UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 11-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

o TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-13991

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

MFA FINANCIAL, INC.

One Vanderbilt Ave., 48th Floor

New York, New York 10017

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

Financial Statements and Supplemental Schedule

(Unaudited)

TABLE OF CONTENTS

| | | | | |

| Page |

| Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| Supplemental Schedule* | |

| |

| |

| |

| |

* Other supplemental schedules required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable or not required.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

(Unaudited)

| | | | | | | | | | | | | | |

| | December 31, |

| | 2021 | | 2020 |

| | | | |

| Assets | | | | |

| Investments at fair value: | | | | |

| Investments, at fair value | | $ | 17,168,660 | | | $ | 14,884,950 | |

| Cash equivalents including money market funds | | 952,672 | | | 1,279,570 | |

| Total Investments at fair value | | $ | 18,121,332 | | | $ | 16,164,520 | |

| | | | |

| Receivables: | | | | |

| Employer’s contributions | | $ | 467,117 | | | $ | 464,925 | |

| Notes receivable from participant loans | | 118,739 | | | 185,146 | |

| Total Receivables | | $ | 585,856 | | | $ | 650,071 | |

| | | | |

| Total Assets | | $ | 18,707,188 | | | $ | 16,814,591 | |

| | | | |

| Net Assets Available for Benefits | | $ | 18,707,188 | | | $ | 16,814,591 | |

See accompanying notes to the financial statements.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

(Unaudited)

| | | | | | | | |

| | For the year ended December 31, 2021 |

| | |

| Additions to net assets: | | |

| Investment Income: | | |

| Interest and dividends | | $ | 991,603 | |

| Net appreciation in fair value of investments | | 1,873,675 | |

| Total investment income | | 2,865,278 | |

| | |

| Contributions: | | |

| Participant’s Contributions | | $ | 824,646 | |

| Employer’s Contributions | | 467,117 | |

| | |

| Total contributions | | 1,291,763 | |

| | |

| Interest on notes receivable from participants | | $ | 8,323 | |

| | |

| Total additions to net assets | | $ | 4,165,364 | |

| | |

| Deductions from net assets: | | |

| Benefits distributed to participants | | $ | 2,268,306 | |

| Administrative expenses | | 4,461 | |

| Total deductions from net assets | | $ | 2,272,767 | |

| | |

| Increase in net assets available for plan benefits | | $ | 1,892,597 | |

| | |

| Net assets available for benefits: | | |

| Beginning of year | | 16,814,591 | |

| End of year | | $ | 18,707,188 | |

See accompanying notes to the financial statements.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

Notes to the Unaudited Financial Statements

December 31, 2021

1. Description of the Plan

The following description of the MFA Financial, Inc. 401(k) Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan documents for a more complete description of the Plan’s provisions, a copy of which is available from MFA Financial, Inc. (the “Company”).

General

The Plan, which became effective January 1, 2002, is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan is administered by the Company’s 401(k) committee (the “401(k) Committee”) with certain administrative functions of the Plan delegated to others in accordance with the terms of the Plan. The Plan’s investments are held by a trust fund administered by Fidelity Management Trust Company (the “Trustee”). In February 2017, the Company transferred the recordkeeping, trustee services and investment options for the Plan to the Trustee. Prior to that date, the Plan’s investments were self-directed and were held in a trust for which Morgan Stanley Smith Barney, LLC served as trustee.

Investment Funds, Contributions and Vesting

Under the terms of the Plan, all regular full-time and part-time employees of the Company who are 21 years of age 1) can make elective contributions to the Plan beginning as soon as practicable after the date of hire; and 2) are eligible to receive Company matching contributions.

Participants may elect to have a portion of their eligible compensation contributed to the Plan on a before-tax basis, up to the maximum deferral permitted under the Internal Revenue Code of 1986, as amended (the “Code”). For 2021, this limit was $19,500. Participants who are age 50 or older can make before-tax catch-up contributions to the Plan, the amount of which was limited to $6,500 per participant in 2021. Participants may change their deferral percentage as applicable at the beginning of each payroll period. Participant’s contributions may be invested in one or a combination of the various investment options offered by the Plan. A participant’s account balance may generally be transferred among the Plan’s investment options at any time upon receipt of instructions from the participant, except for certain limitations, including, but not limited to, the provisions of the Company’s Insider Trading Policy.

