Credit Markets: European Bonds Draw In U.S. Companies -- WSJ

January 21 2020 - 3:02AM

Dow Jones News

By Anna Hirtenstein and Pat Minczeski

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 21, 2020).

U.S. blue-chip companies raised an unprecedented sum in eurozone

debt markets last year, reflecting the region's ultralow interest

rates and global investors' thirst for securities issued by highly

rated companies.

Coca-Cola Co. and International Business Machines Corp. were

among the companies that raised a total of EUR101.7 billion ($113.5

billion) -- a record for nonfinancial company debt -- by selling

corporate bonds denominated in euros in the past year, according to

data from Dealogic. That was more than double the EUR42.2 billion

raised the previous year from selling such debt, known as reverse

Yankee bonds.

Capital markets in Europe have gained growing attention from

corporate borrowers since 2012, as central banks in the region

pushed a number of key benchmark rates to subzero levels. That has

driven down borrowing costs, while leaving fixed-income investors

looking for alternatives to the razor-thin returns offered by

government bonds.

The average yield on euro-denominated nonfinancial corporate

debt is currently 2.38 percentage points lower than on the

U.S.-dollar equivalent, weighted across maturities, according to

data from ICE BofAML indexes.

The low yields and strong investor appetite helped fuel a 38%

increase in the sale of euro-denominated bonds, to EUR450 billion

in 2019, by companies that aren't banks, insurers or other types of

financial firms, according to Dealogic. U.S. businesses dominated

the market, eclipsing Germany to make up nearly a quarter of the

total, as some of the largest and most creditworthy American

companies took advantage of the attractive yields to tap a fresh

group of investors while paring their debt costs.

Investors' interest has escalated further since the European

Central Bank resumed bond repurchases in November, snatching up

even more of the debt on its approved list and leaving investors

looking to other corners of the market for fresh opportunities.

"You even have some companies that have no European operations

still financing in euros and hedging it back," said Thomas Ross, a

fixed-income portfolio manager at Janus Henderson in London.

"They're both benefiting from the ECB and the demand for yield from

investors globally."

Even after factoring in the expense of converting the euros to

dollars, there's a cost advantage of about 15 basis points on

benchmark 10-year bonds for the issuers, according to Thibaut

Cuilliere, head of real asset research and a credit strategist at

French bank Natixis. He estimates that is likely to widen to 25

basis points on average by the end of the year.

In the first two weeks of 2020, U.S. companies including food

manufacturer General Mills Inc. raised EUR1.14 billion from reverse

Yankees, according to data from Dealogic. General Mills, whose

brands include Lucky Charms and Pillsbury, tapped the market for

EUR600 million with a 0.450%-coupon note maturing in 2026.

While American companies in the past have used reverse Yankee

bonds to fund European operations or the acquisition of companies

in the region, more and more businesses on both sides of the

Atlantic are now simply taking the opportunity to refinance their

existing debt at cheaper levels, and for longer periods. The

average maturity for reverse Yankee bonds in 2019 was 8.84 years,

according to Dealogic.

Redemptions -- or early repayments on debt -- will climb 21% to

EUR260 billion in the euro-denominated corporate bond market this

year, according to Natixis.

U.S. companies with investment-grade ratings, rather than

high-yield issuers, have benefited the most from the imbalance

created by the ECB's bond-buying program, which focuses on

lower-risk securities. Companies with lower ratings also tend to be

smaller and less known internationally, hindering their ability to

get favorable treatment from European investors.

"If you're a high-yield name in the U.S., you'd have to spend a

lot of time trying to educate the investor base in Europe if you

come over here, " said Roger Appleyard, head of credit sector

strategy at RBC Capital Markets. "Even in those circumstances, you

might not get cheaper funding than in the States."

The European corporate-bond market is likely to see a slowdown

this year following a pause in mergers and acquisitions during

2019, and as big cash piles deter local businesses from

fundraising, according to Mr. Cuilliere. Still, reverse Yankee

bonds will continue to dominate the market, he forecast.

"Given the high levels of liquidity provided by the central

bank, it means that the spread will stay low for a longer period of

time," Janus Henderson's Mr. Ross said.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

January 21, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

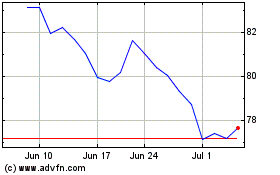

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

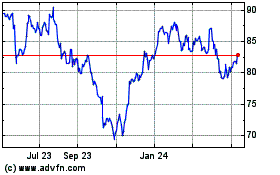

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024