By Heather Haddon and Jacob Bunge

The hottest item in the burger business is chicken.

At least 10 major U.S. fast-food chains have introduced

fried-chicken sandwiches in the past three months, or are set to

shortly. Many of those peddling the new poultry items are better

known as hamburger chains, including McDonald's Corp., Shake Shack

Inc. and Jack in the Box Inc.

Restaurant operators, grappling with slowdowns and restrictions

brought on by the Covid-19 pandemic, aim to capture consumers'

enthusiasm for crispy, breaded-chicken sandwiches. That fervor

helped build Chick-fil-A Inc. into one of the nation's top

fast-food chains over the past decade, and made Popeyes Louisiana

Kitchen Inc.'s offering a social-media sensation after its 2019

debut.

The chicken-sandwich war, as industry competitors describe it,

means diners have lots of options -- such as a Korean-style

iteration at Shake Shack, a McDonald's version topped with spicy

pepper sauce and a new KFC offering that the chain bills as its

"best chicken sandwich ever." The sandwich craze also might bring

lasting changes to the restaurant business, with owners spending

thousands of dollars on new equipment for battering chicken filets

to compete for what some franchisees say is the future of eating

out.

Shake Shack began selling its new fried-chicken sandwich in the

burger chain's South Korean restaurants during the fall, before it

made its debut in the U.S. this month. One of the first

limited-time items it put on menus during the pandemic was a spicy

chicken sandwich, also during the fall.

"We just want to sell more chicken," said Shake Shack Chief

Executive Randy Garutti in an interview. "People are always going

to love burgers and chicken, and we want to be known for both."

The largest restaurant and convenience chains promoted 213

chicken sandwiches through November last year, up 22% from a year

earlier, industry research firm Technomic Inc. said. Many of those

sandwiches have found a permanent place on menus.

Fast-food restaurants remain bastions of beef, with Big Macs,

Whoppers and other burgers outselling breaded-chicken sandwiches by

roughly 3-to-1, according to data from market-research firm NPD

Group.

Beyond fast food, though, chicken has been Americans' meat of

choice for decades.

Chicken overtook beef in 1992 as the most-consumed meat per

capita in America, according to the U.S. Department of Agriculture.

Consumers bought 1.4 billion more units of chicken than beef last

year in grocery stores, according to Nielsen figures.

The number of fast-food customers who ate a chicken sandwich

rose 21% last year from 2019, outpacing burgers, roast beef and

other similar items, according to Technomic surveys.

"It's hard not to succumb to temptation," said Mimi Finley, a

Tampa, Fla.-area stay-at-home mom and former restaurateur who likes

to sample chicken sandwiches from fast-food chains.

Chick-fil-A's signature chicken-breast sandwich, served with

pickles on a buttered, toasted bun, helped make the Georgia-based

company the third-biggest U.S. restaurant chain by domestic sales,

behind McDonald's and Starbucks Corp. Fanatical diners camp out

ahead of the chain's new restaurant openings, and Chick-fil-A

overtook KFC as the leading U.S. chicken chain by domestic sales in

2011, according to Technomic.

The 2019 launch of the Popeyes Chicken Sandwich spawned long

lines at restaurants and a temporary shortage that upset some

customers and sent the chain searching for supplies. The Restaurant

Brands International Inc.-owned chain's sales grew by double-digit

percentages, and have remained elevated since.

"Others have seen that success and are catching up," Sami

Siddiqui, president for the Americas at Popeyes, said in an

interview about the company's sandwich.

The new sandwiches are well-timed for fast-food chains and

chicken suppliers.

The jumbo-size boneless, skinless breast meat favored for such

products is typically the poultry industry's most profitable cut.

The average weekly price for a boneless, skinless chicken breast

last year was about $1.01 a pound, the lowest level in more than 30

years. The price had languished below $1 since August, until it

crept back above that level this month, according to data compiled

by market-research firm Urner Barry.

Sit-down-restaurant closures and export slowdowns have helped

build supplies. The quantity of frozen breast meat in U.S.

cold-storage facilities in late November stood 23% above last

year's level.

Some in the chicken industry said the sandwich launches could

send prices higher. Prices for jumbo boneless, skinless breasts

have topped $2 a pound only twice in the past decade, in 2013 and

in 2014, according to Urner Barry.

Both peaks, which came when meat prices already were riding

high, coincided with fast-food chicken skirmishes. McDonald's in

2013 launched chicken wraps, while Dunkin', Jack in the Box and

Wendy's Co. all promoted chicken sandwiches. A year later, Wendy's

and McDonald's both introduced new chicken sandwiches, while KFC

promoted its Double Down sandwich, in which bacon, cheese and sauce

were sandwiched between hunks of fried chicken.

Hailing the new chicken competition are poultry executives, who

face pandemic-constrained dining and surging grain prices. "We wish

all the participants much success," said Joe Sanderson, chief

executive of Sanderson Farms Inc., the third-largest U.S. poultry

producer, after Tyson Foods Inc. and Pilgrim's Pride Corp.

Chicken sandwiches tend to be more profitable than beef ones

sold in chain restaurants, as they draw on a cheaper commodity,

according to industry research firm Revenue Management Solutions.

Chicken sandwiches typically cost less on menus than big burgers, a

possible draw for budget-conscious consumers during the pandemic,

the firm said.

Restaurant chains and franchisees are investing heavily in the

battle. KFC said it worked with six bakeries to find a bun able to

handle its quarter-pound white-meat filet that will make its

nationwide debut in February, a chicken patty about 20% larger than

its existing crispy option. Church's Chicken owners spent about

$3,000 per restaurant to buy equipment to make the chain's new

chicken sandwich, while Burger King owners are buying battering

stations to install in kitchens as the Restaurant Brands chain

tests a hand-breaded chicken sandwich.

At McDonald's, which hasn't had a Southern-style

battered-chicken sandwich on its U.S. menus nationwide for years,

franchisees have been pushing for one.

"We cannot afford to be last in a category that clearly is the

future of fast food," the National Owners Association, a group of

McDonald's franchisees in the U.S., said in an email to members

last month.

Responding to customer demand, McDonald's said it would begin

selling a Crispy Chicken Sandwich next month with crinkle-cut

pickles on a buttered potato bun, while adding two other chicken

sandwiches to the permanent menu.

McDonald's executives told franchisees during an internal

meeting in December that a successful crispy-chicken-sandwich

launch was a priority. Executives said they were studying how to

introduce more chicken at breakfast, an option long sought by

franchisees in the South.

"Developing a reputation for great chicken represents one of our

highest aspirations," McDonald's U.S. President Joe Erlinger said

during an investor presentation last month.

Write to Heather Haddon at heather.haddon@wsj.com and Jacob

Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

January 19, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

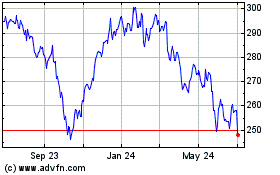

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

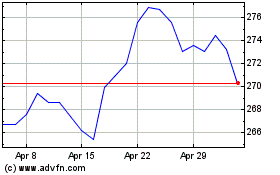

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024