Dynamic Yield Launches Element, Bringing the Power of Mastercard to Personalization

March 15 2023 - 5:00AM

Business Wire

Mastercard’s proprietary prediction models and

aggregated consumer spend insights activate new ways for customers

to enhance personalization across digital channels as part of the

company’s Experience OS.

Dynamic Yield, a Mastercard company, today unveiled Element, an

exclusive suite of Mastercard applications and extensions

integrated into Dynamic Yield’s Experience OS. As consumer demand

for personalization continues to grow, brands must differentiate

their approach to providing relevant experiences at scale.

Mastercard’s proprietary prediction models and aggregated consumer

spend insights will allow customers across verticals – from

retailers to brands to banks and beyond – to deliver greater

personalization on any digital channel.

“Together, Mastercard and Dynamic Yield are deepening

insight-driven personalization,” said Raj Seshadri, President of

Data & Services, Mastercard. “This joint innovation is an

important step in advancing our mission to help customers make

smarter decisions with better outcomes and showcases the power,

impact and reach of our services.”

While consumer behavior has been in a state of rapid change over

the past few years, the desire for more tailored, meaningful

interactions has never been stronger. According to McKinsey

research, 71% of consumers expect companies to deliver personalized

interactions, and 76% get frustrated when those demands aren’t

met1. And companies are noticing – 98% of organizations believe in

the benefits of personalization and plan to invest further2.

Element directly links select Mastercard services within

Experience OS, the company’s operating system that organizes

applications in an open, modular, and fully customizable core

framework. This unified approach will allow customers to build

their own mix of Dynamic Yield and Mastercard capabilities to meet

their evolving personalization needs.

Within Element, subscribed customers will be able to leverage

the following capabilities:

- Reach new audiences using actionable, geographic spend insights

based on aggregated and anonymized transaction data.

- Apply Mastercard’s propensity modeling techniques to help

issuers dynamically curate relevant offers, products, and content

for existing cardholders within their personal banking

platform.

- Use Mastercard SpendingPulse™ to uncover regional

spending trends and identify macroeconomic indicators of retail

sales to power personalization at the local level3.

- Identify relationships between products, locations, and product

attributes with Market Basket Analyzer and use these

insights to drive smarter personalization decisions.

“Bringing insights from the Mastercard services ecosystem into

Experience OS is a game-changer. From financial services to QSR to

retail, companies can now hyper-personalize the consumer experience

in entirely new ways,” said Ori Bauer, CEO of Dynamic Yield. “For

example, by looking at consumer spending in one category, you can

now analyze how it will drive usage in another, and then deliver

tailored offers online or in an app based on those unique insights.

And those efforts can be implemented no matter the industry.”

Mastercard acquired Dynamic Yield in 2022 to strengthen its

suite of consumer engagement and loyalty services, helping brands

deliver more effective and trusted experiences across channels. The

Element suite of Mastercard applications and extensions are

available for subscribed customers in Experience OS; availability

of each application may vary across regions. Mastercard embeds best

in class privacy safeguards into all of our products and services

in line with a thorough Privacy by Design approach and anonymizes

data to produce aggregated trends and insights. We employ rigorous

standards to ensure the safety and security of data not only within

Mastercard, but with all our partners and vendors as well.

Learn more about Element, Mastercard Services, and Experience

OS.

About Mastercard (NYSE: MA) Mastercard is a global

technology company in the payments industry. Our mission is to

connect and power an inclusive, digital economy that benefits

everyone, everywhere by making transactions safe, simple, smart and

accessible. Using secure data and networks, partnerships and

passion, our innovations and solutions help individuals, financial

institutions, governments and businesses realize their greatest

potential. Our decency quotient, or DQ, drives our culture and

everything we do inside and outside of our company. With

connections across more than 210 countries and territories, we are

building a sustainable world that unlocks priceless possibilities

for all. www.mastercard.com

About Dynamic Yield Dynamic Yield, a Mastercard company,

helps businesses across industries deliver digital customer

experiences that are personalized, optimized, and synchronized.

With Dynamic Yield’s Experience OS, marketers, product managers,

developers, and digital teams can algorithmically match content,

products, and offers to each individual customer for the

acceleration of revenue and customer loyalty.

1 The value of getting personalization right—or wrong—is

multiplying 2 The State of Personalization Maturity - 2023 3

Mastercard SpendingPulse solutions unlock market intelligence on

consumer spending by measuring in-store and online retail sales

across all forms of payment

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230315005198/en/

Courtney Meola Global Communications, Mastercard

courtney.meola@mastercard.com

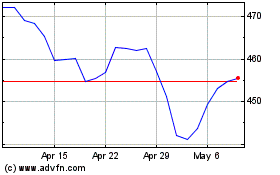

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024