AG Mortgage Investment Trust, Inc. ("MITT," "we," the “Company”

or "our") (NYSE: MITT) today reported financial results for the

quarter-ended June 30, 2019. AG Mortgage Investment Trust, Inc. is

a hybrid mortgage REIT that opportunistically invests in, acquires

and manages a diversified risk-adjusted portfolio of Agency RMBS,

Credit Investments, and Single-Family Rental Properties. Our Credit

Investments include our Residential Investments, Commercial

Investments, and ABS Investments.

SECOND QUARTER 2019 FINANCIAL HIGHLIGHTS

- $0.47 of Net Income/(Loss) per diluted common share(1)

- $0.36 of Core Earnings per diluted common share(1)

- Includes $(0.04) retrospective adjustment

- Decrease in Core Earnings from last quarter primarily due to

the flattening of the yield curve and a change in prepayment

expectations

- 2.9% economic return on equity for the quarter, 11.6%

annualized(2)

- $17.42 Book value per share(1) as of June 30, 2019

- $17.57 Undepreciated Book Value per share(1) as of June 30,

2019 versus $17.56 as of March 31, 2019

- Undepreciated Book Value increased $0.01 or 0.1% from the prior

quarter primarily due to:

- $0.01 or 0.1% due to our investments in Agency RMBS,

Residential Loans(a) and associated derivatives

- Agency RMBS spreads widened versus benchmarks as the interest

rate rally resulted in elevated gross supply, prepayment

uncertainty and increased implied volatility offset by

short-duration non-performing and re-performing loan spreads

tightening during the quarter

- $0.13 or 0.7% due to our Credit Investments excluding

Residential Loans(a)

- CRT and Legacy RMBS spreads tightened during the quarter, while

CMBS spreads remained relatively unchanged despite some volatility

in AAA rated securities

- $(0.13)(b) or (0.7)% due to core earnings below the $0.50

dividend

(a)

Residential Loans includes

Re/Non-Performing Loans and New Origination Loans

(b)

Includes $0.01 or 0.1% due to equity based

compensation

Q1 2019

Q2 2019

Summary of Operating Results:

GAAP Net Income/(Loss) Available to Common

Stockholders

$

25.8

mm

$

15.3

mm

GAAP Net Income/(Loss) Available to Common

Stockholders, per diluted common share(1)

$

0.84

$

0.47

Non-GAAP Results:

Core Earnings*

$

13.6

mm

$

11.8

mm

Core Earnings, per diluted common

share(1)

$

0.45

$

0.36

*A reconciliation of net income/(loss) per

diluted common share to core earnings per diluted common share for

the three months ended June 30, 2019, along with an explanation of

this non-GAAP financial measure, is provided at the end of this

press release.

MANAGEMENT REMARKS

"MITT's undepreciated book value was relatively flat quarter

over quarter, increasing by one cent to $17.57," said Chief

Executive Officer, David Roberts. "While our core earnings during

the quarter were less than our $0.50 dividend, that shortfall was

made up by an increase in the value of our credit investments."

"Our core earnings decreased from the prior quarter by $0.09 to

$0.36 per share, after a $0.04 negative retrospective adjustment.

Asset yields decreased in the quarter while our funding costs

remained sticky," Mr. Roberts continued.

Mr. Roberts added, "We anticipate that our Board will adjust our

quarterly common dividend to $0.45 per share for the third quarter

of 2019, subject to any changes in our outlook at that time. We

believe that this level of dividend better reflects the modeled

earnings power of our targeted asset portfolio, anticipated

leverage, and projected funding costs in the current market

environment."

"The mortgage-backed sector performed well during the second

quarter," said Chief Investment Officer, T.J. Durkin. "The credit

risk transfer market extended its first quarter spread tightening,

which serves as a barometer of overall mortgage credit. During the

quarter we rotated out of Agency RMBS into credit investments,

increasing our exposure in newly originated non-QM loans, credit

risk transfer securities, and commercial real estate loans, while

also committing to purchase re/non-performing loans. Going forward,

we continue to see a pipeline of credit opportunities at favorable

risk-adjusted returns; and we intend to remain active in the

securitization markets."

