Lockheed Martin Agrees to Buy Aerojet Rocketdyne

December 20 2020 - 7:16PM

Dow Jones News

By Doug Cameron

Lockheed Martin Corp. announced plans on Sunday to buy space and

missile defense specialist Aerojet Rocketdyne Holdings Inc. for

around $4.6 billion in cash.

The proposed deal would give it one of the largest makers of

rocket motors for space launch vehicles and missiles, one of the

few growth areas even as the Pentagon's budget is expected to

remain flat over the next several years.

Lockheed Martin Chief Executive Jim Taiclet flagged plans to

prioritize acquisitions when he took over in the summer, and the

proposed deal follows a recent string of smaller transactions by

rivals in the defense services sector.

Aerojet Rocketdyne employs around 5,000 staff and had revenue of

almost $2 billion last year. Its order backlog approaching $7

billion includes some of the biggest Pentagon priorities such as

hypersonic missiles as well as work for the National Aeronautic and

Space Administration.

The company makes rocket boosters for key missile defense

systems such as Lockheed's own Thaad program and provides a route

into other big priorities such as the replacement of land-based

nuclear missiles led by Northrop Grumman Corp. and the Boeing

Co.-led Space Launch System.

Lockheed Martin offered $56 a share for Aerojet, reduced to $51

following the payment of a cash dividend, a 17% premium over its

closing price Friday.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

December 20, 2020 19:01 ET (00:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

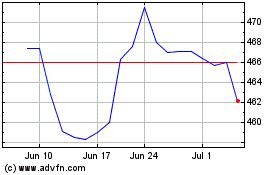

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

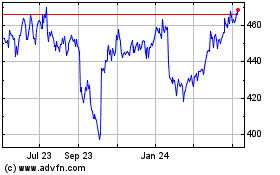

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024