Retailer Group Predicts Robust Holidays, but Sounds Warning -- WSJ

October 04 2019 - 3:02AM

Dow Jones News

By Sarah Nassauer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 4, 2019).

Retailers expect a strong holiday shopping season, but warn that

global political and economic uncertainty could erode consumer

confidence and spending.

The National Retail Federation, which represents retailers

including Walmart Inc., Amazon.com Inc. and Macy's Inc., said

Thursday it expects holiday sales to rise in a range of 3.8% to

4.2% -- to about $730 billion -- after sales came in lower than

expected last year in the midst of a federal government

shutdown.

Retailers and consumers are feeling confident amid low

unemployment and rising wages, but the economy is growing at a

slower pace than last year and there is "considerable uncertainty

around issues including trade, interest rates, global risk factors

and political rhetoric," said Matthew Shay, president of the retail

federation.

The NRF's figures, which cover sales online and in stores from

Nov. 1 to Dec. 31 and exclude auto, gasoline and restaurant sales,

are in line with those of retail consulting firms.

AlixPartners predicts holiday sales to rise between 4.4% and

5.3% compared with last year. "While our 2019 forecast is an

upswing from last year, tariffs and the trade war are finally

beginning to take a hit on consumer confidence, and the buzz of an

oncoming recession is getting louder," the firm said in a research

report.

U.S. stocks are down in October as signs emerge that a

manufacturing slowdown has spread to other parts of the economy.

Last week, consumer spending, the driving force in the U.S.

economy, showed a slight slowdown in August. Federal data released

Thursday showed services activity in the U.S. and eurozone softened

in September. Investors and economists are watching Friday's

planned employment-data report carefully.

The NRF and retailers have long pointed to the trade war between

the U.S. and China as a potential source of economic instability,

but so far that mostly hasn't translated to higher prices for

consumers, Mr. Shay said Thursday on a call with reporters.

The Trump administration has imposed tariffs on the majority of

goods imported from China, with some to take effect later in the

holiday season on consumer goods including toys and apparel. China

also has imposed tariffs on some U.S. goods. Both countries have

offered some concessions ahead of high-level negotiations between

the countries in October. On Wednesday, the administration said it

would impose tariffs on aircraft, food and other goods from the

European Union.

"None of these retailers want to pass on cost to consumers if

they can avoid it," said the retail federation's Mr. Shay. But if

cost increases because of tariffs spread to more categories of

goods in the coming weeks and months, he said, "tariffs certainly

could make an impact."

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

October 04, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

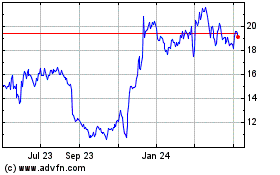

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

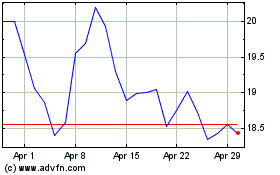

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024