€11.4

million) from 1 January, which partially offset the

reclassification of M6 Créations in the TV division (€11.5 million

in H1 2021) and the decline in Best of TV’s business.

Diversification EBITA was €8.3 million, compared with

€6.1 million for the first half of 2021.

FINANCIAL POSITION

The Group had shareholders’ equity of €1,135.3 million at 30

June 2022, compared with €1,156.4 million at 31 December 2021. The

net cash position was positive and stood at €162.9 million8 against

€248.4 million at 31 December 2021, thereby reflecting the rapid

rebuilding of the cash position following the payment of the

dividend of €126.3 million in May 2022 (€1.0 per share).

PROPOSED MERGER OF M6 AND TF1

Regarding the merger of the TF1 and M6 Groups, a communication

will be released very soon.

A conference call will be held on 26 July 2022

at 6.30pm (CEST). A webcast will be broadcast on the site

www.groupem6.fr (Finance section). Details on how to access the

conference call are available at the same address. Both the

slideshow presentation and the consolidated half-year financial

statements will be accessible online from 6.00 pm, it being

specified that the Statutory Auditors have completed a limited

review of the financial statements and issued an unqualified

report.

Next release: Third quarter financial

information on 25 October 2022 after close of trading

M6 Métropole Télévision is listed on Euronext

Paris, Compartment A.

Ticker: MMT, ISIN Code: FR0000053225

1 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue includes TV

advertising revenue (advertising revenue of free-to-air channels

M6, W9, 6ter and Gulli, and the platforms 6play and Gulli Replay,

as well as the share of advertising revenue from pay channels), the

advertising revenue of radio stations RTL, RTL2 and Fun, and the

share of advertising revenue generated by diversification

activities (mainly Internet).

2 Profit from recurring operations (EBITA) is defined as

operating profit (EBIT) before amortisation and impairment of

intangible assets (excluding audiovisual rights) related to

acquisitions and capital gains and losses on the disposal of

financial assets and subsidiaries.

3 Source: Médiamétrie

4 Reclassification of M6 Créations (previously in the

Diversification division) to the TV division: €11.5 million in

revenue and EBITA of €1.3 million in H1 2021

5 Source: Médiamétrie EAR > National

6 Source: Médiamétrie, eStat Podcast / June 2022

7 Source: CBO Box-office

8 The net cash position does not take into account lease

liabilities resulting from the application of IFRS 16 - Leases

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220726005955/en/

INVESTOR RELATIONS Guillaume Couturié +33 (0)1 41 92 28

03 / guillaume.couturie@m6.fr

PRESS Paul Mennesson +33 (0)1 41 92 61 36

/ paul.mennesson@m6.fr

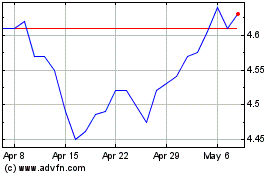

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Apr 2023 to Apr 2024