Dunkin' to Be Sold to Inspire Brands for $11.3 Billion -- Update

October 30 2020 - 8:48PM

Dow Jones News

By Heather Haddon

Inspire Brands Inc. will buy Dunkin' Brands Group Inc. for $11.3

billion including debt, the companies said, setting up one of the

largest restaurant deals in years as some in the industry think

beyond the coronavirus pandemic.

The deal is the second-largest acquisition of a North American

restaurant chain in at least a decade, behind the $13.3 billion

deal for Tim Hortons by Restaurant Brands International Inc. in

2014, according to investment data provider Dealogic. Inspire, the

owner of Arby's and other chains that is backed by private-equity

firm Roark Capital, said the deal will make it the second-largest

U.S. restaurant chain by domestic sales after McDonald's Corp. The

deal is expected to close by the end of the year, the companies

said on Friday.

Talks between the companies started before the pandemic,

according to Inspire. The pandemic complicated negotiations,

Inspire's Chief Executive Paul Brown said, in part because it

caused a steep drop in Dunkin's core breakfast sales. Chains

focused on breakfast sales have been hit hard by the end of daily

commutes and school runs.

Mr. Brown said that he believes consumers will get back to their

old routines after the pandemic is over and that the chain's

drive-throughs were attractive. During the pandemic, chains with

drive-throughs have benefited from being able to maintain that

relatively low-contact avenue for sales.

Dunkin' on Thursday reported a U.S. same-store sales increase of

1% in its quarter ended in September, and said that sales remained

up in its current period.

"There's an opportunity for the right kind of brand doing the

right thing to actually take advantage when those habits are

rebuilt," Mr. Brown said in an interview.

Dunkin' CEO Dave Hoffman said in a statement that the deal will

help the company's franchisees continue to grow their

businesses.

Inspire said its all-cash deal to take the owner of Dunkin'

coffee shops and Baskin-Robbins ice cream stores private would

value it at $106.50 a share, a 20% premium to its closing price on

Oct. 23, before the New York Times reported last weekend that the

two companies were discussing a possible deal.

More to come...

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

October 30, 2020 20:33 ET (00:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

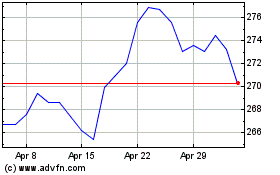

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

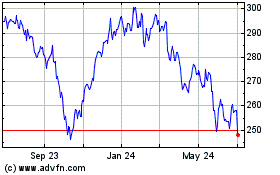

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024