Current Report Filing (8-k)

March 27 2020 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 23, 2020

AG Mortgage Investment Trust, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

001-35151

|

27-5254382

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

245 Park Avenue, 26th floor

New York, New York 10167

(Address of principal executive offices)

Registrant's telephone number, including area code: (212) 692-2000

Not Applicable

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class:

|

|

Trading Symbols:

|

|

Name of each exchange on which registered:

|

|

Common Stock, $0.01 par value per share

|

|

MITT

|

|

New York Stock Exchange (NYSE)

|

|

8.25% Series A Cumulative Redeemable Preferred Stock

|

|

MITT PrA

|

|

New York Stock Exchange (NYSE)

|

|

8.00% Series B Cumulative Redeemable Preferred Stock

|

|

MITT PrB

|

|

New York Stock Exchange (NYSE)

|

|

8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

MITT PrC

|

|

New York Stock Exchange (NYSE)

|

Item 2.01. Completion of Acquisition or Disposition of Assets.

On March 23, 2020, AG Mortgage Investment Trust, Inc. (the “Company”), in an effort to prudently manage its portfolio through unprecedented market volatility and preserve long-term stockholder value, completed the sale of the Company’s portfolio (the “Agency Portfolio”) of residential mortgage-backed securities issued or guaranteed by a U.S. government-sponsored entity (“Agency MBS”). After satisfaction of an aggregate of approximately $880 million of repurchase financing obligations with respect to the Agency Portfolio, the transaction netted the Company approximately $38 million of cash proceeds through T+0 settlement. After giving effect to the sale of the Agency Portfolio, the Company no longer owns any whole pool Agency MBS and as of close of business on March 27, 2020, the Company has approximately $78 million of cash and cash equivalents on hand.

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On March 24, 2020, the Company received written notices from certain affiliates of Royal Bank of Canada (“RBC”) alleging that events of default had occurred with respect to various financing agreements. The Company disputes RBC’s notices of events of default and filed a suit in federal district court in New York describing the wrongful conduct by RBC and seeking both to enjoin RBC from selling the Company’s collateral securities as well as damages. The Company has also received notifications from several additional financing counterparties of alleged events of default under their financing agreements, and of certain of those counterparties’ intentions to accelerate the Company’s and such subsidiaries’ performance obligations under the relevant agreements.

Under the terms of the applicable financing arrangements, if the Company fails to deliver additional collateral or otherwise meet margin calls when due, the financing counterparties may demand immediate payment by the Company of the aggregate outstanding financing obligations owed to such counterparties, and if such financing obligations are not paid, may sell the securities and apply the proceeds to the Company’s financing obligations and/or take ownership of the securities securing the Company’s financing obligations. The Company may also be liable for a shortfall if the proceeds from such sale or value of such securities is less than the relevant financing obligation.

As previously announced, on Monday, March 23, 2020, the Company notified its financing counterparties that it was not in a position to fund the margin calls it received on March 23, 2020, and that the Company did not expect to be in a position to fund the anticipated volume of future margin calls under its financing arrangements in the near term as a result of market disruptions created by the COVID-19 pandemic.

Since March 23, 2020, the Company and several of its subsidiaries have received notifications from several financing counterparties of alleged events of default under their financing agreements, and of certain of those counterparties’ intentions to accelerate the Company’s and such subsidiaries’ performance obligations under the relevant agreements. The Company and its subsidiaries have disputed certain of those notices. However, in the event of a default under one or more of those agreements, financial and other obligations under such agreements, and in some cases the Company’s obligations as a guarantor, may be accelerated and the counterparties may take ownership of the securities pledged to secure the financing obligations by the Company or its subsidiaries. Certain counterparties have informed the Company that they have sold the securities pledged to secure the financing obligations. The Company and its subsidiaries also may be subject to penalties under those agreements and may suffer cross-default claims from its other lenders.

The Company continues to engage in discussions with its financing counterparties with regard to entering into forbearance agreements pursuant to which each counterparty would agree to forbear from exercising its rights and remedies with respect to an event of default under the applicable financing arrangement for an agreed-upon period. The Company cannot predict whether its financing counterparties will enter into a forbearance agreement, the timing of any such agreement, or the terms thereof.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 25, 2020, Andrew L. Berger, an independent member of the Company’s Board of Directors (the “Board”) and a member of the Audit Committee of the Board, tendered his resignation, effective immediately. Mr. Berger’s resignation was due to personal health issues, and not as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Item 7.01. Regulation FD Disclosure.

On March 27, 2020, the Company issued a press release announcing the sale of the its Agency Portfolio, suspension of dividends on its common stock and preferred stock and providing updated information on default notices and forbearance discussions with its financing counterparties. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information included under Item 7.01 in this Current Report on Form 8-K (including Exhibit 99.1 hereto), shall not be deemed “filed” for the purposes of Section 18 of the Securities Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On March 27, 2020, the Company announced that the Board has approved a suspension of the Company’s quarterly dividends on the Company’s common stock, the Company’s 8.25% Series A Cumulative Redeemable Preferred Stock, the Company’s 8.00% Series B Cumulative Redeemable Preferred Stock, and the Company’s 8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, beginning with the common dividends that normally would have been declared in March 2020 and the preferred dividends that would have been declared in May 2020. The Board’s decision reflects the Company’s continuing focus on conserving capital and improving its liquidity position during the current market volatility.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: March 27, 2020

|

AG MORTGAGE INVESTMENT TRUST, INC.

|

|

|

|

|

|

|

By:

|

/s/ RAUL E. MORENO

|

|

|

|

Name: Raul E. Moreno

|

|

|

|

Title: General Counsel and Secretary

|

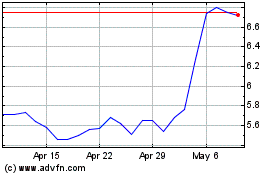

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Mar 2024 to Apr 2024

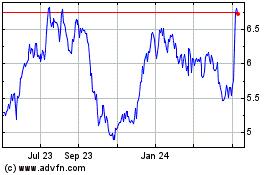

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Apr 2023 to Apr 2024