INVESTMENT HIGHLIGHTS

- $4.0 billion investment portfolio as of June 30, 2019 as

compared to the $4.1 billion investment portfolio as of March 31,

2019(3) (4)

- 2.0% Net Interest Margin (“NIM”) as of June 30, 2019 (5)

- 4.4x “At Risk” Leverage as of June 30, 2019 (6)

- 7.1% constant prepayment rate ("CPR") on the Agency RMBS

investment portfolio for the second quarter (7)

- Duration gap was approximately 0.98 years as of June 30, 2019

(8)

- Duration gap is presented pro-forma for the purchase of $234.2

million of Re/Non-Performing Loans that we have committed to

purchase but that have not settled as the hedges related to these

purchases have already been added to the portfolio. The duration

gap exclusive of these commitments would be 0.67.

SECOND QUARTER ACTIVITY

($ in millions)

Description

Purchased

(Sold/Payoff)

Net Activity

30 Year Fixed Rate

$—

$(123.6)

$(123.6)

Inverse Interest Only

—

(3.2)

(3.2)

Fixed Rate 30 Year TBA

746.6

(748.7)

(2.1)

Total Agency RMBS

746.6

(875.5)

(128.9)

Prime

1.2

(32.4)

(31.2)

Alt-A/Subprime

7.3

—

7.3

Credit Risk Transfer

53.1

(0.9)

52.2

Re/Non-Performing Loans

6.3

(13.1)

(6.8)

New Origination Loans

206.2

(181.9)

24.3

Total Residential Investments

274.1

(228.3)

45.8

CMBS

23.7

(21.1)

2.6

CMBS Interest Only

—

(1.7)

(1.7)

Commercial Real Estate Loans

7.8

—

7.8

Total Commercial Investments

31.5

(22.8)

8.7

Total Q2 Activity

$1,052.2

$(1,126.6)

$(74.4)

Note: The chart above is based on trade

date for securities and settle date for loans.

Re/Non-Performing Loan Activity

- Participated in a term securitization alongside another Angelo

Gordon fund in June which refinanced previously securitized

primarily re-performing mortgage loans into a new lower cost, fixed

rate long-term financing, returning $14.0mm of equity to MITT

- MITT maintained exposure to the securitization through an

interest in the subordinated tranches

- Entered into commitments to purchase two pools of

Re/Non-Performing loans which are not included in the table

above

New Origination Loan Activity

- Purchased several Non-QM pools alongside other Angelo Gordon

funds

- Participated in Angelo Gordon's first rated Non-QM

securitization alongside other Angelo Gordon funds in June, which

refinanced Non-QM loans from repurchase agreement financing into

lower cost, fixed rate, non-recourse long-term financing, returning

$16.7mm of equity to MITT

- MITT maintained exposure to the securitization through an

interest in the subordinated tranches

SINGLE-FAMILY RENTAL PORTFOLIO UPDATE

- Occupancy remained stable throughout the 2nd quarter in the

92-93% range

- The slight occupancy dip in June is related to seasonally

higher number of lease expirations and lower renewal

pull-through

- Decline in operating margin primarily due to the aging and

subsequent write-off of certain rent receivables

3/31/2019

6/30/2019

Gross Carrying Value(a)

$

141.7

$

141.3

Accumulated Depreciation and

Amortization(a)

(3.8

)

(4.9

)

Net Carrying Value(a)

$

137.9

$

136.4

Occupancy(b)

93.7

%

92.1

%

Average Square Footage(b)

1,463

1,455

Average Monthly Rental Income per

Home(b)(c)

$

1,020

$

1,028

Operating Margin(11)

45.2

%

(d)

41.5

%

(a)

$ in millions

(b)

Based on occupied residences as of each

corresponding period end

(c)

Based on straight-line rent as of each

corresponding period end

(d)

Includes a write-off of approximately $0.1

million of rental income receivable taken in Q2 2019

KEY STATISTICS

($ in millions)

June 30, 2019

Investment portfolio(3) (4)

$3,951.8

Financing arrangements, net(4)

3,176.5

Total financing(6)

