Statement of Changes in Beneficial Ownership (4)

November 24 2021 - 6:17PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Liberty Media Corp |

2. Issuer Name and Ticker or Trading Symbol

Live Nation Entertainment, Inc.

[

LYV

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

12300 LIBERTY BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/23/2021 |

|

(Street)

ENGLEWOOD, CO 80112

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| 2.25% Exch. Sr. Debentures due 2048 (obligation to sell) | (1)(3) | 11/23/2021 (1) | | C (1)(3) | | $25249000 | | (3) | 12/1/2048 | Common Stock | 380972 | (3) | $359751000 (1) | D | |

| 2.25% Exch. Sr. Debentures due 2048 (obligation to sell) | (2)(3) | 11/24/2021 (2) | | C (2)(3) | | $21119000 | | (3) | 12/1/2048 | Common Stock | 318656 | (3) | $338632000 (2) | D | |

| Explanation of Responses: |

| (1) | On November 23, 2021, the election of holders of an aggregate of $25,249,000 in original principal amount of the reporting person's 2.25% exchangeable senior debentures due 2048 (the "Debentures") to exchange such Debentures for cash having a value equal to the current market price of the reference shares attributable to each Debenture exchanged became irrevocable. |

| (2) | On November 24, 2021, the election of holders of an aggregate of $21,119,000 in original principal amount of the Debentures to exchange such Debentures for cash having a value equal to the current market price of the reference shares attributable to each Debenture exchanged became irrevocable. |

| (3) | Currently, the reference shares attributable to each $1,000 original principal amount of Debentures consist of 15.0886 shares of the issuer's common stock, par value $0.01 per share. In connection with such exchanges, the current market price for each reference share will be equal to the average of the daily volume weighted average price of that reference share on the New York Stock Exchange for the 30 trading day period commencing on the fourth trading day following December 1, 2021. The Debentures were called for redemption in full by the reporting person on December 1, 2021. The Debentures are exchangeable solely for cash, at the option of the holder and subject to certain terms and conditions, at any time during the period commencing on September 1, 2021 until the close of business on the second scheduled trading day immediately preceding December 1, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Liberty Media Corp

12300 LIBERTY BOULEVARD

ENGLEWOOD, CO 80112 | X | X |

|

|

Signatures

|

| Liberty Media Corporation By: /s/ Brittany A. Uthoff Name: Brittany A. Uthoff Title: Vice President | | 11/24/2021 |

| **Signature of Reporting Person | Date |

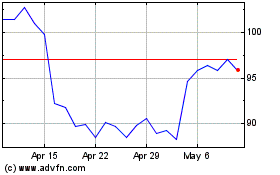

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

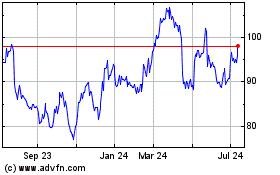

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024