Current Report Filing (8-k)

November 25 2019 - 4:33PM

Edgar (US Regulatory)

false0000063908MCDONALDS CORP

0000063908

2019-11-19

2019-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 19, 2019

McDONALD’S CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Delaware | | 1-5231 | | 36-2361282 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

110 North Carpenter Street

Chicago, Illinois

(Address of Principal Executive Offices)

60607

(Zip Code)

(630) 623-3000

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | MCD | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| | | |

Emerging growth company | ☐ | | |

|

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

Item 5.04 Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans.

As a result of a change in vendors for the McDonald’s 401k Plan (the “Plan”), on November 19, 2019, McDonald’s Corporation (the “Company”) informed participants in the Plan that they will be unable, for a period of time beginning at 2 p.m. Eastern Time on December 24, 2019, to obtain a loan, withdrawal or distribution from the Plan, and beginning at 4 p.m. Eastern Time on December 30, 2019 to transfer or diversify investments or otherwise make investment or contribution changes in their accounts under the Plan (collectively, the “Blackout Period”). The temporary Blackout Period for participants under the Plan is expected to end by January 18, 2020. The Blackout Period applies to all Plan assets, including Company shares held by the Plan.

On November 25, 2019, the Company provided written notice (the “Notice”) to its directors and executive officers informing them of the Blackout Period and the restrictions on trading in Company common stock that apply to them during the Blackout Period, pursuant to Section 306(a) of the Sarbanes-Oxley Act of 2002 and Rule 104 of Regulation BTR under the Securities Exchange Act of 1934. A copy of the Notice is attached as Exhibit 99 to this Form 8-K and is incorporated by reference.

Company stockholders or other interested persons may obtain information about whether the Blackout Period has started or ended, without charge, by contacting the Company’s Corporate Legal Department by phone at 630-623-3000 or by mail c/o McDonald’s Corporation, 110 North Carpenter Street, Chicago, IL 60607 during this Blackout Period and for a period of two years after its ending date.

Item 9.01. Financial Statements and Exhibits.

|

| | | | | |

(d) | | Exhibits | | | |

| | | | | |

Exhibit No. | | Description |

| | | | | |

99 | | |

| | | | | |

104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | McDONALD’S CORPORATION | | |

| | | (Registrant) | | |

| | | | | | |

Date: | November 25, 2019 | | By: | /s/ Denise A. Horne | |

| | | | Denise A. Horne | |

| | | | Corporate Vice President, Associate General Counsel and Assistant Secretary | |

Exhibit 99

Important Notice to Directors and Executive Officers

Of McDonald’s Corporation (the “Company”)

Concerning Additional Legal Restrictions on Their Personal Trading in Company Stock

November 25, 2019

Federal securities laws require the Company to provide this notice to its Directors and Executive Officers.

In connection with a change in vendors for the Company’s 401k Plan (the “401k Plan”), there will be a temporary blackout period for 401k Plan participants. Beginning on December 24, 2019 at 2 p.m. Eastern Time, 401k Plan participants will not be able to obtain a loan, withdrawal or distribution from the 401k Plan, and beginning on December 31, 2019, participants will not be able to transfer or diversify investments or otherwise make investment or contribution changes in their accounts under the 401k Plan. These restrictions are expected to end by January 18, 2020 (collectively, the “Plan Blackout Period”). The Plan Blackout Period is required in order to implement a change in the vendor for the 401k Plan, as well as for administrative and technology reasons.

Under federal law, during the Plan Blackout Period, Directors and Executive Officers will be prohibited from directly or indirectly purchasing, selling, or otherwise acquiring, disposing or transferring shares of McDonald's Corporation common stock or derivative securities, acquired in connection with their service as a Director or Executive Officer of McDonald’s (“Compensatory Shares”). These restrictions include indirect transactions by family members, partnerships, corporations, trusts or others involving Compensatory Shares where the Director or Executive Officer has a pecuniary interest. There are limited exceptions to these restrictions (e.g., sales pursuant to court orders or as required by law).

Please note that during the Plan Blackout Period, the Company’s trading window will be closed. As a result, the restrictions referred to above are duplicative of trading prohibitions that already apply to Directors and Executive Officers during this period.

Please contact Denise Horne (by telephone at 630-623-3000 or by mail c/o McDonald’s Corporation, 110 North Carpenter Street, Chicago, IL 60607) for additional information or if you have any questions regarding the Plan Blackout Period.

v3.19.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe end date of the period reflected on the cover page if a periodic report. For all other reports and registration statements containing historical data, it is the date up through which that historical data is presented. If there is no historical data in the report, use the filing date. The format of the date is CCYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

This regulatory filing also includes additional resources:

form8k.pdf

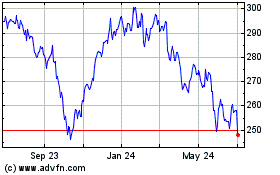

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

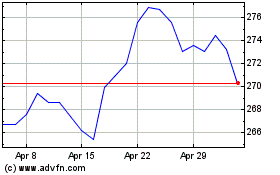

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024