3,232.5

Stockholders’ equity

730.9

GAAP Leverage

4.1x

“At Risk” Leverage(6)

4.4x

Yield on investment portfolio(9)

5.0%

Cost of funds(10)

3.0%

Net interest margin(5)

2.0%

Other operating expenses

(corporate)(12)

1.5%

Book value, per share(1)

$17.42

Undepreciated Book Value, per share(1)

$17.57

Undistributed taxable income, per share(1)

(13)

$1.28

Dividend, per share(1)

$0.50

Note: Cost of funds and NIM shown include

the costs or benefits of our interest rate hedges. Cost of funds

and NIM excluding the cost or benefit of our interest rate hedges

would be 3.2% and 1.8%, respectively.

INVESTMENT PORTFOLIO

The following summarizes the Company’s investment portfolio as of

June 30, 2019(3) (4):

($ in millions)

Amortized Cost

Net Carrying Value

Percent of Net Carrying

Value

Allocated Equity(15)

Percent of Equity

Leverage Ratio*

Agency RMBS

$2,211.6

$2,270.5

57.5%

$263.8

36.1%

7.5x

Residential Investments

1,047.6

1,119.7

28.3%

287.2

39.3%

3.1x

Commercial Investments

379.5

404.6

10.2%

133.0

18.2%

2.1x

ABS

20.7

20.6

0.5%

11.1

1.5%

0.9x

Single-Family Rental Properties

136.4

136.4

3.5%

35.8

4.9%

2.8x

Total

$3,795.8

$3,951.8

100.0%

$730.9

100.0%

4.4x

*The leverage ratio on Agency RMBS

includes any net receivables on TBA. The leverage ratio by type of

investment is calculated by dividing the investment type's total

financing by its allocated equity.(15)

Note: The chart above includes fair value

of $0.6 million of Agency RMBS, $239.1 million of Residential

Investments and $5.6 million of Commercial Investments that are

included in the “Investments in debt and equity of affiliates” line

item on our consolidated balance sheet.

Premiums and discounts associated with purchases of the

Company’s investments are amortized or accreted into interest

income over the estimated life of such investments, using the

effective yield method. The Company recorded a $(0.04)

retrospective adjustment per diluted common share, excluding

interest-only securities and TBAs. Since the cost basis of the

Company’s Agency RMBS securities, excluding interest-only

securities and TBAs, exceeds the underlying principal balance by

2.7% as of June 30, 2019, slower actual or projected prepayments

can have a meaningful positive impact on the Company's asset

yields, while faster actual or projected prepayments can have a

meaningful negative impact on the yields.

FINANCING AND HEDGING ACTIVITIES

The Company, either directly or through its equity method

investments in affiliates, had financing arrangements with 45

counterparties, under which it had debt outstanding with 33

counterparties as of June 30, 2019. Our weighted average days to

maturity is 138 days and our weighted average original days to

maturity is 236 days. The Company's financing arrangements as of

June 30, 2019 are summarized below:

($ in millions)

Agency

Credit

SFR**

Maturing Within:*

Amount Outstanding

WA Funding Cost

Amount Outstanding

WA Funding Cost

Amount

Outstanding

WA Funding Cost

Overnight

$

118.3

2.7%

$

—

—%

$

—

—%

30 Days or Less

999.2

2.7%

571.0

3.5%

—

—%

31-60 Days

428.1

2.6%

134.1

3.8%

—

—%

61-90 Days

147.2

2.6%

74.9

3.9%

—

—%

91-180 Days

249.0

2.6%

—

—%

—

—%

Greater than 180 Days

—

—%

352.7

4.5%

102.0

4.8%

Total / Weighted Avg

$

1,941.8

2.7%

$

1,132.7

3.9%

$

102.0

4.8%

*Amounts in table above do not include

securitized debt of $8.6 million.

**Includes $0.9 million of deferred

financing costs.