On an annual basis, the Company makes matching contributions in cash for each eligible participant in an amount equal to the addition of 1) 100% of the first 3% of an eligible participant’s compensation contributed to the Plan; and 2) 50% of the next 2% of the eligible participant’s compensation contributed to the Plan. Company matching contributions are subject to certain limitations imposed by applicable provisions of the Plan and the Code, including compliance with applicable statutory limits and non-discrimination rules. For 2021, the annual maximum employer matching contribution for each eligible participant was $11,600. Participants are immediately vested in their before-tax and Company matching contributions, as well as any investment earnings/losses thereon. During 2021, the Company made matching contributions of $464,925 with respect to eligible employee contributions made during 2020. In addition, on an annual basis, the Company at its discretion, may decide to make nonelective employer contributions to eligible participants in the Plan. The Plan provides that such contributions by the Company will vest 20% after two years of service with an additional 20% vesting for each year of service thereafter until the sixth year, at which time such contributions are fully vested. The nonelective employer contributions are automatically fully vested upon a participant’s termination due to retirement, death or disability, as defined in the Plan. The Company has not made any non-elective employer contributions during 2020 and 2021.

Participants are permitted to transfer eligible amounts from certain other tax qualified plans to the Plan (“Rollovers”), subject to Plan requirements. Rollovers are not subject to Company matching contributions.

The Plan provides for multiple investment options to be made available through the Trustee, including core investment options as determined by the 401(k) Committee, a group of target date options, an advisory asset management service and a self-directed brokerage option. In addition, the Plan document provides that the Company’s equity securities be offered as a core investment option, subject to compliance with ERISA. Contributions or Rollovers related to the Company’s common or preferred stock are also subject to the Company’s Insider Trading Policy. See Note 3 for Investment Options under the Plan.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

Notes to the Unaudited Financial Statements

December 31, 2021

Notes Receivable from Participants (Loans)

The Plan includes a provision that allows participants to apply for a loan from their account balance for a minimum amount of $1,000 up to the lesser of 50% of the value of the vested portion of their Plan assets or $50,000, subject to the certain restrictions set forth in the Plan and the Code. The loans may be repaid through payroll deductions and may have loan terms ranging up to five years, or ten years if for the purchase of a primary residence. A participant may have only two loans outstanding at a time. The loans are secured by the balance in the participant’s account and bear interest at a fixed rate throughout the duration the loan of prime plus one percentage point. At December 31, 2021, loans outstanding to participants had interest rates ranging from 4.25% to 6.50% and will mature at various dates through January, 2031.

Distributions and Withdrawals

Participants are permitted to withdraw any portion of their vested account balance due to death, permanent disability, retirement, attainment of age 59-½, or in the event of financial hardship or termination of service. The participant may elect to receive a lump sum payment, installment payments, or rollover the vested account balance to another qualified plan. Hardship withdrawals are allowed for participants incurring an “immediate and heavy financial need,” as defined by the Plan. Hardship withdrawals are strictly regulated under the Code and the regulations thereunder, and a participant must exhaust all available loan options and available distributions prior to being permitted to make a hardship withdrawal.

Administrative Expenses

Plan administrative expenses, to the extent not paid by the Company, are charged to and paid from the Plan’s assets as incurred.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes and schedule thereto. Actual results could differ from those estimates.

Cash Equivalents Including Money Market Funds

Participant investments in money market funds, whose underlying investments are assessed to be liquid financial instruments are considered to be cash equivalents.

Valuation of Investments and Investment Income

Investments held by the Plan are stated at estimated fair value. Equity securities are valued at the closing price reported on the market on which the individual securities are traded on the last business day of the Plan year. Investments in mutual funds are valued at the net asset value of units held by the Plan as reported by the mutual fund on the last business day of the Plan year. Other investments are valued using available information including information reported on the market on which such investments are traded, net asset value of the entity that issued the investment security or other information as deemed appropriate to use to estimate fair value.

