Mayville Engineering Company, Inc. Announces Pricing of Initial Public Offering

May 08 2019 - 9:14PM

Business Wire

Mayville Engineering Company, Inc. (“MEC”) today announced the

pricing of its initial public offering of 6,250,000 shares of

common stock at a price to the public of $17.00 per share. In

addition, MEC has granted the underwriters a 30-day option to

purchase up to an additional 937,500 shares of common stock at the

initial public offering price, less underwriting discounts and

commissions. The shares are expected to begin trading on

the New York Stock Exchange on May 9, 2019 under the

symbol “MEC” and the offering is expected to close on May 13, 2019,

subject to customary closing conditions.

Baird, Citigroup and Jefferies are acting as lead book-running

managers for the offering. UBS Investment Bank and William Blair

are also acting as joint book-running managers for the

offering.

The offering is being made only by means of a prospectus. Copies

of the final prospectus relating to this offering may be obtained,

when available, from Robert W. Baird & Co. Incorporated,

Attention: Syndicate Department, 777 East Wisconsin Avenue,

Milwaukee, WI 53202, by telephone at (800) 792-2473, or by email at

syndicate@rwbaird.com; Citigroup Global Markets Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by telephone at (800) 831-9146; or Jefferies LLC,

Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, 2nd Floor, New York, NY 10022, by telephone at (877)

821-7388, or by email at prospectus_department@jefferies.com.

A registration statement relating to these securities has been

filed with the SEC and was declared effective on May 8, 2019. It

may be obtained by visiting the SEC’s website www.sec.gov. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About MEC

Founded in 1945, MEC is a leading U.S.-based value-added

manufacturing partner that provides a broad range of prototyping

and tooling, production fabrication, coating, assembly and

aftermarket services. Our customers operate in diverse end markets,

including heavy- and medium-duty commercial vehicle, construction,

powersports, agriculture, military and other end markets. Along

with process engineering and development services, MEC maintains an

extensive manufacturing infrastructure in 21 facilities across

eight states. These facilities make it possible to offer

conventional and CNC stamping, shearing, fiber laser cutting,

forming, drilling, tapping, grinding, tube bending, machining,

welding, assembly and logistic services. MEC also possesses a broad

range of finishing capabilities including shot blasting, e-coating,

powder coating, wet spray and military grade chemical agent

resistant coating (CARC) painting.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190508005989/en/

Nathan ElwellLincoln Churchill Advisors(847)

530-0249nelwell@lincolnchurchilladvisors.com

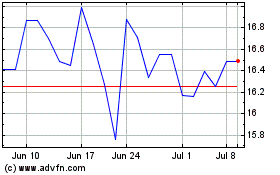

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

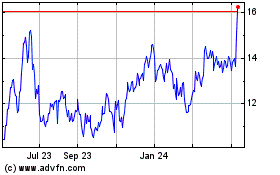

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

From Apr 2023 to Apr 2024