The Company’s interest rate swaps as of June 30, 2019 are

summarized as follows:

($ in millions)

Maturity

Notional Amount

WA Pay-Fixed Rate

WA Receive-Variable

Rate*

WA Years to Maturity

2020

$

105.0

1.5%

2.6%

0.7

2022

778.8

1.9%

2.5%

3.0

2023

5.7

3.2%

2.6%

4.4

2024

345.0

2.0%

2.1%

5.0

2026

20.0

1.9%

2.5%

7.4

2027

10.0

2.2%

2.3%

8.0

2029

38.0

1.9%

2.3%

10.0

Total/Wtd Avg

$

1,302.5

1.9%

2.4%

3.6

* 100% of our receive-variable interest

rate swap notional resets quarterly based on three-month LIBOR.

TAXABLE INCOME

The primary differences between taxable income and GAAP net

income include (i) unrealized gains and losses associated with

investment and derivative portfolios which are marked-to-market in

current income for GAAP purposes, but excluded from taxable income

until realized or settled, (ii) temporary differences related to

amortization of premiums and discounts paid on investments, (iii)

the timing and amount of deductions related to stock-based

compensation, (iv) temporary differences related to the recognition

of certain terminated investments and derivatives, (v) taxes and

(vi) methods of depreciation between GAAP and tax. As of June 30,

2019, the Company had estimated undistributed taxable income of

approximately $1.28 per share.(1) (13)

DIVIDEND

On June 14, 2019, the Company’s board of directors declared a

second quarter dividend of $0.50 per share of common stock that was

paid on July 31, 2019 to stockholders of record as of June 28,

2019.

On May 17, 2019, the Company’s board of directors declared a

quarterly dividend of $0.51563 per share on its 8.25% Series A

Cumulative Redeemable Preferred Stock and a quarterly dividend of

$0.50 per share on its 8.00% Series B Cumulative Redeemable

Preferred Stock. The preferred distributions were paid on June 17,

2019 to stockholders of record as of May 31, 2019.

STOCKHOLDER CALL

The Company invites stockholders, prospective stockholders and

analysts to participate in MITT’s second quarter earnings

conference call on August 6, 2019 at 9:30 am Eastern Time. The

stockholder call can be accessed by dialing (888) 424-8151 (U.S.

domestic) or (847) 585-4422 (international). Please enter code

number 5976527.

A presentation will accompany the conference call and will be

available on the Company’s website at www.agmit.com. Select the Q2

2019 Earnings Presentation link to download the presentation in

advance of the stockholder call.

An audio replay of the stockholder call combined with the

presentation will be made available on our website after the call.

The replay will be available until September 5, 2019. If you are

interested in hearing the replay, please dial (888) 843-7419 (U.S.

domestic) or (630) 652-3042 (international). The conference ID

number is 5976527.

For further information or questions, please e-mail

ir@agmit.com.

ABOUT AG MORTGAGE INVESTMENT TRUST, INC.

AG Mortgage Investment Trust, Inc. is a hybrid mortgage REIT

that opportunistically invests in, acquires and manages a

diversified risk-adjusted portfolio of Agency RMBS, Credit

Investments, and Single-Family Rental Properties. Its Credit

Investments include Residential Investments, Commercial

Investments, and ABS Investments. AG Mortgage Investment Trust,

Inc. is externally managed and advised by AG REIT Management, LLC,

a subsidiary of Angelo, Gordon & Co., L.P., an SEC-registered

investment adviser that specializes in alternative investment

activities.

Additional information can be found on the Company’s website at

www.agmit.com.

ABOUT ANGELO GORDON

Angelo, Gordon & Co., L.P. is a privately held limited

partnership founded in November 1988. The firm manages

approximately $33 billion as of June 30, 2019 with a primary focus

on credit and real estate strategies. Angelo Gordon has over 500

employees, including more than 200 investment professionals, and is

headquartered in New York, with offices in the U.S., Europe and

Asia. For more information, visit www.angelogordon.com.