The net appreciation or depreciation in the fair value of investments, which includes any unrealized appreciation or depreciation on those investments plus realized gains or losses on any investments sold, are reported in Investment Income on the Plan’s Statement of Changes in Net Assets Available for Benefits. Interest and dividend income is recorded when received.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

Notes to the Unaudited Financial Statements

December 31, 2021

Distributions to Participants

Distributions to participants are recorded when paid by the Plan.

Notes Receivable from Participants

Notes receivable from participants (loans) are funded directly from the participants account balance. Repayments of principal and interest related to the loan are credited to the participant’s account on a pro-rata basis in accordance with their selected investment options.

3. Investment Options

The Plan provides participants with various investment options, which are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investments, it is at least reasonably possible that changes in the values of a participant’s investments could occur in the near term and that such changes could materially affect the account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

In addition to the self-directed brokerage account option, set out below are the investment options made available under the Plan as of December 31, 2021:

| | | | | | | | |

| Name of Fund | | Name of Fund |

| Fidelity 500 Index Fund | | Fidelity Freedom 2065 Fund |

| Fidelity Blue Chip Growth Fund | | Fidelity Freedom Income Fund |

| Fidelity Emerging Markets Fund | | Fidelity Global ex U.S. Index Fund |

| Fidelity Extended Market Index Fund | | Fidelity Government Money Market Fund |

| Fidelity Freedom 2005 Fund | | Fidelity Overseas Fund |

| Fidelity Freedom 2010 Fund | | Fidelity Small Cap Growth Fund |

| Fidelity Freedom 2015 Fund | | Fidelity Total Bond Fund |

| Fidelity Freedom 2020 Fund | | Fidelity U.S. Bond Index Fund |

| Fidelity Freedom 2025 Fund | | Fidelity Value Fund |

| Fidelity Freedom 2030 Fund | | Goldman Sachs Inflation Protected Securities Fund Investor Shares |

| Fidelity Freedom 2035 Fund | | Invesco Diversified Dividend Fund R5 Class |

| Fidelity Freedom 2040 Fund | | Janus Henderson Enterprise Fund Class T |

| Fidelity Freedom 2045 Fund | | MassMutual Premier Small Cap Opportunities Fund Administrative Class |

| Fidelity Freedom 2050 Fund | | MFA Financial, Inc. Common Stock |

| Fidelity Freedom 2055 Fund | | MFA Financial, Inc. Preferred Stock |

| Fidelity Freedom 2060 Fund | | Allspring Special Small Cap Value Fund - Class Admin |

4. Party-in-Interest Transactions

The Trustee and the Company are parties-in-interest with respect to the Plan. The Plan’s investments are held by the Trustee, and certain of the investment options available to participants include investments managed by the Trustee and its affiliates. Transactions between the Plan, and the Trustee and its affiliates, are exempt from the prohibited transactions rules under ERISA. As of December 31, 2021, participants in the Plan held 24,646 shares of MFA Financial, Inc. Common Stock valued at $450,589 and 6,784 shares of MFA Financial, Inc. 7.50% Series B Cumulative Redeemable Preferred Stock valued at $171,659. Notes Receivable from Participants, as discussed in Note 1 (Description of the Plan), are also considered to be party-in-interest transactions and totaled $118,739 at December 31, 2021.

MFA FINANCIAL, INC. 401(K) SAVINGS PLAN

Notes to the Unaudited Financial Statements

December 31, 2021

5. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. Each participant’s interest in the Plan is 100% vested at all times, including the portion attributable to Company matching contributions. In the event of Plan termination, any unvested nonelective employer contributions will become 100% vested and the Plan assets will be distributed in accordance with the Plan document.

6. Tax Status

The Plan has received a determination letter from the Internal Revenue Service (“IRS”) dated March 31, 2014, stating that the Plan is qualified under section 401(a) of the Code, and therefore, the related trust is exempt from taxation.

7. Subsequent Events

The Company has evaluated whether events or transactions have occurred after December 31, 2021 that would require recognition or disclosure in these financial statements through June 28, 2022, which is the date these financial statements were available to be issued. No such transactions required recognition or disclosure in these financial statements.

