Group Including Blackstone Nears Deal to Buy Medline for Over $30 Billion

June 05 2021 - 12:57PM

Dow Jones News

By Cara Lombardo and Miriam Gottfried

A group of private-equity firms including Blackstone Group Inc.

is nearing a deal to acquire Medline Industries Inc. that would

value the medical-supply giant at more than $30 billion, in one of

the largest leveraged buyouts since the financial crisis, according

to people familiar with the matter.

The deal could come together as soon as this weekend assuming

the talks don't fall apart, the people said. The Blackstone

consortium includes Carlyle Group Inc. and Hellman & Friedman

LLC. They beat out a rival bid from the private-equity arm of

Canadian investing giant Brookfield Asset Management Inc., the

people said.

Including debt, the transaction would be valued at about $34

billion, and north of $30 billion excluding borrowings, the people

said. That could potentially make it the largest healthcare LBO

ever.

Based in Northfield, Ill., family-owned Medline is a

little-known but a major player in the field of medical equipment.

It manufactures and distributes equipment and supplies used in

hospitals, surgery centers, acute-care and other medical facilities

in over 125 countries. It has some $17.5 billion in annual sales,

according to its website.

Brothers James and Jon Mills founded the company in 1966, taking

it public in 1972. The brothers bought back the shares five years

later. James's son Charlie has been Medline's CEO since 1997.

The family will remain the single largest shareholder in the

company after the buyout and the management team will remain in

place, some of the people said.

Write to Cara Lombardo at cara.lombardo@wsj.com and Miriam

Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

June 05, 2021 12:48 ET (16:48 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

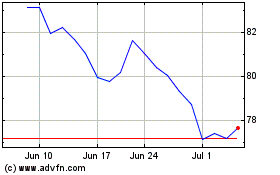

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

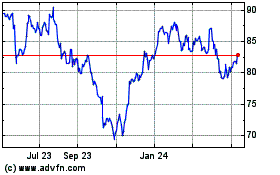

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024