FORWARD LOOKING STATEMENTS

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995 related to

dividends, book value, our investments, our investment and

portfolio strategy, investment returns, return on equity,

liquidity, financing, taxes, our assets, our interest rate

sensitivity, and our views on certain macroeconomic trends and

conditions, among others. Forward-looking statements are based on

estimates, projections, beliefs and assumptions of management of

the Company at the time of such statements and are not guarantees

of future performance. Forward-looking statements involve risks and

uncertainties in predicting future results and conditions. Actual

results could differ materially from those projected in these

forward-looking statements due to a variety of factors, including,

without limitation, changes in interest rates, changes in the yield

curve, changes in prepayment rates, changes in default rates, the

availability and terms of financing, changes in the market value of

our assets, general economic conditions, conditions in the market

for Agency RMBS, Non-Agency RMBS, ABS and CMBS securities, Excess

MSRs and loans, our ability to integrate single-family rental

assets into our investment portfolio, our ability to predict and

control costs, conditions in the real estate market, and

legislative and regulatory changes that could adversely affect the

business of the Company. Additional information concerning these

and other risk factors are contained in the Company’s filings with

the Securities and Exchange Commission (“SEC”), including its most

recent Annual Report on Form 10-K and subsequent filings. Copies

are available free of charge on the SEC’s website, http://www.sec.gov/. All information in this press

release is as of August 5, 2019. The Company undertakes no duty to

update any forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based.

AG Mortgage Investment Trust,

Inc. and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

(in thousands, except per

share data)

June 30, 2019

December 31, 2018

Assets

Real estate securities, at fair value:

Agency - $2,062,928 and $1,934,562 pledged

as collateral, respectively

$

2,123,088

$

1,988,280

Non-Agency - $652,582 and $605,243 pledged

as collateral, respectively

680,492

625,350

ABS - $12,781 and $13,346 pledged as

collateral, respectively

20,571

21,160

CMBS - $258,424 and $248,355 pledged as

collateral, respectively

281,040

261,385

Residential mortgage loans, at fair value

- $127,854 and $99,283 pledged as collateral, respectively

199,970

186,096

Commercial loans, at fair value - $3,233

and $- pledged as collateral, respectively

118,005

98,574

Single-family rental properties, net

136,374

138,678

Investments in debt and equity of

affiliates

99,955

84,892

Excess mortgage servicing rights, at fair

value

20,893

26,650

Cash and cash equivalents

60,097

31,579

Restricted cash

32,853

52,779

Other assets

24,577

33,503

Total Assets

$

3,797,915

$

3,548,926

Liabilities

Financing arrangements, net

$

2,993,233

$

2,822,505

Securitized debt, at fair value

8,630

10,858

Dividend payable

16,355

14,372

Other liabilities

48,833

45,180

Total Liabilities

3,067,051

2,892,915

Commitments and Contingencies

Stockholders’ Equity

Preferred stock - $0.01 par value; 50,000

shares authorized:

8.25% Series A Cumulative

Redeemable Preferred Stock, 2,070 shares issued and outstanding

($51,750 aggregate liquidation preference)

49,921

49,921

8.00% Series B Cumulative

Redeemable Preferred Stock, 4,600 shares issued and outstanding

($115,000 aggregate liquidation preference)

111,293

111,293

Common stock, par value $0.01 per share;

450,000 shares of common stock authorized and 32,709 and 28,744

shares issued and outstanding at June 30, 2019 and December 31,

2018, respectively

327

287

Additional paid-in capital

661,833

595,412

Retained earnings/(deficit)

(92,510

)

(100,902

)

Total Stockholders’ Equity

730,864

656,011

Total Liabilities & Stockholders’

Equity

$

3,797,915

$

3,548,926

AG Mortgage Investment Trust,

Inc. and Subsidiaries

Consolidated Statements of

Operations (Unaudited)

(in thousands, except per

share data)

Three Months Ended

June 30, 2019

June 30, 2018

Net Interest Income

Interest income

$

40,901

$

36,012

Interest expense

24,277

16,271

Total Net Interest Income

16,624

19,741

Other Income/(Loss)

Rental income

3,162

—

Net realized gain/(loss)

(27,579

)

(11,060

)

Net interest component of interest rate

swaps

1,800

1,262

Unrealized gain/(loss) on real estate

securities and loans, net

43,165

(578

)

Unrealized gain/(loss) on derivative and

other instruments, net

(10,839

)

4,781

Other income

346

20

Total Other Income/(Loss)