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| Tesla, Inc. | | Common Stock, shares: 2,104 | | $ | 2,223,465 | |

| *MFA Financial, Inc. Common Stock | | Common Stock, shares: 24,646 | | 450,589 | |

| Apple Inc. | | Common Stock, shares: 2,495 | | 443,189 | |

| Amazon.com, Inc. | | Common Stock, shares: 75 | | 250,076 | |

| Facebook, Inc. | | Common Stock, shares: 545 | | 183,311 | |

| Square, Inc. | | Common Stock, shares: 615 | | 99,329 | |

| Royal Bank of Canada | | Common Stock, shares: 929 | | 98,632 | |

| AT&T Inc. | | Common Stock, shares: 2,597 | | 63,903 | |

| Microsoft Corporation | | Common Stock, shares: 188 | | 63,429 | |

| Verizon Communications Inc. | | Common Stock, shares: 1,203 | | 62,527 | |

| Spotify Technology S.A. | | Common Stock, shares: 200 | | 46,806 | |

| Advanced Micro Devices, Inc. | | Common Stock, shares: 292 | | 42,019 | |

| Camping World Holdings, Inc. | | Common Stock, shares: 1,000 | | 40,400 | |

| Deere & Company | | Common Stock, shares: 108 | | 37,083 | |

| Shift4 Payments | | Common Stock, shares: 639 | | 37,017 | |

| The Walt Disney Company | | Common Stock, shares: 233 | | 36,195 | |

| Mitek Systems, Inc | | Common Stock, shares: 1,587 | | 28,169 | |

| Union Pacific Corporation | | Common Stock, shares: 110 | | 27,868 | |

| Callaway Golf Company | | Common Stock, shares: 1,000 | | 27,440 | |

| Owens Corning | | Common Stock, shares: 300 | | 27,150 | |

| Alexander’s Inc. | | Common Stock, shares: 100 | | 26,030 | |

| Qualcomm | | Common Stock, shares: 136 | | 24,882 | |

| Alphabet Inc. Class A | | Common Stock, shares: 8 | | 23,176 | |

| Walmart Inc. | | Common Stock, shares: 160 | | 23,160 | |

| Royal Caribbean Cruises Ltd. | | Common Stock, shares: 261 | | 20,071 | |

| Fulgent Genetics | | Common Stock, shares: 199 | | 20,017 | |

| Target Corporation | | Common Stock, shares: 75 | | 17,358 | |

| Netflix, Inc. | | Common Stock, shares: 24 | | 14,459 | |

| Alibaba Group Holding Limited | | Common Stock, shares: 120 | | 14,255 | |

| Liberty Global | | Common Stock, shares: 500 | | 14,045 | |

| Apollo Commercial Real Estate | | Common Stock, shares: 988 | | 13,002 | |

| Dow Inc. | | Common Stock, shares: 223 | | 12,675 | |

| Coinbase Global, Inc. | | Common Stock, shares: 50 | | 12,619 | |

| Pubmatic, Inc. | | Common Stock, shares: 369 | | 12,564 | |

| Exxon Mobil Corporation | | Common Stock, shares: 204 | | 12,507 | |

| NeoPhotonics Corporation | | Common Stock, shares: 800 | | 12,296 | |

| IBM | | Common Stock, shares: 81 | | 10,938 | |

| Innovative Industrial Properties, Inc. | | Common Stock, shares: 40 | | 10,516 | |

| Ellington Residential Mortgage | | Common Stock, shares: 1,000 | | 10,390 | |

| Redfin | | Common Stock, shares: 269 | | 10,327 | |

| Fannie Mae | | Common Stock, shares: 12,000 | | 9,841 | |

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| Dupont de Nemours, Inc. | | Common Stock, shares: 120 | | 9,694 | |

