By Heather Haddon

McDonald's Corp. is making changes to its menu and restaurant

operations as the coronavirus pandemic persists, including an

emphasis on to-go orders and new "McPlant" vegetarian items.

The burger company said Monday that it would test a slate of new

plant-based products in some markets next year. McDonald's ran a

pilot program earlier this year in Canada to sell patties made by

Beyond Meat Inc., a leader in the market to sell new plant-based

products that closely mimic meat.

Beyond Meat said it developed a patty for the McPlant line

together with McDonald's. McDonald's, which said the McPlant line

could include imitation burgers, chicken and breakfast foods,

declined to discuss what companies would supply the new items or

what ingredients they would include.

McDonald's shares fell 1.5% Monday to $213, while Beyond Meat's

shares fell 4.1% to $150.50.

After markets closed, Beyond Meat reported a $19.3 million

quarterly loss due to a pandemic-driven slowdown in restaurant

sales. Its shares dropped 26% in after-hours trading.

Plant-based meat substitutes have made a splash in the past year

as they moved onto more fast-food menus and retail shelves.

Imitation meats made by Beyond Meat, Impossible Foods Inc. and

other competitors claim to taste and cook more like the genuine

article than traditional veggie burgers.

Many chains have cut deals with plant-based meat manufacturers

last year, including Burger King's partnership with Impossible

Foods and Dunkin' Brands Group Inc.'s deal with Beyond Meat. Beyond

Meat and Impossible Foods have both added manufacturing capacity to

meet rising demand for their products.

McDonald's Chief Executive Chris Kempczinski said local demand

would determine where and when to introduce "McPlant" items. "It's

not a matter of if McDonald's gets into plant-based, it's when," he

said during an investor event.

Beyond Meat CEO Ethan Brown said his company's relationship with

McDonald's is strong. "We're working closely with them on a number

of matters," Mr. Brown said.

"We worked hard to develop the burger that was in the PLT and

will be in the McPlant," he said, referring to the "plant, lettuce

and tomato" sandwich the two companies served for a time this year

in Canada.

As a result of the pandemic, Mr. Kempczinski said it is testing

automated order taking, dedicated drive-through lanes for online

orders and a restaurant design with no dining room. Rivals are also

investing in to-go operations. Chipotle Mexican Grill Inc. this

year built dozens of drive-through lanes for online orders.

McDonald's said it is also exploring its own delivery service in

some markets with high demand, including Australia and Germany.

"The restaurant experience we offer must evolve," Mr.

Kempczinski said during an investor event Monday.

The company said Monday that global same-store sales fell 2.2%

during its third quarter from a year earlier, a slightly better

result than analysts had expected and a sizable improvement from a

24% drop in the second quarter. Sales improved as countries allowed

restaurants to reopen during the summer and autumn after initial

lockdowns, McDonald's said.

Rising numbers of coronavirus cases are closing dining rooms in

some places again. McDonald's said government restrictions on

restaurant hours, dine-in capacity and dining rooms since September

are hurting its operations, particularly in markets outside the

U.S. such as France, Germany, Canada and the U.K.

While restaurants have been hit hard by the pandemic,

well-capitalized chains are in many cases performing better than

independent restaurants. Companies with drive-through and delivery,

including McDonald's, have had an advantage.

McDonald's reported a 4.6% year-over-year increase in same-store

sales in the U.S. for its latest quarter. It said bigger orders and

dinner business helped overcome lower total customer tallies.

Drive-through service and a promotional partnership with the

musician Travis Scott drew customers, McDonald's said.

Burger King, owned by Restaurant Brands International Inc.,

reported a 3.2% drop year-over-year for its U.S. same-store sales

for the quarter ended Sept. 30.

McDonald's recently set a plan for closed dining rooms in the

U.S. to reopen if cases of Covid-19, the illness caused by the new

coronavirus, fall locally over time. McDonald's said it would focus

on improving core menu items such as its burgers, as consumers have

gravitated toward familiar food during the pandemic. McDonald's had

introduced customizable burgers and other higher-end options in

recent years before removing some of those items to simplify its

operations.

"It's a clear reminder that each product must earn its place on

our menu, " said Ian Borden, McDonald's president,

international.

One item McDonald's does plan to add is a crispy chicken

sandwich on a toasted potato roll, due to arrive in the U.S. early

next year. Competitors, particularly Popeyes Louisiana Kitchen,

have notched big sales increases through chicken sandwiches.

McDonald's also said it would introduce a loyalty program, starting

with tests in the Phoenix area in coming weeks. Starbucks Corp. and

other big chains have run loyalty programs for years and attracted

millions of regular users.

For its 2021 and 2022 fiscal years, McDonald's said it expects

sales growth in the mid-single-digit percentages, similar to 2019

levels. It expects capital expenditures of roughly $2.3 billion,

about half going to new restaurants. The company expects much of

its 2021 spending to go to hundreds of new restaurants,

particularly in China and other global markets.

Revenue for the quarter totaled $5.4 billion, in line with

expectations from analysts polled by FactSet. Profit rose to $1.8

billion from $1.6 billion a year earlier. Profit was aided by the

sale of part of its stake in its Japanese business. Analysts had

expected profit of $1.4 billion for the quarter.

For its third quarter ended Sept. 30, McDonald's reported

earnings per share adjusted for one-time items of $2.22, up 5% from

the prior year. Analysts had expected $1.91.

Jacob Bunge contributed to this article.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

November 09, 2020 18:22 ET (23:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

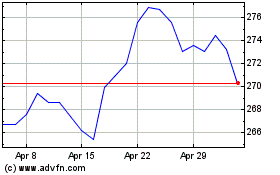

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

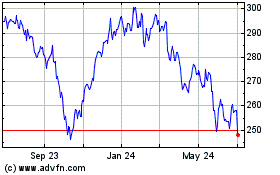

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024