10,055

(5,575

)

Expenses

Management fee to affiliate

2,400

2,387

Other operating expenses

3,850

3,443

Equity based compensation to affiliate

73

94

Excise tax

186

375

Servicing fees

416

22

Property depreciation and amortization

1,180

—

Property operating expenses

1,946

—

Total Expenses

10,051

6,321

Income/(loss) before equity in

earnings/(loss) from affiliates

16,628

7,845

Equity in earnings/(loss) from

affiliates

2,050

323

Net Income/(Loss)

18,678

8,168

Dividends on preferred stock

3,367

3,367

Net Income/(Loss) Available to Common

Stockholders

$

15,311

$

4,801

Earnings/(Loss) Per Share of Common

Stock

Basic

$

0.47

$

0.17

Diluted

$

0.47

$

0.17

Weighted Average Number of Shares of

Common Stock Outstanding

Basic

32,709

28,201

Diluted

32,737

28,228

NON-GAAP FINANCIAL MEASURE

This press release contains Core Earnings, a non-GAAP financial

measure. Our presentation of Core Earnings may not be comparable to

similarly-titled measures of other companies, who may use different

calculations. This non-GAAP measure should not be considered a

substitute for, or superior to, the financial measures calculated

in accordance with GAAP. Our GAAP financial results and the

reconciliations from these results should be carefully

evaluated.

We define Core Earnings, a non-GAAP financial measure, as Net

Income/(loss) available to common stockholders excluding (i)

unrealized gains/(losses) on real estate securities, loans,

derivatives and other investments and realized gains/(losses) on

the sale or termination of such instruments, (ii) beginning with Q2

2018, as a policy change, any transaction related expenses incurred

in connection with the acquisition or disposition of our

investments, (iii) beginning with Q3 2018, concurrent with a change

in the Company's business, any depreciation or amortization expense

related to the Company's SFR portfolio, (iv) beginning with Q3

2018, as a policy change, accrued deal related performance fees

payable to Arc Home and third party operators to the extent the

primary component of the accrual relates to items that are excluded

from Core Earnings, such as unrealized and realized gains/(losses),

and (v) beginning with Q4 2018 and applied retrospectively, as a

policy change, realized and unrealized changes in the fair value of

Arc Home's net mortgage servicing rights as well as realized and

unrealized changes in the fair value of derivatives that are

intended to offset changes in the fair value of those net mortgage

servicing rights. Items (i) through (v) above include any amounts

related to those items held in affiliated entities. Management

considers the transaction related expenses referenced in (ii) above

to be similar to realized losses incurred at acquisition or

disposition and does not view them as being part of its core

operations. Management views the exclusion described in (v) above

to be consistent with how it calculates Core Earnings on the

remainder of its portfolio. As defined, Core Earnings include the

net interest income and other income earned on the Company's

investments on a yield adjusted basis, including TBA dollar roll

income, or any other investment activity that may earn or pay net

interest or its economic equivalent. One of the Company's

objectives is to generate net income from net interest margin on

the portfolio, and management uses Core Earnings to help measure

this objective. Management believes that this non-GAAP measure,

when considered with its GAAP financials, provides supplemental

information useful for investors as it enables them to evaluate the

Company's current core performance using the same measure that

management uses to operate the business. This metric, in

conjunction with related GAAP measures, provides greater

transparency into the information used by the Company's management

team in its financial and operational decision-making.

A reconciliation of GAAP Net Income/(loss) available to common

stockholders to Core Earnings for the three months ended June 30,

2019 and June 30, 2018 is set forth below (in thousands, except per

share data):

Three Months Ended

June 30, 2019

June 30, 2018

Net Income/(loss) available to common

stockholders

$

15,311

$

4,801

Add (Deduct):

Net realized (gain)/loss

27,579

11,060

Unrealized (gain)/loss on real estate

securities and loans, net

(43,165

)

578

Unrealized (gain)/loss on derivative and

other instruments, net

10,839

(4,781

)

Property depreciation and amortization

1,180

—

Transaction related expenses and deal

related performance fees(a)

484

314

Equity in (earnings)/loss from

affiliates

(2,050

)

(323

)

Net interest income and expenses from

equity method investments(b)

1,352

2,326

Dollar roll income

363

656

Other Income

(114

)

—

Core Earnings (c)

$

11,779

$

14,631

Core Earnings, per Diluted Share (c)

$

0.36

$

0.52

(a)

For the three months ended June 30, 2018,

the above chart was not adjusted for deal related performance fees

as they did not have a material impact on Core Earnings for the

period. Our policy with respect to deal related performance fees

was modified in Q3 2018.