| Shopify Inc. | | Common Stock, shares: 7 | | 9,642 | |

| Live Oak Bancshares, Inc. | | Common Stock, shares: 100 | | 8,751 | |

| Alphabet Inc. | | Common Stock, shares: 3 | | 8,681 | |

| Twitter | | Common Stock, shares: 200 | | 8,644 | |

| FedEx Corporation | | Common Stock, shares: 30 | | 7,960 | |

| Axos Financial | | Common Stock, shares: 123 | | 6,877 | |

| DXC Technology | | Common Stock, shares: 200 | | 6,438 | |

| Occidental Petroleum Corporation | | Common Stock, shares: 220 | | 6,387 | |

| DigitalBridge Group, Inc. | | Common Stock, shares: 725 | | 6,039 | |

| APA | | Common Stock, shares: 218 | | 5,885 | |

| Corteva, Inc. | | Common Stock, shares: 120 | | 5,674 | |

| Fastly | | Common Stock, shares: 155 | | 5,495 | |

| DraftKings | | Common Stock, shares: 200 | | 5,494 | |

| Kohls Corp Nfs Llc Is A Special | | Common Stock, shares: 109 | | 5,389 | |

| Lumen Technologies, Inc. | | Common Stock, shares: 417 | | 5,233 | |

| AG Mortgage Investment Trust, Inc. | | Common Stock, shares: 510 | | 5,228 | |

| Hudson Pacific Properties | | Common Stock, shares: 209 | | 5,184 | |

| Salesforce.com | | Common Stock, shares: 20 | | 5,083 | |

| Snowflake Inc. | | Common Stock, shares: 15 | | 5,081 | |

| Green Dot Corporation | | Common Stock, shares: 139 | | 5,037 | |

| Wix.com Ltd | | Common Stock, shares: 30 | | 4,734 | |

| Joyy, Inc. | | Common Stock, shares: 100 | | 4,543 | |

| Rocket Companies | | Common Stock, shares: 323 | | 4,533 | |

| Gap Inc. | | Common Stock, shares: 252 | | 4,454 | |

| NVIDIA Corp. | | Common Stock, shares: 15 | | 4,412 | |

| Desktop Metal, Inc. | | Common Stock, shares: 856 | | 4,237 | |

| Lemonade, Inc. | | Common Stock, shares: 100 | | 4,211 | |

| Cabot Oil & Gas Corporation | | Common Stock, shares: 217 | | 4,141 | |

| Crowdstrike Holdings, Inc. | | Common Stock, shares: 20 | | 4,095 | |

| Peloton Interactive, Inc. | | Common Stock, shares: 110 | | 3,934 | |

| Biomerica, Inc. | | Common Stock, shares: 1,000 | | 3,890 | |

| PennyMac Mortgage Investment Trust | | Common Stock, shares: 215 | | 3,726 | |

| New Residential Investment Corp | | Common Stock, shares: 335 | | 3,588 | |

| Citigroup Inc. | | Common Stock, shares: 54 | | 3,321 | |

| Danaher Corp. | | Common Stock, shares: 10 | | 3,290 | |

| Annaly Capital Management Inc. | | Common Stock, shares: 419 | | 3,277 | |

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| Upstart Holdings, Inc. | | Common Stock, shares: 20 | | 3,026 | |

| Chimera Investment Corporation | | Common Stock, shares: 200 | | 3,016 | |

| Pulte Group, Inc. | | Common Stock, shares: 50 | | 2,867 | |

| Adobe Systems, Inc. | | Common Stock, shares: 5 | | 2,835 | |

| AGNC Investment Corporation | | Common Stock, shares: 160 | | 2,406 | |

| Two Harbors Investment Corp | | Common Stock, shares: 396 | | 2,285 | |

| Panasonic Corporation | | Common Stock, shares: 200 | | 2,197 | |

| Norwegian Cruise Line Holdings | | Common Stock, shares: 100 | | 2,074 | |

| The Honest Company, Inc. | | Common Stock, shares: 250 | | 2,023 | |

| AppHarvest, Inc. | | Common Stock, shares: 400 | | 1,556 | |

| New York Mortgage Trust Inc. | | Common Stock, shares: 380 | | 1,414 | |

| Invesco Mortgage Capital | | Common Stock, shares: 499 | | 1,387 | |

| RSA Inversiones y Representaciones S.A. | | Common Stock, shares: 270 | | 1,150 | |

