Disney, McDonald's and Lyft Set to Report Results

November 08 2020 - 8:29AM

Dow Jones News

By Allison Prang

Walt Disney Co., Lyft Inc. and McDonald's Corp. are among the

major companies that will provide quarterly updates to investors

this week, as Wall Street nears the end of another earnings

season.

The coronavirus pandemic has hit the businesses of those three

companies in different ways. Covid-19 has changed consumers'

dining-out habits, lowered demand for ride-shares and led to

restrictions at theme parks and movie theaters -- while increasing

the interest in streaming-video options at home.

The companies' results come toward the end of earnings season,

with 89% of the S&P 500 already having reported quarterly

financials as of Friday, according to FactSet.

Disney is slated to reveal its fiscal fourth-quarter results on

Thursday. The Wall Street Journal reported this month that

Disney-owned ESPN was cutting its staff by about 10%. Disruptions

from the Covid-19 pandemic have dinged the sporting-events industry

as well as the theme-park business, a prominent revenue stream for

Disney.

Investors will see how Disney's year-old streaming business,

Disney+, is performing during a time when people are staying at

home more because of the pandemic. There were 57.5 million paid

Disney+ subscribers as of June 27, but the pandemic has made

producing new content for the platform difficult.

"We had a lot of really great content that was queued up to be

produced and have a nice cadence as it was put onto the service,

and that has slowed a bit because we haven't been able to do a lot

of those productions," Disney finance chief Christine McCarthy said

in September.

Subscribers at streaming competitor Netflix Inc. rose by 2.2

million in the quarter ended Sept. 30, less than in the first two

quarters this year and less than the 2.5 million that the company

had targeted. Netflix said the slower growth followed strong

subscriber gains in the first half, when pandemic lockdowns stoked

demand for its streaming service.

Analysts surveyed by FactSet expect Disney to report a loss for

the latest three-month period. In August, the company logged its

first quarterly loss since 2001. Analysts expect quarterly revenue

to top $14 billion, substantially below the $19.1 billion in the

year-earlier period.

McDonald's, which is scheduled to report its third-quarter

results on Monday, said last month that sales at stores open at

least 13 months fell 2.2% for the period. Analysts are expecting

the company's total revenue to decline slightly from a year

earlier. The pandemic has deterred indoor dining and eating out,

while also crimping demand for breakfast items at fast-food

chains.

Ride-hailing company Lyft is slated to report on its third

quarter on Tuesday, and analysts are expecting its revenue to rise

from the second quarter but amount to only about half of the

year-earlier total.

Competitor Uber Technologies Inc. last week reported a smaller

loss, compared with the year-earlier quarter even as gross bookings

for rides fell 53%. Uber Eats' bookings, meanwhile, more than

doubled.

Other companies on the docket to report in the coming week

include Beyond Meat Inc., Nikola Corp., D.R. Horton Inc., Cisco

Systems Inc. and newly public Palantir Technologies Inc.

Of the S&P 500 companies that have already reported,

according to FactSet, 86% have exceeded analysts' earnings

estimates and 79% have topped revenue expectations.

Overall, earnings for S&P 500 companies are on track to fall

7.5% from the year-earlier quarter, FactSet said, based on actual

results and estimates for those companies yet to report. Revenue is

expected to drop by 1.7%.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

November 08, 2020 08:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

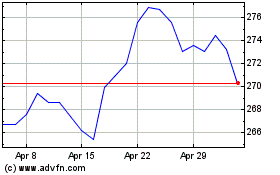

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

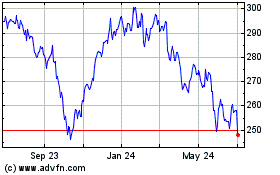

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024