(b)

For the three months ended June 30, 2019

and June 30, 2018, $(4.8) million or $(0.15) per diluted share and

$0.8 million or $0.03 per diluted share, respectively, of realized

and unrealized changes in the fair value of Arc Home's net mortgage

servicing rights and corresponding derivatives were excluded from

Core earnings per diluted share as a result of our modification to

the definition and calculation of Core Earnings in Q4 2018.

(c)

The three months ended June 30, 2019 and

June 30, 2018 include cumulative retrospective adjustments of

$(1.3) million or $(0.04) per diluted share and $(0.1) million or

de minimis per diluted share, respectively, on the premium

amortization for investments accounted for under ASC 320-10.

Footnotes

(1)

Diluted per share figures are

calculated using weighted average outstanding shares in accordance

with GAAP. Per share figures are calculated using a denominator of

all outstanding common shares including vested shares granted to

our Manager and our independent directors under our equity

incentive plans as of quarter-end. Book value uses stockholders’

equity less net proceeds of the Company’s 8.25% Series A and 8.00%

Series B Cumulative Redeemable Preferred Stock as the numerator.

Undepreciated book value per share is a non-GAAP book value metric

which adds accumulated depreciation and amortization back to book

value to present an adjusted book value that incorporates the

Company's single-family rental property portfolio at its

undepreciated basis. This metric allows management to consider the

investment portfolio exclusive of non-cash adjustments and

facilitates the comparison of our financial performance to peer

REITs. Book value and Undepreciated book value include the current

quarter dividend.

(2)

The economic return on equity for

the quarter represents the change in undepreciated book value per

share from March 31, 2019 to June 30, 2019, plus the common

dividends declared over that period, divided by undepreciated book

value per share as of March 31, 2019. The annualized economic

return on equity is the quarterly return on equity multiplied by

four.

(3)

The investment portfolio at

period end is calculated by summing the net carrying value of our

Agency RMBS, any long positions in TBAs, Residential Investments,

Commercial Investments, ABS Investments and our SFR portfolio,

including securities and mortgage loans owned through investments

in affiliates, exclusive of AG Arc LLC. Our Agency RMBS,

Residential Investments, Commercial Investments, and ABS

Investments are held at fair market value and our SFR portfolio is

held at purchase price plus capitalized expenses less accumulated

depreciation and amortization and any adjustments related to

impairment. Our Credit Investments refer to our Residential

Investments, Commercial Investments and ABS Investments. Refer to

footnote (4) for more information on the GAAP accounting for

certain items included in our investment portfolio. See footnote

(14) for further details on AG Arc LLC.

(4)

Generally, when we purchase an

investment and finance it, the investment is included in our assets

and the financing is reflected in our liabilities on our

consolidated balance sheet as either “Financing arrangements, net”

or “Securitized debt, at fair value.” Throughout this press release

where we disclose our investment portfolio and the related

financing, we have presented this information inclusive of (i)

securities and mortgage loans owned through investments in

affiliates that are accounted for under GAAP using the equity

method and (ii) long positions in TBAs, which are accounted for as

derivatives under GAAP. This press release excludes investments

through AG Arc LLC unless otherwise noted. This presentation of our

investment portfolio is consistent with how our management

evaluates the business, and we believe this presentation, when

considered with the GAAP presentation, provides supplemental

information useful for investors in evaluating our investment

portfolio and financial condition. See footnote (14) for further

details on AG Arc LLC.

(5)

Net interest margin is calculated

by subtracting the weighted average cost of funds from the weighted

average yield for the Company’s investment portfolio, which

excludes cash held by the Company. See footnotes (9) and (10) for

further detail. Net interest margin also excludes any net TBA

position.