| Transocean Ltd. | | Common Stock, shares: 392 | | 1,082 | |

| Cherry Hill Mortgage Investment | | Common Stock, shares: 117 | | 968 | |

| Blackstone Group Inc. | | Common Stock, shares: 6 | | 776 | |

| Virgin Galactic | | Common Stock, shares: 58 | | 776 | |

| Compass Pathways PLC | | Common Stock, shares: 33 | | 729 | |

| Boston Omaha Corporation | | Common Stock, shares: 23 | | 661 | |

| Curiosity Stream, Inc. | | Common Stock, shares: 100 | | 593 | |

| Arlington Asset Investment Corp. | | Common Stock, shares: 125 | | 438 | |

| Figs, Inc. | | Common Stock, shares: 14 | | 392 | |

| Overstock.com, Inc. | | Common Stock, shares: 5 | | 294 | |

| Kyndryl Holdings, Inc. | | Common Stock, shares: 16 | | 289 | |

| D-Market Electronic Services Trading | | Common Stock, shares: 150 | | 286 | |

| VTV Therapeutics, Inc. | | Common Stock, shares: 200 | | 198 | |

| Logan Ridge Finance Corporation | | Common Stock, shares: 6 | | 137 | |

| Impac Mortgage Holdings, Inc. | | Common Stock, shares: 10 | | 10 | |

| Seadrill | | Common Stock, shares: 3 | | — | |

| | Sub-Total | | $ | 4,851,872 | |

| | | | |

| *MFA Financial, Inc. Preferred Stock Series B | | Preferred Stock, shares: 6,784 | | $ | 171,659 | |

| Two Harbors Investment Corp Series A | | Preferred Stock, shares: 3,000 | | 78,990 | |

| Chimera Investment Corp Series B | | Preferred Stock, shares: 3,000 | | 76,650 | |

| New York Mortgage Trust Series E | | Preferred Stock, shares: 3,000 | | 76,080 | |

| Pennymac Mortgage Investment | | Preferred Stock, shares: 2,000 | | 52,880 | |

| New York Mortgage Trust Preferred Series G | | Preferred Stock, shares: 2,000 | | 49,600 | |

| AG Mortgage Investment Trust | | Preferred Stock, shares: 2,000 | | 49,380 | |

| New York Mortgage Trust Series D | | Preferred Stock, shares: 1,000 | | 25,520 | |

| Chimera Investment Corp Series D | | Preferred Stock, shares: 1,000 | | 25,250 | |

| Overstock.com, Inc. Preferred Stock | | Preferred Stock, shares: 400 | | 18,800 | |

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| Chimera Investment Corp Series A | | Preferred Stock, shares: 700 | | 17,822 | |

