By Jared S. Hopkins

An $18 billion offer from three major drug wholesalers aimed at

settling litigation over their alleged role in the opioid crisis

fell through, after more than 20 state attorneys general rejected

it in a letter to the companies' law firms this week.

The letter, reviewed by The Wall Street Journal, shows that the

drug industry hasn't won enough support from states to begin moving

the sprawling litigation to a global resolution.

At least 30 states have either sued the distributors or have

been involved in talks to resolve claims. Whether they support the

$18 billion offer or not, many are continuing to talk to the

wholesalers.

Many in the industry had hoped the offer would be a first step

toward resolving the claims outside bankruptcy. In September,

OxyContin maker Purdue Pharma LP filed for bankruptcy to help

implement a settlement the company's owners, the Sackler family,

estimate to be worth at least $10 billion.

The dissenting states want a larger total amount, or for the sum

to be paid out sooner than the proposed 18 years, according to

people familiar with the matter. Some states are targeting between

$22 billion and $32 billion over fewer than 18 years, according to

a person familiar with the matter.

The rejection is the latest setback in talks to resolve the

thousands of lawsuits arising from the opioid crisis. The majority

of suits filed against the drug industry have been brought by

county and city governments and are consolidated in federal court

in Cleveland. State attorneys general have largely pursued cases in

their own state courts.

The dissenting states' letter signals an agreement isn't likely

before summer and will probably involve a larger sum than Wall

Street anticipated, Evercore ISI analyst Elizabeth Anderson said in

a note Friday to investors.

The Wall Street Journal reported in October that three

distributors -- McKesson Corp., AmerisourceBergen Corp., and

Cardinal Health Inc. -- were in talks to collectively pay $18

billion over 18 years to settle the state- and local-government

claims. Johnson & Johnson was also involved in the discussions

to contribute additional money, the Journal reported.

The letter was signed by attorneys general for 21 states as well

as Puerto Rico and the District of Columbia, including some of the

places hardest hit by the opioid crisis, such as Ohio and West

Virginia. Those who signed were mostly Democratic attorneys

general, although there are some Republicans, including West

Virginia's Patrick Morrisey and Florida's Ashley Moody.

"Each of you has expressed that your clients seek a settlement

that is global," the letter reads. "It is our collective view that

the most recently communicated offer is unlikely to achieve that

goal. We invite you to discuss our specific issues more fully so

that a global settlement may be reached."

Some states remain supportive of the $18 billion offer, which

grew out of talks with wholesalers led by a bipartisan group of

attorneys general from North Carolina, Texas, Pennsylvania and

Tennessee. Those attorneys general didn't sign the letter.

"This is a complicated set of cases and negotiations continue,"

Tennessee Attorney General Herbert H. Slatery III said in a

statement. "States have taken different positions for different

reasons, and the ups and downs are expected."

Ohio Attorney General Dave Yost said the letter shows the states

"who are not willing to sign on" to the offer. He said in an

interview the wholesalers should either pay $18 billion in a

shorter time period, or provide more funding.

Ohio hired a firm that analyzed the wholesalers' ability to pay

damages and found an $18 billion settlement would have limited or

no impact on the companies' finances over the long-term, he

said.

States don't want to drive the companies into bankruptcy but

believe the wholesalers can provide additional funds, according to

people familiar with the matter.

AmerisourceBergen said it remains committed to a "fair

negotiated resolution" but will continue to defend itself in court

and is preparing for coming trials. It said in a statement it was

"disappointed to hear that some states do not currently understand

the merits of the global settlement framework that the distributors

have been discussing with the attorneys' general over the past many

months."

McKesson said it is focused on "finalizing a global settlement

structure that would serve as the best path forward to provide

billions of dollars in immediate funding and relief to states and

local communities." The company said it is committed to be part of

a solution" but is prepared to defend itself in litigation. A

Cardinal Health spokeswoman said the company continues to work

toward a nationwide settlement to provide relief to communities

affected by the opioid epidemic.

Some dissenting states were frustrated by comments that

AmerisourceBergen Chief Executive Steve Collis made last month on

an earnings call, according to people familiar with the matter. Mr.

Collis said the company didn't need to save up cash for an opioid

litigation settlement.

"It is a lot of cash in absolute terms," Mr. Collis said. "In

relative terms, it's relative too, a couple of hundred million

dollars a day in sales, it's not that much. And some of it is out

of the country."

The state attorneys general who signed the letter don't include

New York's Attorney General Letitia James, who has a March trial

scheduled against several drug companies including wholesalers. A

spokesman for Ms. James said negotiations with wholesalers are

ongoing.

Drugmakers, distributors and retail pharmacies are facing

lawsuits from virtually every state and thousands of city and

county governments.

More than 2,000 lawsuits allege the industry's overly aggressive

marketing of prescription painkillers and lax oversight of drug

distribution contributed to widespread opioid addiction.

At least 400,000 people have died in the U.S. from overdoses of

legal and illegal opioids since 1999, according to federal data.

The lawsuits seek to recoup costs borne by communities grappling

with widespread addiction, including burdens on emergency services,

medical care and foster services for children born to addicted

parents.

In September, OxyContin maker Purdue Pharma LP filed for

bankruptcy to help implement a settlement the company's owners, the

Sackler family, estimate to be worth at least $10 billion.

Teva Pharmaceuticals Industries Ltd. said in October it had

agreed in principle with several states to resolve all its legal

claims by donating addiction-treatment drugs, in a deal the

Israel-based company valued at $23 billion, as well as a cash

payment of $250 million. Johnson & Johnson has said it would

put forward $4 billion toward a global settlement.

A Teva spokeswoman said its agreement in principle remains

intact.

A J&J spokesman said in a statement its "agreement in

principle is intended to provide certainty for involved parties and

critical assistance for families and communities in need," and it

will continue working with states to finalize it.

Reaching a global resolution has proven difficult for lawyers

representing the various parts of the pharmaceutical industry,

thousands of municipalities and the states, which often have

differing interests.

In October, four drug companies, including the three

wholesalers, secured a settlement with two Ohio counties in

Cleveland and avoided a trial at the last minute.

That trial would have been the first time documents were

presented and witnesses questioned in open court about how drug

distributors allegedly contributed to the opioid crisis.

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

February 14, 2020 19:13 ET (00:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

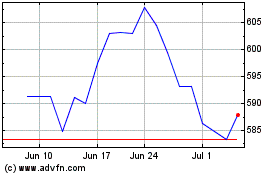

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024