(6)

“At Risk” Leverage is calculated

by dividing total financing including any net TBA position by our

GAAP stockholders’ equity at quarter-end. Total financing at

quarter-end includes financing arrangements through affiliated

entities, exclusive of any financing utilized through AG Arc LLC,

plus the payable on all unsettled buys less the financing on all

unsettled sells, securitized debt, and any net TBA position (at

cost). Total financing excludes any financing arrangements and

unsettled trades on U.S. Treasuries.

(7)

This represents the weighted

average monthly CPRs published during the quarter for our in-place

portfolio during the same period. Any net TBA position is excluded

from the CPR calculation.

(8)

The Company estimates duration

based on third-party models. Different models and methodologies can

produce different effective duration estimates for the same

securities. Duration does not include our equity interest in AG Arc

LLC or our investment in SFR.

(9)

The yield on our debt investments

represents an effective interest rate, which utilizes all estimates

of future cash flows and adjusts for actual prepayment and cash

flow activity as of quarter-end. The yield on our SFR portfolio

represents annualized net operating income for the quarter divided

by its carrying value, gross of accumulated depreciation and

amortization. Net operating income on our SFR portfolio is

comprised of rental income and other SFR related income less

property operating expenses. Our calculation excludes cash held by

the Company and excludes any net TBA position. The calculation of

weighted average yield is weighted based on net carrying value.

(10)

The cost of funds at quarter-end

is calculated as the sum of (i) the weighted average funding costs

on total financing outstanding at quarter-end and (ii) the weighted

average of the net pay rate on our interest rate swaps, the net

receive rate on our Treasury long positions, the net pay rate on

our Treasury short positions, and the net receivable rate on our IO

index derivatives, if any. Both elements of the cost of funds at

quarter-end are weighted by the outstanding financing arrangements

and securitized debt outstanding at quarter-end, excluding

financing arrangements associated with U.S. Treasury positions. The

cost of funds excludes any net TBA position.

(11)

Operating margin on our SFR

portfolio is calculated as net operating income divided by revenues

from our SFR portfolio adjusted for rent write-offs taken in the

relevant quarter. Net operating income on our SFR portfolio is

comprised of rental income and other SFR related income less

property operating expenses.

(12)

The other operating expenses

(corporate) percentage at quarter-end is calculated by annualizing

other operating expenses (corporate) recorded during the quarter

and dividing by our quarter-end stockholders’ equity.

(13)

This estimate of undistributed

taxable income per share represents the total estimated

undistributed taxable income as of quarter-end. Undistributed

taxable income is based on current estimates and projections. As a

result, the actual amount is not finalized until we file our annual

tax return, typically in October of the following year.

(14)

The Company invests in Arc Home

LLC through AG Arc LLC, one of its indirect subsidiaries.

(15)

The Company allocates its equity

by investment using the fair market value of our investment

portfolio, less any associated leverage, inclusive of any long TBA

position (at cost). The Company allocates all non-investment

portfolio related items based on their respective characteristics,

beginning by allocating those items within the Securities and Loans

Segment and Single-Family Rental Properties Segment and then

allocating Corporate between the Securities and Loans Segment and

Single-Family Rental Properties Segment in order to sum to

stockholders’ equity per the consolidated balance sheets. The

Company's equity allocation method is a non-GAAP methodology and

may not be comparable to the similarly titled measure or concepts

of other companies, who may use different calculations and

allocation methodologies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190805005668/en/

AG Mortgage Investment Trust, Inc. Investor Relations

(212) 692-2110 ir@agmit.com

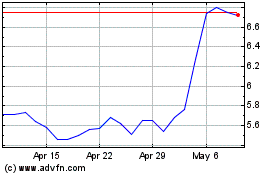

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Mar 2024 to Apr 2024

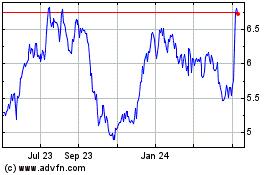

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Apr 2023 to Apr 2024