| | Sub-Total | | $ | 642,631 | |

| | | | |

| *Fidelity 500 Index Fund | | Mutual Funds | | $ | 1,440,180 | |

| *Fidelity Freedom 2040 Fund | | Mutual Funds | | 826,349 | |

| *Fidelity Freedom 2030 Fund | | Mutual Funds | | 751,944 | |

| *Fidelity Freedom 2050 Fund | | Mutual Funds | | 704,459 | |

| *Fidelity Freedom 2045 Fund | | Mutual Funds | | 680,034 | |

| *Fidelity Blue Chip Growth | | Mutual Funds | | 622,241 | |

| American Growth Fund of America Class F | | Mutual Funds | | 482,739 | |

| American New Perspective Class F | | Mutual Funds | | 459,743 | |

| *Fidelity Freedom 2020 | | Mutual Funds | | 452,860 | |

| American Europacific Growth Class F | | Mutual Funds | | 385,378 | |

| *Fidelity Freedom 2055 Fund | | Mutual Funds | | 304,907 | |

| *Fidelity Freedom 2060 Fund | | Mutual Funds | | 283,699 | |

| *Fidelity Small Cap Growth Fund | | Mutual Funds | | 268,581 | |

| Virtus NFJ Mid Cap Value A | | Mutual Funds | | 236,203 | |

| *Fidelity Equity Income | | Mutual Funds | | 201,504 | |

| *Fidelity Contrafund | | Mutual Funds | | 198,310 | |

| *Fidelity Freedom 2035 Fund | | Mutual Funds | | 159,526 | |

| Smead Value Fund Investor Cl Shares | | Mutual Funds | | 149,552 | |

| *Fidelity Real Estate Income | | Mutual Funds | | 144,162 | |

| *Fidelity Emerging Markets Fund | | Mutual Funds | | 138,612 | |

| *Fidelity Total Bond Fund | | Mutual Funds | | 120,747 | |

| *Fidelity U.S. Bond Index Fund | | Mutual Funds | | 119,112 | |

| *Fidelity Value Fund | | Mutual Funds | | 118,152 | |

| *Fidelity Extended Market Index Fund | | Mutual Funds | | 117,031 | |

| *Fidelity Low Priced Stock | | Mutual Funds | | 98,193 | |

| *Fidelity Mid Cap Stock | | Mutual Funds | | 87,232 | |

| *Fidelity Global Ex U.S. Index Fund | | Mutual Funds | | 76,385 | |

| Blackrock Commodity Strategies Fund Class A | | Mutual Funds | | 76,201 | |

| *Janus Henderson Enterprise Fund Class T | | Mutual Funds | | 68,088 | |

| *Goldman Sachs Inflation Protected Securities Fund Investor Shares | | Mutual Funds | | 60,974 | |

| *Fidelity Overseas Fund | | Mutual Funds | | 59,862 | |

| *Invesco Diversified Dividend Fund R5 Class | | Mutual Funds | | 58,794 | |

| Invesco Equally Weighted S&P 500 | | Mutual Funds | | 56,323 | |

| *Fidelity Large Cap Value Enhanced Index | | Mutual Funds | | 53,248 | |

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| *Fidelity Small Cap Value | | Mutual Funds | | 52,008 | |

| *Fidelity Freedom 2015 Fund | | Mutual Funds | | 51,025 | |

| *Fidelity Freedom 2025 Fund | | Mutual Funds | | 40,629 | |

| *Allspring Special Small Cap Value Fund - Class Admin | | Mutual Funds | | 37,238 | |

| Growth Fund Of America Class A | | Mutual Funds | | 35,074 | |

| New Perspective Class A | | Mutual Funds | | 30,210 | |

| *Fidelity Select Medical Equipment & Systems | | Mutual Funds | | 28,492 | |

| Europacific Growth Class A | | Mutual Funds | | 19,291 | |

| *Massmutual Premier Small Cap Opportunities Fund Administrative Class | | Mutual Funds | | 19,034 | |

| Baron Discovery Fund Institutional Shares | | Mutual Funds | | 10,825 | |

| Baron Global Advantage Fund Retail | | Mutual Funds | | 8,010 | |

| *Fidelity Select Technology | | Mutual Funds | | 3,249 | |

| *Fidelity Select Software & Computer | | Mutual Funds | | 3,119 | |

| *Fidelity Freedom Income Fund | | Mutual Funds | | 3,062 | |

| Wasatch Micro-Cap Value Fund | | Mutual Funds | | 2,919 | |

| Wasatch Small Cap Value | | Mutual Funds | | 2,904 | |

| Lord Abbett Develop Growth Class A | | Mutual Funds | | 2,165 | |

| Wasatch Microcap | | Mutual Funds | | 1,249 | |

| Morgan Stanley Global Opportunity A | | Mutual Funds | | 946 | |

| Lord Abbett Micro Cap Growth Fund A | | Mutual Funds | | 926 | |

| Morgan Stanley Institutional Fund Trust Discovery | | Mutual Funds | | 873 | |

| Morgan Stanley Institutional Fund, Inc. Growth Portoflio Class A | | Mutual Funds | | 854 | |

| Morgan Stanley Institutional Fund, Inc. Inception Portflio Class A | | Mutual Funds | | 712 | |

