Stocks: Ralph Lauren Recovery Is Put at Risk by Prospect of Higher Costs -- WSJ

August 27 2019 - 3:02AM

Dow Jones News

By Michael Wursthorn

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 27, 2019).

Ralph Lauren Corp.'s U.S. turnaround is hanging by a thread,

putting its shares at risk of a deeper pullback.

Some analysts are cutting their financial forecasts for the

fashion company, predicting flat revenue and lower earnings for its

fiscal year as weaker tourist spending, tightening inventory at

department stores and tariffs pressure a brand that had already

been struggling with tepid demand.

The company's shares have slumped nearly 26% since the end of

June -- including Monday's 0.3% drop -- and are on pace for their

biggest quarterly decline in almost four years.

Analysts cut their forecasts for Ralph Lauren following the

latest escalation in U.S.-China trade tensions this month. For the

fiscal year ending in March, Bank of America Merrill Lynch analysts

predict little change in sales from the previous year and have cut

their earnings projections.

The company said last month, before the latest escalation in

tariffs, that it expected sales for the fiscal year to grow as much

as 3%.

Analysts across Wall Street now predict Ralph Lauren's earnings

to contract 0.7% for the quarter ending in September, after

initially forecasting positive growth just a month ago, according

to FactSet.

Additional tariffs are set to take effect on Chinese imports

next month, potentially forcing Ralph Lauren to absorb higher costs

or pass those on by raising prices. Neither of those options is

ideal for the struggling fashion designer, analysts said, since the

first will likely further crimp profit margins, while the latter

has the potential to alienate consumers.

Macy's Inc. already said earlier this month that customers don't

have an appetite for higher prices. The department store also said

it plans to cut back its inventory in the second half of the year,

another factor that would hurt sales of Ralph Lauren products,

analysts added.

In response, Bank of America cut Ralph Lauren's price target to

$76, a 9% decrease from where the shares closed on Monday.

A Ralph Lauren spokeswoman declined to comment further, but

pointed to the company's previously disclosed efforts to reduce its

dependency on China. As of July 2019, the company had less than a

quarter of its manufacturing based in China, down from about a

third in its last fiscal year.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

Corrections & Amplifications As of July 2019, Ralph Lauren

had less than a quarter of its manufacturing based in China, down

from about a third in its last fiscal year. An earlier version of

this article incorrectly stated that about a third of manufacturing

was currently based in China and that it would fall to less than a

quarter by July 2020. (Aug. 26)

(END) Dow Jones Newswires

August 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

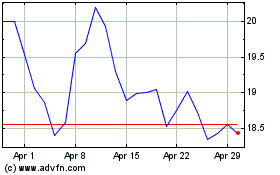

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

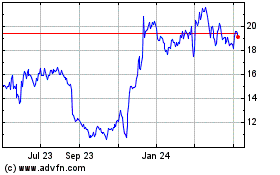

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024