| JPMorgan Income Builder Fund Class A | | Mutual Funds | | 24 | |

| | Sub-Total | | $ | 10,416,163 | |

| | | | |

| SPDR S&P 500 ETF Trust | | Other Investments | | $ | 232,817 | |

| SPDR Portfolio Total Stock Market | | Other Investments | | 216,385 | |

| WisdomTree India Earnings Fund | | Other Investments | | 156,864 | |

| Vanguard S&P 500 ETF | | Other Investments | | 120,057 | |

| Vanguard Extended Market ETF | | Other Investments | | 91,430 | |

| Invesco QQQ Trust, Series 1 | | Other Investments | | 86,026 | |

| iShares MSCI India Small-Cap ETF | | Other Investments | | 76,041 | |

| SPDR Dow Jones Industrial Average ETF | | Other Investments | | 36,332 | |

| Vanguard Growth ETF | | Other Investments | | 33,695 | |

| iShares MSCI India ETF | | Other Investments | | 25,285 | |

| The Technology Sector SPDR Fund | | Other Investments | | 20,864 | |

| Vanguard Information Technology ETF | | Other Investments | | 20,618 | |

| Vanguard Total Stock Market ETF | | Other Investments | | 18,591 | |

| Global X Robotics & Artificial Intelligence ETF | | Other Investments | | 17,970 | |

MFA FINANCIAL, INC. 401(k) SAVINGS PLAN

Schedule of Assets Held For Investment Purposes

December 31, 2021

(Unaudited)

| | | | | | | | | | | | | | |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of

Investment Including

Maturity Date, Rate

of Interest, Collateral,

Par or Maturity Value | | Current Value |

| | | | | | | | | | | | | | |

| VanEck Vectors Semiconductor ETF | | Other Investments | | 15,440 | |

| iShares S&P 500 ETF | | Other Investments | | 13,329 | |

| Vaneck Vectors Vietnam ETF | | Other Investments | | 12,744 | |

| Vanguard S&P 500 Growth ETF | | Other Investments | | 12,070 | |

| SPDR S&P Semiconductor ETF | | Other Investments | | 10,942 | |

| iPath S&P GSCI Crude Oil Total Return Index ETN | | Other Investments | | 9,462 | |

| VanEck Vectors Oil Services ETF | | Other Investments | | 9,242 | |

| iShares Expanded Tech-Software Sector ETF | | Other Investments | | 7,953 | |

| Vanguard Energy ETF | | Other Investments | | 7,761 | |

| ARK Autonomous Technology & Robotics ETF | | Other Investments | | 1,925 | |

| ARK Innovation ETF | | Other Investments | | 946 | |

| ARK Space Exploration and Innovation ETF | | Other Investments | | 943 | |

| iShares MSCI Mexico ETF | | Other Investments | | 902 | |

| ARK Genomic Revolution ETF | | Other Investments | | 612 | |

| ARK Fintech Innovation ETF | | Other Investments | | 409 | |

| Occidental Petroleum Corporation - Warrants | | Other Investments | | 339 | |

| | Sub-Total | | $ | 1,257,994 | |

| | | | |

| *Fidelity Cash Reserves | | Cash and cash equivalents | | $ | 581,535 | |

| *Fidelity Government Money Market Fund | | Cash and cash equivalents | | 371,137 | |

| | Sub-Total | | $ | 952,672 | |

| | | | |

| * Participant Loans | | Interest Rate 4.25% - 6.50%

Maturity Dates through January, 2031 | | $ | 118,739 | |

| | | | |

| | Grand Total | | $ | 18,240,071 | |

| | | | |

| * Indicates party-in-interest to the Plan. | | | | |

| | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the MFA Financial, Inc. 401(k) Savings Plan) have duly caused this annual report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| Date: June 28, 2022 | MFA FINANCIAL, INC. 401(k) SAVINGS PLAN |

| | |

| | |

| | |

| By: | /s/ Stephen D. Yarad |

| | | Stephen D. Yarad |

| | | Member |

| | | MFA Financial, Inc. 401(k) Administration Committee |

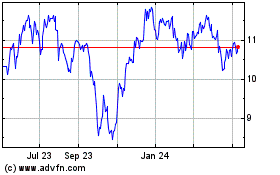

MFA Financial (NYSE:MFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

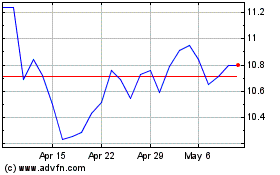

MFA Financial (NYSE:MFA)

Historical Stock Chart

From Apr 2023 to Apr 2024